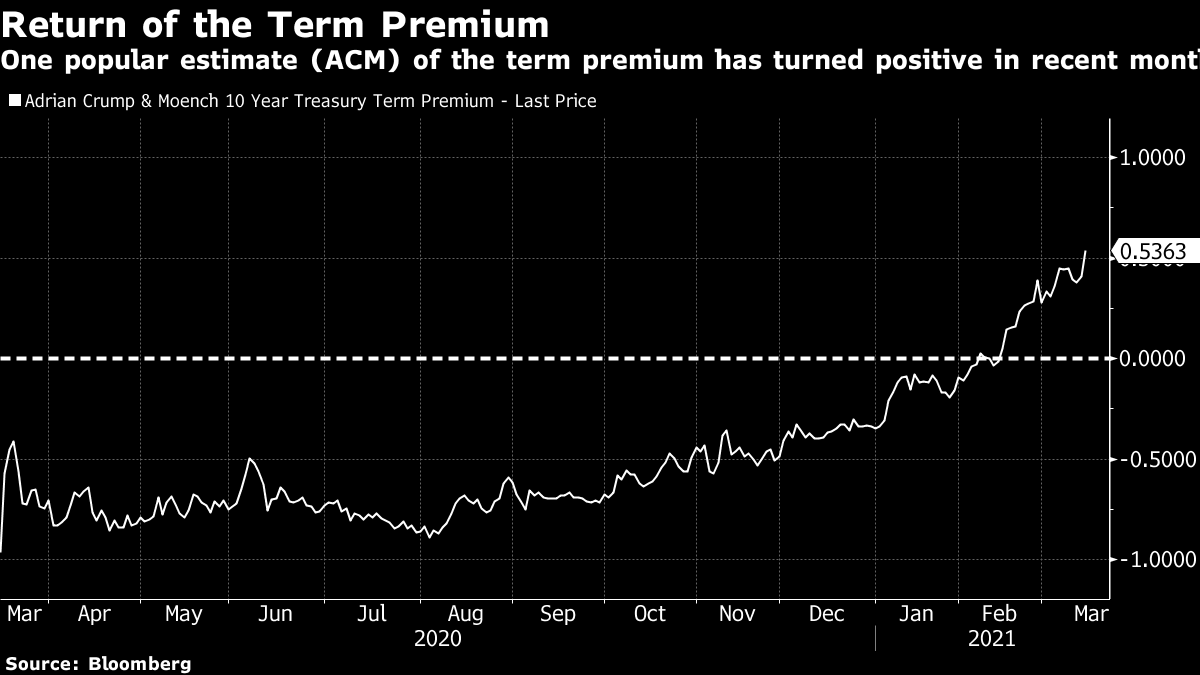

| Alibaba's influence over public opinion worries the Chinese government. The AstraZeneca vaccine rollout is halted in Europe's biggest countries. Australia's equality advocates hope to force a turning point over sexism. Here's what people in markets are talking about today. The Chinese government wants Alibaba to sell some of its media assets, as concerns grow that the empire has too much influence over public opinion in the country. Alibaba founder Jack Ma and his e-commerce giant have a sprawling portfolio that includes a major stake in the Twitter-like Weibo, plus TV, online and print news outlets including the South China Morning Post, Hong Kong's leading English-language newspaper. Beijing is most upset about the company's influence over social media in China and its role in an online scandal. Tencent has also been copping it from Beijing watchdogs and Xiaomi is under fire in the U.S.. Asian stocks were set to open stronger Tuesday as optimism about the economic recovery drove U.S. shares to a record-high close. Long-term Treasury yields edged lower. Futures pointed higher in Japan, Australia and Hong Kong. The S&P 500 Index gained for a fifth-straight trading session, led by the utilities and real estate sectors, while Apple, Tesla and Facebook led the tech-heavy Nasdaq 100 higher. Oil slipped, the dollar ticked higher and Bitcoin eased back from a weekend rally that propelled the cryptocurrency above $61,000. Europe's biggest countries, including Germany and France, suspended use of AstraZeneca Covid-19 vaccine amid growing concerns about possible side effects from the first two batches. Italy, Spain, the Netherlands, Ireland and Portugal have also suspended use of the shot. The move is a U-turn for some countries that had previously said inoculations should continue while the issue was investigated. U.K. Prime Minister Boris Johnson has defended the vaccine and the European Medicines Agency said its benefits continue to outweigh the risks. Meanwhile, Biden's administration is stockpiling the shot, which is not yet approved in the U.S. Thousands of people rallied in cities across Australia on Monday, angered by the government's handling of rape allegations in Parliament House, and its refusal to hold an inquiry into separate historical claims the attorney-general sexually assaulted a woman. The women and men who took to the streets hope that the high-profile cases will force Australia to a turning point where it takes serious steps to tackle sexual harassment — a stain that bleeds well beyond political life. By one estimate, workplace sexual harassment costs the country some A$3.5 billion ($2.7 billion) a year. Can the one-time richest person in Asia salvage his battered empire? These days Dalian Wanda Group founder Wang Jianlin doesn't even figure among China's top 30 richest people, having lost about $32 billion of his personal fortune in less than six years — more than any other tycoon in the period. Wang, who once purchased Spanish soccer club Atletico Madrid and aspired to compete with Walt Disney Co., is still shedding assets. As he seeks to slash his debt from 362 billion yuan ($56 billion), Wang's portfolio of tumbling dollar bonds is warning investors that entertainment-to-property empire may have fallen for good. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayTerm premium. It's the Rorschach test of the financial world. You can see anything you like in it, and use it to justify almost any market move. Back in 2019, when the yield curve inverted in a traditional harbinger of recession, people blamed it on term premia being far too low. You could just as easily have argued they were simply mispriced. So what are term premia supposed to be, exactly, and why bring them up now? Put simply, they are the extra compensation investors receive for the added risk of owning longer-term bonds. In recent years, they have been negative thanks to never-ending demand for U.S. Treasuries and forward guidance from central banks. But in 2021, the term premium has returned, and with it, a bunch of questions about what positive premia might actually say about the market. In fact, one could argue that the return of the term premium is driving a lot of market action at the moment. Citigroup strategist Matt King, for instance, argued in a note on Monday that the backup in bond yields is more about changes in term premia than in interest rate expectations. He noted that about two-thirds of the 100-basis-point jump in U.S. 10-year yields since last July can be attributed to the rise in term premia, depending on which estimate you use.  This makes some sense if you think that the big uncertainty right now is at the long end of U.S. government debt. It's unlikely that the Federal Reserve is going to raise rates any time soon, given that it's promised to overlook temporary overshoots in inflation. But there's always the possibility that economic growth comes roaring back in the longer term and puts pressure on the central bank to hike. As former U.S. Treasury Secretary Larry Summers put it in a recent client call with Citi, which King cites, "it's not just that the new $1.9 trillion stimulus package comes against a backdrop of a booming economy rather than last year's slump; it's that bond investors have no guarantee that this will be the last such outsized stimulus." Until the mystery of future fiscal policy is settled, uncertainty over the risk of holding bonds longer-term will persist, and so will a positive term premium. You can follow Tracy Alloway on Twitter at @tracyalloway. Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment