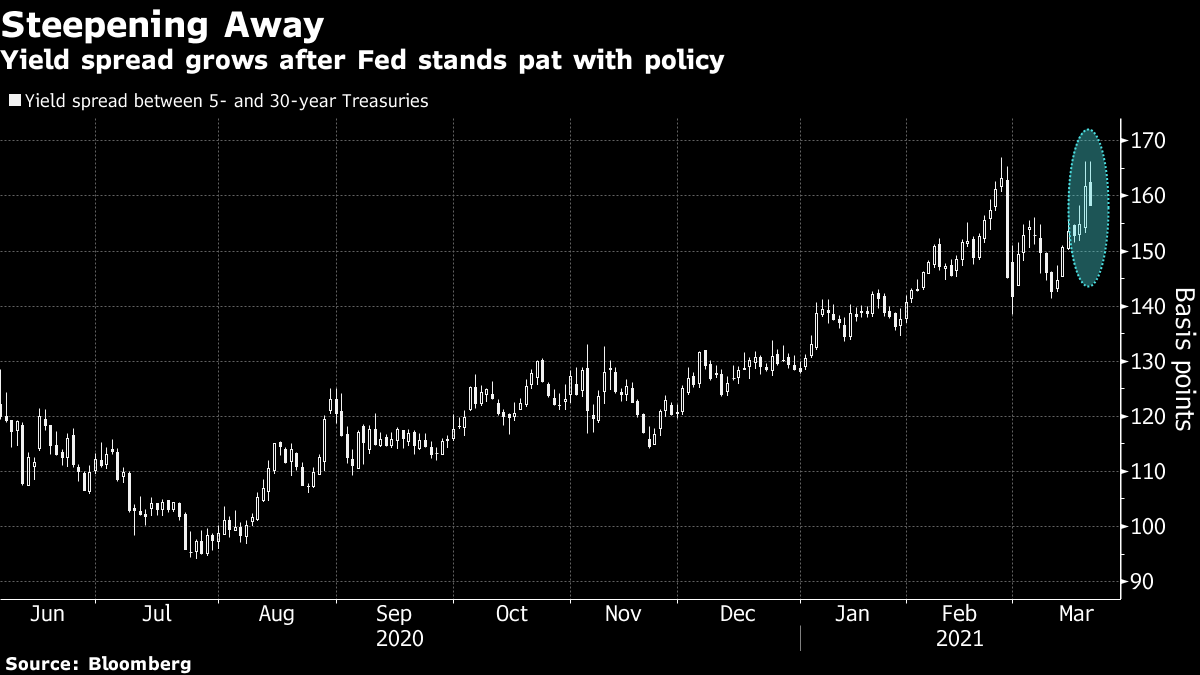

| Officials from the U.S. and China begin their first meeting since Biden became president. Hong Kong's strict quarantine measures rattle the city's bankers. And as China targets Jack Ma's empire, patriotic upstarts are thriving. Here's what people in markets are talking about today. The first face-to-face talks between senior U.S. and Chinese officials since President Joe Biden took office are off to a rough start. U.S. Secretary of State Antony Blinken began his remarks in Alaska by vowing to raise concerns about recent cyber attacks, the treatment of Muslim minorities in Xinjiang and Beijing's increasing control over Hong Kong. He said China's actions threatened the international order and human rights. Chinese State Councilor Yang Jiechi shot back with a lengthy monologue in which he said Western nations don't represent global public opinion and called the U.S. the "champion" of cyber-attacks. Beijing is seeking a meeting between Presidents Joe Biden and Xi Jinping if this week's high-level talks are productive, but the U.S. has sought to set low expectations for a breakthrough. Read how China's imminent trials of Canadian nationals and the feud over Huawei are raising the stakes. Asian stocks looked set to drop after U.S. shares fell from a record, with equity futures pointing lower in Japan, Hong Kong and Australia. Oil plunged more than 9% at one point and traders were also bracing for quadruple witching Friday, a major expirations of options and futures contracts that can exacerbate swings in asset prices. Treasury yields touched the highest levels in more than a year amid concern the Federal Reserve will allow inflation to accelerate. Bridgewater's Ray Dalio said rising inflation could force the Fed to raise rates earlier than anticipated. Hong Kong's strict Covid containment measures are causing growing anxiety in the city's financial sector, after an outbreak forced several firms to shut offices and left some residents in spartan government quarantine facilities. Close contacts of positive cases, including young children, must spend as much as two weeks in centralized surveillance facilities even if they test negative. While one of the quarantine centers is in a Dorsett-brand hotel, other purpose-built facilities feature tiny rooms with bare-bones furniture. Some lack WiFi connections that can support remote work. In Europe, the rollout of AstraZeneca's vaccine has restarted, while the U.K.'s vaccine rollout is experiencing its first major interruption due to a delayed shipment from India. More than 400 million doses of various vaccines have been administered worldwide. Read more about vaccine nationalism here. Even as China moves to strip away media outlets from Jack Ma's Alibaba, authorities are allowing several patriotic upstarts to blossom in one of the world's most restrictive media spaces. One of the key voices is Chairman Rabbit — the social media moniker for Harvard University-educated princeling Ren Yi, whose popularity partly stems from Chinese citizens tired of what they view as constant China bashing in Western media outlets. A former assistant to the late Sinologist Ezra Vogel, Chairman Rabbit has built a following of more than two million fans on social media platforms Weibo and WeChat. Read about the sale of Hong Kong's top English-language newspaper — currently owned by Alibaba — here. The world's biggest pension fund is investing in pot. While Japan's ultra-harsh penalties for cannabis possession include prison terms for the equivalent of a few joints, the Government Pension Investment Fund has accumulated stakes totaling some $80 million in at least three pot companies. In fact, GPIF's 1.7 million shares of Canopy Growth, a recreational pot business trading under the ticker WEED, would make it one of the company's top shareholders. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayAt this week's central bank meeting, Fed Chair Jerome Powell was crystal clear in his communication. He won't hike if bond yields go up. He won't hike if inflation goes to 2% (looking at the dot plot, it seems the Fed won't even hike if inflation goes to 2.5%!). He won't hike if employment falls to 3.5%. And he won't hike if the economy grows by 6.5% this year. As Morgan Stanley analysts led by Ellen Zentner put it: "Our takeaway from the March FOMC meeting was that policymakers did not just 'double-down' on dovish guidance, they 'tripled-down'."  Of course, the history of the rates market is littered with expectations for central bank hikes that don't match reality. But there is a downside to being this unequivocal: You risk boxing yourself into a corner. It's obviously going to be difficult for Powell to walk any of this back if he needs to. And it's going to be even more difficult for anyone else at the Fed to walk it back. By anchoring rate expectations so firmly and by tying the definition of "substantial further progress" so directly to "an element of judgement," as he put it at the press conference, Powell, now into his third year of a four-year term, has created his own version of key man risk at the Fed. You can follow Tracy Alloway on Twitter at @tracyalloway. Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment