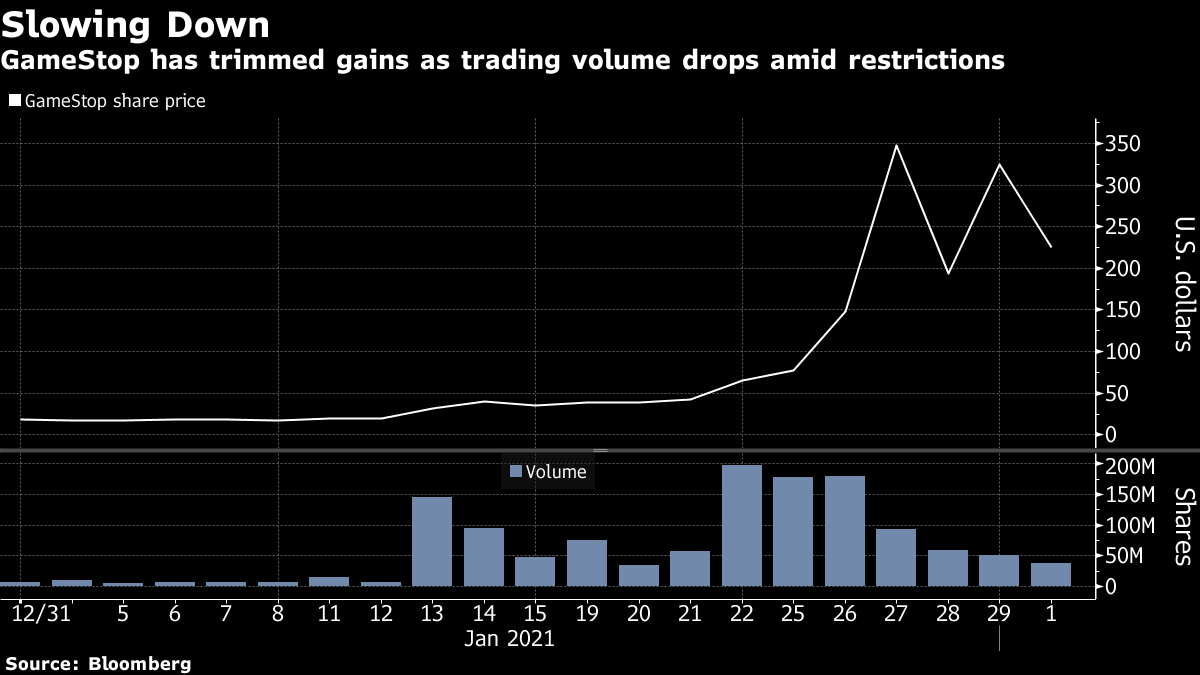

| Jeff Bezos steps down as Amazon CEO. Retail trading euphoria shows fatigue. Alibaba posts stronger-than-expected sales. Amazon Chief Executive Officer Jeff Bezos will step down from his post in the third quarter of 2021 and be replaced by Andy Jassy, the head of the company's cloud computing unit. Jassy for years has been seen as a potential successor to Bezos, who founded the company as an online bookstore from his Seattle garage more than 25 years ago and became one of the world's wealthiest men. Bezos will become executive chairman, Amazon said in a statement. The wild run-up of trades popular with Reddit crowds is starting to come crashing down, with meme stocks losing $167 billion in just a matter of days. GameStop sank 47% and is now down 65% from its record close on Wednesday. AMC slid 39% and Express Inc. lost 26%. Silver tumbled more than 5% after surging to an eight-year high as the speculative retail frenzy ensnared metals and captivated global markets. The retreats coincide with a sharp reduction in short interest after bearish investors appeared to cover their positions. While a few funds were hit with double-digit losses, including Melvin's 53% drubbing, January performance numbers show that most funds navigated the Reddit-fueled trading frenzy with only a few bruises. Asian stocks looked set to extend a global rally amid a slew of corporate earnings and a crumbling of the retail trading frenzy that fueled swings in heavily shorted shares. The dollar slipped. Futures in Japan and Australia pointed higher, though dipped in Hong Kong. U.S. stocks climbed for a second session. Treasury yields edged higher amid a move to fast track a U.S. stimulus plan. Oil climbed to its highest in over a year on tightening global supplies and signs of strength in physical markets. Alibaba offered investors few clues into how the regulatory crackdown on Jack Ma's tech empire will impact its future growth after reporting a stronger-than-expected 37% increase in quarterly sales. The e-commerce giant has established a special taskforce to conduct internal reviews and is actively communicating with antitrust regulators on complying with their requirements as investigations continue, Alibaba said. It's also unable to make a complete assessment of how the ongoing "rectification" of affiliate Ant Group will affect its business, according to the statement. Myanmar moved to suspend all flights through April, raising fresh concerns about the army's crackdown a day after it seized power in a coup, detaining senior government officials and activists. A rally was held in the commercial capital Yangon in support of the army. World leaders have condemned the coup, with President Joe Biden saying the U.S. could reinstate sanctions if the military doesn't "immediately relinquish the power they have seized." What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne of the weird things about the silver squeeze — and there are many— is the fact no one wants to claim responsibility for it. The front page of WallStreetBets, which was all about the success of the GameStop squeeze last week, is now mostly posts screaming at people not to buy silver and warning them that the whole idea of a squeeze is being fueled by a bunch of bots in league with hedge funds. (It is, however, pretty easy to find examples of bullish silver posts on WallStreetBets from just a week or so ago). This isn't meant to be a referendum on whether the subreddit sparked the silver frenzy or not, but it does suggest it's going to be harder to pull off another GameStop-like squeeze. The problem with flash mob trading is that it relies on unity: you have to get enough people on side to make the trade work. That becomes infinitely harder once the subreddit starts tearing itself apart and distrusting its own members. Of course, there's always been disagreement on WallStreetBets. But with an influx of new subscribers — its gone from about 2 million to 8 million in a little over a week — there are more suspicions and accusations flying around than ever.  In the end WallStreetBets could end up being a victim of its own success. The GameStop phenomenon has been so well publicized that hedge funds have already been cutting short positions or getting smarter in terms of how they do them, which might make it harder to find easy squeeze targets. There's talk of call options becoming structurally more expensive, which would also take some momentum out equity squeezes. And, as laid out above, there's the possibility that WallStreetBets collapses under the collective weight of its own popularity. You could say that a bunch of people all dancing — or trading — to the same tune is a flash mob. A bunch of people all doing different things is just one big mess. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment