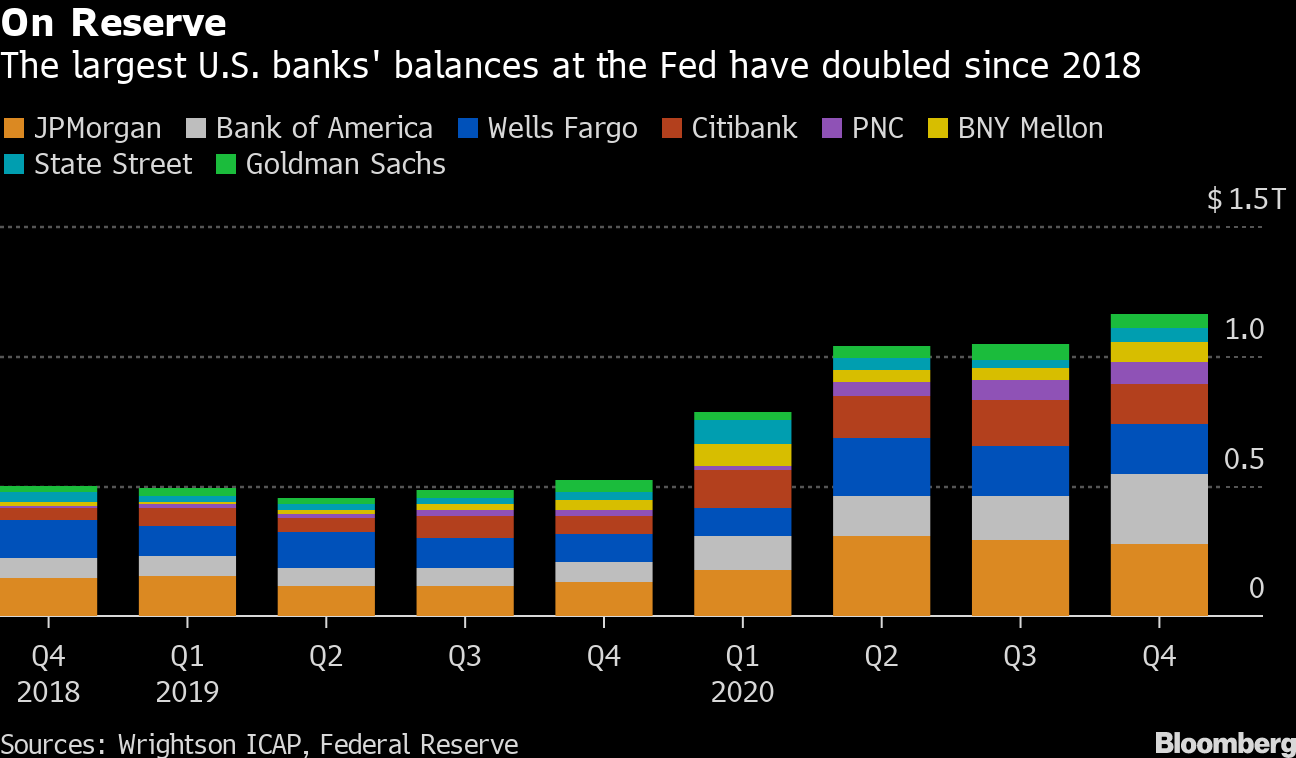

| Welcome to the Weekly Fix, the newsletter that gets nervous about three-letter acronyms. I'm cross-asset reporter Katie Greifeld. Redemption or Reckoning?The latest acronym on Wall Street's mind is SLR: the supplementary leverage ratio. In normal times, SLR required U.S. banks to hold a minimum level of capital against their assets as a buffer against losses. However, the Federal Reserve exempted Treasuries and deposits at the central bank from those requirements roughly a year ago. Banks took advantage, with balance sheets ballooning by as much as $600 billion as a result of the regulatory relief. Now, the SLR redemption is set to expire on March 31, and no one's quite sure what to make of it. BMO Capital Markets strategist Dan Krieter estimates that letting the relief lapse could force a bout of Treasuries selling, while JPMorgan Chase & Co. Chief Financial Officer Jennifer A. Piepszak warned last month that banks may have to "turn away deposits" in that event. Others, like Bank of America U.S. interest rates strategy head Mark Cabana, are more sanguine: while the market has "assigned almost mythical powers" to the SLR exemption, in reality, banks' share of the demand for Treasuries is "very marginal."  In any case, jitters around whether relief would be extended were one of the main factors blamed for last month's sloppy 7-year note auction, which by some measures, saw the lowest demand on record. Zoltan Pozsar, a strategist at Credit Suisse, broke down that mindset in a recent episode of the " Odd Lots" podcast: So when you look at an auction that goes bad, a large part is basically because a bank portfolio doesn't show up, because a bank portfolio doesn't know what's going to happen to this SLR exemption. Management is getting the balance sheet ready for stock buybacks. If you want to buy back stocks and SLR exemption does not happen, then you will be throwing balance sheet capacity away to basically carry liquid assets.

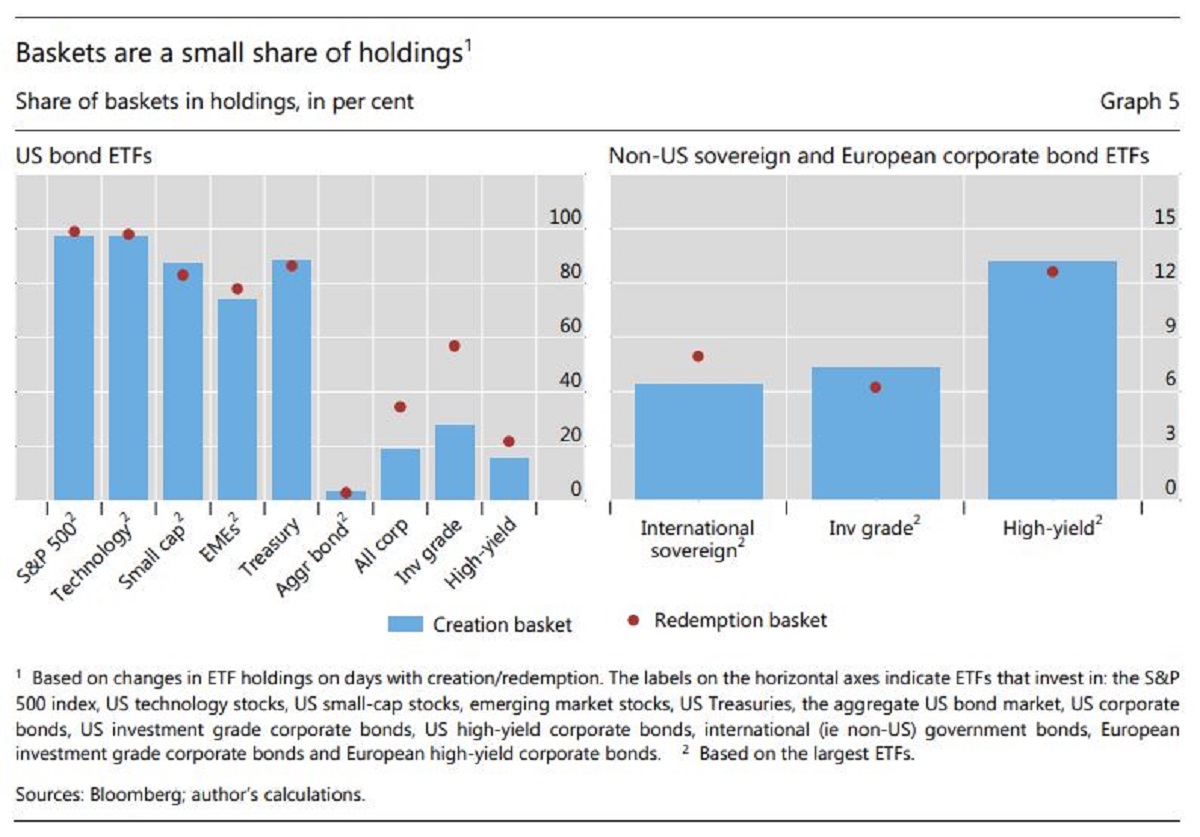

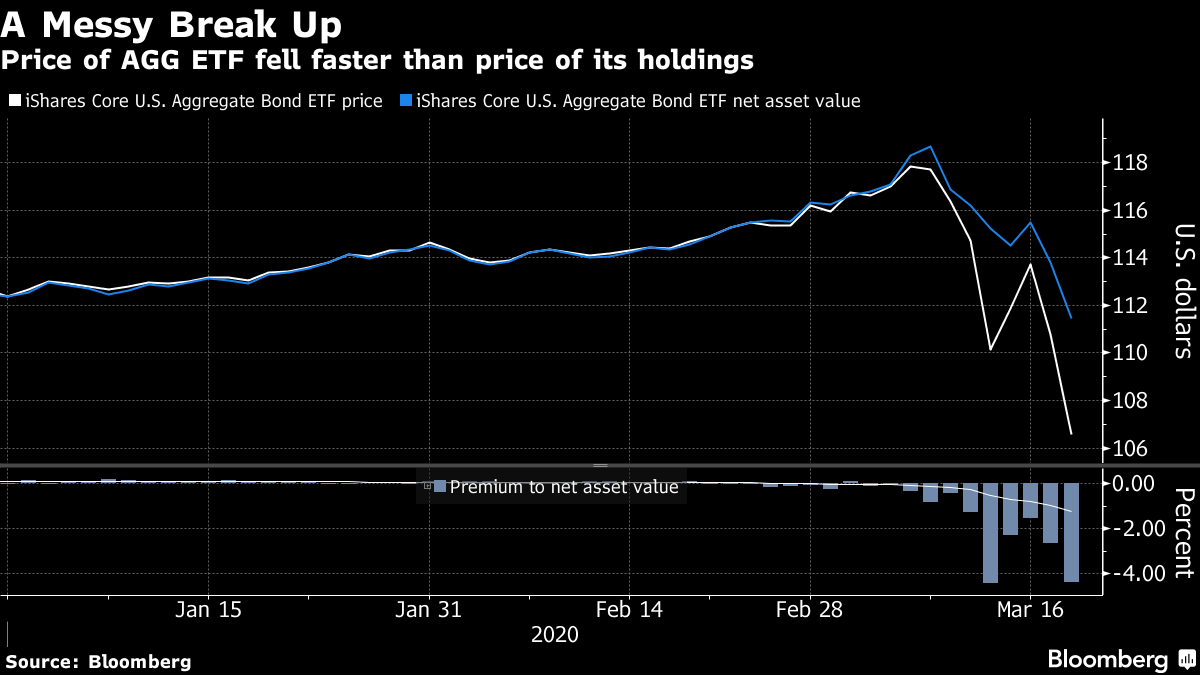

Given that disaster of a 7-year sale, the stakes were sky-high heading into this week, with the Treasury Department scheduled to auction off $120 billion between 3-, 10- and 30-year securities. The auctions went fairly smoothly -- only the 30-year sale produced a small tail -- reigniting a rally in tech stocks, which had buckled in previous weeks under the weight of rising rates. However, a couple of OK auctions don't mean we're out of the woods yet, cautions Priya Misra of TD Securities. "Those concerns move higher every day we get closer to March 31 without a Fed announcement," said Misra, the firm's head of global rates strategy, who noted that banks don't tend to buy the 10- and 30-year tenors. "In a world where the Fed might taper late this year and the President is talking about another stimulus package, who is the marginal buyer of Treasuries and at what price?" Fed policymakers have largely been mum about their plans -- and probably for good reason. Senators Elizabeth Warren and Sherrod Brown said in a letter to U.S. regulators this month that extending relief to banks would be a " grave error." As my Bloomberg Opinion colleague Brian Chappatta notes, this puts the Fed in a somewhat impossible position -- the central bank can renew the exemption and appear beholden to the banks, or let it lapse and risk destabilizing the $21 trillion Treasury market. In any case, the clock is ticking. Backhanded BIS ComplimentTo the delight of fixed-income and exchange-traded fund nerds alike, the Bank of International Settlements included a special report in its latest quarterly review with the titillating title " The anatomy of bond ETF arbitrage." The conclusion was even more scintillating: that in times of market stress, ETF issuers may deliver authorized participants -- specialized traders tasked with keeping an ETF's price in line with its net-asset value -- baskets of less-than-desirable, perhaps-illiquid bonds in order to discourage redemptions. To fully appreciate that verdict, let's quickly recap how ETFs function. When cash flows into an ETF, an AP buys the fund's underlying securities (bonds in this case) and exchanges them with the issue for shares of the ETF. When an ETF is hit with outflows, that process happens in reverse. For example, if an ETF were trading at a discount to the debt it holds, an AP would buy shares of the ETF in exchange for the underlying bonds (the redemption basket) to sell -- ultimately keeping the ETF's price in lockstep with its holdings. Importantly, the BIS notes, the ETF issuer has discretion over which bonds they include in a redemption basket.  Bloomberg Bloomberg "The flexibility inherent in baskets' composition may allow ETFs to withstand episodes of market stress," the BIS's Karamfil Todorov wrote. "In the face of panic selling (runs), which generates redemption pressure, ETF sponsors could tilt redemption baskets towards riskier or less liquid securities. This would decrease prices of ETF shares since shares are exchanged for a lower-quality subset of ETF holdings." This, Todorov continued, is a good thing: By making it less appealing to redeem shares, the issuer can make an en-masse exodus from an ETF less likely -- potentially limiting broader market spillover. That casts the jaw-dropping discounts on some of the world's largest bond ETFs last March in a new light. But to Invesco global strategist Jason Bloom, the report amounts to a "backhanded compliment" at best and "basically pure fantasy" at worst. For starters, passive portfolios live and die by their tracking error to their fund's benchmark, he said, giving them little reason to attempt to opportunistically discourage redemptions. "Anyone who's ever sat through a quarterly fund board meeting and watched the board of directors grill the portfolio manager over their tracking error over the prior quarter knows they have a legal obligation to minimize tracking error," Bloom said in an interview, "If they were to make a meaningful change to the redemption basket to skew away from a presentation of the overall portfolio, they will by definition blow up their tracking error. That goes against both their legal and personal motives."  Being choosy about which bonds to include in redemption baskets makes more sense for an active fund manager, Bloom allowed. But even then, that discretion can only go so far. "If we're in the midst of the selloff and their goal is to de-risk, of course, they're going to give you the securities they don't want in the fund. That's actually in the shareholders best interest," Bloom said. "That system of incentives makes sense, but what if we're in a period of high stress, and the active manager has already de-risked going into it?" Show Me The YieldThe tables are slowly turning in the investment-grade bond market, where up until a few weeks ago, borrowers were in the drivers' seat. Rock-bottom interest rates and a Fed backstop fueled record issuance last year, but now -- with inflation expectations on the rise and demand for duration cooling -- that dynamic is shifting. For proof, look no further than March 9. Brian Smith of Bloomberg News crunched the numbers and found that of the six high-grade deals that came to market, the average concession clocked in at 13 basis points -- that was the highest daily figure since late June, and compares to the 0.5 basis point year-to-date average. In another telling sign, the books were 2.1 times covered, compared to the 2021 average of 3.1. Of course, one day doesn't make a trend, but across the investment-grade space, there's a building sense that the go-go times of ultra-low borrowing costs may be coming to an end -- pushing some companies to pull forward their debt issuance plans. Meanwhile, investment-grade spreads inch wider from their own ultra-low levels as Treasury turbulence picks up.  "With rate volatility up a lot since mid-February, it's spooked IG investors a bit," said Michael Contopoulos, director of fixed income and portfolio manager at Richard Bernstein Advisors LLC. "Before the increase in rate vol, IG was pretty much priced to perfection. Spreads were very tight for the overall market. If rates rise gradually spreads can certainly continue to tighten and demand will be there, but as uncertainty about where rates can go jumps, spreads often widen." If spooked investors and higher concessions are becoming a trend, Verizon Communications Inc. is the exception. Its jumbo bond sale Thursday attracted a whopping $109 billion worth of bids for $25 billion of supply after the company offered a premium of as much as 35 basis points over its existing bonds, people with knowledge of the matter told Bloomberg News. Whether other issuers will have such success in a still-limp market remains to be seen, but clearly, the search for yield is still alive and well. Bonus PointsWant access to the CDS market, but unsure how to get it? There may soon be an ETF for that The $30 billion sale of General Electric's jet-leasing business marks an inauspicious end for an former high-grade heavyweight The days of traders slamming phones and breaking computers are becoming a thing of the past |

Post a Comment