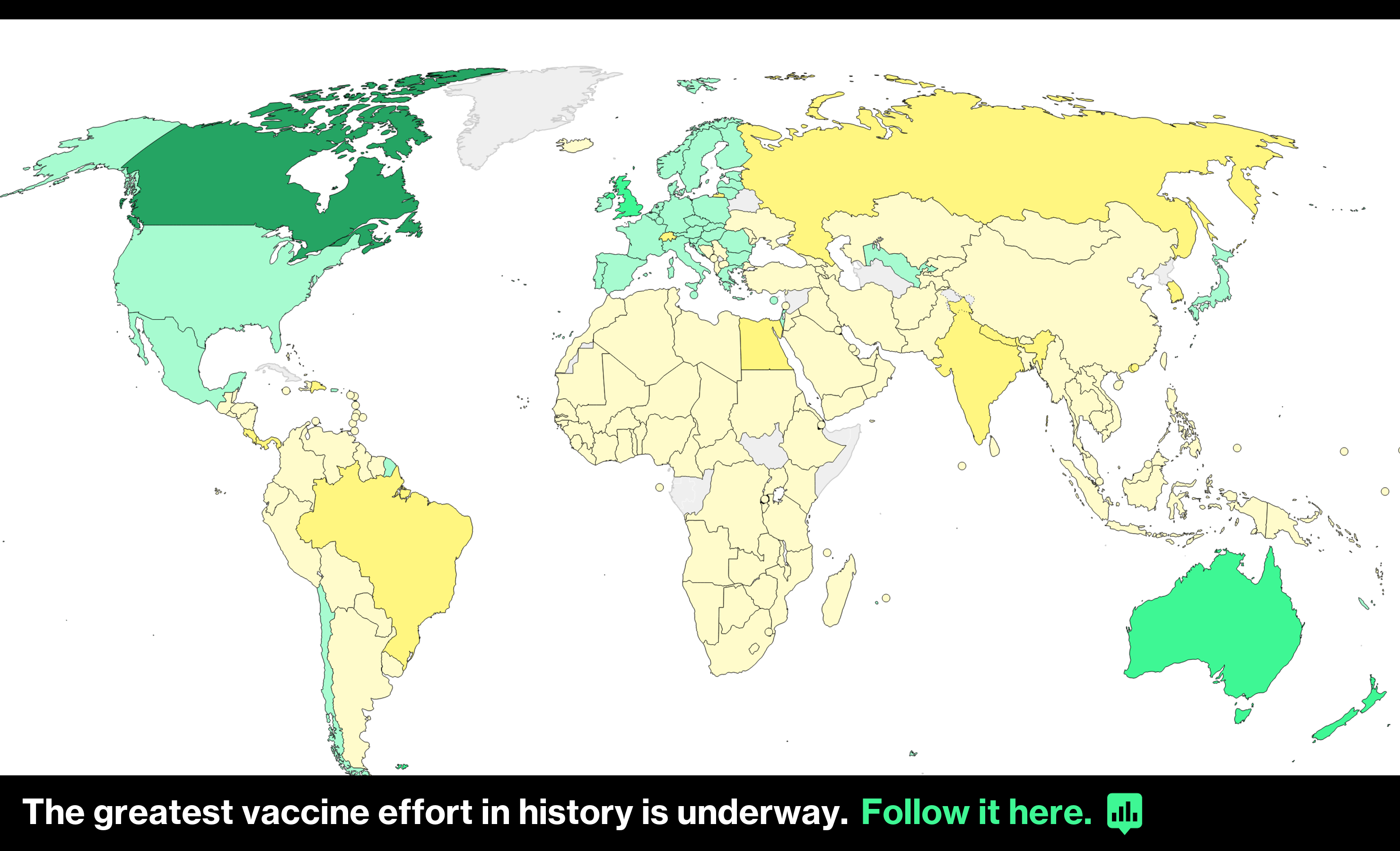

| What's happening? The post-Brexit tussle over banking and finance is hotting up. The battle for the crown jewels of the U.K. economy continued this week, and there was some positive news for Brexit Britain. About 1,000 European Union finance firms are expected to open their first offices in the U.K. after losing their passporting rights in the divorce. Bank of England Governor Andrew Bailey waggled his finger at Brussels. Any demand from the EU that euro derivatives must be settled by clearinghouses inside the bloc would be a "very serious escalation" that would draw a U.K. response, Bailey warned.  Bank of England Governor Andrew Bailey Photographer: WPA Pool/Getty Images Europe That was a symptom of Britain's growing frustration over the EU's reluctance to grant so-called equivalence rulings. But there was a glimmer of hope on Thursday when a French minister close to President Emmanuel Macron said he thought the EU might grant some, albeit limited, form of equivalence by the middle of this year. (Mind you, he also said France wants to grab more British finance jobs.) Separately, the U.K. and EU are also nearing agreement on how to cooperate on financial market rules. As for the rest of business, new Brexit paperwork is the biggest headache for firms trading with the rest of the world – worse than border disruption and transportation costs – according to a survey by the Office for National Statistics. Half of exporters reported no difficulties. Cargo rates from France into the U.K. have risen 44.7% in the year through February, according to high-frequency data from TimConsult, a unit of logistics platform Transporeon. The knock-on effect will ultimately be stock shortages and inflated prices for consumers, says the Chartered Institute of Procurement and Supply. — Lizzy Burden As ever, if Brexit is affecting your business in a way we haven't reported, please get in touch. You can reach me at eburden6@bloomberg.net Coming NextThe U.K.'s departure from the EU is complete, and the impact of the divorce will help shape its economy for years to come. With that in mind, it's time for the Brexit Bulletin to look ahead. Almost five years since I wrote our first edition, this newsletter will next week be retooled as Beyond Brexit. We will still be your essential one-stop weekly Brexit shop. But we will also focus more directly on changes happening to the U.K. economy, government, businesses and markets. Will Brexit (or the pandemic) help or hinder Boris Johnson's ambition to "level up" the rich and poor parts of Britain? How will the U.K. repair its public finances, and what will that feel like for consumers and businesses? Will foreign firms keep investing in the U.K. and will financial giants keep calling London home? These are the kinds of questions we'll aim to answer. Look out for a special post-Budget launch edition in your inboxes next week. — Simon Kennedy, Executive Editor for Bloomberg Economics Don't Miss Click here for the latest on the global coronavirus vaccine rollout. Sign up here for our coronavirus newsletter, and subscribe to our podcast. Watch Bloomberg Quicktake, our new streaming news service with a global view and an informed take. Want to keep up with Brexit?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Like getting the Brexit Bulletin? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment