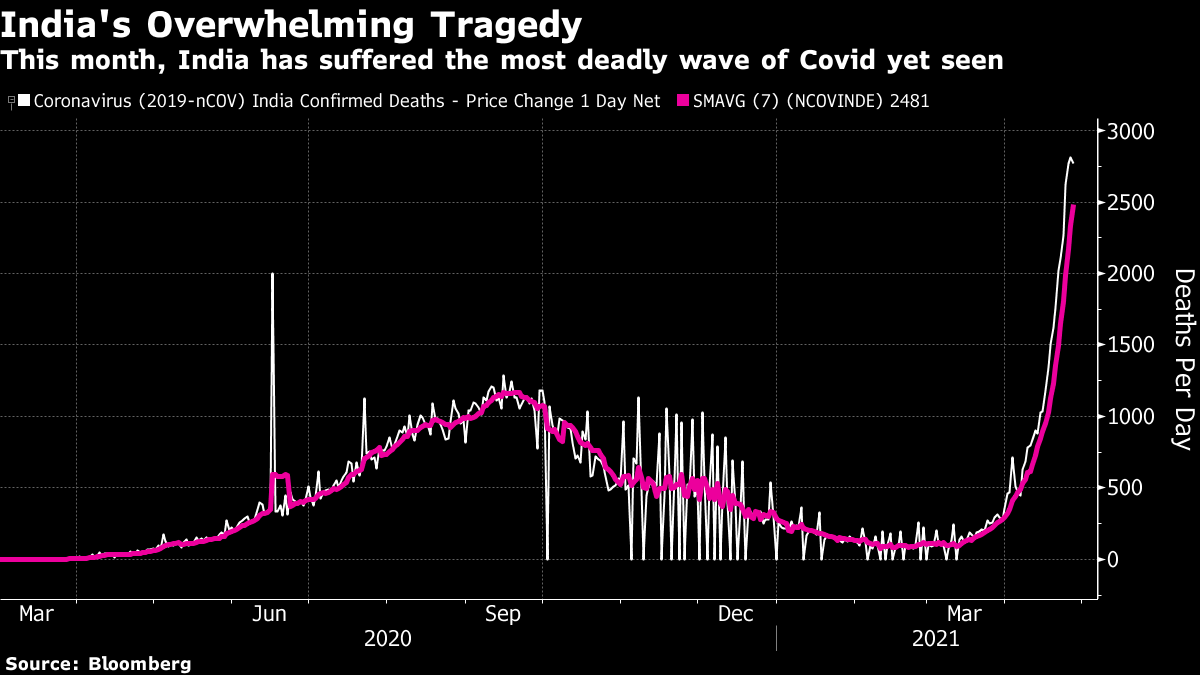

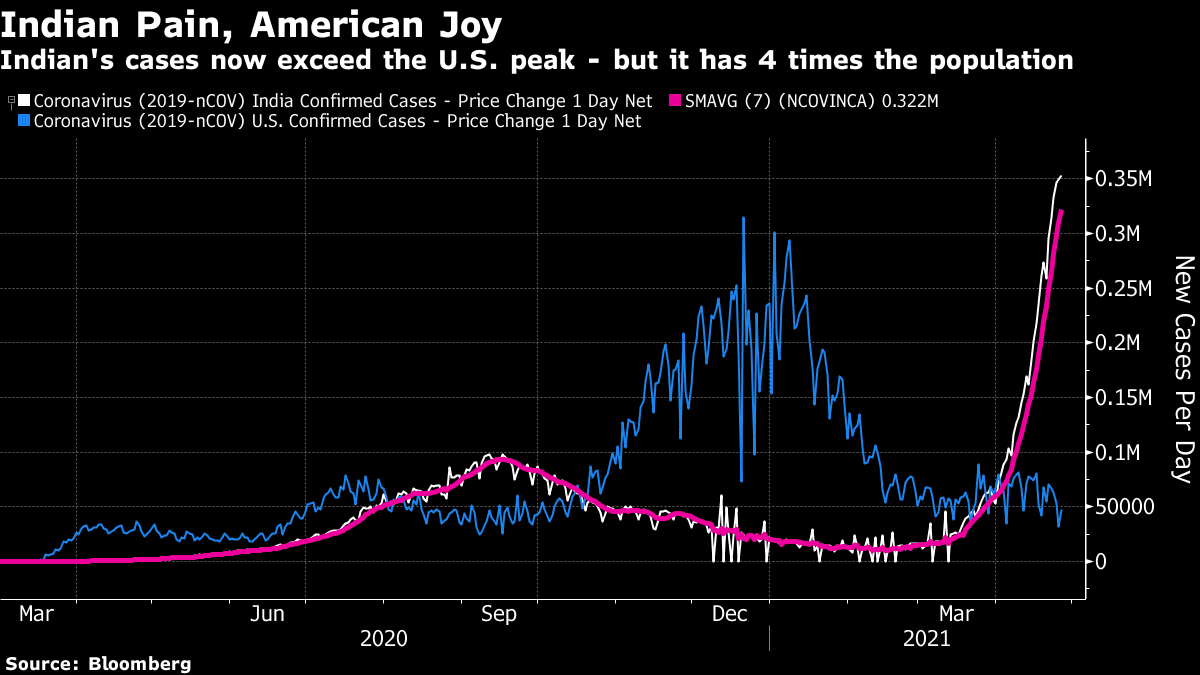

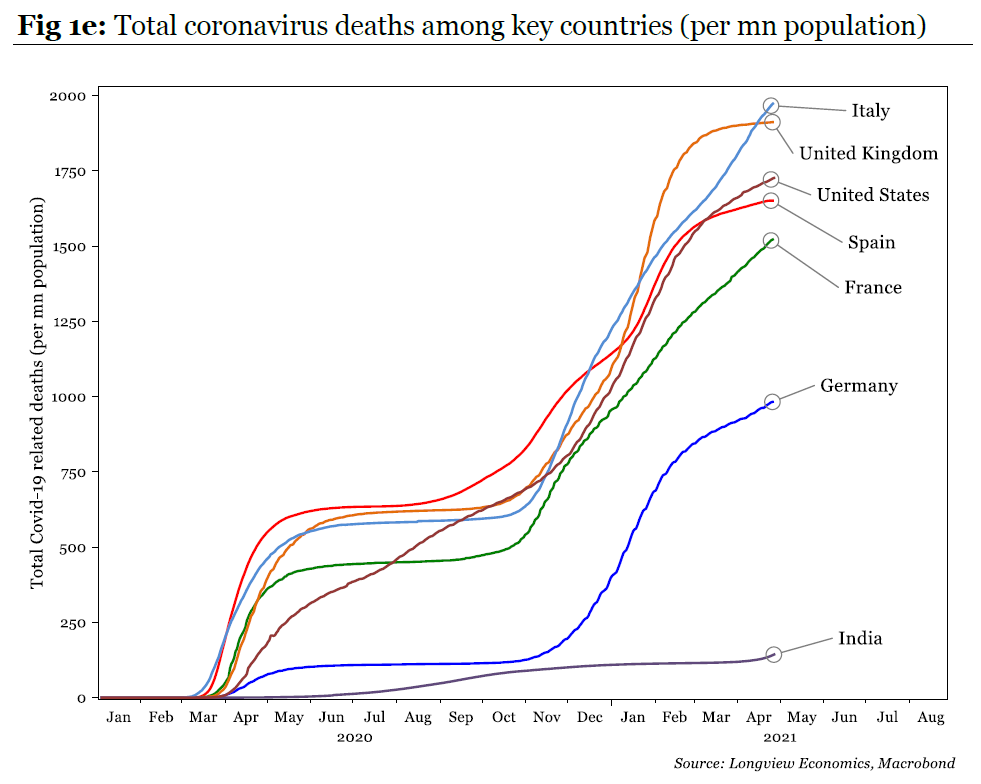

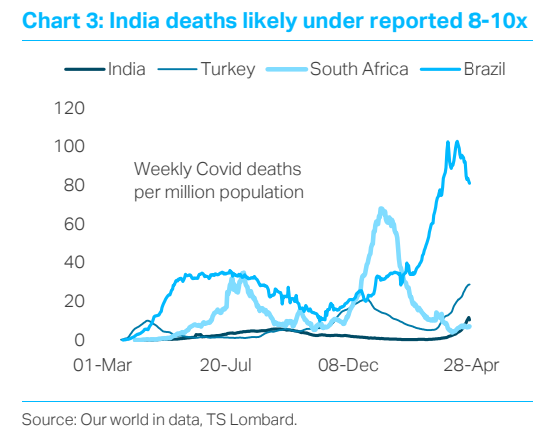

An Unfolding DisasterSometimes this job can be distasteful. As the U.S. and the U.K. enjoy a steady relaxation of Covid-19 restrictions, India is in the grip of arguably the single most violent and overwhelming outbreak the world has seen. All of us should be primarily concerned about the human cost. For good reportage on these appalling events, read lengthy reports in the New York Times, the Wall Street Journal, or watch this video from Bloomberg. The Guardian has a moving podcast, recorded shortly after one of its journalists in Delhi had died of Covid. However, it is my job now to try to work out how much of a financial impact this wave will have on India and the rest of the world. This isn't the most important aspect of the unfolding disaster, but it needs to be considered. First, a look at the death toll shows that India has been hit suddenly and very hard. This is how the number of deaths has moved since the pandemic took hold early last year:  Deaths are a trailing indicator, as we all now know. Here are daily cases, with the U.S. for comparison. Note that India has more than four times the population of the U.S., and yet this is the first time new cases have exceeded the American peak, set at the turn of the year:  Once we look at deaths per million, India's rate is still remarkably low compared to the U.S. and major western European nations (the chart is from Longview Economics Ltd. of London):  This could imply that the toll will get far worse, with the scale of the increase in deaths and cases showing the disease is out of control. It could also imply that India's pandemic isn't yet an issue of concern beyond its borders. But the best interpretation may be simply that India's deaths and cases have been underreported. Jon Harrison of London's TS Lombard argues that the correct figure could be as much as 8-10 times higher than the official data: A combination of lack of testing capacity and popular reluctance to be tested suggests that true infection levels may be significantly higher than reported (positivity rates in India and Philippines are 20%). Healthcare expenditure in India, Philippines and Thailand is low compared with that in Brazil and Turkey, while large rural populations further add to the challenge of tracking the pandemic. It is difficult to assess the true scale of under reporting, but some local analysts suggest that in India, for example, the total number of deaths could be as much as 8-10x that reported, which would mean that the scale of India's pandemic has equaled that of Brazil . Vaccination has likely helped contain the pandemic in Brazil and Turkey but India's vaccine roll out has recently slowed in the face of supply shortages. Imports of doses and raw materials from the US, Russia and elsewhere should help overcome recent constraints

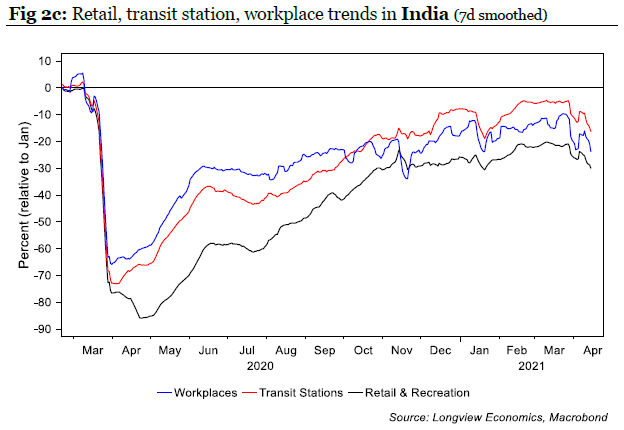

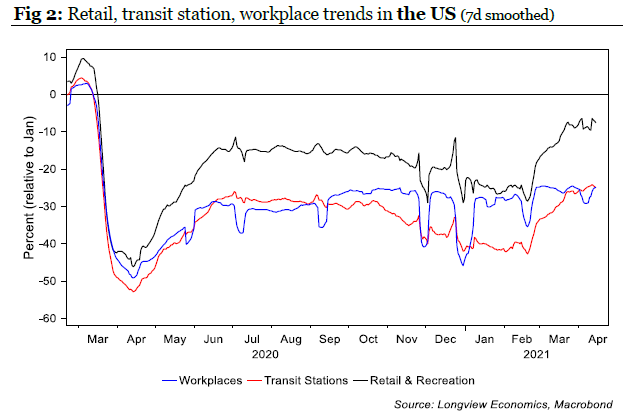

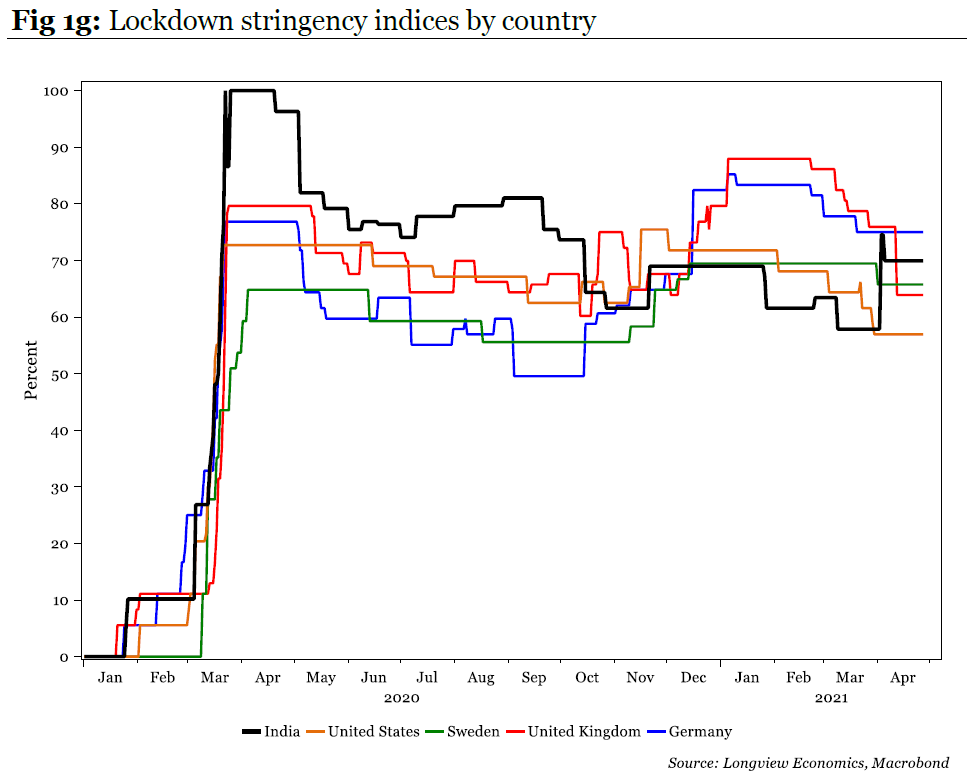

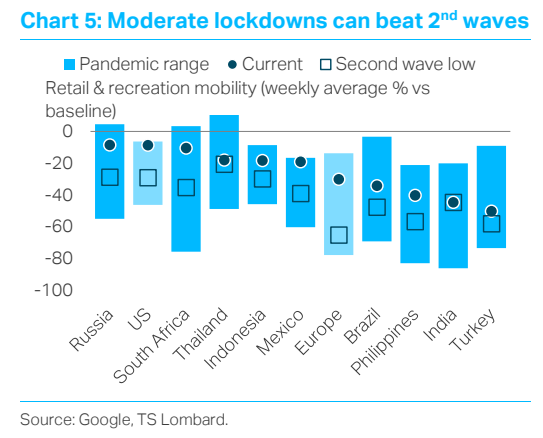

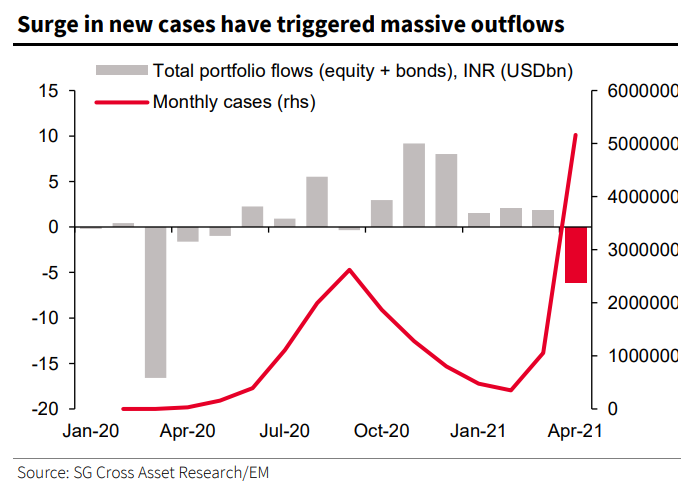

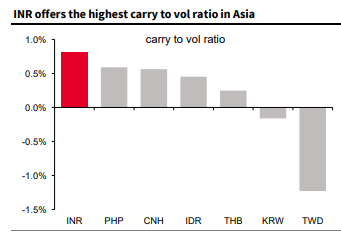

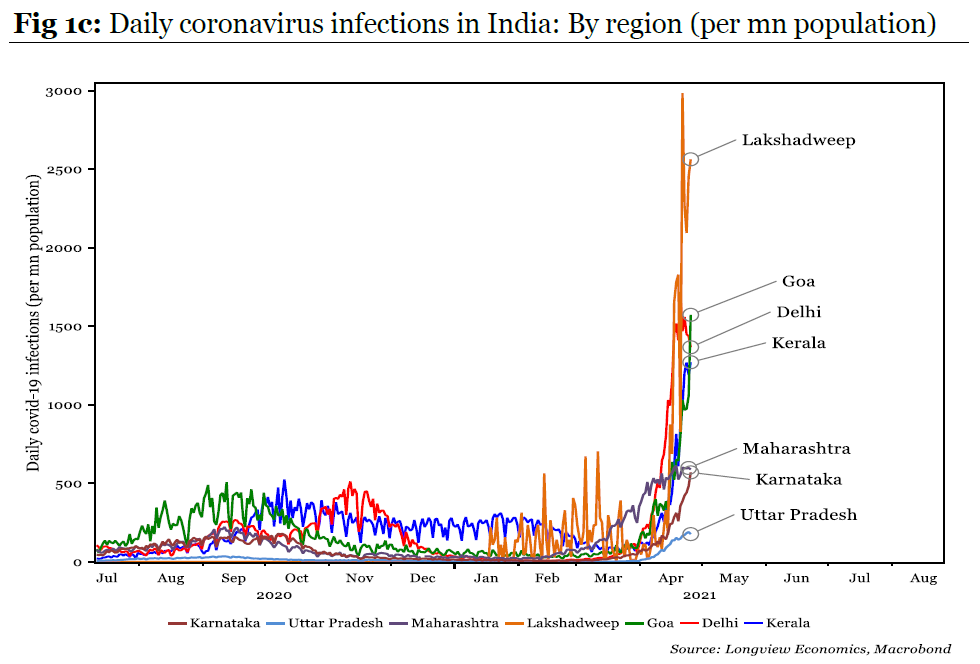

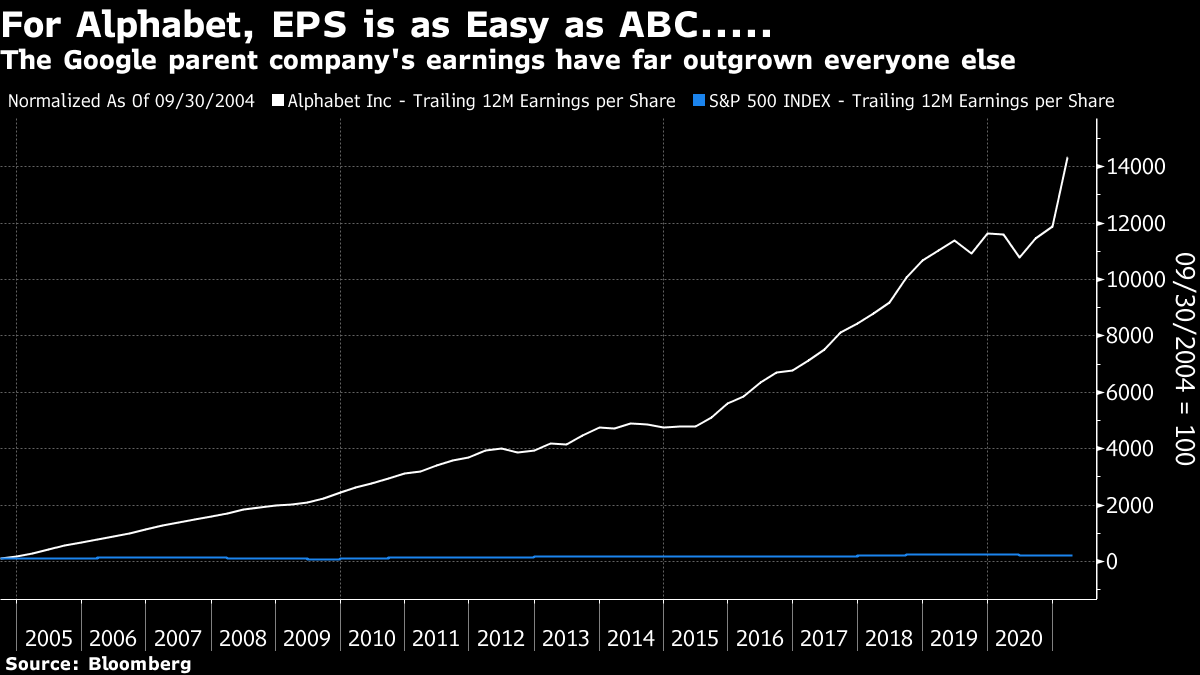

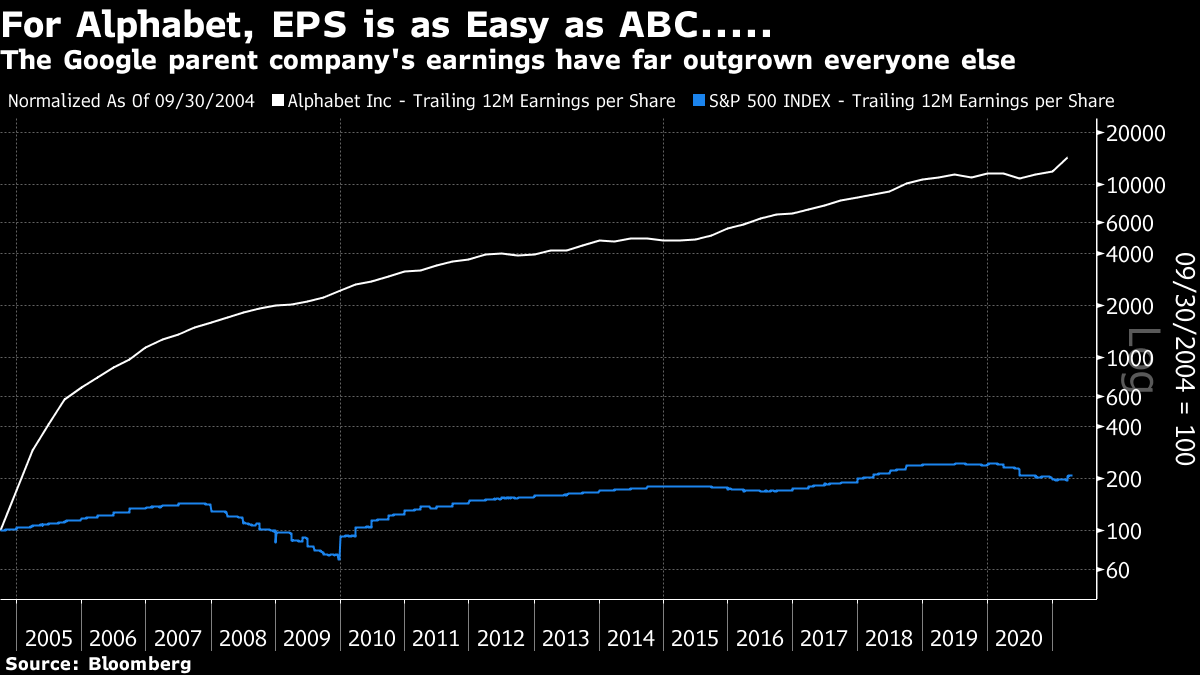

So far, these horrors haven't been reflected in any great decline in India's economic activity. There follow two charts from Longview, showing the amount of retail, transit station and workplace usage compared to January of last year, for India and the U.S. Note that the scales are slightly different because Indian retail and recreation activity dropped by almost 90% last year, while U.S. activity barely ever dipped by more than 50%. By this metric, the use of transit stations implies that Indians at this moment are more likely to be commuting to work than Americans:   This again implies that the economic impact of the Indian pandemic could get much worse for the rest of the world, if the country decides to adopt a national lockdown. That, however, looks unlikely. India imposed an exceptionally stringent lockdown last year, which appeared to work at the time, and appetite to do so again is limited. At this point, its anti-Covid measures are less stringent than Germany's:  As the following chart of primarily emerging nations from TS Lombard shows, India's restrictions are currently stricter than most, though less severe than Turkey's. Other countries have generally opted for more moderate second-wave lockdowns:  Where does this leave financial markets? Unsurprisingly, Indian assets have been hurt, although perhaps not by as much as might have been expected. The benchmark Sensex index has dropped sharply compared to FTSE's all-world index since the second wave began, but in relative terms it is still far ahead of where it was last summer, when India appeared to be relatively lightly affected:  Outflows this month have been massive. Foreign investors had plowed $5.3 billion into Indian equities and bonds from January to March, according to Societe Generale SA, buoyed by expectations of one of the world's strongest economic recoveries. The IMF's forecast was for 12.5% growth next year. But $6.1 billion of capital has exited so far this month: This SocGen chart shows portfolio flows in and out of stocks and bonds combined since the beginning of last year:  Could this have further to run? Outflows were far more severe last year, so it is possible. This in part depends on whether the disease continues to spread, and also perhaps critically on political responses. Prime Minister Narendra Modi is popular with international markets, and has until recently been regarded as one of the world's most secure national leaders. That is now being called into doubt. Escalating political problems for Modi would radically change perceptions of India. As for the currency, there has been much focus on its weakening against the dollar. This is how the rupee has moved over the last decade (the spike in 2013 came amid the brief crisis prompted by the taper tantrum):  It is nearly at an all-time low. However, much of this has to do with the strength of the dollar, which has been in a bull market for much of the last decade. If we look at the rupee compared to a range of other currencies, on a real effective rate (taking into account different countries' inflation rates), the currency is still far stronger than it was during the crisis of 2013, and so far hasn't sustained that much damage:  Again, this can be looked at two ways. The pandemic hasn't had much financial impact yet, but there is time for it to wreak considerably more damage. As SocGen shows in this chart, the yields available on Indian deposits (the "carry" for holding assets in rupees) is now more appealing than those of any other main Asian currency, so this should act as some kind of a buffer.  Broadly, then, the health crisis has yet to have as big an effect on Indian financial markets as might have been expected. This would change if the more nightmarish scenarios were to come true. India's scale makes it hard to judge, but at this point the state of Uttar Pradesh, whose 237 million population would make it the world's fifth-largest country if considered alone, has one of the lowest incidences of Covid-19 in India:  There is much scope for authorities to bring the outbreak under control. Indian assets aren't going to recover until there is some confidence that the worst is in. There is room for them to fall far further if the outbreak continues to spread at the same rate, and particularly if is perceived to do fatal political damage to Modi. The consequences for fighting the pandemic elsewhere could be greater. The rest of the emerging world has relied on India as a chief source of vaccine. It's fair to assume that Indian-made vaccines aren't going to be exported for a while given the intensity of the problem at home. That is very bad news for other emerging nations, particularly the populous and generally much poorer countries that surround India. It will increase pressure on developed nations to export some of their vaccines, and also stoke geopolitical tensions. Russia has played a canny game of "vaccine diplomacy" so far, and leaders in the West wouldn't be happy to see India saved by Russian vaccines. Beyond that, the fact that Covid remains so strong in such a large country raises doubts as to whether the pandemic can truly be said to be vanquished in the U.S. or Europe. The odds are that more people will die of the disease this year than last, and we already know that it can cross borders easily. Finally, there is the issue of global demand. The world has counted on India, as the second-largest country by population, to contribute. By the IMF's optimistic forecasts, its growth rate should match that of China over the next few years, although India's economic output is less than one-quarter as large. Its pandemic wave has contributed to concerns about the oil price, but the Organization of the Petroleum Exporting Countries has yet to act on this. Beyond the human tragedy, India's Covid-19 outbreak is a potent reminder that the pandemic is yet to be banished. It raises the risks of considerable further economic damage. But that damage hasn't yet been done. If India (and the rest of the world) can bring the wave under control in the next few weeks, it shouldn't have any serious long-term effects for the global economy. There should be strong human incentives to try to thwart the outbreak in any case; finance provides another. Methinks Google Doth Earn Too MuchAmid a plethora of earnings reports, the numbers from Alphabet Inc., parent of Google, demand attention. Revenue surged 35%, while earnings per share came in at more than double the level a year earlier. It has enough cash to announce a $50 billion share buyback. Obviously, the company has a fantastic business model and an entrenched competitive position, and has continued to prosper even as many people start to return to the real world and spend less time online. Earnings growth since it went public in 2004 has been phenomenal, and the pace has stepped up again:  This is extraordinary. For a better grasp of what is going on, here is the same chart on a log scale:  Alphabet is a great company. But it might have preferred to make a little less money. This week and next, new books come out from Senators Amy Klobuchar of Minnesota and Josh Hawley of Missouri, who aren't ideological soulmates — but are strongly in favor of breaking up Big Tech. Politicians and regulators in other territories that Google dominates will think likewise. Profits on this scale tend to make the case for them. Survival TipsHere's one way to keep body and soul together; plan some tourism. Until now this has seemed like tempting fate. Large swathes of the Earth's crust (including India, unfortunately) are still off-limits. But a lot of the world is open for business and pleasure once more, for those who are fully vaccinated. Whitney Tilson, the former hedge fund manager whose Covid-19 newsletter is a regular must-read, offers a classic value investor's recommendation — many places that cater mostly to European tourists will be almost empty. Cancun has already been besieged by a mass of people (although there are plenty of less discovered Mexican resorts you could try), but if you head to the Mediterranean, you might find sunshine, beauty — and even solitude. Tilson recommends this piece and this piece to help brush up on the rules that different countries are adopting. He also suggests that if you head for Kenya, national parks like the Masai Mara will be all yours (even though there won't be many people there, you'd still need to look out for lions). Personally, I'd like to plug western Crete, which my family has treated as a home away from home for decades. It's as far south as you can go while still staying in Europe, it has undiscovered beautiful beaches, and also, amazingly, snow-capped mountains, with deep and dramatic gorges between them. You can find the ruins of Europe's first great civilization tucked into the mountain crags. And the food's great. This is what it looks like, in a photo I took from this wonderful gallery of western Cretan photography.  I gather from my parents' friends that if you were to head there now you'd be unlikely to find any hotels open outside the big cities, and tourist restaurants haven't reopened, but the place is desperate for business. The water is already swimmable, and at the end of spring the countryside is still carpeted with flowers. Maybe it isn't going to happen just yet, but after a year of forced inactivity, it'll be good for your mental health to dream. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment