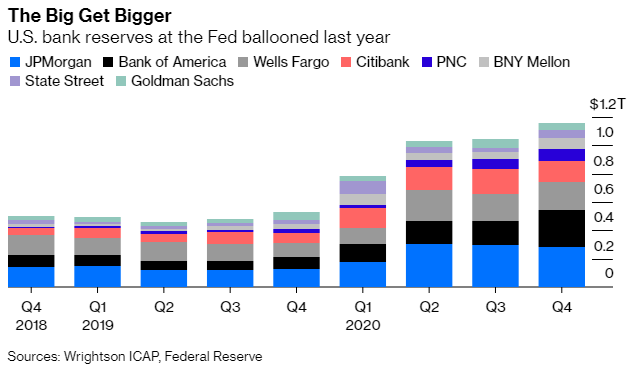

| Turkey's lira tumbles after the central-bank head is fired. Hedge funds predict a new surge of money into Asia. China has room to pump more cash into the economy, its central bank governor says. Here's what people in markets are talking about today. China still has room to pump more cash into the economy while keeping its debt ratio stable, People's Bank of China Governor Yi Gang said in Beijing on Sunday. China's total debt-to-GDP ratio remains at a stable level, Yi said at the China Development Forum. "This will not only provide positive incentives for economic players, but also help create an environment less likely to spawn financial risks." he said. China appointed two new members to the PBOC's monetary policy committee as it shifts focuses to lowering risk: Cai Fang, a well-known economist, and Wang Yiming, a former deputy director of the Development Research Center of the State Council. Meanwhile the country's crusade against risk is tormenting financial markets. Asian stocks look set to start the week cautiously with investors continuing to fret about rising bond yields and inflation as economic activity picks up. Futures slipped in Japan and Australia and were higher in Hong Kong earlier. The Turkish lira plunged as much as 17% in early Asian trading after President Recep Tayyip Erdogan removed the central-bank governor following a bigger-than-expected increase in interest rates. The lira's slide is unlikely to have a sustained spill-over to Asia's emerging currencies. The yen and the dollar advanced against G10 currencies. Oil ended its worst week since October with a gain, while a heavy slate of Treasury auctions this week focused in maturities that have taken a beating recently will keep the bond market in focus. Saudi Aramco is planning to expand and intensify its cooperation with China, teaming up on research in areas including hydrogen and ammonia production from natural gas, according to Aramco's Chief Executive Officer Amin Nasser. "All of these are essential to achieving our long-term, low-carbon ambitions," Nasser said at the China Development Forum. Read more about Saudi's bold plan to rule the $700 billion hydrogen market here. Meanwhile, Aramco's $75 billion dividend has survived one of the biggest disruptions to oil markets in decades. Despite a slump in earnings and revenue, the world's biggest oil company will make the largest payout of any listed company, almost all of which goes to the Saudi government. The Asian market is looking hot to hedge funds. A Credit Suisse survey of more than 200 institutional investors with $812 billion in hedge fund assets showed Asia-Pacific was the most-sought after region with 55% net demand, the highest level of interest in over a decade. Funds predict a flow of cash from North America and Europe as investors seek to tap the early pandemic recovery in China and other parts of the region. The GameStop investing craze may add to Asian flows, with investors looking to avoid similar losses from short-selling squeezes, according to hedge fund companies including APS Asset Management. The surge in stimulus measures in the U.S. and Europe may also push some investors to park more money in Asia, and regulatory changes that have made it easier for hedge funds to invest in China are also boosting demand. The $1 billion market for non-fungible tokens has seemingly come out of nowhere. While the digital projects range from eight-bit pixelated portraits to elaborate ink and paint creations, what they all have in common is the behind-the-scenes startup Alchemy. The San Francisco-based firm was founded in 2017, but was only opened to general customers, rather than private, in August. Since opening to the crypto-crazed public, transactions have grown 54-fold to power $25 billion worth of Ethereum projects. And yes, digital artist Beeple's record-breaking $69 million NFT sale was thanks to Alchemy: The company powers the Makersplace NFT platform that partnered with auction house Christie's. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayNegative rates might be one step closer in the U.S. In fact, they might already be here. At issue is the amount of cash currently sloshing through the U.S. banking system, as well as the Federal Reserve's decision last week to not extend emergency changes to the supplementary leverage ratio (SLR) which requires banks to hold more capital to offset their leverage. The SLR changes were granted last year after the drama in the U.S. Treasury market, and temporarily allowed banks to exclude U.S. government debt and reserves at the Fed from their SLR ratio, meaning they didn't have to hold as much capital against those positions.  The relief helped soothe the volatile Treasury market by encouraging banks to hold and deal more U.S. bonds. It also helped banks continue to take deposits at a time when clients were giving them a lot of money for safe-keeping and when the Fed was buying bonds to inject liquidity into the financial system. Every bond purchased ends up as an additional deposit at a bank, swelling their liabilities and requiring them to hold more capital. Without the relief granted by SLR, the concern is that banks will have to turn away deposits or even impose negative rates to discourage them. As JPMorgan analysts noted late last week: "scoping reserves back into SLR could prompt US GSIBs to be even more aggressive in resisting new deposits and shedding existing ones." In the meantime, they say, at least one big bank has already begun imposing negative rates on domestic deposits. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment