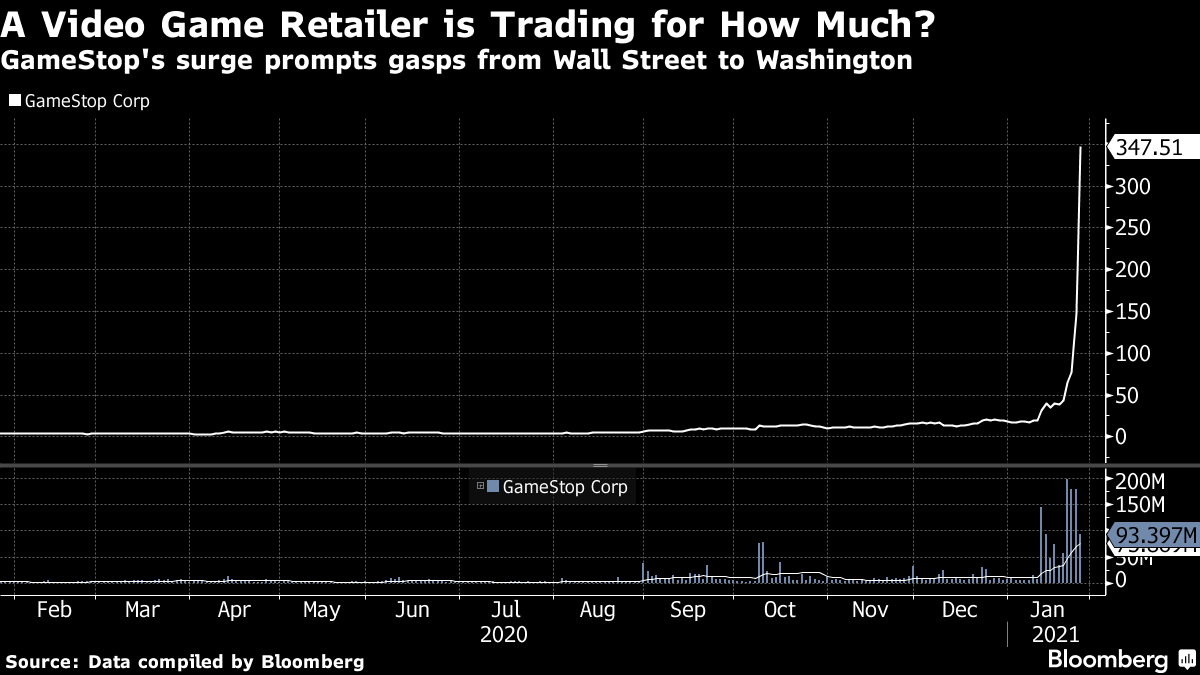

| Welcome to The Weekly Fix, the newsletter that knows the revolution will not be televised. But it will be released in high definition and multi-player mode. --Emily Barrett, Asia FX/rates editor. The Fed has better things to do......Than break up a stock-market party. It's busy trying to nurture a fragile recovery, resolve inequality and keep the financial system on its feet. That's the message this week from Jerome Powell, who also stepped around reporters' questions about the rebel forces attacking Wall Street's short-selling bases. Instead he focused on what the Fed is NOT doing, specifically, not making any changes to its ultra-easy policy stance and definitely not tapering asset purchases. (It's almost protesting too much. When the fateful time comes to taper, the Fed might want to come up with another word for it -- perhaps there's a mysterious string of German, though Kaufprogrammverjüngung might be a bit of a mouthful, and doesn't sound terribly benign.) Powell's spit-take-worthy statement was that Fed policy was less a driver of asset prices than widely assumed: "The connection between low interest rates and asset values is probably something that's not as tight as people think." Pepperstone's Chris Weston couldn't agree less: "Let's make no bones about this -- the Fed created this evolving juggernaut. Cheap money/liquidity is not supposed to be directed to places that are inefficient and that has played out. The Fed has created a craze in equities, as they are directly targeting financial conditions, and installed a belief that equities only go one way. Government policy has given this a tailwind but the emotion of watching your neighbour get rich through stocks has impacted hard."

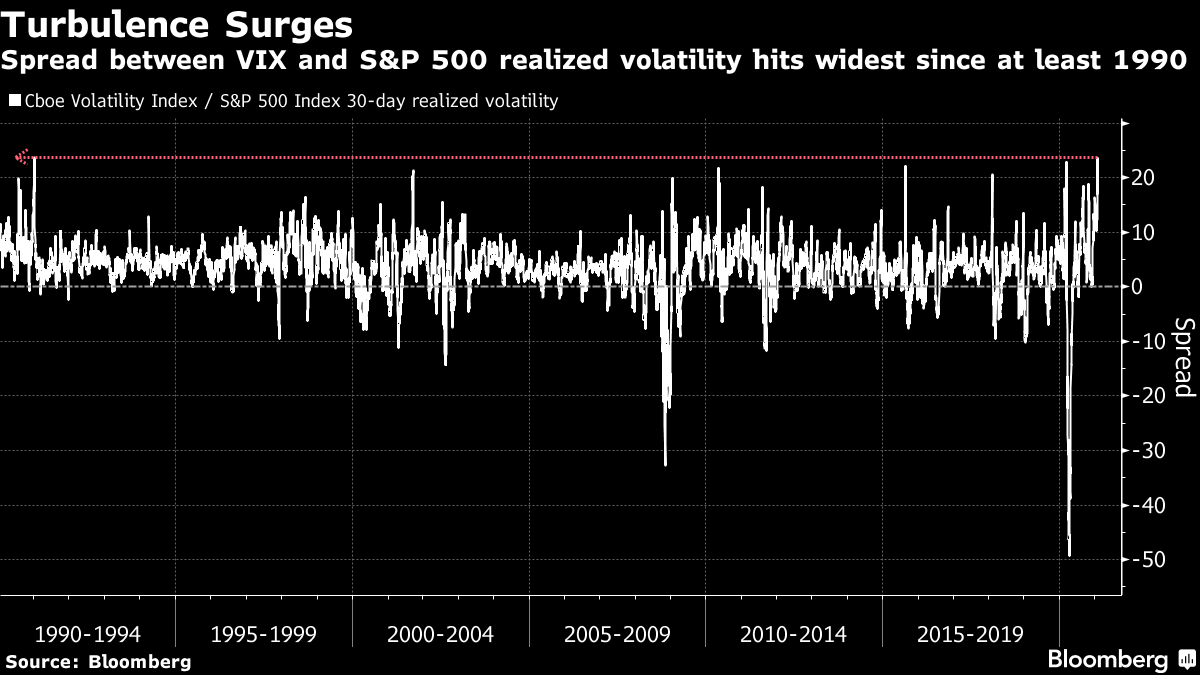

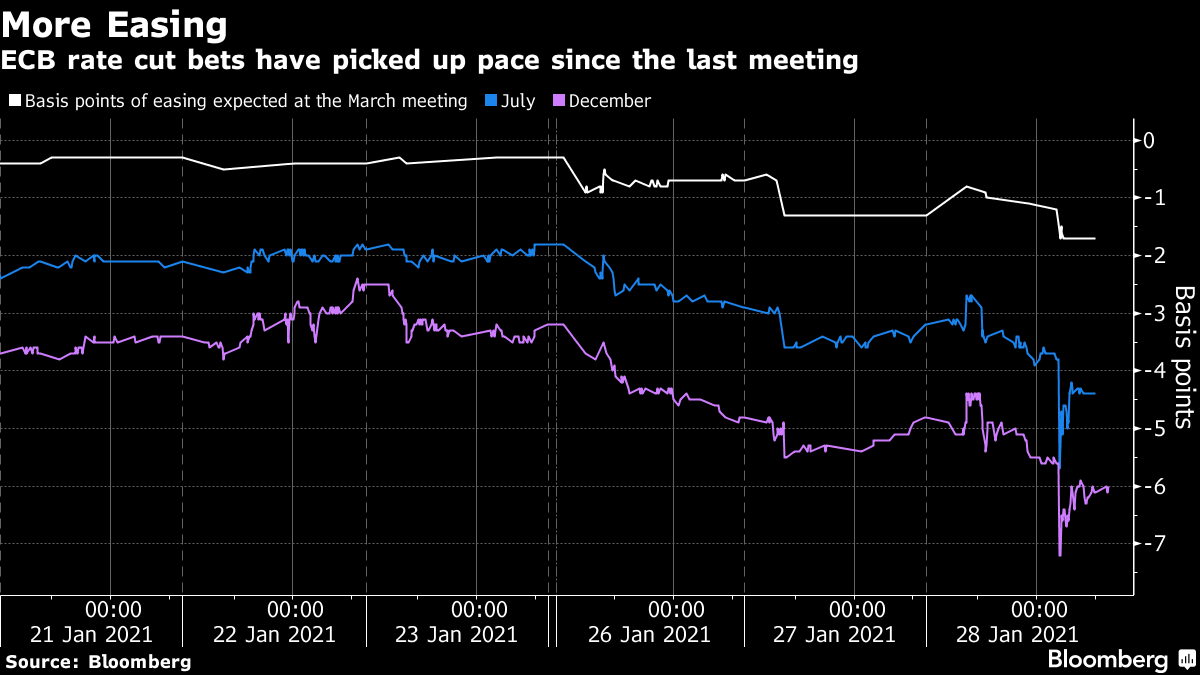

It seems unfair to castigate the Fed for what is so far at least a joyride at the expense of a handful hedge funds, particularly when the central bank's actions may well have averted a Great Depression. But it's a long shot to say that ultra-easy policies globally haven't had a profound effect on asset prices, having driven yields on more than $17 trillion of bonds globally below zero. Still, since there can be no dispute that the recovery is still fragile, better to leave the buzz-killing to the Securities and Exchange Commission, which said it is "actively monitoring" volatility in options and equities markets. A game of whack-a-mole looks very much underway, with Robinhood suddenly imposing and then lifting trading restrictions, and various unloved stocks still springing to dizzying heights. To add to the confusion, politicians seem hardly to know which side to champion, as the renegades taking on Wall Street may also be shaking its foundations, and their donors. It's too soon to tell whether the rebellion against short-sellers turns out to be "some nonsense," as BlackRock Vice Chairman Philipp Hildebrand put it, or a teachable moment for leveraged investors, or a multi-layered activist movement. By Friday, the movement had crossed the world to Malaysia, where the discussions of an online community, Bursabets, have so far included calls to rally against institutional investors who have kept the share prices of glove makers low amid the pandemic. At this stage, it's easy to imagine a scenario in which such communities have a bigger impact than a couple of scorched hedge funds and a confused Australian mining company. While the redditors cast around for their next likely targets, hedge fund losses are still relatively contained. But the more they come under stress, the more potential for widespread degrossing and shedding of other assets to cover losses and reduce their market exposure. That could lead to weakness across sectors and possibly other asset classes. Volatility jumped this week, bringing the VIX close to levels that can see spillover to credit, said T Rowe Price multi-asset portfolio manager Rick de los Reyes.  (Rates reporter Edward Bolingbroke noted this week that the closing spread between the Cboe Volatility Index and the S&P 500 Index's 30-day realized volatility jumped to the widest in Bloomberg data back to 1990. "Expectations for future volatility against a period of prior days' price changes in the equity benchmark have never been greater, so investors may want to buckle up.") De los Reyes isn't anticipating a broader shake-out now. But the short squeeze combines with recent dollar strengthening, and moves in Fed funds, to reflect increased risks of policy tightening. This combination signals mounting concerns that the Fed may not be firm in its resolve to stick its new strategy of keeping policy loose as growth improves and inflation climbs, the portfolio manager said. "The issue is, because it's a new framework, the market is going to test that. It wouldn't surprise me at all in the coming months -- and it's happening now -- if we get a selloff in risk assets because people are concerned the Fed doesn't mean what they say." So good luck to the Fed explaining to the market when it wants to trim bond buying that its stance with rates at zero is still loose. "We're kind of addicted to stimulus, so even just maintaining the same level of stimulus may not be enough," de los Reyes said. "The market definitely views tapering as tightening." The ECB isn't doneA little ambiguity is a useful thing for a central bank, a point made often and indirectly by the master of obfuscation, Alan Greenspan. The ECB's policy makers were busy building a little more of it into their outlook this week, agreeing to stress that rate cuts are still on the table. Even the negative-rates skeptics followed the script, with Governing Council member Klaas Knot, the Dutch central bank president, telling Bloomberg Television: "I always quip that we've explored the effective lower bound, but we haven't found it yet," he said. "There is still room to cut rates." That seems a pretty clear dovish pivot from the prior message, which carried into last week's meeting, that the asset purchase program is the primary policy tool, and policy makers might not even use all of that. Traders acted accordingly. Having all but wiped out the odds of a further cut until September, their positioning in interest-rate markets now puts in play a July move to drop the deposit rate below its current record low of -0.50%.

The European yield curve also moved lower, and the gap between German and Italian benchmarks narrowed. And the ECB's pivot prompted Barclays to reboot a long Italy versus Spain 10-year trade, avoiding Germany in case of any sharper risk-off moves. "If speculation around rate cuts grows and outright Bund yields rally, this would likely provide a spur to yield-grab buying" in European government bond spreads, wrote strategists including Cagdas Aksu.  D'AccordAs the ECB scoops bonds out of the market, the European Union is issuing more than ever -- kicking off 2021 with a two-part sale of seven- and 30-year bonds to raise money for the region's new jobs program, SURE. The order book for the 14 billion euro ($17 billion) deal was almost 10 times size of the deal, at 132 billion euros. That's impressive, but a way short of last year's 223-billion-euro record. As John Ainger reported this week, these deals highlight the immense appetite for assets that are AAA-rated and whose proceeds fund either green or social projects. And the pace of issuance accelerates in the second half of the year, when the EU embarks on its 800-billion-euro recovery fund plan, a third of which will be covered by the proceeds of green debt. So we finally have better news for the planet, in the week that President Biden re-entered the U.S. in the Paris Agreement on climate change. Bloomberg Intelligence says sustainable bond issuance could reach $1 trillion this year. That's after the supply of global sustainable debt surged by almost a third to $732 billion last year, primarily to fund social projects to ease the ravages of the pandemic. The EU is a relative latecomer among the ranks of major sovereign issuers of ESG bonds. Chile raised a total of about $4.25 billion in euro and U.S. dollar markets this week, Caleb Mutua reports, including the biggest sustainability bond issued by a Latin American country in foreign debt markets. And Hong Kong sold its second U.S. dollar-denominated green bond this week, raising $2.5 billion in a three-part deal to finance projects under the city's Green Bond Framework. That helped propel issuance of ESG debt across Asia to $13 billion in January, the highest in more than two years, according to data compiled by Bloomberg. Bonus PointsNew Yorkers could be Andrew Yang's UBI guinea pigs The pandemic has added $19.5 trillion to global debt Renewables are now the dominant power source in Europe's electric grid  |

Post a Comment