| Biden's plan faces a difficult passage through Congress, claims data due, and OPEC and its allies decide production levels. Compromise President Joe Biden's plan to rebuild U.S. infrastructure is going to have a difficult path through Congress as Republicans want no part of the corporate tax hikes that will pay for it, while progressive Democrats say it is not nearly big enough. The complexity of negotiations, and the possibility the package could be broken into several parts, means lawmakers don't see completion until September or October this year. One surprise winner from the plan which lauds its environmental credentials would be the Canadian oil-sands industry. ClaimsWhile economists forecast that the initial jobless claims number published at 8:30 a.m. Eastern Time will continue to show improvement, the median estimate of 675,000 points to a labor market far from full recovery. Yesterday's ADP employment change number showed a pickup in hiring, particularly in the hospitality sector. Tomorrow's monthly jobs report is expected to show a surge in hiring, with 650,000 added to payrolls and unemployment falling to 6%. Cartel OPEC and its allies are holding talks today on whether to prolong the vast production curbs that have been in place to support the oil price. Secretary-General Mohammad Barkindo said that the market is "surrounded by uncertainties" ahead of the meeting which is widely expected to maintain output at current levels for another month. The U.S. is trying to put some political pressure on Saudi Arabia not to hold prices too high for too long, highlighting the importance of "affordable energy" in a call yesterday. Oil investors seem confident that the meeting will not lead to an increase in production, with a barrel of West Texas Intermediate for May settlement trading almost 2% higher this morning. Markets riseGlobal equity markets are getting the second quarter off to an optimistic, if somewhat subdued start. Overnight the MSCI Asia Pacific Index added 0.9% while Japan's Topix index closed 0.2% higher. In Europe the Stoxx 600 Index had gained 0.5% by 5:50 a.m. in a broad-based advance. S&P 500 futures pointed to plenty of green at the open, the 10-year Treasury yield was at 1.718% and gold was higher. Coming up... U.S. manufacturing PMI for March is at 9:45 a.m., with ISM manufacturing for the month at 10:00 a.m. Construction spending for February is also at 10:00 a.m. The Baker Hughes rig count is at 1:00 p.m. Philadelphia Fed President Patrick Harker speaks later. Autosales data for March is released today. Carmax Inc. reports earnings. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningWithout a doubt the big story in markets in Q1 was the huge selloff in Treasuries, which had their worst quarter in years. At around 1.70% on the 10-year yield, the absolute level of long rates is still very low. But the size of the move was historic and at one point the whole situation had people questioning the Fed's strategy and whether Powell & Co. were being tested in some way, requiring a strategy pivot.

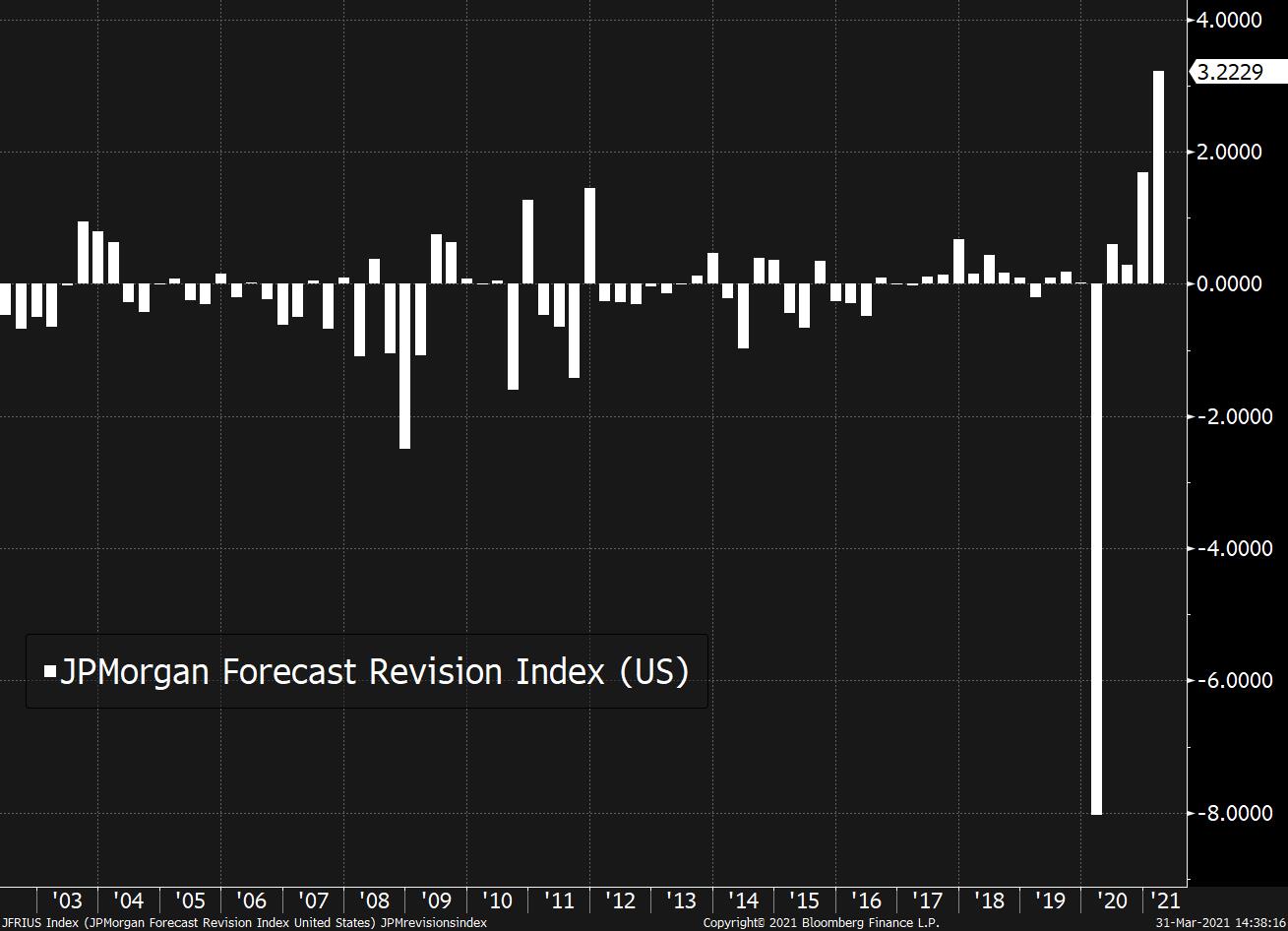

But if you want to understand what happened to Treasuries, here's a simple chart to break it down. This is a chart of the quarterly change to the JPMorgan Forecast Revision Index, which basically measures how much economic forecasts have changed either upward or downward over the course of the quarter. As a JPM derivative strategist pointed out in a TV interview with us, the index just saw its single biggest upward move in history. In other words, the economic outlook improved at a historic pace in this quarter.  Bloomberg Bloomberg Think back to Jan. 1. The virus situation was still getting worse. And at that point it looked like we were done with stimulus, because the Senate was probably going to be divided. And the vaccine rollout got off to a horrible start, with numerous headlines about how poorly it was all going. Fast-forward to the end of the quarter, and we got historic stimulus, the prospects of even more spending and our vaccine distribution is one of the fastest in the world. Naturally growth expectations have come way up over the last three months. And so basically what happened this quarter was things got dramatically brighter, and the market pulled forward its expectations for when the Fed would hike rates, which lead to the Treasury selloff. It quite straightforwardly represents -- as various Fed officials have said -- an unprecedented improvement in optimism about the economy. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment