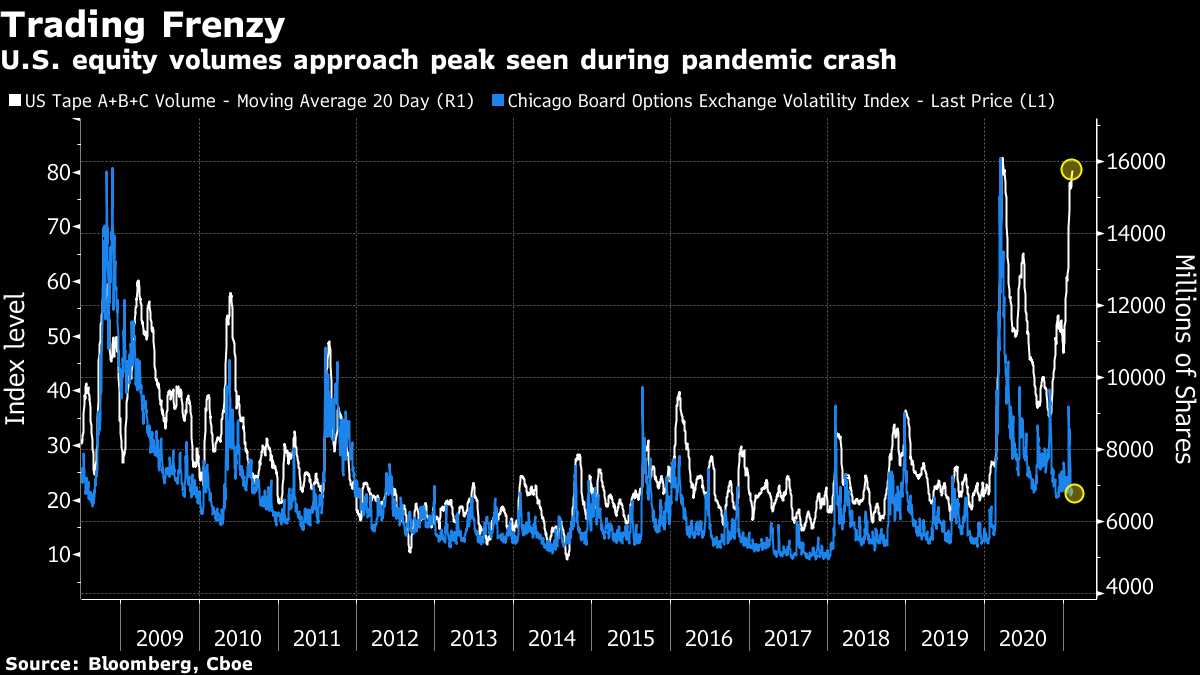

| Bitcoin flirts with $50,000. Markets to start in the green. Crown CEO in Australia steps down. Bitcoin reached a new record on Sunday, rising above $49,000 for the first time. The world's largest cryptocurrency reached about $49,694 earlier in the day. It's now up almost 70% so far this year. Bitcoin has been buoyed in recent months by endorsements from the likes of Paul Tudor Jones and Stan Druckenmiller. Morgan Stanley may bet on Bitcoin in its $150 billion investment arm, following news late last week that BNY Mellon plans to service cryptocurrencies for its clients. Stocks in Asia looked set to begin the week on the front foot during signs that the pace of coronavirus outbreaks in the U.S. are continuing to slow. The kiwi dipped after New Zealand locked down Auckland as it investigates three new Covid-19 cases. U.S. markets are shut for Presidents' Day, while exchanges in China, Hong Kong and Taiwan are also shut on Monday. Bitcoin approached $50,000. The reflation trade remains alive and well — global equities ended Friday at a record high, with the MSCI World Index up about 6% this year, while the Treasury yield curve tested the steepest levels in more than five years. Crown Resorts Ltd. Chief Executive Officer Ken Barton finally stepped down, bowing to days of pressure, after a scathing regulatory report found the Australian casino operator facilitated money laundering and wasn't fit to hold a license in Sydney. Barton will leave immediately, Melbourne-based Crown said in a statement Monday. Helen Coonan will lead the company as executive chairman while the board oversees a search for a new CEO, the company said. Hong Kong plans to expand scrutiny on capital flows and transactions by Chinese officials, according to a recent consultation paper on anti-money laundering. The Financial Services and the Treasury Bureau is proposing to implement enhanced due diligence on "politically exposed persons" from anywhere outside Hong Kong instead of outside the People's Republic of China, according to the paper. The Asian financial hub is seeking to enhance compliance of anti-money laundering regulations ahead of a series of assessments in the next few years. After the world's second-largest Covid-19 outbreak, life in India is almost back to normal. While the U.S. and large swaths of Europe remain in crisis and China stays vigilant over new clusters, concerns about the virus seem to have ebbed across India. Infection and death rates have dropped, and the economy and consumer companies are posting strong gains, far sooner than most expected. The steady decline of reported infections in India has puzzled scientists, especially given that many countries are battling second, third and fourth waves. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in this morningThe frenzy of trading in U.S. equities is showing no signs of abating and looks set to surpass levels seen during the worst of the pandemic panic in March. Over the 20 days to Friday, an average 15.8 billion shares have traded each day on all U.S. exchanges, according to data compiled by Bloomberg. That's just below the 16.1 billion average hit on March 25, which was the highest in at least over a decade, the data show.  Bursts of trading in U.S. stocks usually come amid periods of surging volatility in markets, such as the spike seen early last year when fears about the coronavirus spread led to a sharp selloff in equities. This time, volatility is much more subdued, suggesting the jump in trading activity is one more sign of exuberance in the stock market. Last month's parabolic surge and rapid collapse in GameStop Corp. shares seem to have done little to dampen enthusiasm for equity exposure. A similar measure of euphoria in the options market — volume in bullish bets via call options — has itself hit another record. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment