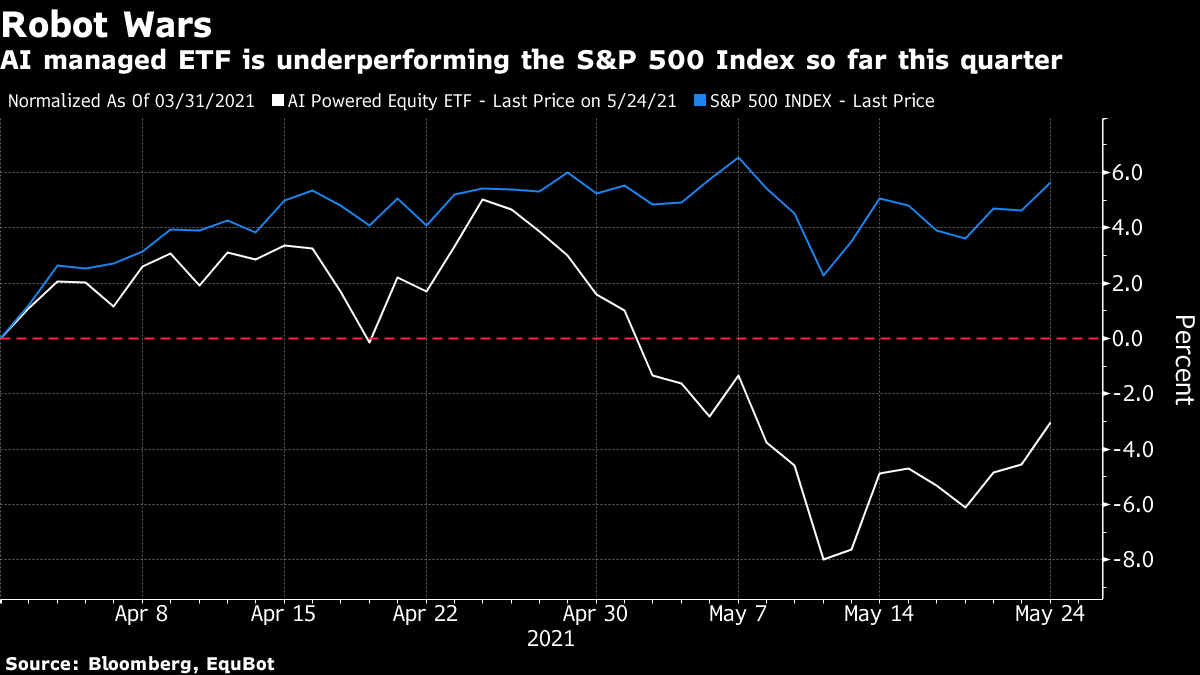

| Good morning. Belarus sanctions, oil gains, a big property merger and a broker bans cold calling. Here's what's moving markets. Summit, SanctionsA European Council summit continues in Brussels amid the backlash over what the European Union called the "hijacking" of a Ryanair jet and the arrest of dissident journalist Raman Pratasevich. Members have tasked ministers to ban overflight of EU airspace by Belarusian Airlines and prevent access to EU airports, while asking European airlines to avoid overflight of Belarus. Ministers were also asked to come up with broader measures to target sectors of the country's economy. 26-year-old Pratasevich, meanwhile, appeared in a video posted by state-owned media channels, speaking from what appeared to be a jail cell. Oil FirmerCrude held the biggest two-day gain since March as investors monitor a recovery in demand that may enable the market to accommodate fresh flows from Iran, should the nation's nuclear deal be revived. Talks between Iran and world powers will continue this week to resolve outstanding issues on the pact, which may pave the way for the removal of U.S. sanctions. Goldman Sachs Group reckons the market will likely be able to absorb the extra supply. Property MergerGerman residential property firm Vonovia agreed to acquire rival Deutsche Wohnen for about 19 billion euros ($23 billion) in the biggest-ever takeover in European real estate. The pact is set to reshape the country's property industry, bringing together the two largest residential landlords with control of more than 500,000 apartment units. Cold Calling OutCold calling by trainee brokers — traditionally a rite of passage for junior staff — is being ditched at a top broker. Merrill Lynch Wealth Management is revamping its training program for 3,000 fresh-faced brokers, including placing a ban on cold calling, and expanding accessibility to attract more diverse talent. Participants will be directed to use internal referrals or LinkedIn messages instead of cold calls. Coming Up…With stocks green across the board almost everywhere in Asia, European equity futures are pointing toward a gain after soothing comments from the Fed on inflation. More central bank officials will have their say today, with Japan's Haruhiko Kuroda, Sweden's Stefan Ingves, and European Central Bank Chief Economist Philip Lane all taking part in a conference. Elsewhere, Bitcoin trimmed gains after Elon Musk's effort to bolster the token's green credentials stoked a rally. Industrial software maker Aveva and real estate firm Shaftesbury report earnings in the U.K., while in the U.S., retailer Nordstrom and large-cap management software firm Intuit update. Finally, the U.S. said Americans should avoid traveling to Japan, less than two months before the Olympic Games are set to begin. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningA machine-guided fund which roared ahead of the market at the start of the year has suffered a setback this quarter thanks to the poor performance of its bets on tech stocks. The AI Powered Equity ETF, an exchange-traded fund driven by artificial intelligence, has lagged its benchmark S&P 500 Total Return Index by 9 percentage points since the end of March. Stock selection in the tech sector -- the fund's largest -- and health care -- where it is heavily overweight -- accounts for the bulk of the underperformance, according to calculations by Bloomberg. The fund's "manager," a quantitative model which runs 24/7 on IBM Corp.'s Watson platform, is not buying into the reflation trade narrative, according to an analysis of its latest holdings. It has outsized positions in consumer discretionary stocks and is underweight cyclical sectors such as financials, industrials and energy. Still, an international version, which invests in non-U.S. securities using the same approach, is more sympathetic to bets on a cyclical recovery. Its two biggest overweight sectors are industrials and materials -- relative to the MSCI World Index -- and it is underweight growth names such as consumer discretionary, tech and communication services. The AI Powered International Equity ETF has risen 6% so far this year, compared to a 10% gain in the MSCI World.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment