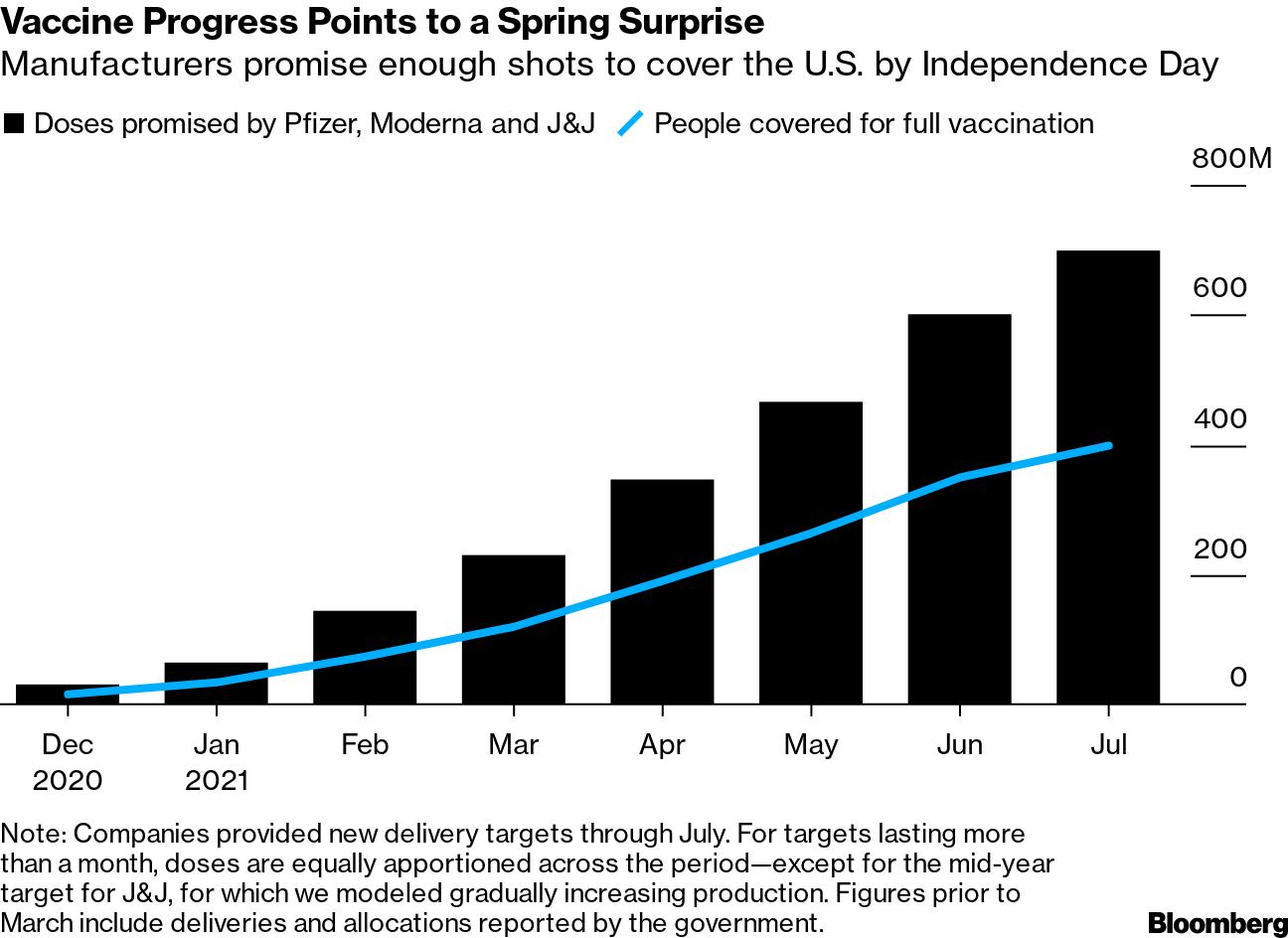

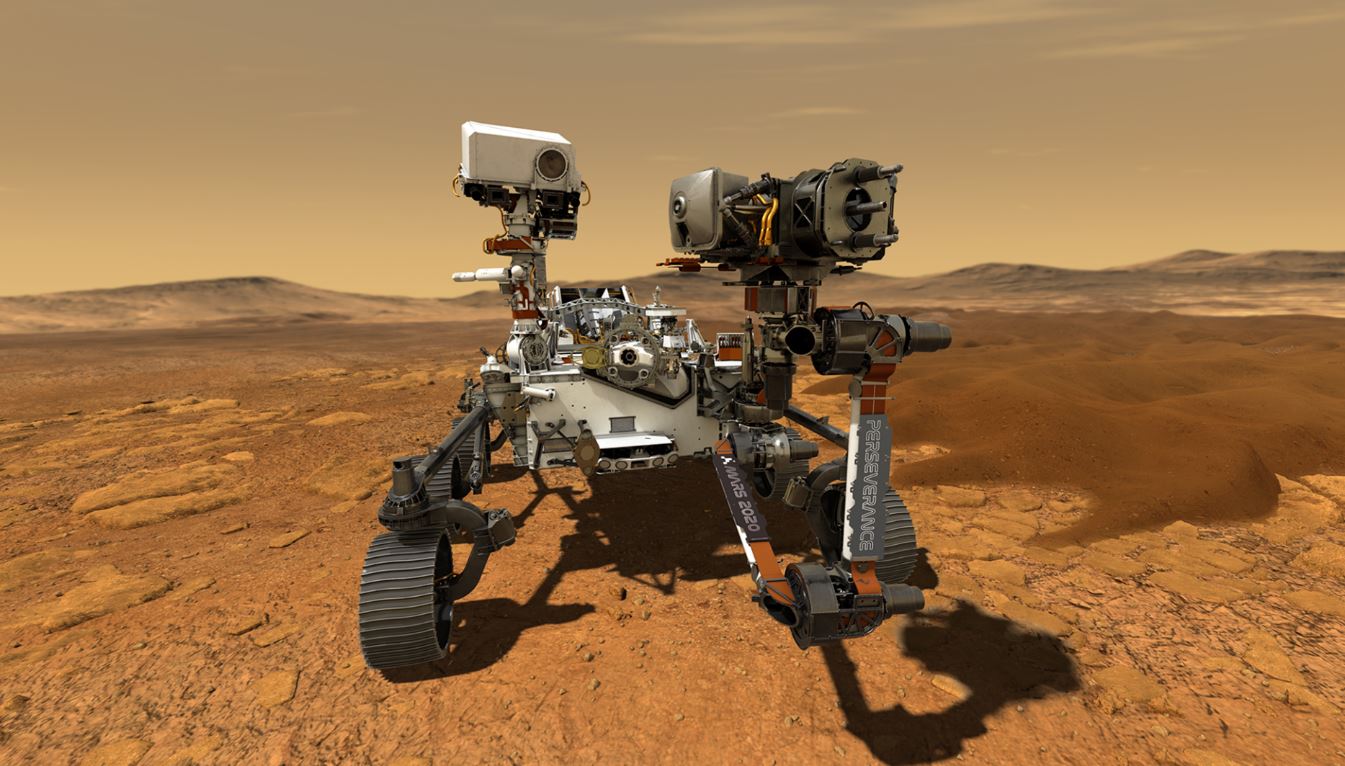

| The U.S. coronavirus vaccine supply is poised to double in the coming weeks and months, according to an analysis by Bloomberg, allowing a broad expansion of vaccination efforts. Currently, the U.S. is administering only 1.6 million doses a day thanks to a supply of about 10 million to 15 million a week. But manufacturers have accelerated production timelines that may provide hundreds of millions of doses to match growing capacity to immunize at pharmacies and mass-vaccination sites. The number of shots delivered should rise to almost 20 million a week in March, more than 25 million a week in April and May, and over 30 million a week June. Though the threat of more easily transmitted Covid-19 variants looms large, with initial research showing some to be less deterred by current vaccines or even potentially deadlier, the pharmaceutical ramp-up, in tandem with a receding third infection wave, may be cause for cautious optimism in America. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today's top stories Brazil became the third country in the world to breach 10 million confirmed coronavirus cases, after the U.S. and India. France is committing to donate 5% of its secured vaccine supplies to poorer countries. Mexico issued a warning about a potentially counterfeit Pfizer vaccine. Here is the latest on the pandemic.  The sprawling blackouts that plunged Texas into chaos as natural gas systems froze up and electric grids buckled under a historic cold blast are easing, but the energy crisis the outages sparked continues. About 375,000 homes and businesses in the state were without electricity midday Thursday. That's down from more than 3 million on Wednesday. Here is the latest energy update. The U.S. labor picture isn't pretty, either. Initial unemployment claims jumped to a four-week high, with first-time applications totaling 861,000, up 13,000 from the prior week's revised totals. With 4.49 million continuing unemployment claims and 4.06 million pandemic extension claims, the latest data suggest the labor market has a tougher road to recovery than previously thought. For those who kept their jobs, Americans finished 2020 with the largest nest eggs on record, as the bull market and automatic annual contribution increases lifted the value of investments in accounts that help reduce taxes and encourage long-term savings. DoubleLine Capital chief and long-time gold bull Jeffrey Gundlach now considers Bitcoin a better trade. Bitcoin may well be "the stimulus asset," he said.  Jeffrey Gundlach, chief executive officer of DoubleLine Capital LP Photographer: Alex Flynn/Bloomberg Apple launched its first iPhones with 5G wireless speeds a few months ago. Now it's looking to start 6G. NASA successfully landed its largest and most sophisticated science rover on Mars, as the spacecraft Perseverance touched down in an ancient river delta that may contain signs of whether the planet ever harbored microbial life.  NASA Perseverance illustration Source: NASA/JPL-Caltech What you'll need to know tomorrow What you'll want to read in Bloomberg GreenWhen Wim Coekaerts bought a hillside lot for his California dream house, there was an old horse barn, a grove of olive trees and lovely views of Silicon Valley. But there was no electricity, and the nearest utility pole to his bucolic acre was 550 feet away. The town of Woodside requires new homes without utility service to pay for wires to be buried underground. Coekaerts faced a choice: pay PG&E roughly $100,000 for engineering work and foot the enormous additional cost of the trenching, or make a more personal fix.  Wim Coekaerts Photographer: Kelsey McClellan for Bloomberg Green Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Bloomberg Crypto Summit: With Bitcoin burgeoning and markets jumping as vaccines signal the coming end to the pandemic, the future of digital assets is bright. Join us Feb. 25 as we analyze what it takes to push cryptocurrencies into the portfolios of the world's largest investors. Sponsored by BitGo and Grayscale Investments. Register here. Download the Bloomberg app: It's available for iOS and Android. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment