| A pill to treat Covid, a bump in U.S. inflation and a Singapore bank cuts back on office space in Hong Kong. Here's what people in markets are talking about today. Pfizer is starting human safety tests of a pill to treat the coronavirus. The drug is designed to be administered at the first signs of illness to prevent patients from becoming very sick. The tests could generate results within weeks, the company's Chief Scientific Officer Mikael Dolsten said. Meanwhile AstraZeneca's vaccine headaches continue, with a U.S. agency questioning the shot's 79% efficacy reading. Vaccinating some of the world's most remote communities is testing Australia, and India is accelerating its inoculation drive as infections rise. The WHO says increasing cases and deaths around the world represent "truly worrying trends," and is warning rich nations against hoarding vaccines. Asian stocks are poised to open weaker after setbacks to the recovery from the pandemic weighed on U.S. equities. Futures pointed lower in Japan and Hong Kong and were steady in Australia. The dollar strengthened while the 10-year U.S. Treasury yield slid for a second day, as Federal Reserve Chair Jerome Powell said prices would rise this year but that he did not expect inflation to get out of hand. Oil dropped below $60 a barrel on concerns the market is oversupplied. Singapore's DBS is the latest global bank to give up office space in Hong Kong with so many people working from home. Southeast Asia's biggest lender — which joins UBS, BNP and Standard Chartered in paring back its rentals — will release two of the eight floors it currently occupies at One Island East tower in Quarry Bay, a source says. Multinational firms are more likely to adopt flexible working arrangements than their local peers, and accounted for 75% of surrendered office stock last year, according to real estate firm Cushman & Wakefield. Protests and the pandemic combined to push rental rates in the city down 17% last year, the most since 2009. China's Tencent may have to overhaul its $120 billion financial services arm. As Beijing clamps down on tech firms, watchdogs are scrutinizing everything from Tencent's insights into the nation's online

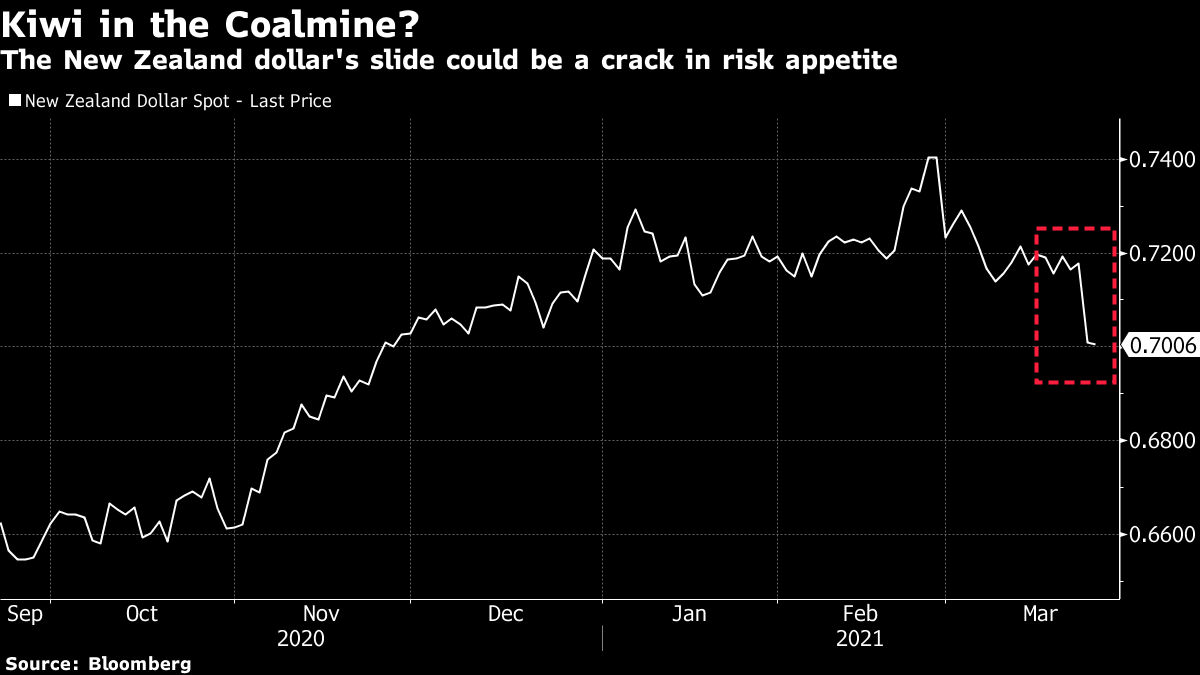

behavior to an investment portfolio spanning hundreds of startups. Regulators are said to be considering forcing the company behind WeChat to fold its fintech operation into a holding company in much the same way they're demanding of Jack Ma's Ant Group. Tencent reports quarterly earnings today. Intel is spending billions of dollars on new factories and creating a foundry business that will make computer chips for other companies, an ambitious plan that puts the company in direct competition with Taiwan's TSMC, the world's most-advanced chipmaker. The stock jumped about 6% on the news. Intel dominated the $400 billion chip industry for decades, but its strategy crumbled in recent years. A global semiconductor shortage has created a "chip race" with geopolitical as well as economic implications, with world leaders from Washington to Beijing making chip supplies a top priority. A case in point: Bringing a fire-damaged chip plant back online in Japan has turned into a coordinated national effort. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayWhat's up with the Kiwi? The New Zealand dollar dropped 1% against the dollar by the middle of the Asian day on Tuesday, after the government introduced a raft of new measures aimed at curbing astronomical home prices. There are some people who see more to the drop though, and the currency did end up falling 2.3% by the close. The kiwi can act as a barometer for risk appetite, and Ned Rumpeltin at TD Ameritrade suggests it could be a "Kiwi in the coalmine" (ahem) for overall market sentiment. He makes the connection between the Federal Reserve's decision to end emergency exemptions to the supplementary leverage ratio (SLR) and the kiwi's recent move. That might seem like a stretch, but if you think that huge swathes of the market are now tied to movements in U.S. Treasuries, it makes some sense that a move which effectively makes holding the bonds more onerous for banks would end up hitting a bunch of unexpected things.  The Fed's decision "is nibbling at the margins of market confidence. The knee-jerk reaction was relatively muted, but we see this as a slow-burn story," Rumpeltin wrote on Tuesday. "It may not have been immediately seen as bad news for investors. It may, however, greatly increase market sensitivity to bad news when it arrives from elsewhere." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment