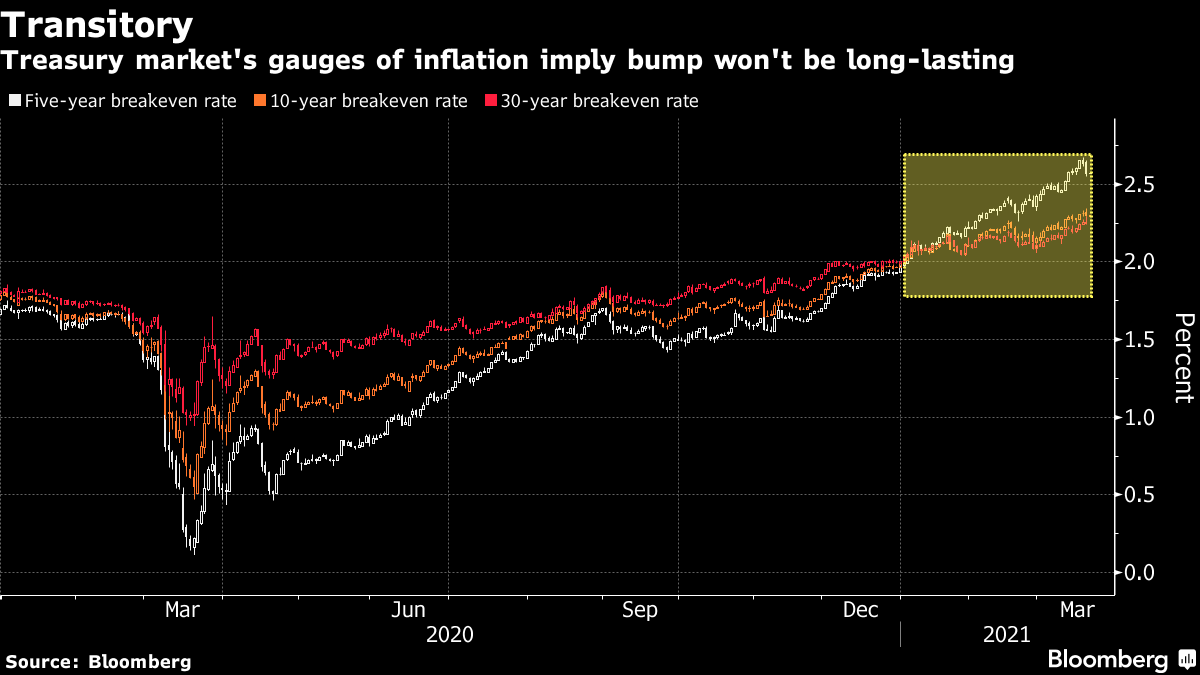

| China-U.S. talks descend into bickering, oil's plunge, and U.S. races ahead with vaccines. Divided There's little sign that a change in the U.S. administration is going to lead to an immediate reset of relations with China. A meeting in Anchorage, Alaska between high-level diplomats from both sides descended into bickering, with a member of the Chinese delegation saying U.S. comments weren't "normal." The talks continue today, with hopes for a leaders summit next month still alive. Rout Crude oil is holding steady close to $60 a barrel this morning after the commodity suffered a 7% loss in yesterday's trade. Analysts are suggesting that the pullback does not mean an end to the oil rally, but rather it is a sign prices had run too far, too fast. Most economists are sticking with their end-year price forecasts after the move. There was also a wider selloff in commodities as the inflation fears that roiled the bond market hit the outlook for products tied to global growth expectations. Vaccines President Joe Biden said the U.S. will have hit his goal of administering 100 million Covid-19 vaccines today. Biden said he would announce a new target next week. Meanwhile, across the Atlantic in Europe, there is a chance to get the inoculation push back on track with most nations restarting use of the AstraZeneca Plc shot after regulators gave it the green light. The number of new cases in Germany hit a two-month high, Hungary extended curbs and Paris is back in lockdown. Markets mixedThe big moves yesterday in bonds and commodities, coupled with the confrontational exchanges between China and the U.S., are hitting investor optimism. Overnight the MSCI Asia Pacific Index slipped 0.7% while Japan's Topix index closed 0.1% higher. In Europe, the Stoxx 600 Index was 0.3% lower at 5:50 a.m. Eastern Time with retailers and banks leading the losses. S&P 500 futures pointed to a small recovery at the open, the 10-year Treasury yield was at 1.689% and gold was slightly higher. Coming up... Canadian retail sales for January are at 8:30 a.m. The latest Baker Hughes rig count is at 1:00 p.m. U.S.-China Economic and Security Review Commission presents its annual report to Congress. It is quadruple witching today, where options and futures on indexes and equities expire, which may lead to higher trading volumes. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningIt looks like the Fed's newfound patience with inflation riled a lot of bond marketeers this week, despite the central bank's pretty consistent message since it unveiled the new average-targeting strategy late last year. To recap, the Fed's new goal is inflation around 2% over time. Given the years of shortfall that means interest rates should stay on hold until price increases appear to be running slightly above that level for a while. So Powell aimed to head off the market's rising expectations for rate hikes, and any fears of an inflationary spiral, as the economic numbers improve. Arguably the bigger controversy of the webcast was Powell's assertion that "you can only go out to dinner once per night" -- which briefly outraged the gourmand subset of the FinTwit community. But his broader point, that the inflationary rebound in this recovery has its limits, is key. People who stopped eating out will start again. However, they're not going to be buying a year's worth of missed teriyaki (with the possible exception of those who know who they are). And that's why the breakeven inflation curve is looking super-distorted right now, with a smorgasbord-sized overhang at the front. Inflation will be higher as pent-up spending is unleashed, and with the help of stimulus checks. But rates further out suggest that inflation will return to the Fed's target.  Emily Barrett is a cross asset reporter for Bloomberg. Follow her on twitter @NotthatECB Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment