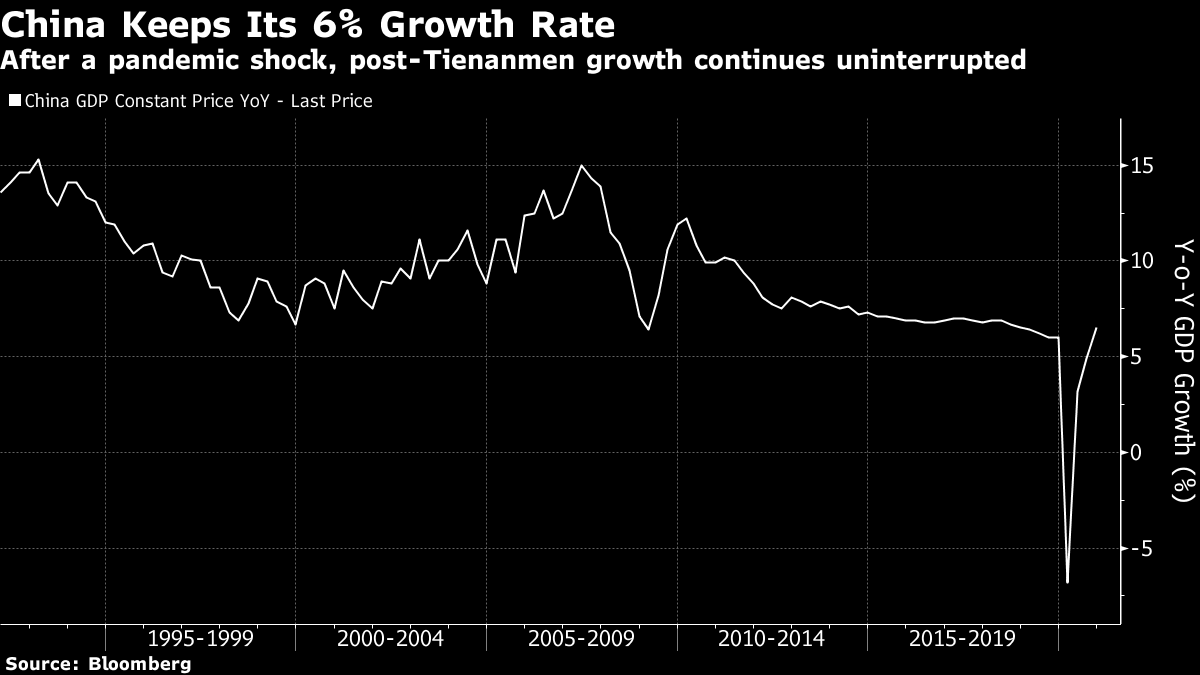

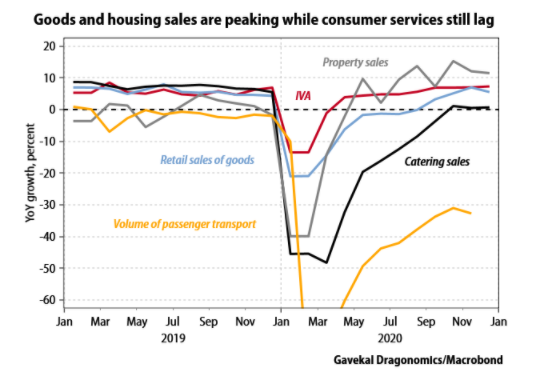

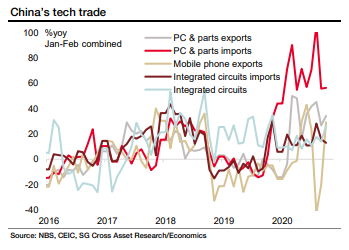

Bulls in the China ShopIt has become one of the iron laws of economics, a constant on which we can all rely. Whatever happens, China's gross domestic product will always rise at an annual rate of 6%. After the briefest but most shocking of dips, and the most V-shaped recovery that could ever have been asked for, China's GDP in the fourth quarter turned out to be 6.5% higher than a year earlier. It was a more or less explicit deal offered to China's people by the Communist Party after the Tiananmen Square massacre of 1989; they might not get democracy, but in return the party would deliver economic growth every year.  Naturally, such consistent expansion, and particularly the way China appeared to eliminate economic volatility almost entirely during the last decade as it grew at a bit above 6.5% year after year, raises questions about the data. Growth quite so strong and so steady is redolent of Bernie Madoff. However, the numbers produced by the various independent economists who track Chinese data suggest that the latest official outturn is if anything slightly understated. This chart compares the official number with the estimate produced by the London economic service TS Lombard:  For another external sign that these numbers are a little more trustworthy than others, look at the main Chinese benchmark price for iron ore. It is at a decade high, and its trajectory over the past 10 years looks convincingly similar to the trajectory most independent economists think China's economy took over the period:  So while skepticism is reasonable, it behooves us to accept that these growth figures broadly reflect reality. China's economy rebounded from the seizure caused by Covid-19 to log impressive growth last year. That doesn't mean that all is well, however. What is most important, and which might yet prove a template for post-pandemic recoveries in the West, is that this recovery is very uneven. As the following chart from