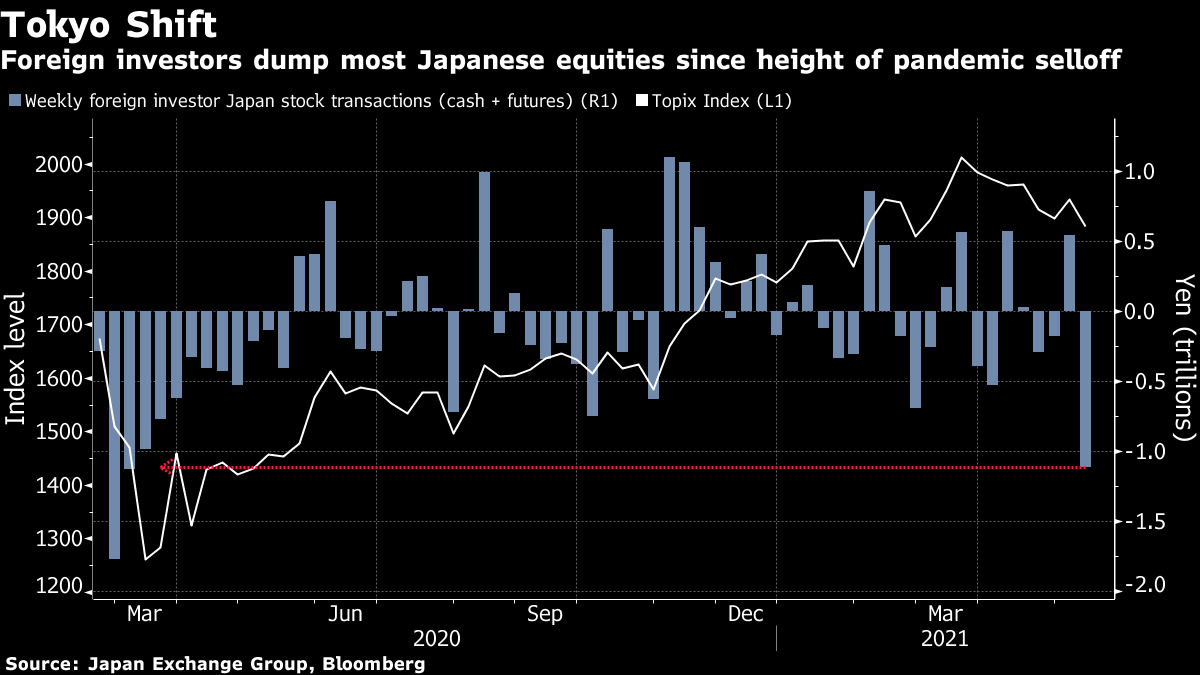

| Good morning. A cease-fire between Israel and Hamas, increased scrutiny of cryptocurrencies and more cases of the Indian variant in the U.K. Here's what's moving markets. Cease-FireIsrael and Hamas agreed to implement an unconditional, bilateral truce in the early hours of Friday, sparking wide celebrations in Palestinian cities following an 11-day conflict. Israel's security cabinet voted unanimously to approve an Egyptian-brokered proposal to stop the fighting. U.S. President Joe Biden, who had earlier this week increased the pressure on Israeli Prime Minister Benjamin Netanyahu to seek a cease-fire, praised the agreement as he continues to face pressure to distance his administration from Netanyahu. Crypto ScrutinyGiven the wild swings seen earlier in the week, cryptocurrency markets have been much calmer through Thursday and into Friday, but are now having to deal with a few sobering developments. Bitcoin pared some of its recovery after the U.S. Treasury called for stronger tax compliance in the space. Then Federal Reserve Chair Jerome Powell said the central bank will launch a major research project on digital currencies in the summer and seek public input, as policymakers consider how to proceed. Warnings also emerged from Canada and Norway's central banks. For Bitcoin, the extra scrutiny is the price it has to pay given the size of the market nowadays. Indian VariantCases of a worrying new Covid-19 variant from India more than doubled in the U.K. for a second week, putting more pressure on the country's current reopening schedule. More encouragingly on the vaccine front, two doses of the AstraZeneca Covid-19 vaccine provide between 85% and 90% protection from symptomatic disease, according to a study from Public Health England. Meanwhile, the U.S. is accelerating vaccine exports, marking a key step in the push by the country to ship its domestic supply abroad. And the European Union has now agreed on the introduction of vaccine certificates which will allow quarantine-free travel in the bloc, potentially providing a boost to the area's battered tourism industry. BanksA series of developments in the banking sector to catch up with. The teams that will sit at the helm of the world's largest banks in the future are starting to take shape. Morgan Stanley unveiled a slate of potential successors which were notably White and male, days after JPMorgan Chase had pushed two women toward the front of the field to replace boss Jamie Dimon. Elsewhere, Credit Suisse is reportedly considering retention bonuses to keep its talent as it reels from the Greensill and Archegos scandals. And in the U.K., Lloyds Banking Group came face-to-face with its shareholders for the first time since Covid-19 closed the economy down, and it was not a quiet affair. Coming Up…European and U.S. stock-futures are trending marginally higher with Asian stocks steady following Wall Street's rebound overnight and after European stocks bounced on Thursday. U.K. retail sales for April are expected to show a spending recovery as pent-up demand was unleashed by the country easing Covid restrictions. Euro-area finance ministers and central bank chiefs hold an informal meeting today, while in a quieter day for European earnings, luxury watches and jewelry maker Richemont will report. And watch for any reaction to the U.S. calling for a global minimum corporate tax rate of at least 15%. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThey weren't invited for the Olympics and now foreigners seem to be turning their backs on Japan's stock market. Overseas investors sold $10.2 billion worth of Japanese equities and futures in the week ended May 14, according to the latest exchange data. As my colleague Kurt Schussler pointed out Friday, that's the most since March 2020 amid the height of the pandemic selloff. Concerns about higher inflation hit global stocks in the week of the outflows, pushing Japanese shares to the brink of a technical correction. But worries about a lack of inflation in Japan must also be weighing on investors' minds especially toward shares most exposed to the domestic economy. Japan's key inflation indicator showed prices falling for a ninth straight month in April in stark contrast with global peers. The country is suffering from a slow vaccine rollout which is holding back the domestic recovery and capping demand-driven inflationary pressure. A historic unwillingness to raise prices also leaves Japan's companies open to margin pressure if external inflation increases their costs of production. The inflation imbalance could well weigh on the yen which should give stocks some support. But it's hard to make a bull case for Japanese shares when the country is lagging its developed peers on so many fronts.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment