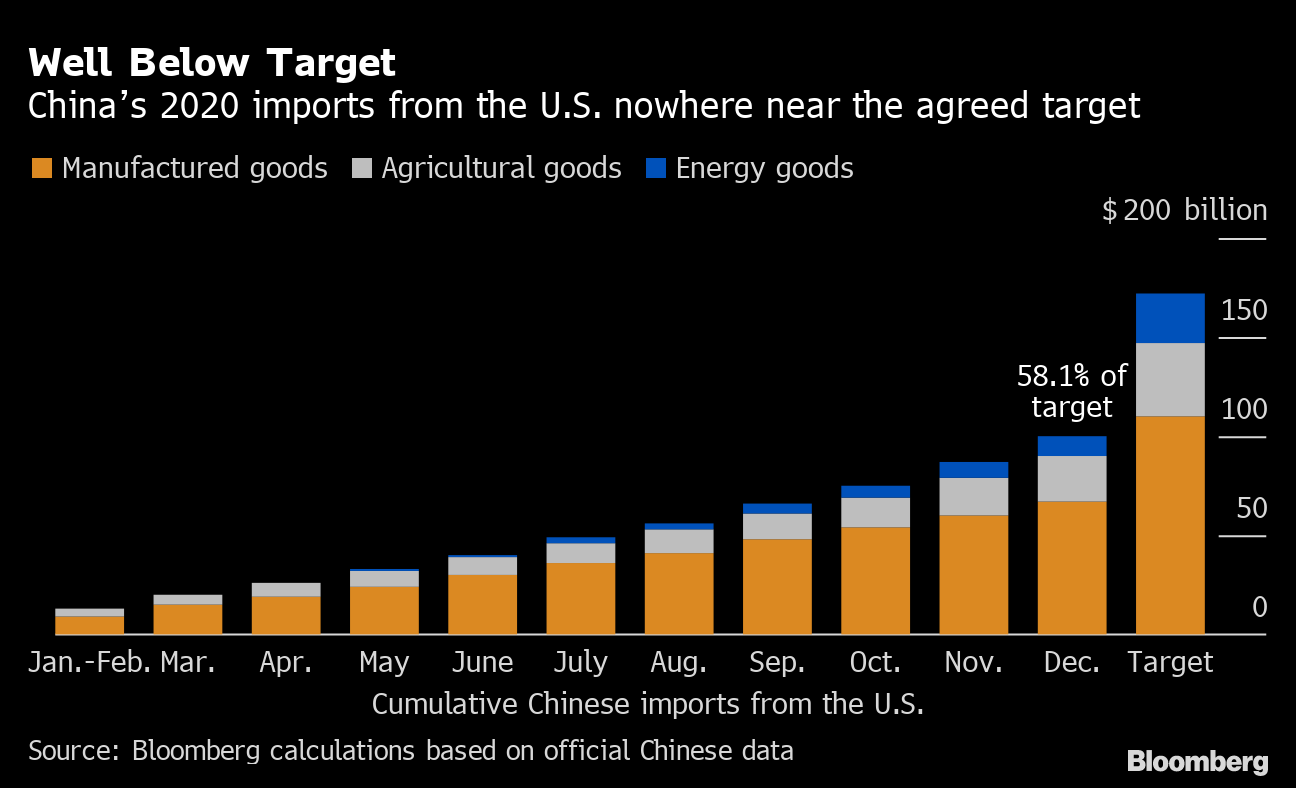

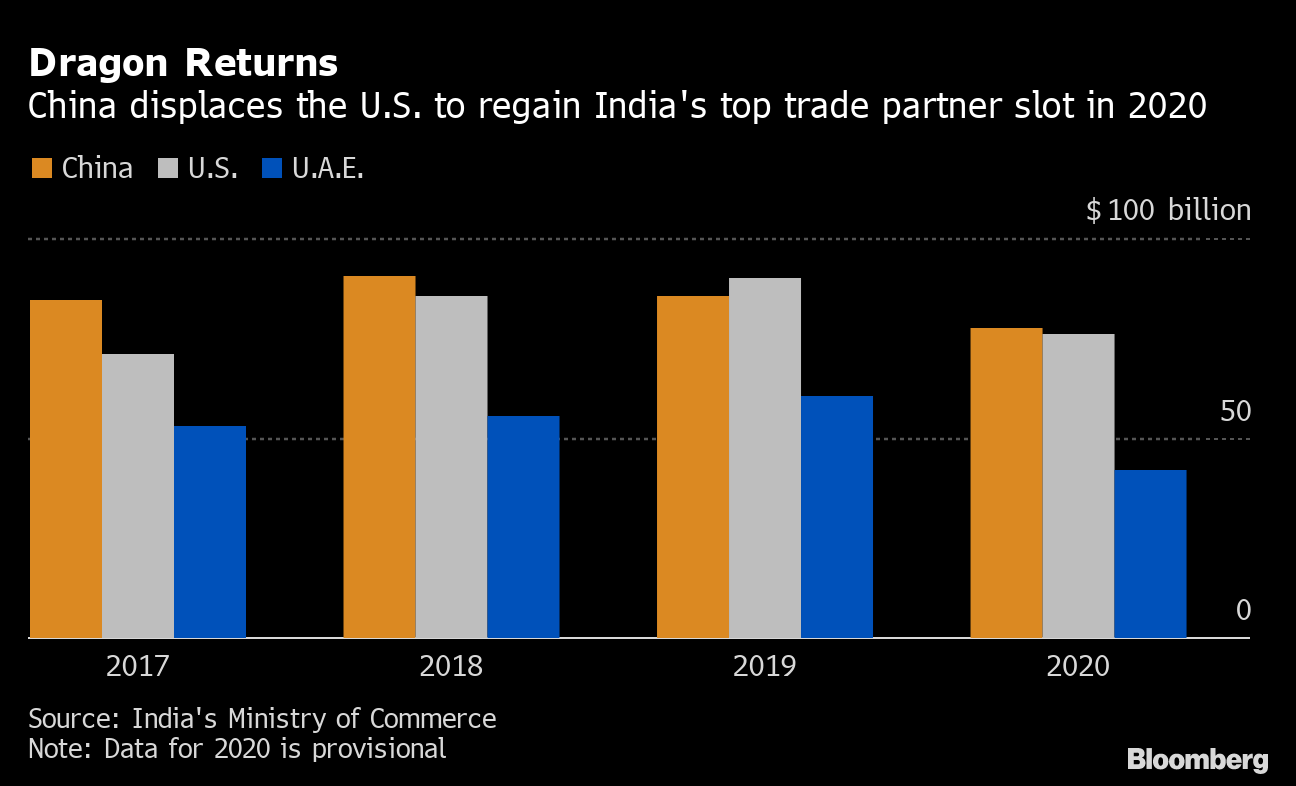

| For all the headlines about decoupling and great power competition, there's one area where Chinese and American prosperity are becoming ever more intertwined: food. China's demand for agricultural goods is surging as its massive population gets wealthier and eats ever greater amounts of meat. That's fueled imports of crops such as corn to feed growing herds of hogs, cattle and chicken. And who better to supply that need than America? Indeed, the U.S. Department of Agriculture estimated this month that Chinese buying of American farm goods will hit a record $31.5 billion in the fiscal year ending Sept. 30. While demand is strong around the world, China is "just blowing off the chart," according to Jason Hafemeister, a USDA trade official. One person who is rather happy about the trend is Dave MacLennan, the chief executive of Cargill Inc., the world's largest agricultural commodities trader. Surging Chinese imports have helped revive profits at the company and MacLennan sees the country's demand staying strong for "at least another couple of quarters." There's also the phase-one trade deal that Beijing signed with the Trump administration. While China fell well short last year of hitting purchase targets set out in that pact — thanks in no small part to the pandemic — Cargill is optimistic Beijing will continue to try to hit those levels.  What's more, Cargill also sees potential for a phase-two deal under President Joe Biden. That positivity, as MacLennan explained, derives in part from the hope that the new administration will "have as a priority that the American farmer needs Chinese markets." Katherine Tai, Biden's nominee for America's trade chief, seemed to acknowledge that need this week in comments for her confirmation hearing before the U.S. Senate, in which she described China as both a rival and a partner. The counterpoint to this optimism is that there's far less cheer in Beijing, where China's growing reliance on imports to feed its population has stoked concerns about food security. Just days after the USDA forecast record Chinese purchases, Beijing released a new policy directive pledging to boost "rural revitalization." That includes pushing to modernize agricultural production and using technology, such as genetically modified crops, to improve yields. Agriculture Minister Tang Renjian would later say that China will try to produce and store as much grain as possible to deal with any "uncertainty in the external environment." If the past four years have taught Chinese policy makers anything, it's how quickly interdependence can be weaponized. Canadian TiesIt's been more than two years since Canadian authorities detained Huawei Chief Financial Officer Meng Wanzhou in Vancouver on a U.S. extradition request. Shortly thereafter, China detained two Canadian nationals — Michael Korvig and Michael Spavor — and bilateral ties plunged into a precipitous nosedive. While it remains unclear how the two countries can go about repairing their relationship, Canadian Prime Minister Justin Trudeau did get some positive news this week. Biden's administration has acknowledged that the U.S. has a "significant" role to play in resolving the standoff and is eager to help do that, Trudeau said in an interview a day after a bilateral meeting with the new American president. But there is also reason to tamp down expectations. The rift between Beijing and Ottawa has widened well beyond the fates of Meng, Korvig and Spavor to now encompass Chinese policies in Hong Kong and the western province of Xinjiang. Even with America's help, nothing will come easily.  Justin Trudeau speaks during a virtual meeting with Joe Biden from his Ottawa office on Feb. 23. Photographer: Adrian Wyld/Canadian Press Stock-Trading TaxIn a surprise move this week, Hong Kong announced it will increase its tax on the trading of stocks in the city, with the levy on transactions set to rise to 0.13% from 0.10% starting in August. Investors responded with a selloff in the $7.6 trillion market after the Wednesday announcement, even though the tax remains lower than many other jurisdictions. The U.K., for example, charges 0.5%. The dramatic reaction could have been a reflection of how unexpected the move was, with a notable market rebound on Thursday suggesting that to be the case. But the targeting of stocks trading also speaks to another concern that's loomed over Hong Kong. While it's unclear what role Beijing played in the decision, Chinese officials have undoubtedly taken a more proactive approach to Hong Kong governance. The city's yawning wealth disparities have also long been blamed by pro-Beijing figures for the unrest Hong Kong has seen in recent years. If the stock-trading tax is not just a bid to bolster the city's finances but instead part of an effort to address those disparities, then the implications for Hong Kong's future could be far more pronounced. Trade with IndiaData released this week showed China surpassing the U.S. last year to become India's largest trading partner. It wasn't because of some surge in commerce, however. Instead, it was the result of India's trade with both powers declining in 2020 and commerce with China slipping by less than that with America. Still, it's a significant development. Since the middle of last year, India and China have been engaged in a tense standoff over their disputed border high up in the Himalayas. And though both sides have begun to pull troops back, it didn't happened quickly enough to prevent the clash from substantially wounding their relationship. What's made Beijing's ties with New Delhi all the more important are American efforts to recruit India as an Asian counterbalance to Chinese power. It's not so surprising then to see the Times of India reporting that President Xi Jinping is considering a visit to India as soon as the second half of 2021. With the U.S. and China continuing to vie for influence around the world, how India decides to situate itself between them will be pivotal.  What We're ReadingAnd finally, a few other things that caught our attention: |

Post a Comment