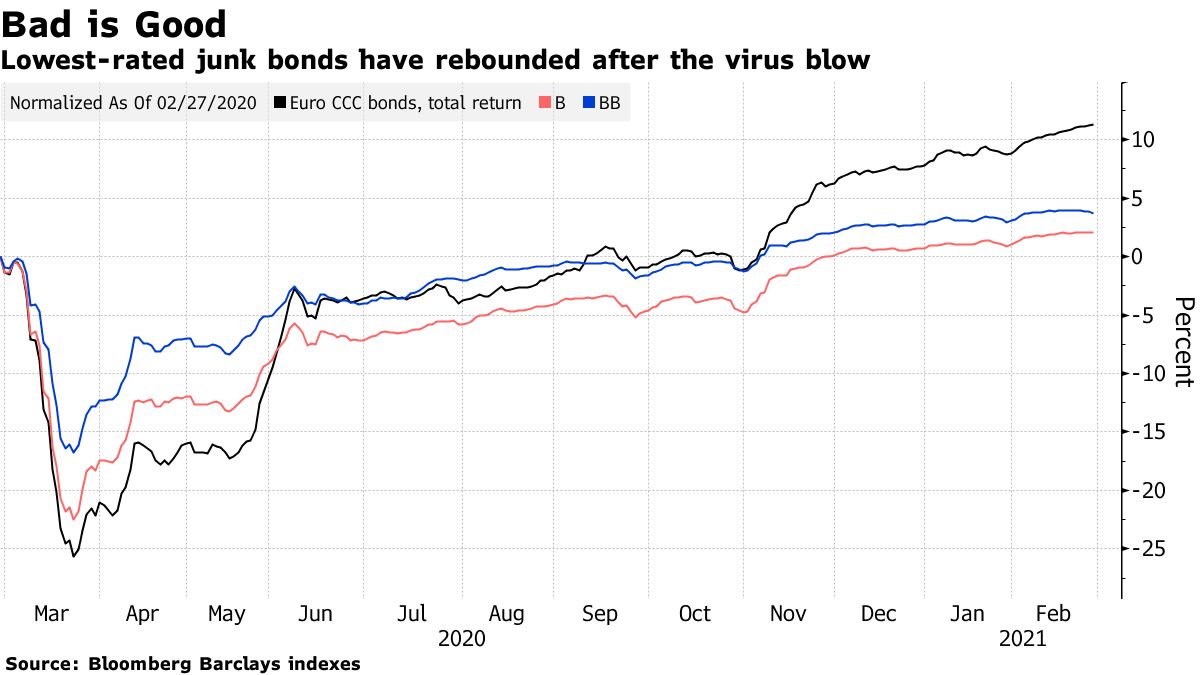

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. As EU health ministers gather for another video call this morning, the situation on the continent is looking increasingly ugly: Italy will tighten restrictions in Milan, Turin and other areas starting today; the Czech Republic will impose its strictest lockdown yet; and Germany introduced a test requirement at its border with the French Moselle region to tackle the spread of coronavirus mutations. The European Commission will urge ministers to massively scale up testing and genome sequencing for virus variants, including placing orders for some 550 million jointly-procured rapid antigen tests, and via wastewater monitoring for Covid-19. Crucially, with vaccine supply issues on course to be resolved, governments are facing questions about whether they are up to the task ahead. If some countries still aren't using the limited supplies they have now, how can they handle the massive, wartime-like mobilization required to swiftly vaccinate their entire adult population? — Nikos Chrysoloras What's HappeningRussian Shots | The Czech Republic won't wait for EU approval to use Russia's Sputnik V coronavirus vaccine, Prime Minister Andrej Babis said. The European Medicines Agency is continuing talks with Russian authorities on starting a rolling review of the shot, while its nod for the Johnson & Johnson vaccine is expected in the next ten days. Vaccine Passports | We all need a break, but we may not get one this summer unless the EU completes work soon on some form of immunity certificate that will allow travel to resume. On a video call of EU tourism ministers today, countries such as Greece will argue that another season is at risk if the bloc can't resolve a debate on vaccine passports. The Bond Battle | The European Central Bank will reveal today how serious it is about countering rising bond yields. After days of top policy makers saying they won't tolerate higher yields if they undermine the economic recovery, the institution will publish its latest bond-buying figures. A significant increase in purchases would show they are backing their words with action. Russian Justice | Russian opposition leader Alexey Navalny, who survived a poisoning last year that he called a Kremlin attempt to assassinate him, has begun serving his two-and-a-half-year sentence at a notorious penal camp. EU diplomats are wrapping up preparations for the sanctioning of Russian officials involved in his arrest, though the measures won't have any material impact on Russia's economy. In Case You Missed ItExpelling Orban | The biggest political group at the European Parliament is inching toward tightening membership rules to make it easier to expel parties that fall short on fundamental freedoms and values. The new rules would represent another step toward the expulsion of Hungarian Prime Minister Viktor Orban's Fidesz from the European People's Party. Orban threatened to walk rather than being shown the door. Equivalence Deal | Britain and the EU are nearing agreement on how to cooperate on financial market rules — a first, limited step toward working together after Brexit. The two sides are proposing a joint forum for discussing regulations and sharing information, though this accord won't require them to open markets. Fiscal Rules | The EU's fiscal rules should be adapted to allow for more spending to boost growth as countries struggle to pull their economies out of pandemic-induced recessions, according to the bloc's top economic official. The new framework should include special treatment for growth-enhancing expenditure, Paolo Gentiloni said. Food Inflation | Global food prices are at the highest in more than six years, driven by a jump in the cost of everything from soybeans to palm oil because of demand from China, vulnerable supply chains and adverse weather. In some rich Western EU countries it might just be a case of switching product brand. In the poorest nations, it can mean the difference between sending a child to school or out to earn money. Chart of the Day European credit markets have just completed a round-trip recovery from peak pandemic fear. Borrowing costs are retreading pre-crisis levels, with confidence in an economic recovery sparking double-digit gains in the riskiest debt. Today's AgendaAll times CET. - 9 a.m. Speech by European Commission President von der Leyen at CDU/CSU event at the European Parliament

- 10 a.m. Informal video conference of EU tourism ministers

- 10:30 a.m. Informal video conference of EU health ministers

- 5:10 p.m. ECB President Lagarde video message to German association of small and mid-sized businesses

- Euro-area manufacturing PMI reading for February

- EU energy chief Simson participates via videoconference in the panel session: How Governments & Businesses Align on Net Zero hosted by CERAWeek

- EU financial services chief McGuinness participates via videoconference in a fireside chat at the 2021 Annual Washington Conference organized by the Institute of International Bankers

- The WTO's new director general begins her term and oversees a General Council meeting in Geneva

- A Paris court rules on accusations that ex-President Sarkozy offered to pull strings for a now-retired court official in exchange for improper help in a legal dispute

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment