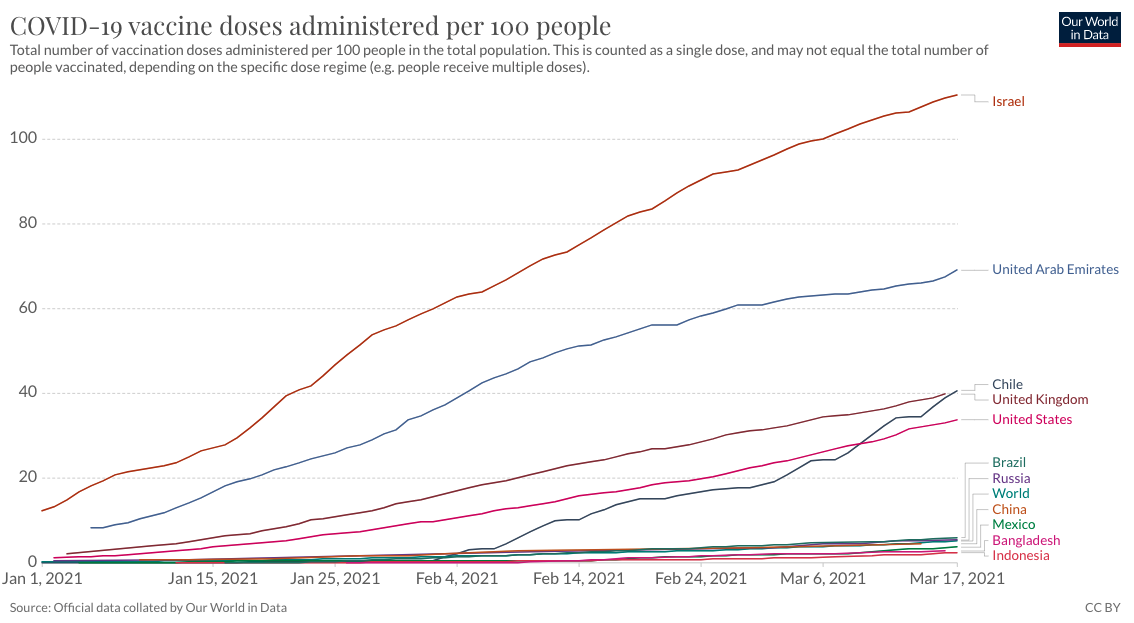

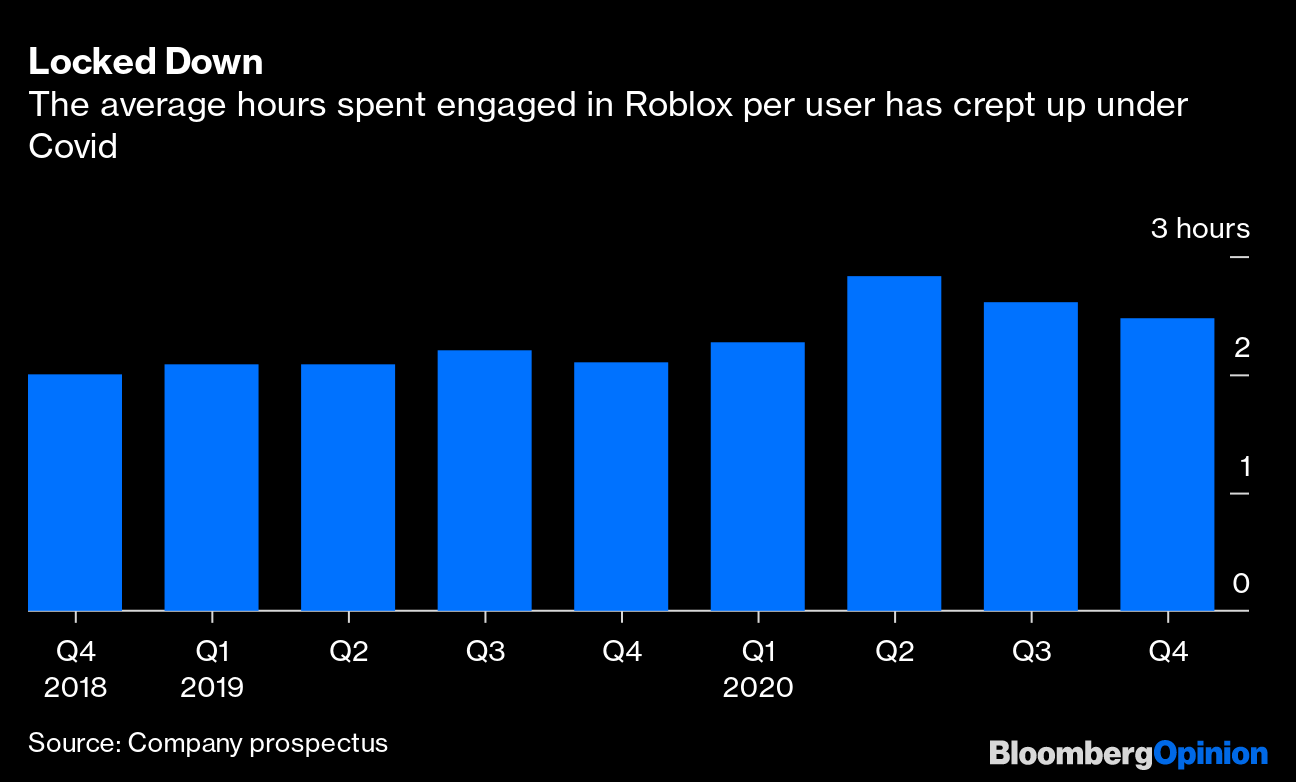

| This is Bloomberg Opinion Today, a whistling robot of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Solyndra Also RisesAround this time 10 years ago a solar-energy company that used a highly publicized federal loan guarantee to build an immense Silicon Valley factory with Disney-tune-whistling robots and space-age showers was on the verge of going bankrupt. The company was Solyndra, and its splashy demise became a political headache for then-President Barack Obama and may have made some politicians skittish of throwing more government money at green energy. It also punctuated the end of a brief but frantic boom in clean-tech investment. Fast-forward to 2021, and it's as if Solyndra never happened. Public opinion heavily favors government intervention to fight climate change. America's new corporate darling, Tesla, bulked up on billions in government subsidies — including some of the same guarantees that helped Solyndra. And investors are once again throwing money at anything in the green region of the color wheel. Will it all go bust again? Noah Smith argues it won't, citing the biggest change of the past decade: Green-energy costs have fallen dramatically. This means impatient investors won't have to wait as long for profits, and the government won't have to provide as much scaffolding — although maybe it should; Solyndra was just one overblown failure of a mostly successful program. If the pre-Solyndra boom was clean tech's version of the dot-com bubble, then maybe the current hype phase is more mature and durable, Noah suggests. Investors can still get burned when so much hot money is flying around. That Nikola truck rolling downhill should still be fresh in everybody's memories. More recently, accounting questions have rocked shares in hydrogen-fuel-cell maker Plug Power and EV maker Lordstown Motors, notes Chris Bryant. No whistling robots were involved, but such scandals could make investors leery again, at a time green energy really needs all the cash it can get. The Fed Will Just Turn This Car Right Around If You Don't Knock It OffThere was a Fed meeting yesterday, and that noise you don't hear is the blissful silence of a market realizing this central bank doesn't respond to tantrums. Jay Powell & Co. made clear that, no matter how much bond traders raise interest rates, the Fed won't play along until it sees hard evidence of actual inflation, writes Brian Chappatta. This was a pleasant surprise for a stock market bracing for the Fed to be more hawkish, writes John Authers. But it will keep getting more difficult for the Fed to balance its perma-dovish stance against ever-improving economic data, writes Mohamed El-Erian. All the fiscal stimulus that's about to hit the economy will only make that harder, writes Bloomberg's editorial board. Of course, the Fed has been asking for fiscal help for a long time. Is this an example of being careful what you wish for? Bonus Editorials: Vaccine Failure StoriesIsrael, the U.K. and the U.S. are widely considered the world leaders in getting Covid vaccine shots in people's arms. Less well-known is the UAE, which trails only Israel in vaccinations per capita. Even less well-known, and perhaps more surprising, is the third-best country in the world at this, which you can see if you squint or click on the following JPG:  That's right, it's Chile. This is a shocker because the rest of Latin America has been an absolute disaster at vaccine management, writes Mac Margolis. Poor leadership, vaccine hesitancy, nationalism — you name a hurdle to immunization, and Latin America's got it, and not just in Brazil. Among regional leaders, only Chilean President Sebastian Pinera had the wherewithal to line up vaccine sources from around the world. His country's reward will be not only a healthy population but also a stronger economy. Not seen on that chart, but not doing much better than laggard Brazil, is Europe. Going into this pandemic, you might have expected the continent to be a world leader in getting people vaccinated. But Lionel Laurent writes its strange mix of technocracy and populism is exactly the wrong cocktail for this enterprise, leading to too much indecision and too few shots in arms. Telltale ChartsIf you have young-ish children, there's a good chance they're playing Roblox right now, helping your sanity and also Roblox's profitability. But we all must reckon with how the company's business model runs the risk of creating a new generation of screen addicts, warns David Fickling.  At least European countries are able to borrow money at low rates, Marcus Ashworth notes, including even Greece.  Further ReadingAmazon is one of the world's most profitable companies, making Jeff Bezos one of the world's richest men, while American taxpayers help cover the basic living costs of many of its employees. — Nir Kaissar and Tim O'Brien Roaring Kitty and Warren Buffett have more in common than you'd think. — Tae Kim Goldman analysts are angry about working too hard. — Matt Levine Two bailouts in 12 years make it clear we need to reform money market funds. — Timothy Massad Biden needs his own culture war, of the sort FDR and Ronald Reagan won. — Pankaj Mishra Biden must make clear Asian Americans are not foreigners or enemies. — Noah Smith ICYMIThe U.S. will hit Biden's vaccination goal six weeks early. Goldman seeks volunteers to move to West Palm Beach. Vladimir Putin deploys "I know you are, but what am I?" defense against Biden. KickersJust look at the havoc you create when you walk while looking at your phone. (h/t Ellen Kominers) Primordial lightning may have sparked life on Earth. Maybe Oumuamua was not a cigar but a cookie. The art in that $69 million Beeple NFT is almost incomprehensibly not OK. (h/t Scott Kominers for the last three kickers) Notes: Please send $69 million and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment