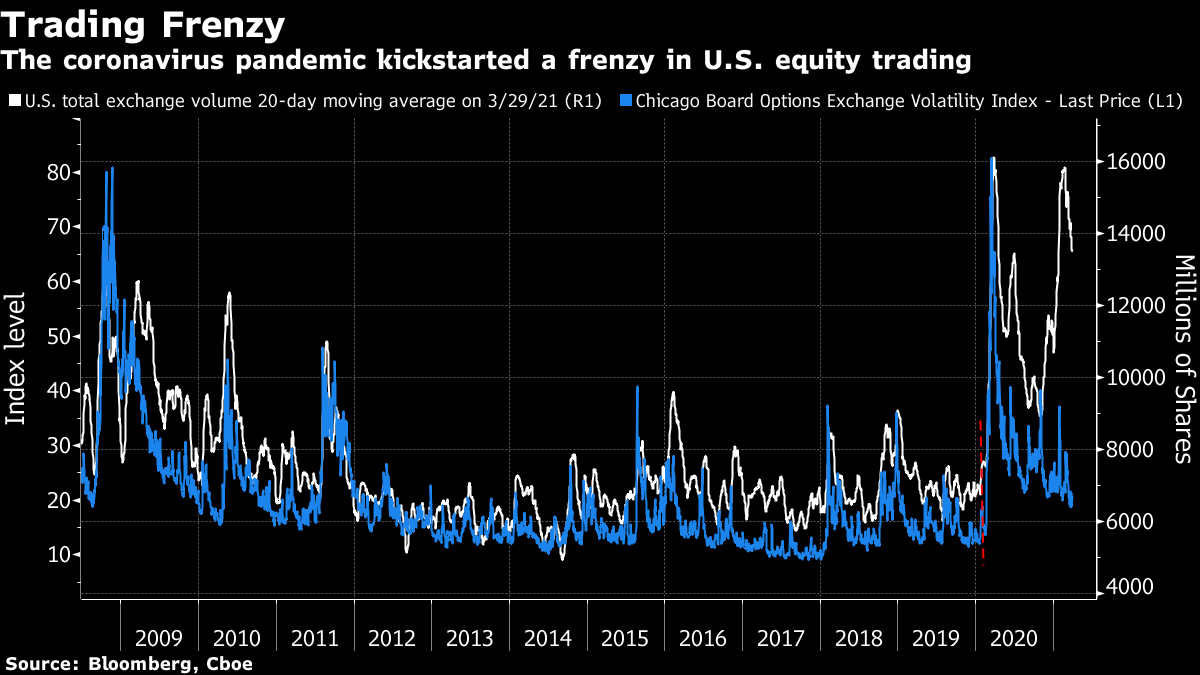

| Good morning. More signs that vaccines work in real-world conditions, knock-on effects of the Suez blockage and finger pointing among major banks over Archego. Here's what's moving markets. Far From OverBy Monday evening, salvage crews managed to tow the Ever Given to a lake halfway through the Suez Canal, allowing a massive queue of ships to start passing through the waterway. While the traffic jam may disappear within two and a half days, global trade is bracing for more disruption after the incident threw a complex network of tightly scheduled supply chains into disarray. Ports in Europe and Asia are bracing to be inundated with goods held up near Egypt for almost a week, with at least 59 container ships delayed on their way to Rotterdam, Europe's largest seaport. "We will continue to see the unfolding of congestion issues in Europe as the cargo arrives, blank sailings resulting from the severe delay of many vessels, as well as a deterioration of the equipment situation," Lars Jensen of SeaIntelligence Consulting told Bloomberg. Breaking RanksA truce among global investment banks, called last week to unwind positions related to Archegos Capital without escalating losses, proved short-lived. By Friday, it was everyone for themselves after some banks started issuing notices of default to Bill Hwang's fund to seize collateral. So far, Credit Suisse and Nomura have told shareholders their businesses face "significant" losses. Goldman Sachs, ahead of the pack on unloading positions, is telling investors the impact on its financial results will probably be immaterial. Deutsche Bank said it escaped, too. Morgan Stanley, another big player that was still shopping blocks of stock as late as Sunday night, has yet to specify any toll. On Monday, the SEC summoned banks for hasty meetings on what triggered the forced sales, according to people familiar with the matter. Hurray for mRNACovid-19 vaccines from Pfizer and Moderna effectively prevented coronavirus infections, not just illness, with substantial protection evident two weeks after the first dose, U.S. government researchers said. The study adds to evidence that new vaccines made with messenger RNA technology actually reduce the spread of the virus in real-world conditions. An earlier study in Israel found a single dose of the Pfizer vaccine reduced infections by as much as 85%. Despite the success of the U.S. vaccination program, CDC Director Rochelle Walensky said she had a feeling of "impending doom" as the U.S. appeared to be on a similar trajectory to Europe, where Covid spikes prompted fresh restrictions this month. 'Not the KGB'Nissan Motor's former top lawyer, who led an internal investigation into alleged financial misconduct by Carlos Ghosn, said he endured retaliation, demotions and even corporate surveillance of his family after questioning the integrity of the probe. Former Global General Counsel Ravinder Passi, speaking for the first time about the arrest of Nissan's celebrated ex-chairman Ghosn and his daring escape out of Japan, described what he views as a toxic corporate culture, one rife with fear, intrigue and reprisals for those who step out of line. "This is just not normal behavior," said Passi of what he claims was heavy surveillance of his family. "This is a car company. This is not the KGB." Coming Up…European stock futures are heading higher after modest gains in Asian markets. In the U.K. earnings rush, watch for results from tobacco maker Imperial Brands, which has underperformed peers amid a wider shift toward cigarette alternatives. German vaccine maker BioNTech, whose primary listing is in New York, is expected to report fourth-quarter results in the afternoon. In China, liquor maker Kweichow Moutai, the country's most valuable firm, is likely to show double-digit net income growth when it gives earnings. And the main assembler of iPhones, Taiwan's Hon Hai, will give results that provide insight into how Apple is doing. Inflation data is due from Germany and Spain. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningAcademics have quantified what many have long suspected, that retail investors are punching well above their weight in the stock market. Individual investors had an impact five times the size of their estimated assets in the second quarter of 2020, according to recent research from the Swiss Finance Institute. They added 1% to the aggregate stock market valuation in that period, and 20% to the value of small cap shares, Philippe van der Beck and Coralie Jaunin wrote in a paper published in SSRN, a repository of academic research. The researchers found that despite an estimated share of 0.2% of aggregate U.S. market capitalization, traders on the popular retail trading app accounted for 10% of the variation in stock returns in the second quarter of last year, when the rebound from the pandemic selloff began in earnest. That's because the smaller investors react more strongly to price changes than their institutional counterparts. While the impact of Robinhood traders is concentrated toward small cap stocks and the consumer staples industry, they are also able to affect the price of some large companies, which are being held primarily by passive investors, according to the study. The outsized activity of retail investors provided "considerable" liquidity to the U.S. stock market during the crash, but growth in the cohort could lead to a higher level of equity volatility in the future, the study concluded. "If -- facilitated by novel fintech solutions -- the retail sector continues to grow its wealth share, the extraordinary volatility observed during the pandemic may turn out to be the new normal," the researchers said.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment