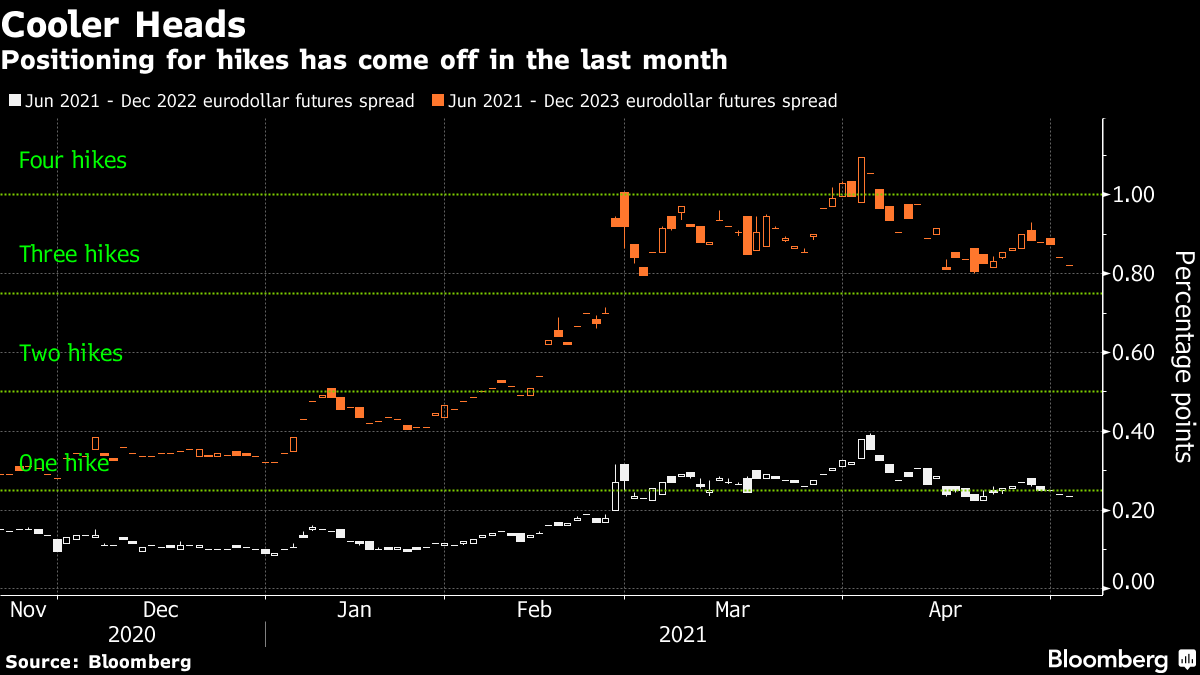

| Good morning. A tech selloff, a plan to revive tourism and booming commodity prices. Here's what's moving markets. Tech SelloffTechnology stocks led a selloff on Tuesday, with megacaps falling and dragging down the wider market as cyclical sectors like industrials and financials went in the other direction. U.S. Treasury Secretary Janet Yellen ruffled the market with comments that most economists see as self-evident: that interest rates will likely have to rise as government spending ramps up and economic growth accelerates. She later clarified she was not forecasting rate rises. Still, her comments appeared to crystallize existing fears about rising prices in a market already showing some jitters about expensive stock valuations. Tourism RecoveryTourism ministers from G-20 countries threw their weight behind vaccine passports as the way to revive the travel industry, with documents to show when a person has been fully vaccinated, has immunity or recently tested negative for Covid-19. The European Union is also looking toward tackling the longer virus fight by proposing the joint procurement of treatments, a way to secure supplies once the acute phase of the pandemic is passed. In the U.K., new labs will be built designed to speed up the development of vaccines to tackle new coronavirus variants. New RulesThe European Union is set to announce new rules on Wednesday that would prevent foreign state-funded companies from undercutting their rivals in the EU. Competition Commissioner Margrethe Vestager backed the plans, which don't mention China but which follow complaints from European companies that the country's firms get support they cannot match. Separately on tensions with China, G-7 nations are considering a U.S. proposal for countries to coordinate to counter what the White House sees as China's economic coercion. Commodities BoomThe burgeoning battle for supremacy in cryptocurrencies between leader Bitcoin and challenger Ether isn't the only area where markets are testing highs. Commodity prices are booming. Oil prices have been boosted as reopening efforts globally underpin hopes for demand to return to normal levels and by U.S. crude stockpiles falling. Copper also rose back above $10,000 a ton. Elsewhere, corn futures topped $7 per bushel for the first time since 2013 amid supply concerns driven by a lack of rainfall in Brazil. And prices for cheese are surging too as restaurants open across the U.S. and customers indulge in cheeseburgers, mozzarella sticks and queso dip. Coming Up…Stock-futures for Europe and the U.S. are both trending higher heading into Wednesday as markets recover some ground. European earnings get busier again, with numbers coming from car manufacturer Stellantis, insulin maker Novo Nordisk and shipping giant AP Moller-Maersk. On the economic data front, we'll get services activity readings for the euro-area. In Spain, watch for any fallout from the sweeping victory for Prime Minister Pedro Sanchez's biggest critic in Madrid's regional elections. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Emily Barrett is interested in this morningTreasury Secretary Janet Yellen's less-than-earth-shattering comments that interest rates may head higher in future have caused some kerfuffle, but so far at least it seems to be playing out mainly in pundit-land rather than in markets. While stock indexes are down, futures have spent much of Asia's session in the green. And Treasury yields still managed to finish the U.S. session slightly lower on the day. If bond markets are unruffled, it's hardly surprising. Yellen's statement is miles from the hawkish scenarios that traders have been pricing into rates for some time. This time last month, Eurodollar futures contracts reflected expectations for at least one Fed hike by the end of next year, and possibly four by the end of 2023. That's versus the central bank's own projections that borrowing costs are likely to stay near zero over that whole period. Traders have scaled back their implausibly hawkish positioning over the past month, though it's still well ahead of the Fed's guidance. With so many markets closed in Asia, including cash Treasuries, European trade may be a better indicator of how well markets are looking through the hype. But it really should die down. Of course investors should pay close heed when Yellen talks about interest rates -- after all, she's the only Treasury Secretary to have led both the Federal Reserve and the White House Council of Economic Advisors.. And there has been much talk of increased cooperation between the central bank and Treasury in this era of massive fiscal and monetary expansion. But no one's really departed from the script: the U.S. economy is still repairing, and the global backdrop is fragile with many places still engulfed by the pandemic -- so the recovery is incomplete.  Emily Barrett is a cross-asset reporter and editor for Bloomberg News in Melbourne. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment