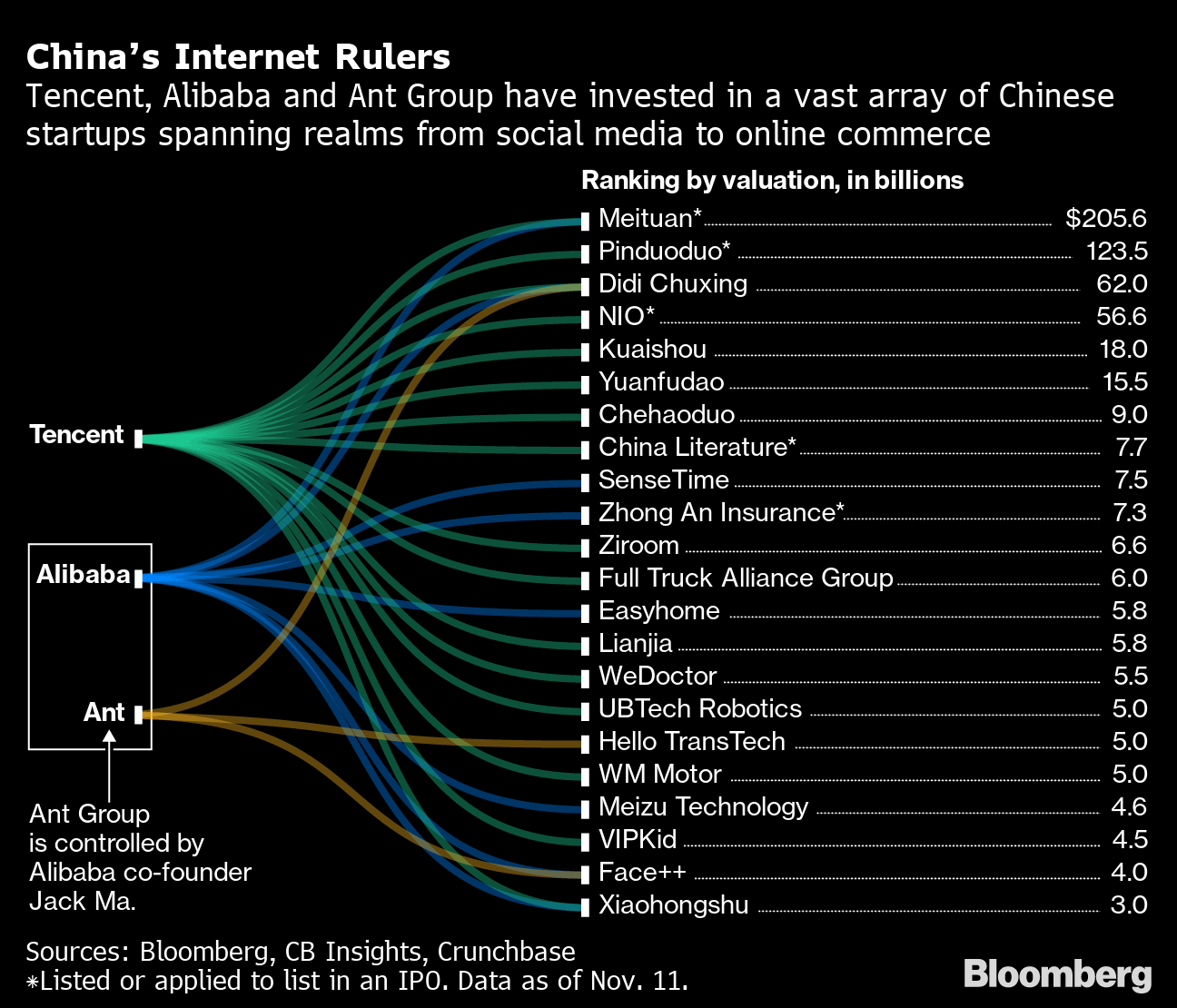

| Alibaba, Tencent, ByteDance, Baidu and Didi — a panoply of big tech in China — have all been punished in recent months for anti-monopoly violations. The events of this past week suggest there's more to come. The loudest signal of that came from President Xi Jinping. At a meeting of the Communist Party's committee overseeing economic and financial affairs, Xi emphasized the need to better regulate "platform" companies, a term Beijing has begun to use that encapsulates the country's biggest tech firms. A readout from that meeting also noted there would be efforts to boost fair competition, fight monopolies and prevent the disorderly expansion of capital. While these points have been raised by other officials in the past, it is significant that they are now coming directly from Xi. It would seem that consensus has formed at the highest-levels of power that more needs to be done. To date, this has been mostly a story about the business empire of Jack Ma. Since putting a stop to Ant Group's public listing late last year, regulators have begun more closely scrutinizing both Ant and Alibaba. Beijing is also now conveying to Alibaba a desire for the company to exit its media holdings. Meanwhile, the rest of big tech has been largely allowed to go about their business as usual. Xi's comments suggest that might be changing. There are other signs of a crackdown as well. Late last week, China's competition regulator imposed fines on Tencent, ByteDance, Baidu and Didi for doing deals without proper government approvals, though the agency did not label any of their actions as anti-competitive.  The actual fines, just 500,000 yuan ($77,000) each, are also not large enough to cause much pain for the companies involved. More worrying is the fact that regulators invested the time to review these dealings. Indeed, Tencent is said to be facing a much broader review of its business practices, according to people familiar with Beijing's thinking. Just as telling was news this week that Alibaba is planning to make one of its services available over Tencent's WeChat messaging platform. The Chinese e-commerce giant has already invited merchants to participate in the project, allowing WeChat users to access its Taobao Deals service, which offers shoppers bargains on merchandise. Alibaba and Tencent have long excluded each other's services from their platforms, creating so-called walled gardens within their ecosystems. If those walls are now coming down, it would represent a major concession to regulators. With Xi having now publicly thrown his support behind greater scrutiny of big tech, more concessions are likely to follow. U.S.-China TalksAmerican and Chinese officials kicked off their meetings in Alaska a few hours before this newsletter was published. Those talks, the first high-level face-to-face meetings since President Joe Biden took office, did not get off to a good start. Indeed, criticisms began flying with each side's opening statements. That perhaps should not have come as a surprise. Just a few days before, Washington imposed sanctions on more than a dozen Chinese officials for their roles in Beijing's tightened control of Hong Kong. And China announced just days ahead of the meeting that it would be putting on trial two Canadians detained shortly after Huawei's chief financial officer was taken into custody in Canada. Whatever the outcome of these talks, the expectations should certainly be set low. Recovery and PollutionSigns of China's robust economic recovery abounded this week. First, data released for the first two months of 2021 showed that retail sales, industrial production and fixed-asset investment all surged by more than 30% from the same period of last year. Then the world's biggest maker of shipping containers said its production can't keep up with demand due in large part to a surge in Chinese exports. Economists at UBS raised their forecast for China GDP growth this year to 9%. And stock market analysts predicted that fourth-quarter profit for companies included in the country's benchmark equity index will surge by the most in a decade. The most visible sign, however, might be the pollution. While Beijing has pushed in recent years to substantially reduce the economy's reliance on heavy industries such as steel, that mission remains a work in progress. China last year was simultaneously the only major economy in the world to grow and also the only big polluter to increase emissions. That trend has continued into the New Year, with air quality in the Chinese capital plunging to a two-year low in early March. Then this week Beijing was struck by the biggest sandstorm the Chinese capital has seen in recent memory, leaving the city covered in an orange fog. While sandstorms are more the result of deforestation and drought than increased factory activity, the level of ultra-fine particulates associated with industrial emissions also soared to the highest since May 2017. The recovery appears to be plugging along.  A woman cycles along a street during a sandstorm in Beijing on March 15. Photographer: NOEL CELIS/AFP Huawei PivotsThe prospects for any near-term loosening of American sanctions against Huawei look distinctly remote. A point hammered home by the Biden administration's decision to further restrict what U.S. companies can supply the Chinese tech giant. But Huawei isn't sitting still either. The company, having watched its consumer business pummeled by its inability to secure cutting-edge chips for its smartphones, has turned to alternative sources of revenue. Among its newest customers is a fish farm in eastern China that's twice the size of New York's Central Park. Instead of selling the farm networking gear, Huawei helped it install tens of thousands of solar panels over its ponds that are shielding the fish from excessive sun and generating power at the same time. The company is also selling sensors and cameras to coalminers so that they can better monitor oxygen levels and for potential machine malfunctions deep in their mines. And this week, Huawei announced that it plans to start charging mobile giants such as Apple and Samsung fees to access its trove of wireless 5G patents. The goal of these efforts, as explained by Huawei founder Ren Zhengfei, is to "keep looking for new opportunities to survive." Pushing Back RetirementChina this week provided a bit more detail on how it plans to go about raising the country's retirement age. In an interview with state media, the head of the Chinese Academy of Labor and Social Security explained that the threshold would be pushed back very gradually, by just a few months every year, and that there will not be any drastic one-time changes. Pushing back the age at which workers can access their pensions is a rather unpopular thing to do. It's why Beijing has invested so much time and energy telegraphing its intention to do so. But policy makers also don't really have a choice. China's population is aging rapidly thanks to decades of its one-child policy and the government's more recent failure to convince families to have more children. Given those dynamics, asking everyone to retire later becomes crucial to any strategy for tackling the country's terrible demographics.  What We're ReadingAnd finally, a few other things that caught our attention: Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment