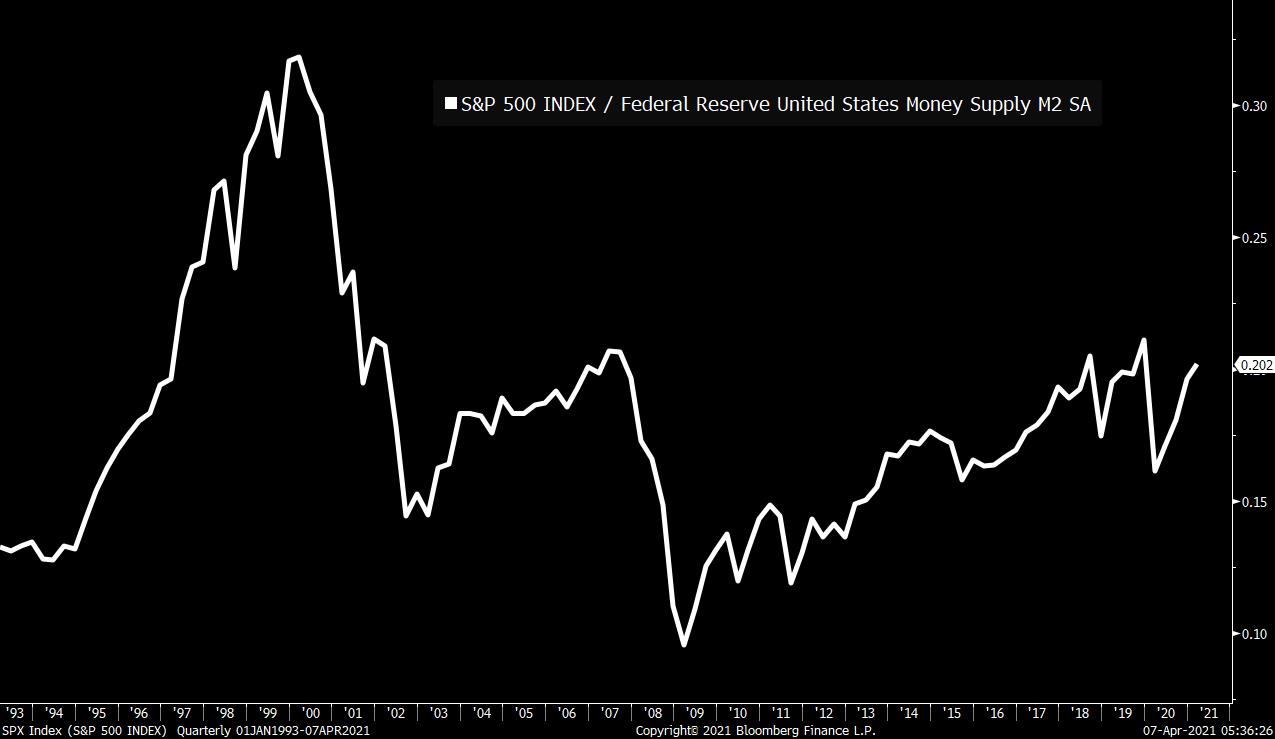

| Biden pushes package, pandemic world divided, and Morgan Stanley's early move. Pitch President Joe Biden will deliver his second major speech on his $2.25 trillion infrastructure plan today as he tries to raise support among Republican voters. White House aides have said they want significant progress made in Congress on the package by Memorial Day. While the recent procedural win means the administration will not have to rely on GOP support for much of that progress, Biden will have to be careful not to alienate any senators from his own party. West Virginia's Joe Manchin has already expressed doubts on the tax measures in the plan. April 19The vaccine rollout success in the U.S. -- where the daily dose rate is running above 3 million -- allowed Biden to announce yesterday that every American adult would be eligible for a vaccine by April 19. At the current rate, 75% of the country's population will be inoculated around July. Progress in Europe is slower, with more than half the adult population expected to be vaccinated by the end of June. Things are far worse in major emerging market countries, with India suffering a record surge in cases with little data on new variants, while Brazil saw 4,000 deaths in a single day. First mover It has emerged that Morgan Stanley sold $5 billion of shares owned by Archegos Capital Management the day before a deluge of block trades sent some company stocks plunging. Credit Suisse Group AG is coming under increasing pressure to get its house in order after it reported a $4.7 billion writedown tied to the collapse of Archegos. The market appears to be ready to move on from the debacle, with options trades showing investors are betting the companies hardest hit by the selling will bounce back in the coming weeks. Markets quietGlobal equity gauges are generally holding close to record highs. Overnight the MSCI Asia Pacific Index slipped less than 0.1% while Japan's Topix index closed around 0.7% higher. In Europe, the Stoxx 600 was 0.1% lower at 5:50 a.m. Eastern Time amid a small rotation into more defensive stocks. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 1.642%, oil and gold were lower. Coming up... The U.S. trade balance for February is at 8:30 a.m. with crude oil inventories at 10:30 a.m. President Biden speaks about his infrastructure plan at 1:45 p.m. The minutes from the last Fed meeting are published at 2:00 p.m. Consumer credit data is at 3:00 p.m. Regional Fed Presidents Charles Evans, Robert Kaplan, Thomas Barkin and Mary Daly speak today. The IMF and World Bank Spring Meetings continue. Carnival Corp. is among the companies reporting results. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn lieu of the normal note, this is a PSA to readers: There's a dangerous new type of chart crime out there that everyone needs to be on the lookout for. People are increasingly posting charts of, say, a stock or an index and then dividing by some monetary aggregate to claim this somehow represents "real" returns. Here's a rough sketch of one. It's a chart of the S&P 500 divided by the M2 money supply.  The insinuation of such a chart is that the money supply somehow is the real measure of inflation and that when you look at things that way, the performance of the market has been extremely mediocre with stock gains barely keeping up with all that printed money. Of course this is dangerous nonsense. M2 isn't a particularly useful measure of anything. It's not a measure of "money printing." And it's certainly not a measure of inflation. What's essentially happening is that because official inflation metrics have been mild, people are coming up with alternative measures to try to prove that things are much worse than they are. But since the goal of any business or household is to take in more revenue than gets spent, it still just makes sense to look at the actual costs for things, rather than trying to capture, say, the volume of money out there in some way. Either prices are going up rapidly or they're not. Either stock returns are outpacing inflation or they're not. Either revenue growth of corporations is exceeding costs or it's not. Those are the questions we need to be answering.

Still, you can see why a chart such as the above could be used by knaves to dupe the uninformed. So if you see one in the wild, don't try to confront it directly. Just please message the tip line I've set up at jweisenthal@bloomberg.net with the subject "chart crime". Anonymity guaranteed. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment