| Welcome to The Weekly Fix, the newsletter where flows match performance. I'm cross-asset reporter Katie Greifeld. Traders Are Bad at Timing

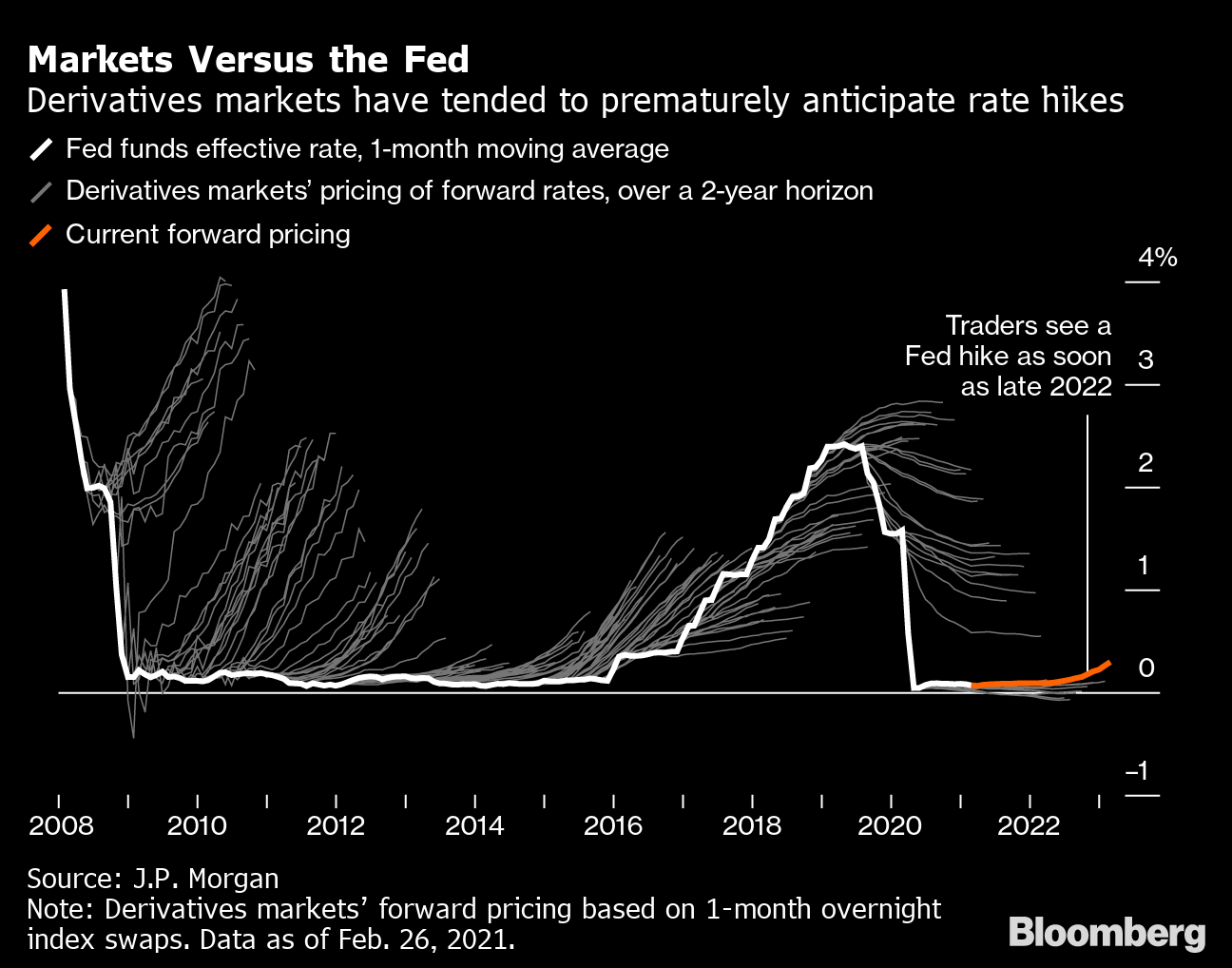

As it turns out, bond traders are pretty terrible at timing the Federal Reserve. While that sounds like a diss, it's also the entertaining conclusion of a Bloomberg News article that examined the past 13 years of money-market derivatives. Since 2008, markets have consistently priced in a more aggressive path of Fed rate hikes than what ultimately happened. Consider the situation in late 2008: traders were already bracing for several hikes in the years ahead, according to data crunched by JPMorgan Chase & Co., but policy makers held off on tightening until 2015.

Amusingly, that experience then left traders behind the curve when the Fed liftoff really got going. The central bank hiked a total of seven times between the start of 2017 through the end of 2018, leaving traders scrambling to keep up.  These history lessons cast a new light on one of the narratives that's emerged from this year's bond selloff -- that the market will somehow force officials into hiking rates earlier than current Fed projections, which have the central bank on hold through 2023. Nearly a quarter-point of tightening late next year was priced into swaps and futures as of Thursday, while three increases of that size were reflected by the end of 2023. "The market has its pricing and perceptions, and what happens can differ from that and has," Alex Roever, head of U.S. rates strategy at JPMorgan, told Bloomberg News. The market has been testing the Fed by "trying to push further forward the first hike. But Fed officials don't seem to be having any of it." A quick look at U.S. financial conditions helps explain why. Financial conditions are a grab-bag measure of different strains across asset classes, from stocks to credit spreads to sovereign bonds. Notably, they've barely budged, even as long-term borrowing costs shot higher this month and equity markets wobbled. Rather, the Fed's policy stance is still decidedly accommodative.  "Overall financing conditions for households are still low and easy. Even though rates have risen, they are coming off a low level. Spreads are still tight. Overall, equities are near all-time highs," said Priya Misra, the head of U.S. rates strategy at TD Securities. "So the Fed's probably looking at that and seeing no reason to get concerned about rising rates." In any case, the bond market is perhaps starting to take Chairman Jerome Powell at his word, which has remained -- throughout four separate speaking engagements this week -- that the Fed won't put away its toolkit until the economy is "all but fully recovered" from the coronavirus shock. Benchmark 10-year Treasury yields have pulled back to about 1.65% from a March high of 1.75%. "As we've repeatedly argued, if markets do give credibility to the Fed's average inflation targeting and maximum employment goals, yields could slide considerably further," Bespoke Investment Group analysts wrote in a note this week. Making Money While You Sleep

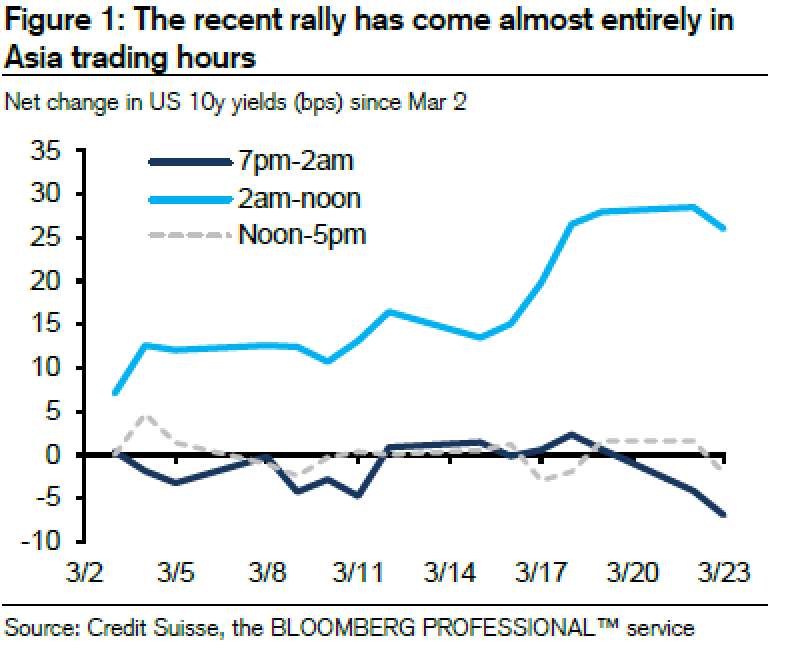

The overnight rally is a well-documented phenomenon in U.S. equity futures, but not as much of a thing in Treasuries -- until now, maybe. A Credit Suisse report this week noted that since early March, Treasuries have been rallying during Asian trading hours, only for yields to retrace higher during the typical U.S. session. Through March 23, 10-year Treasury yields dropped nearly 10 basis points between 7 p.m. and 2 a.m. in New York, before rising roughly 25 basis points between 2 a.m. and noon, according to the bank.

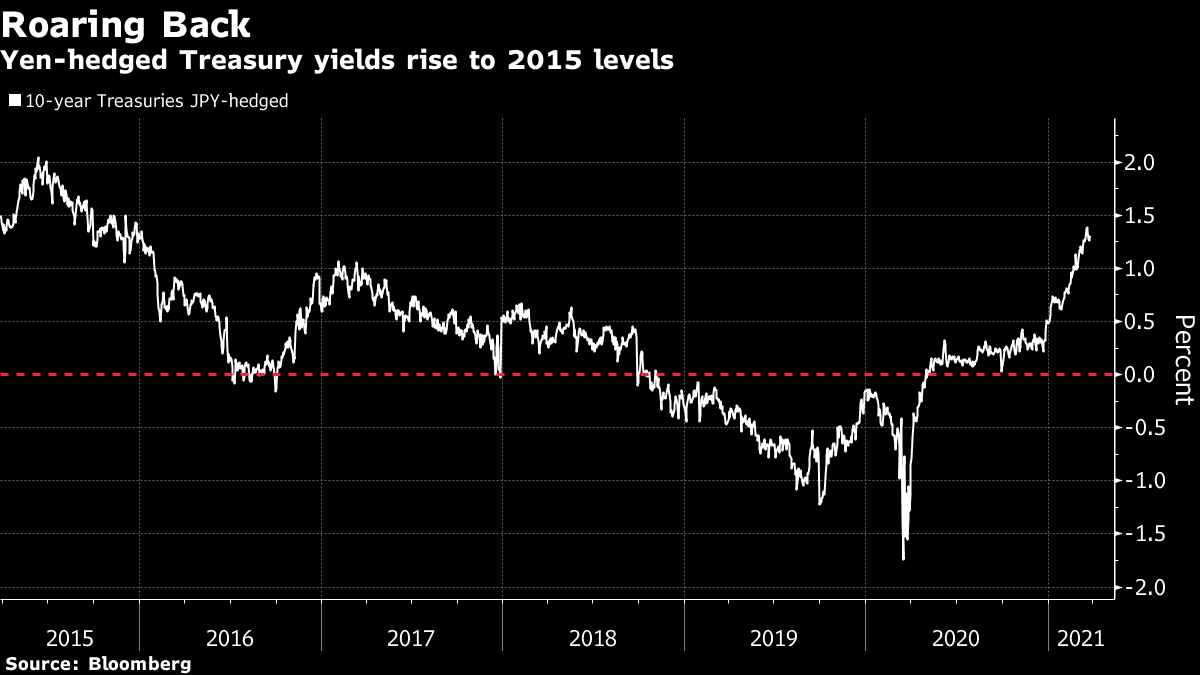

Bloomberg Bloomberg The late-night gains may be an early sign that after Japanese banks sold 1.4 trillion yen ($12.8 billion) of long-term foreign debt in February, appetite may be picking back up. That's good news for bond bulls, given that Japanese investors are the largest overseas holders of Treasuries. While it's unclear to what degree Japanese investors will reload their long-U.S. fixed income positions after Japan's fiscal year-end, Treasuries have become "increasingly attractive" as rate volatility levels off, according to Credit Suisse strategist Jonathan Cohn. "I think it's fair to say that there may be some incremental demand for duration coming through from Asian buyers given the timing of the recent moves, as well as both the stabilization in rates and volatility," Cohn said. "Definitely a theme worth monitoring going forward as potentially tapping the brakes on the relentless sell-off." Which leads neatly into a favorite topic: currency-hedged Treasury yields. Hedging costs for foreign bond buyers -- which are heavily determined by short-term rate differentials -- collapsed over the past year after the Fed slashed rates to near-zero last March. Prior to that emergency cut, overseas investors faced deeply negative yields in the U.S. bond market after protecting against FX swings.  It's a story best told by numbers: in March of last year, a hedged Treasury note yielded minus 1.5% for yen-based buyers. It now stands at about 1.3% -- down slightly from a peak of about 1.4% reached earlier this month, which was the highest since late 2015. That compares to about 0.08% for similarly dated Japanese securities. That premium -- especially in light of tumbling Treasury turbulence -- could soon lure yield-hungry investors back to U.S. bonds. Junk Is Jumping, But No One Wants It

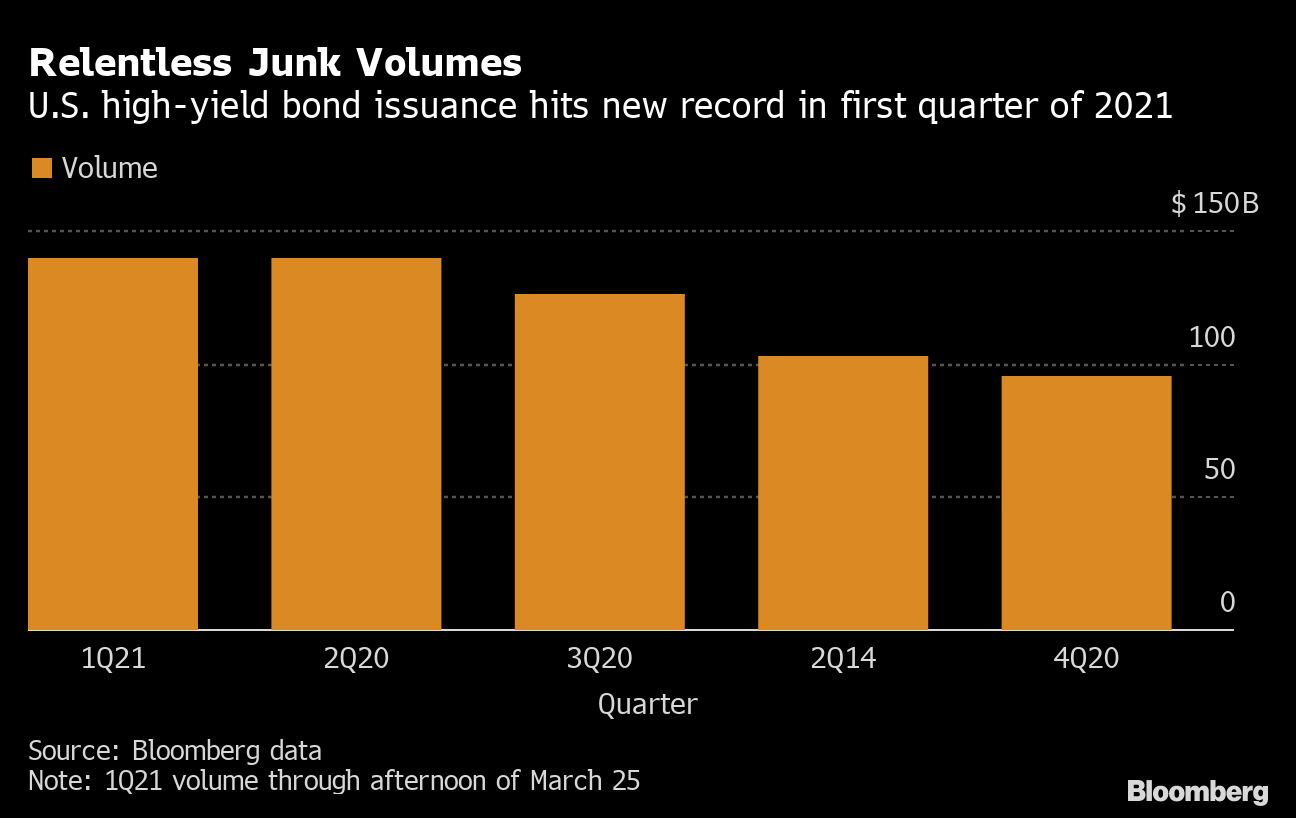

High-yield bonds are in an interesting spot. The primary market has been on fire lately -- a late Thursday offering from Carvana Co. pushed total quarterly issuance to a record $139.6 billion, data compiled by Bloomberg show. That edges out the previous high of $139 billion set in the second quarter of 2020, after the Fed's announcement of its credit market backstop thawed a market effectively frozen by the Covid-19 pandemic.

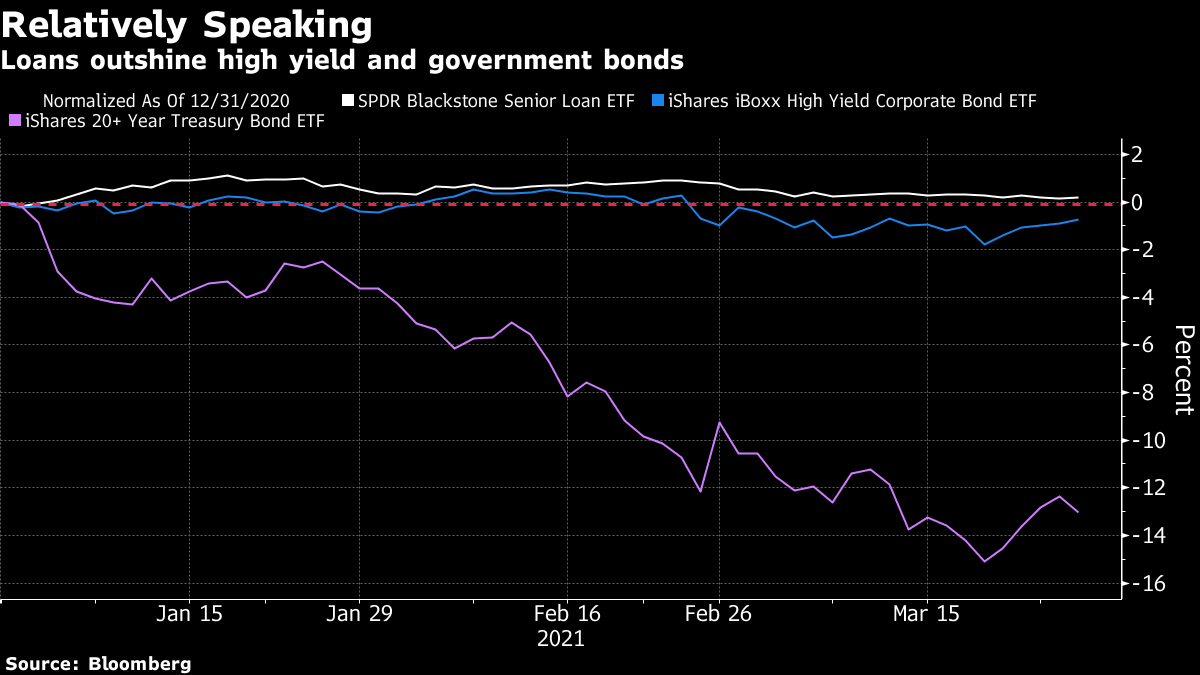

Less than a year later, the pace is even more furious as vaccines find arms and the U.S. economy reopens. The resulting rise in inflation expectations and Treasury yields has fueled a rush of "FOMO" (fear of missing out) borrowing, with companies eager to borrow at rates that are still ultra-low. The secondary market looks similarly hot. February saw the average yield on U.S. junk bonds fall below 4% for the first time ever, turning the "high yield" moniker into a bit of an oxymoron. Yields have since edged up to about 4.3%, which is still well below the decade average of 6.4%, Bloomberg data show.  However, the flow show doesn't match the euphoria. Investors pulled roughly $1.4 billion from junk-tracking mutual funds and exchange-traded funds in the week ended March 24, reversing a $410 million inflow from the prior period, according to Refinitiv Lipper. All told, high-yield funds have posted outflows in eight of the last 11 weeks. Typically one would expect inflows to follow performance, but ultra-tight spreads might be keeping portfolio managers on the sidelines even as fundamentals brighten. "Many allocators think about spread and don't find spreads relative to historic norms appealing. I think this is missing the forest for the trees," said John McClain, a portfolio manager at Diamond Hill Capital Management. "High yield is very much supported by record high equity prices. The quality of high yield is as high as its ever been so these companies are generally in a far better position to payback debt, i.e. low default rates going forward." Like most things in bond markets right now, the discrepancy also boils down to concerns about duration -- or an asset's sensitivity to interest-rate changes. That's fueled demand for ultra-short loan ETFs, which have negligible duration risk relative even to high yield bonds, which are generally less vulnerable to rate run-ups than high-grade peers. Additionally, because loans have floating rates, they actually stand to benefit from rising rates.  Loan ETFs have attracted $3.3 billion in inflows so far this year, with the $3.8 billion SPDR Blackstone Senior Loan ETF (ticker SRLN) on track for a 26th consecutive week of inflows. SRLN is hanging onto gains of 0.2% in 2021, while the $21 billion iShares iBoxx High Yield Corporate Bond ETF (ticker HYG) and the $15 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) have dropped 0.7% and 13%, respectively. "Even though high yield isn't nearly as rate sensitive as investment-grade, there's still duration," said David Schawel, chief investment officer at Family Management Corp. "As rates started to go up and high yield fell a little bit, investors started to swap in levered loans or get out altogether." Bonus PointsThe elite salvage team could need days -- or even weeks -- to prise out the giant container ship that's blocking the Suez Canal Goldman CEO vows to better protect junior bankers' Saturdays off Carcinogen found in widely available hand sanitizers Americans snapped up over past year |

Post a Comment