Gavekal Dragonomics shows, China has a "two-speed recovery," led in particular by sales of housing. Meanwhile, consumer services are lagging behind seriously:  This is exactly the pattern that the Chinese leadership had been hoping to exit in recent years. The pandemic forced them to go back to the old and rather crude playbook of growth based on building real estate — a policy that raises concerns about over-extended credit. Consumer activity still hasn't recovered. Meanwhile, export data show that China has been helped very much by trends in the West. As Societe Generale SA demonstrates, Chinese companies are doing great business exporting products necessary for working from home:  Another way to illustrate the twin-track recovery comes from TS Lombard, which compares growth in industrial production and retail sales. China's ability to turn on the tap and increase manufacturing output when it wants to appears to be intact; its ability to prod consumers into buying is much more limited:  What does all this mean for the future of Chinese economic policy, and for the rest of us? Following the good news that one of the world's largest economies was able to deal with the pandemic better than most and revive itself swiftly, it now seems reasonable to get ready for worse news ahead. The TS Lombard prediction is that we should brace for a deceleration, as China once more tries to rein in credit before it creates a crisis, and attempts to spread the benefits of growth to the consumer: The trifecta-powered classic China growth drivers – industrial production, net exports and investment – have all outperformed even as consumption has lagged. This lopsided growth dynamic is set to continue In H1/21, before narrowing in H2/21 as consumption recovers slowly and traditional economic drivers decelerate on tightening policy support. Steady growth delivered while providing minimal stimulus and simultaneously restarting China's de-risking drive is positive for long-term sustainability but will provide little support for global activity or commodity prices.

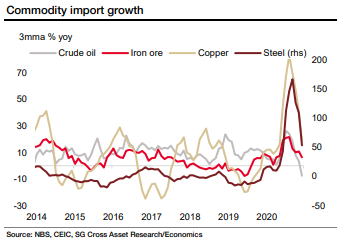

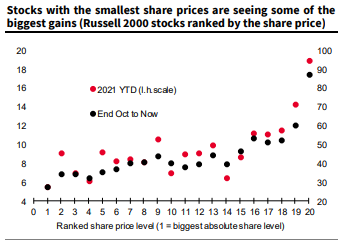

In other words, the biggest support from China for the rest of the world may already be behind us. Many Chinese economic measures show a slight slowing in the final month of the year. Perhaps most significantly, this showed up in imports of industrial commodities, as shown once more by SocGen:  The monetary policy signals could be more important. Having successfully revived economic activity, the professed aim of the People's Bank of China is now to maintain "stable leverage." This may well make sense given the signs of excess in lending; a China concerned with macro-prudential regulation and crisis avoidance is very much in the interests of the rest of the world. The phrase "stable leverage" was last used, according to TS Lombard, during China's big attempt to de-leverage the shadow-banking sector in 2017-18. It seems reasonable to infer that China will now attempt to rein in local government debt and the more excessive behavior by property developers. This is good news for the long term, given that the rest of the world has lived in fear of a Chinese "Lehman Moment" for the last decade. It isn't the greatest news for risk assets in the short term, as China has recently been contributing to the liquidity gushing through the world. Pennies From HeavenAre U.S. stocks really in a bubble? The question continues to reverberate, and I have received at least half a dozen pieces of research headlined with some version of that question in the last couple of weeks. There are sensible arguments that the historically strange conditions in the bond market, and the likely rebound from the economic slump caused by the pandemic mean that stocks aren't as expensive as they appear. There are also decent arguments that the market's froth is no more than peripheral, and therefore not a great cause of concern. Having said that, there is no denying that there is some extremely frothy behavior at the fringe. Whether or not this proves to have contaminated the entire market, it is an alarming development and means that some people somewhere are going to get hurt. The likelihood, as usual on these occasions, is that they will be relatively inexperienced investors losing money that they cannot afford to lose. The latest and most spectacular data point I have seen on this is illustrated below, in a graph from SocGen's chief quantitative strategist, Andrew Lapthorne. It ranks the small-cap stocks in the Russell 2000 by their share price — not their market cap, or their price-earnings ratio or anything like that, but just by the nominal price per share in dollars. The highest-priced stocks are on the left, while the cheapest are on the right. Black dots show how they have done since the vaccine trade got going in earnest at the beginning of November (on the right-hand scale), and the red dots show how well they've done so far this year (on the left-hand scale).  It cannot be good that a low share price counts for so much, or that people are gobbling up penny stocks in a way that pushes up their price to this extent. This has been happening as global stocks consolidated last week. This doesn't prove that the entire market is in a bubble. But it is overwhelming evidence of dangerously excessive speculation. The new administration appears to be staffing regulatory agencies with people who will try to get a lot tougher on Wall Street and the financial services industry again. It might make sense for brokerages to do what they can to tamp down these excesses before new regulators try to do the job for them. Inflation and AgingThis is a reminder that we are reviving the Authers' Notes Bloomberg book club. The current selection is The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival by Charles Goodhart and Manoj Pradhan. The idea is simple. Get hold of a copy and read as much as you can. Then bombard us with questions and follow the live blog we will be holding on the terminal on Feb. 10 at 4 p.m. London time/11 a.m. New York, where I will discuss the book with Pradhan, and some other guests. The core argument they make, which has caused the most brush-back, is that the declining share of workers in the population over the coming decades will lead to rising inflation (and interest rates), while reducing inequality. Some have supported this view — notably former Bank for International Settlements chief economist William White. Others are more cautious. Former colleague Martin Wolf, in his review, pointed to the rise of China as a classic example of a macro development of the first order that had far different effects to those that might have been expected: Yet it is also vital to remember how little we know about how such shifts might play out in the real world. What if we had known in 1980 that China was going to open up its economy to the world and launch the biggest investment boom in world history, culminating in an investment rate of 50 per cent of GDP? How many would have predicted that the macroeconomic situation a few decades later would be one of excess savings, low real interest rates, ultra-loose monetary policies and debt overhangs? Most would surely have assumed that booming China was about to import savings massively and so raise real interest rates and export net demand, instead.

For now, it remains true that the rich in the U.S. are growing richer than ever, with a push from the pandemic. It also remains true that inflation is low, although there is every chance that headline numbers could rise considerably in the next few months, for reasons unconnected with the arguments in Goodhart and Pradhan's book. Neil Irwin in the New York Times has a really good piece going into the different arguments for a return for inflation, and points out correctly that some are benign, such as the inevitable rise from base effects once last March's collapse in the oil price slips 12 months into the past, and others are arguably healthy, such as the big rise in spending that is widely anticipated once people emerge from pandemic hibernation with fat savings accounts. The inflation Goodhart and Pradhan warn of would be deeper-rooted and pose greater problems. To join in the debate, send comments and questions to authersnotes@bloomberg.net. Survival TipsWednesday's presidential inauguration has become a matter of deep foreboding across the U.S. political spectrum. Many believe it is the moment when an illegitimate president will take office; many more fear that it will be the scene of violence and bloodshed, possibly on a greater scale than was witnessed on Jan. 6. So let us find one element to cheer about what will at best be a downbeat affair. Nile Rodgers, the disco genius behind songs like We Are Family and Le Freak will be performing for an online celebration, as will country music titan Garth Brooks, who is denying that he is making a political statement by doing so, and the great 1990s one-hit wonders New Radicals. The new administration has also released a 46-track playlist for the occasion. It's eclectic, running from Vampire Weekend through Steely Dan and Led Zeppelin to Dua Lipa and Mary J Blige. At the very least, it all makes a pleasant change from much more YMCA. Worth listening. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment