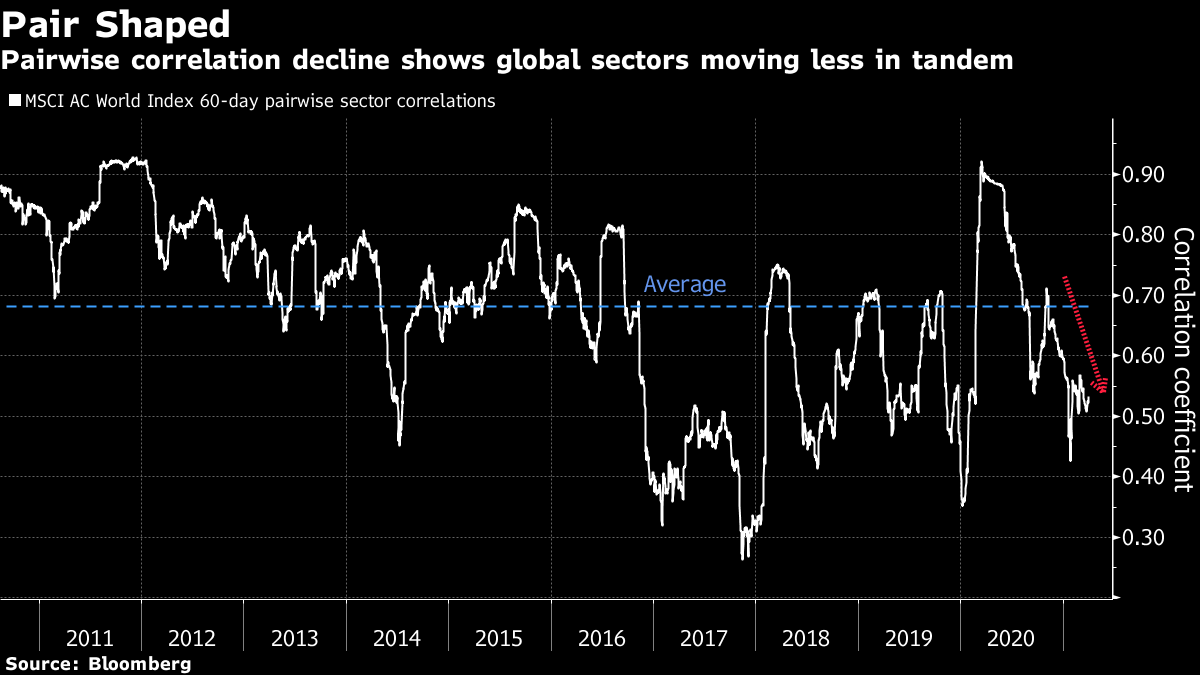

| Janet Yellen outlines the case for global tax cooperation. Archegos claims another investment-banking casualty. Beijing tests Biden in the South China Sea. Here's what people in markets are talking about today. In her first major speech on international economic policy, U.S. Treasury Secretary Janet Yellen made a case for a minimum corporate tax rate across the world's major economies. She spoke of an American return to the "global stage" and singled out China, saying the U.S. needs a "strong presence in global markets" to level the playing field. The tax proposal marks the return of the U.S. to years-long talks — led by the OECD with about 140 countries — to develop a global agreement on minimum levies. This week, Yellen is participating in her first round of meetings as Treasury secretary during the spring IMF and World Bank meetings, being held virtually this year. Asian stocks look set to climb Tuesday after U.S. equities rallied to a record on solid economic data that added to evidence of a strengthening recovery. Futures pointed higher in Japan, while Australian and Chinese markets will reopen after holidays. Hong Kong remains closed. The dollar and Treasury yields fell. Crude oil sank. Key events to watch this week include the 2021 IMF and World Bank spring meetings and the Fed publishing March minutes on Wednesday, plus Japanese balance-of-payments numbers and Chinese consumer and producer prices data. Credit Suisse's investment bank chief, Brian Chin, is set to leave as part of a wider shakeup at the Zurich-based lender that was hard hit by the collapse of Archegos Capital Management. Chin's exit will be announced as soon as Tuesday, according to people familiar with the matter. The bank's leaders are also discussing replacing risk chief Lara Warner while sparing CEO Thomas Gottstein. The firm has acknowledged losses will be significant, and is offering another program of block trades in Archegos-linked stocks on Monday, according to a person familiar with the matter. Here's Money Stuff columnist Matt Levine's take on the Archegos affair. Based on the official view from Beijing, the Philippines has no reason to worry about Chinese fishing boats "taking shelter from the wind" along a disputed reef in the South China Sea. But more than 40 boats have been at Whitsun Reef for more than two weeks and Philippine statements on the "maritime militia" are getting terse. It's beginning to look more and more like Beijing is probing whether the U.S. will take any action after pledging to work with allies in the region to deter Chinese assertiveness. Using commercial fishing boats amounts to a "gray zone" tactic that allows China to deny anything is amiss and makes calibrating a response very tricky. Sending an aircraft carrier or other warships near the reef risks appearing like a U.S. overreaction. But doing nothing could look weak. The total value of the cryptocurrency market pushed past $2 trillion for the first time, doubling in about two months. Institutional investors are dabbling as a way to boost returns in a world of near-zero interest rates. Bitcoin, the largest of the more than 6,600 coins tracked by CoinGecko, is worth more than $1 trillion alone, while the five next biggest coins — Ether, Binance Coin, Polkadot, Tether and Cardano — have a combined value of about $422 billion. Tesla has poured $1 billion of its reserves into Bitcoin, Morgan Stanley is letting some clients to add the token to their portfolios, and firms from Mastercard to PayPal are taking steps to embrace it. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in todayArguably the key underlying investment theme so far this year is divergence. Having fallen together as one in 2020, economies are growing again at varying speeds, thanks in part to differing stimulus measures and vaccine rollouts. U.S. yields are diverging from their European and Japanese peers, driving different moves in their currencies and bond markets. And it's no different in the global equity market, where stocks and sectors are moving ever less in tandem.  A gauge of the MSCI AC World Index's 60-day pairwise sector correlations — a measure of how closely sectors move relative to each other — has fallen back to the 0.50 level, well below its 10-year average. A maximum possible correlation of 1.0 would signify all sectors are moving in lockstep. The theme is going to give asset allocators a chance to earn their stripes this year, it's a great opportunity for active fund managers to outperform their benchmarks. But it could also mean a period of muted returns for those invested in passive funds, where the winning and losing sectors battle under the surface. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment