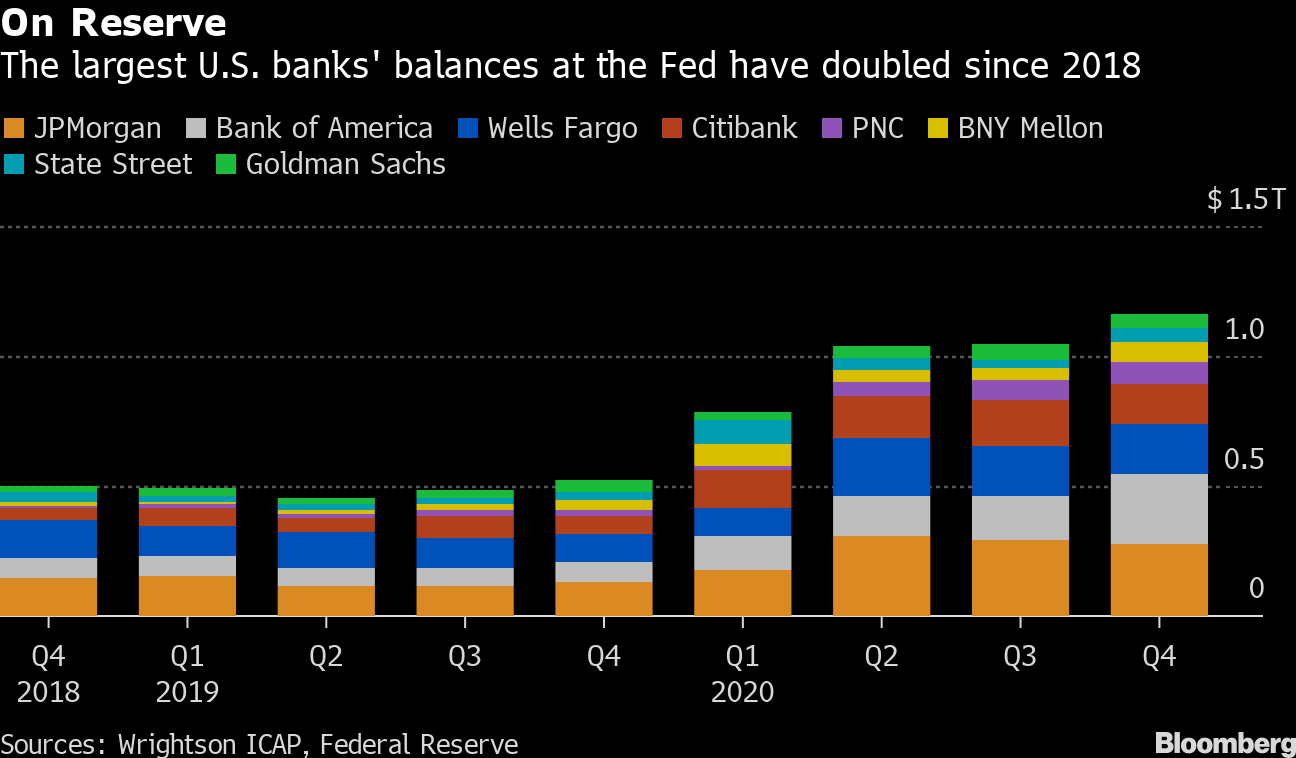

| Trouble for tech, bond yields won't be quelled, and Americans eye return to normal life in July. Tech dust-upChina's tech moguls are facing a backlash at home and abroad. Tencent Holdings Ltd. has become the next target in a crackdown by Chinese authorities that began with Jack Ma's Ant Group Co., according to people with knowledge of the nation's top financial regulators. The conglomerate was dealt an antitrust fine that marks the beginning of a campaign of tougher regulation, the people said. Meanwhile, the U.S. tightened restrictions on selling 5G-related goods to Huawei Technologies Co., explicitly banning export of components like semiconductors, antennas and batteries. The news sent futures on the tech-heavy Nasdaq down more than 1% before the open. Bond moves Benchmark 10-year Treasury yields surged as much as eight basis points to breach the key technical level of 1.6% Friday, reminding investors that bond volatility has become the companion of go-big fiscal stimulus. Bets that extra government spending could overheat the economy were out in full force after U.S. President Joe Biden signed off on $1.9 trillion of stimulus. Meanwhile, European yields are lagging the move higher in Treasuries, prompting strategists to bet on greater divergence, unless the Fed does anything to change it. Most European Central Bank policy makers have no intention of expanding their 1.85 trillion-euro ($2.2 trillion) emergency stimulus program despite their pledge on Thursday to step up the pace of bond buying to keep yields in check, according to officials familiar with the matter. Fireworks and fearBiden is aiming to inoculate enough Americans that normal life begins to return by the summer while families and friends can get together for July 4 fireworks. Meanwhile, in Europe, the vaccine shortage persists. AstraZeneca Plc will supply less than half the planned number of shots to the European Union in the second quarter, with protectionism among nations thwarting efforts to even out distribution. Safety concerns over AstraZeneca Plc's treatment have also led nine countries to suspend its use. Europe's stuttering vaccine rollout risks falling farther behind the U.K. and U.S., prolonging human and economic misery. Markets mixedRising bond yields are unnerving global equity investors, triggering fresh losses among tech stocks. Overnight the MSCI Asia Pacific Index ended flat, the Hang Seng Index fell 2.2% and Japan's Topix rose 1.4%. In Europe, the Stoxx 600 Index was 0.5% lower at 5:32 a.m. Eastern Time with the region's tech stocks declining the most. S&P 500 futures pointed to a lower open, with Nasdaq 100 futures dropping more than 1%. Coming up... The producer price index for February is due at 8:30 a.m., with the report expected to show that price pressures decelerated. Canadian unemployment numbers are also due at that time. University of Michigan sentiment figures for March are due at 10:00 a.m. The Baker Hughes rig count is at 1:00 p.m. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Katie's interested in this morningThe latest acronym on Wall Street's mind is SLR: the supplementary leverage ratio. In normal times, SLR required U.S. banks to hold a minimum level of capital against their assets as a buffer against losses. However, the Federal Reserve exempted Treasuries and deposits at the central bank from those requirements roughly a year ago. Banks took advantage, with balance sheets ballooning by as much as $600 billion as a result of the regulatory relief. Now, the SLR redemption is set to expire on March 31, and no one's quite sure what to make of it. BMO Capital Markets strategist Dan Krieter estimates that letting the relief lapse could force a bout of Treasuries selling, while JPMorgan Chase & Co. Chief Financial Officer Jennifer A. Piepszak warned last month that banks may have to "turn away deposits" in that event. Others, like Bank of America U.S. interest rates strategy head Mark Cabana, are more sanguine: while the market has "assigned almost mythical powers" to the SLR exemption, in reality, banks' share of the demand for Treasuries is "very marginal."  In any case, jitters around whether relief would be extended were one of the main factors blamed for last month's sloppy 7-year note auction, which by some measures, saw the lowest demand on record. Zoltan Pozsar, a strategist at Credit Suisse, broke down that mindset in a recent episode of the Odd Lots podcast: "So when you look at an auction that goes bad, a large part is basically because a bank portfolio doesn't show up, because a bank portfolio doesn't know what's going to happen to this SLR exemption. Management is getting the balance sheet ready for stock buybacks. If you want to buy back stocks and SLR exemption does not happen, then you will be throwing balance sheet capacity away to basically carry liquid assets."

Given that disaster of a 7-year sale, the stakes were sky-high heading into this week, with the Treasury Department scheduled to auction off $120 billion between 3-, 10- and 30-year securities. The auctions went fairly smoothly -- only the 30-year sale produced a small tail -- reigniting a rally in tech stocks, which had buckled in previous weeks under the weight of rising rates. However, a couple of OK auctions don't mean we're out of the woods yet, cautions Priya Misra of TD Securities. "Those concerns move higher every day we get closer to March 31 without a Fed announcement," said Misra, the firm's head of global rates strategy, who noted that banks don't tend to buy the 10- and 30-year tenors. "In a world where the Fed might taper late this year and the President is talking about another stimulus package, who is the marginal buyer of Treasuries and at what price?" Fed policymakers have largely been mum about their plans -- and probably for good reason. Senators Elizabeth Warren and Sherrod Brown said in a letter to U.S. regulators this month that extending relief to banks would be a " grave error." As my Bloomberg Opinion colleague Brian Chappatta notes, this puts the Fed in a somewhat impossible position -- the central bank can renew the exemption and appear beholden to the banks, or let it lapse and risk destabilizing the $21 trillion Treasury market. In any case, the clock is ticking. Follow Bloomberg's Katie Greifeld on Twitter at @kgreifeld Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment