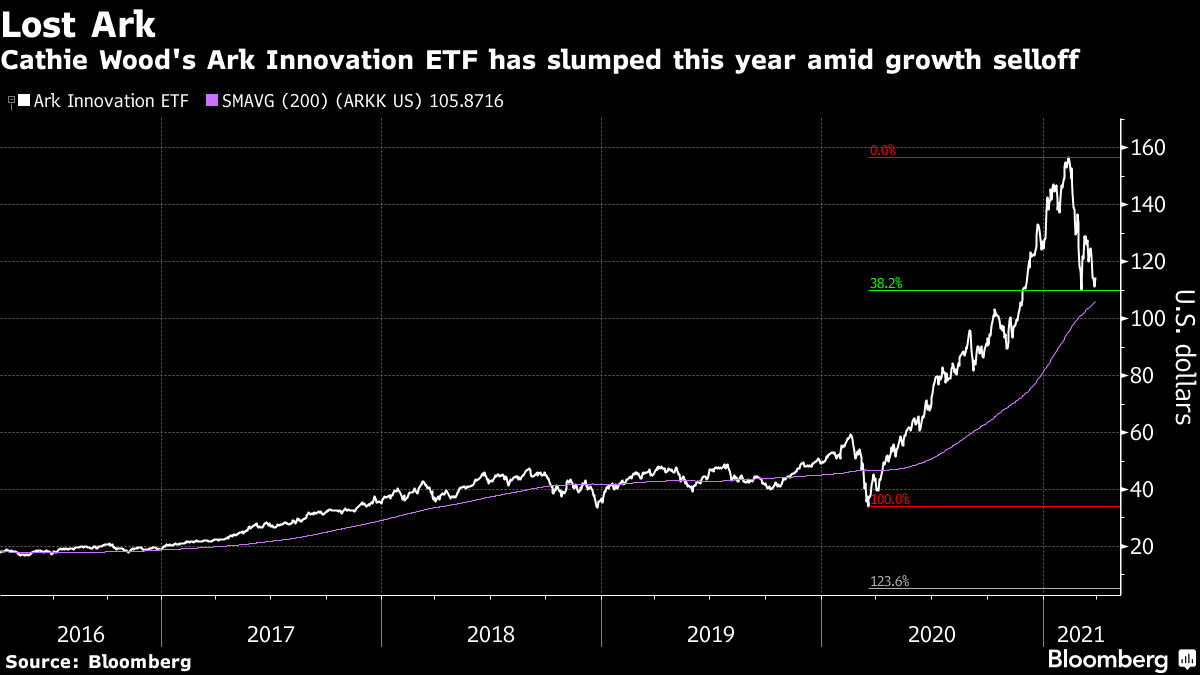

| Biden pitches a $2.25 trillion infrastructure plan. Hong Kong police warn residents to avoid political "red lines." Deutsche looks set to emerge unscathed from the Archegos debacle. Here's what people in markets are talking about today. U.S. President Joe Biden presented a $2.25 trillion U.S. infrastructure plan on Wednesday, promising to "bring everybody along" at the unveiling in Pittsburgh. The "American Jobs Plan" lays out an eight-year program that includes $620 billion for transportation and $650 billion for initiatives such as cleaner water and high-speed broadband. Biden's plan would also allocate $580 billion to American manufacturing. The plan is focused on addressing inequalities, but will face fierce opposition from Republicans, especially over its proposal to pay for the package with tax increases. Meanwhile, the U.S. Trade Representative raised concern about some of China's economic policy tools in its 2021 estimate report on foreign-trade barriers. "Made in China 2025," a key 10-year plan released in 2015, includes a wide array of state intervention and support that restricts and discriminates against foreign enterprises, USTR said. Asia stocks are set for a firmer open after gains in U.S. equities as traders assessed Biden's infrastructure plan. Futures climbed in Japan, Australia and Hong Kong. Ten-year Treasury yields resumed their rise, leading the Bloomberg Barclays index tracking U.S. government bonds to its worst quarter since 1980. Oil fell as talks ahead of a meeting of OPEC and its allies gave no signal of output plans. A slight pullback in the dollar left its best quarter in a year intact. The crisis at Archegos Capital may cost some investment banks billions. But Deutsche Bank looks set to emerge unscathed after selling about $4 billion of holdings seized in the family office's implosion in a private deal Friday. Almost $30 billion of investments are now known to have been liquidated in the messy unwinding. Goldman Sachs, Morgan Stanley and Wells Fargo dumped multibillion-dollar blocks of stock to recover capital they loaned to Archegos. Credit Suisse and Nomura, however, may each face a hit in the billions of dollars. Meanwhile, the U.S. Securities and Exchange Commission opened a preliminary investigation into Bill Hwang over his leveraged trades, a fairly routine measure after a market blowup. For Hong Kong residents wondering what sort of behavior might breach the Beijing-imposed national security law, one of the city's top police officers says it's the wrong question to ask. "A healthy attitude is to say, 'How can I be a responsible citizen and just make sure that I contribute to the overall harmony and peace and security of this place,' rather than say 'Hmm, let me see how far I can push this envelope, so that I can almost touch the red line, but you can't touch me,'" Oscar Kwok, Hong Kong Police Force's deputy commissioner for management, said. The security law prohibits subversion, secession, terrorism and foreign collusion. But lawyers and Western governments have criticized the law's vague provisions as a tool for suppressing normal political activities. In a wide-ranging interview with Bloomberg Television, Kwok defended Hong Kong Police Force, saying the arrests were necessary because the city faces pressing national security threats, including from the U.S. Facebook co-founder Eduardo Saverin's B Capital Group is moving into China, hiring former Softbank Vision Fund partner Daisy Cai to help it hunt down promising startups. A team of about 10 investment professionals will focus on Chinese tech startups serving businesses in health care, financial services and transportation, among others. As China cracks down on its consumer-internet giants, Cai will help deploy some of B Capital's $1.9 billion of assets under management toward the country's fast-emerging enterprise technology segment. "I see a tremendous opportunity for technology companies servicing enterprises as the digitalization theme is going to play out in large industries," Cai said in an interview. "It's very similar to what the U.S. has gone through in the past 20 years." What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in todayCritics denouncing Cathie Wood's Ark Investment Management for having too much cash tied up in too few stocks are kind of missing the point of thematic investing. It's the responsibility of the ETF buyer to have a diversified portfolio, not the fund manager whose mandate is to concentrate exposure toward a specific theme or sector. Ark — which invests in companies involved with disruptive trends — recently altered the prospectuses for its funds to remove clauses limiting its concentration risks, generating fresh criticism in the process. The move comes with its flagship Ark Innovation ETF down over 25% from a February high and potentially signals the high-profile fund manager is looking to use the recent selloff in growth stocks to double down on some holdings.  And that is exactly what Wood is being paid for. She would be doing a disservice to her investors to load up on cash or Treasuries or a bunch of not-so-innovative stocks in a bid to diversify. This is by no means an endorsement. Any concentrated investment is by definition a high-risk one —and the merits of the funds themselves are a separate issue. But like the woodstain advertisements of old, when you buy a robotics/fintech/space exploration/innovation ETF, you should be getting exactly what it says on the tin. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Programming note: Five Things is taking a long weekend break, and will be back on Tuesday. |

Post a Comment