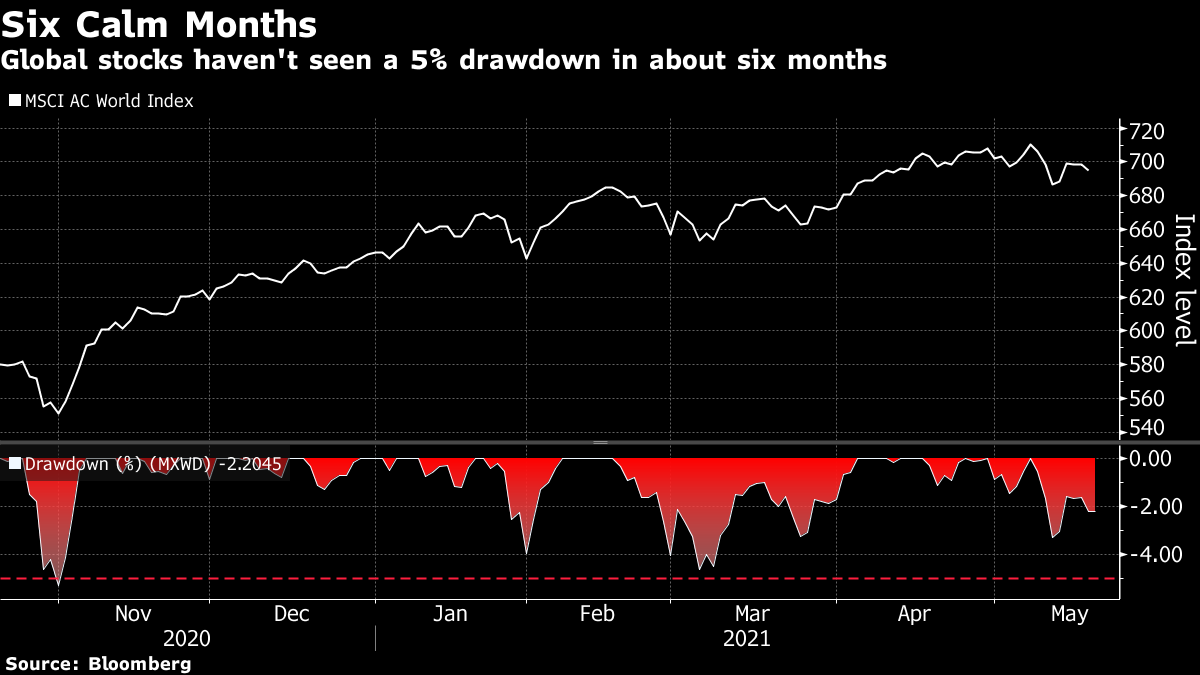

| Good morning. A wild ride for Bitcoin investors, the market nurses its bruises and some vaccines are better than others at stopping transmission. Here's what's moving markets. Crypto RollercoasterBitcoin plunged in the morning, then surged in the afternoon. Even amid what has been a tumultuous period for the token, that's pretty eye-catching volatility. A few hundred billion dollars was wiped off Bitcoin's value, before a big portion was later recovered as prominent proponents, like Ark Investment Management's Cathie Wood, reiterated their backing. Its fall was not as bad as some other cryptocurrencies and the token is steady on Thursday morning. Many newcomers who had helped power the token to records this year were burned and weren't being quiet about it, particularly as the biggest platforms were disrupted amid the chaos. But it was likely worth it for those who have made a killing, even if their nerves are shredded. Bruised MarketCryptos aren't the only assets nursing bruises. Stocks have lost some steam and frothier corners of the market are in retreat. Commodities, which had seemed to be on an unstoppable rally, slumped amid growing fears about inflation and the durability of demand in China, where authorities are increasing rhetoric around the cost of raw materials and taking steps to try and temper prices. Bonds, meanwhile, haven't been so useless as a hedge to stocks since 1999. Vaccine EffectivenessEvidence is starting to emerge that the type of vaccine a nation uses can help it to exit the pandemic quicker, with mRNA shots seemingly better at stopping people becoming contagious and therefore curbing transmission rates. In the U.K., the government is moving to assess how to best retain immunity to Covid-19 over time, conducting trials on seven vaccines to study which generate a successful immune response as a booster shot. U.K. Prime Minister Boris Johnson also said he's more confident vaccines work against variants of the virus. Cautious OptimismThe minutes from the Federal Reserve's latest policy meeting showed officials cautiously optimistic about the U.S. economic recovery, with some saying they would be open to scaling back the bank's bond-buying program "at some point." The specter of inflation continues to loom large, however, even as U.S. policy makers stick to the script that price pressures are transitory. The European Central Bank is also relatively upbeat about the outlook for the region, albeit with the risks to financial stability mounting from overvalued assets. U.K. inflation doubled in April and is likely to fuel speculation about when the Bank of England may take its foot off the stimulus pedal. Coming Up…European stock futures are trending higher, with U.S. futures mixed, following a steady day in Asia as markets focus on the Fed minutes and with commodities still under pressure, with the exception of copper. On Europe's earnings calendar we'll have postal operator Royal Mail and low-cost airline EasyJet, while in the U.S., retailer Kohl's and chip equipment maker Applied Materials are on the schedule. U.S. Commerce Secretary Gina Raimondo holds a summit to discuss the semiconductor shortage, which has roiled supply chains. Elsewhere, watch for developments on Israel amid reports a cease-fire may be edging closer. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningDespite recent wobbles in tech stocks and volatility in risk assets like cryptocurrencies, the global stock market has proven remarkably unruffled for more than six months now. The MSCI AC World Index hasn't experienced a 5% drawdown since November, the longest streak of calm since 2017, according to data compiled by Bloomberg. Still, previous stretches of a similar magnitude without a minor pullback -- at least in a study of U.S. stocks -- have led to poor returns over the next month, wrote Sundial Capital Research founder Jason Goepfert in a recent note. And there's a growing sense among market participants that a modest correction may be overdue. Last week, Morgan Stanley became the latest investment firm to sound the alarm on the impact of a potentially overheating global economy as concerns mount over rising inflation. Strategists at UniCredit had already suggested risk-off trades will become more likely, while peers at T. Rowe Price said that equities are vulnerable to potential setbacks amid peaking global economic growth. The odds are lengthening on the calm streak lasting through the summer.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment