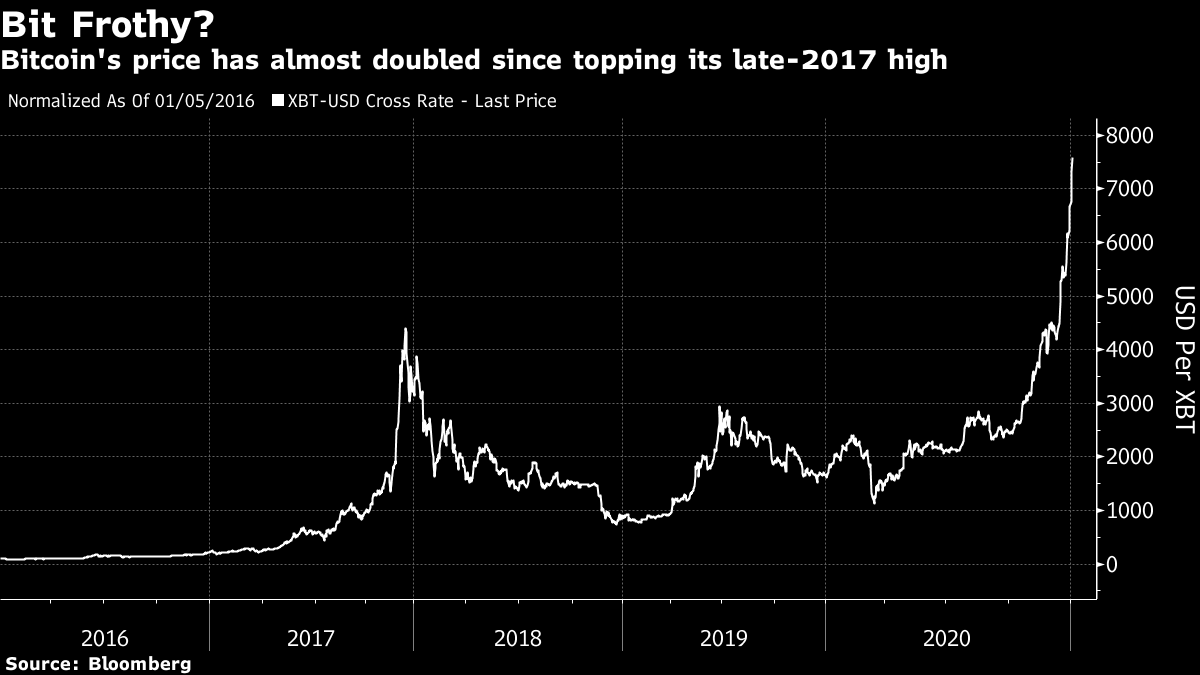

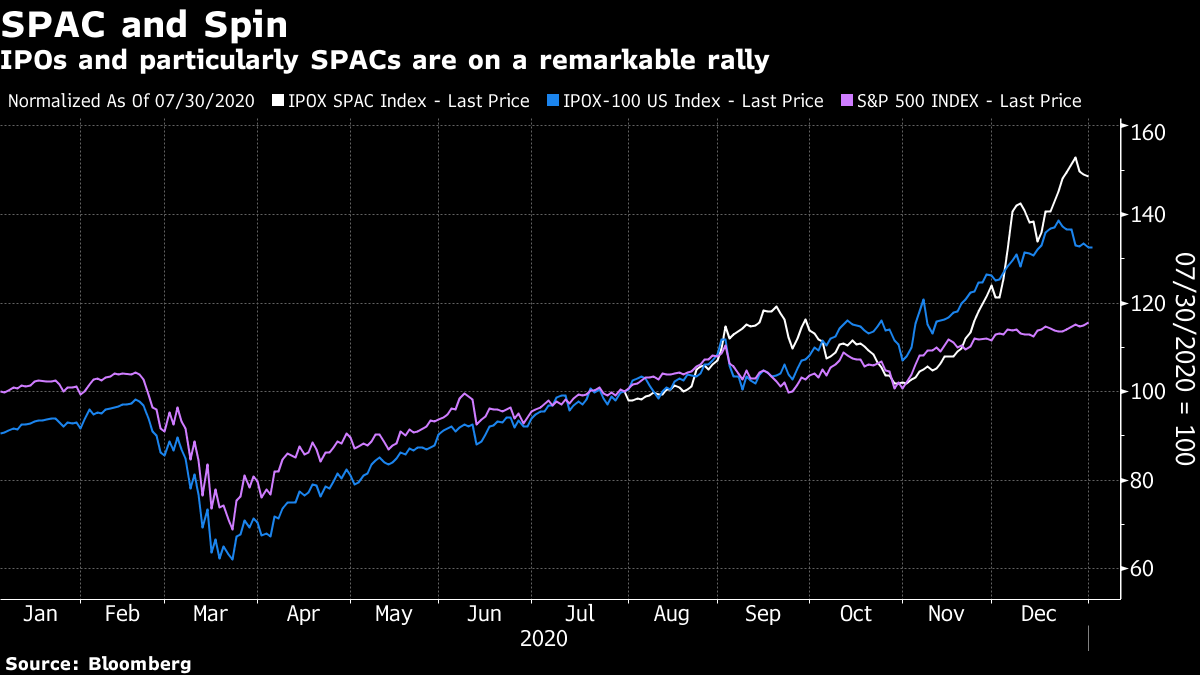

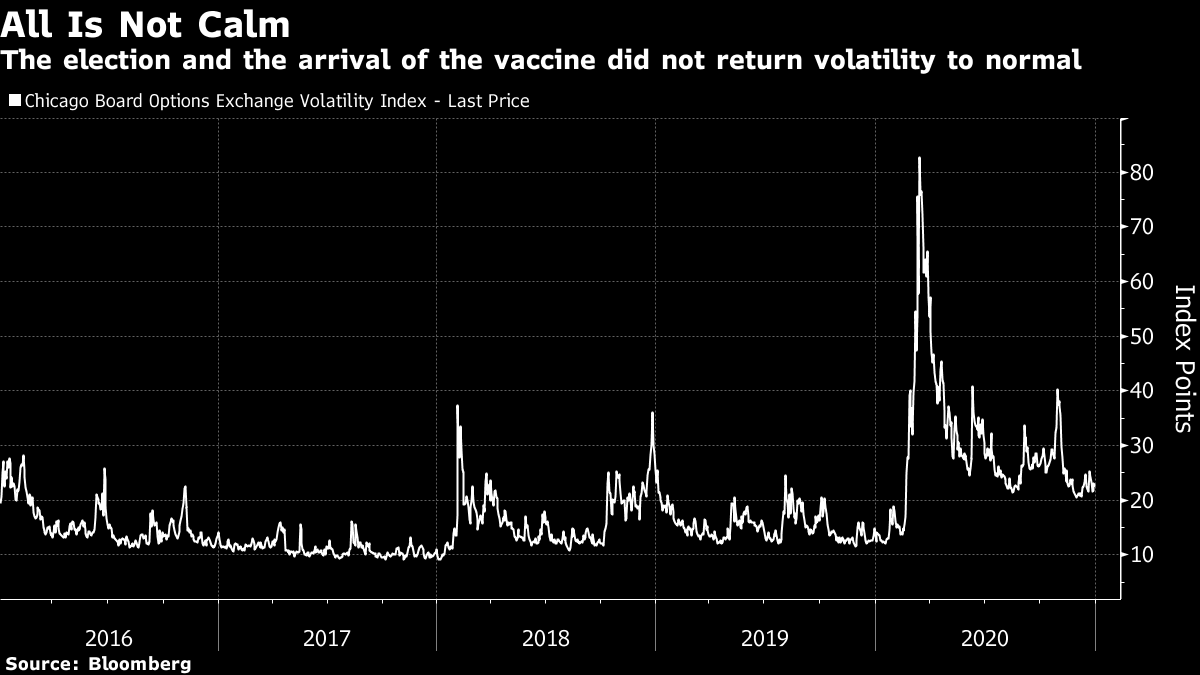

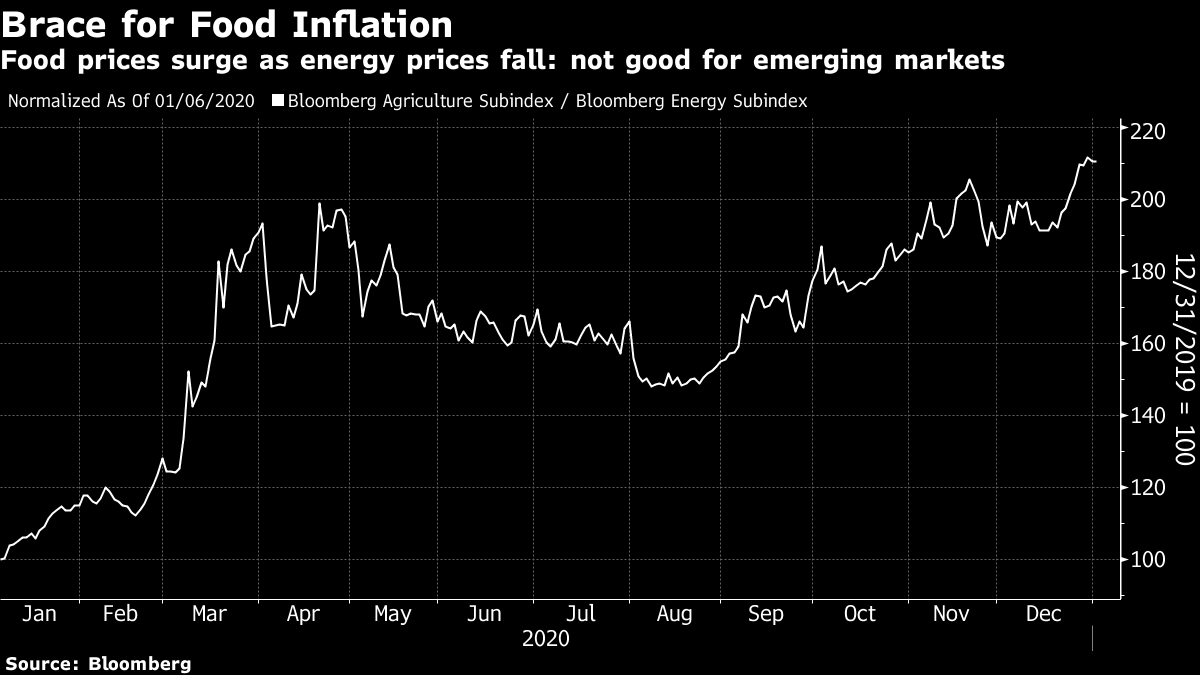

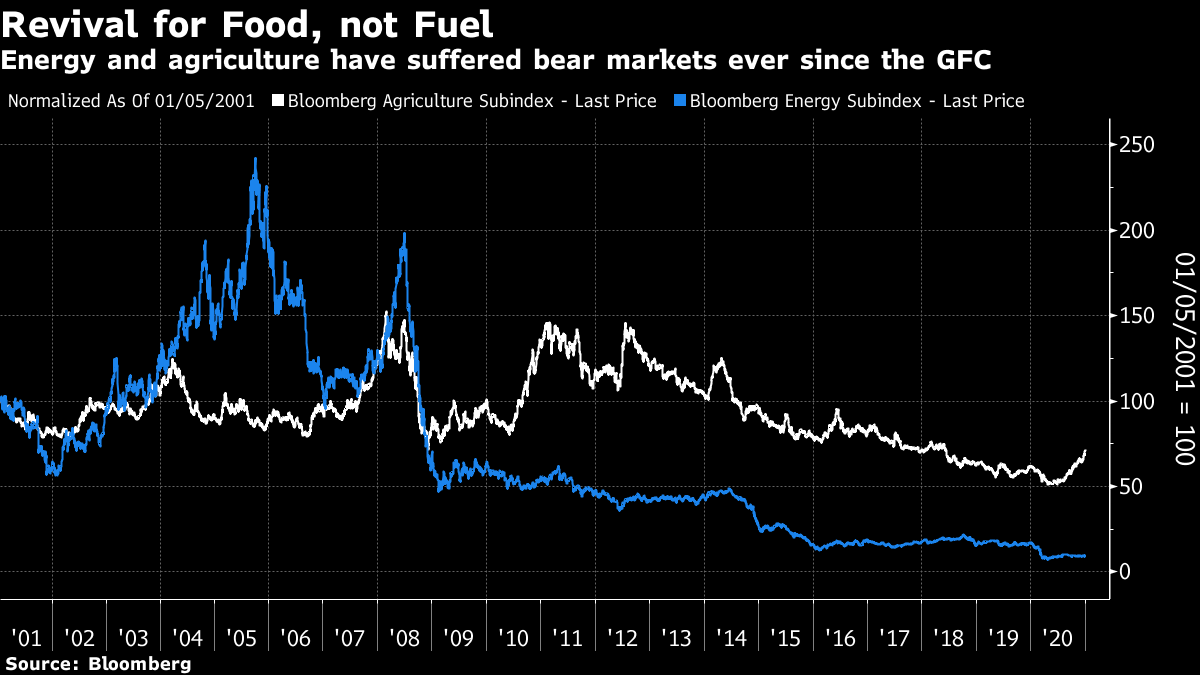

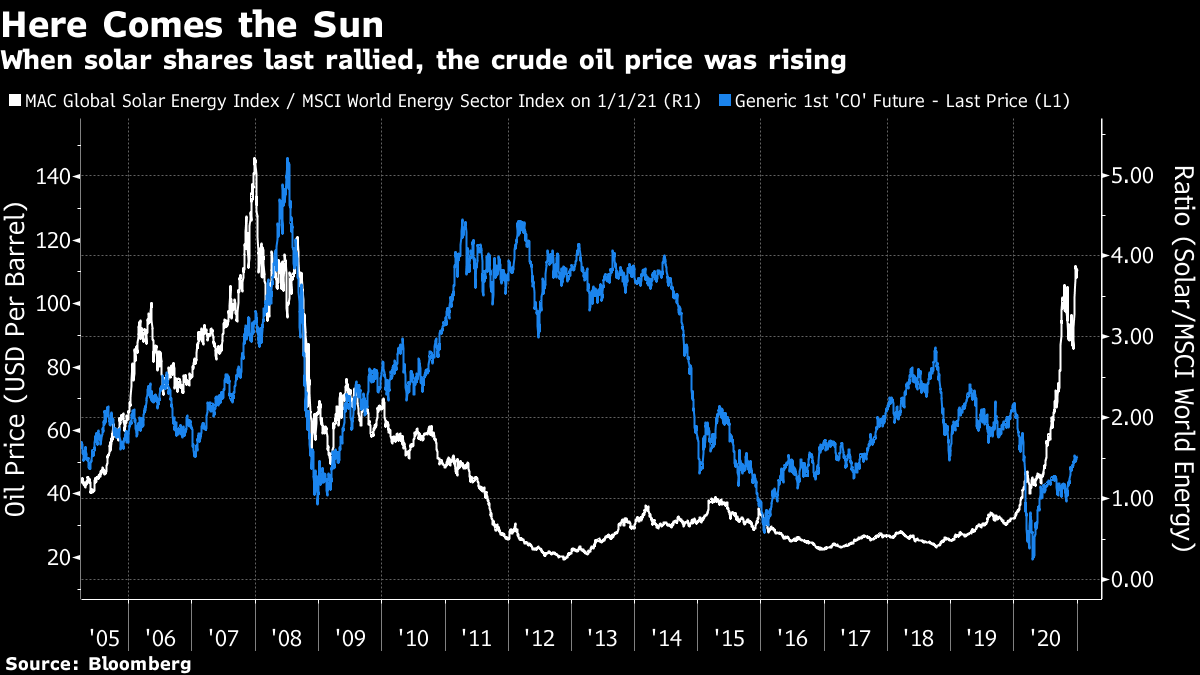

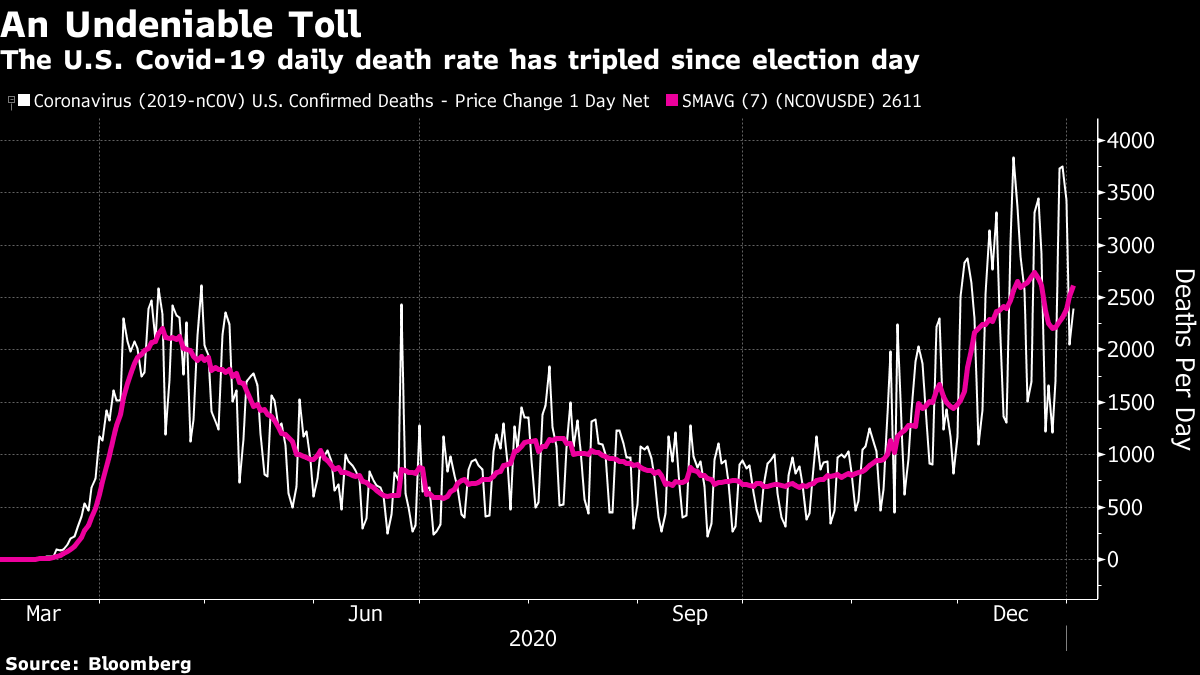

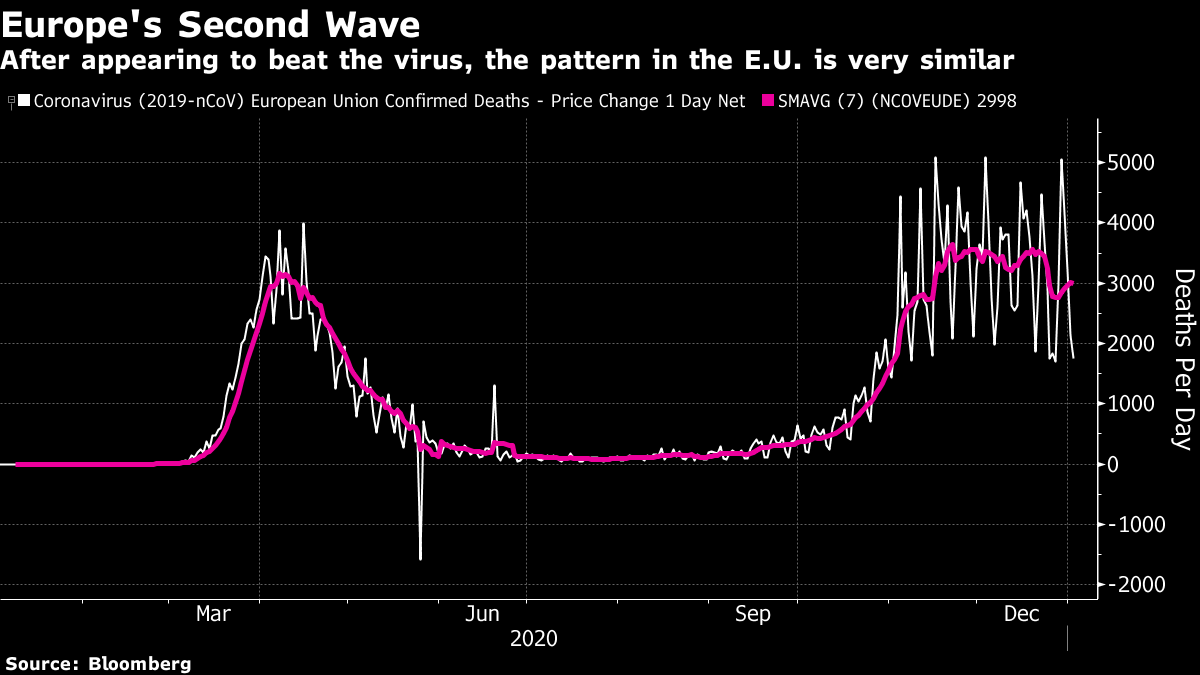

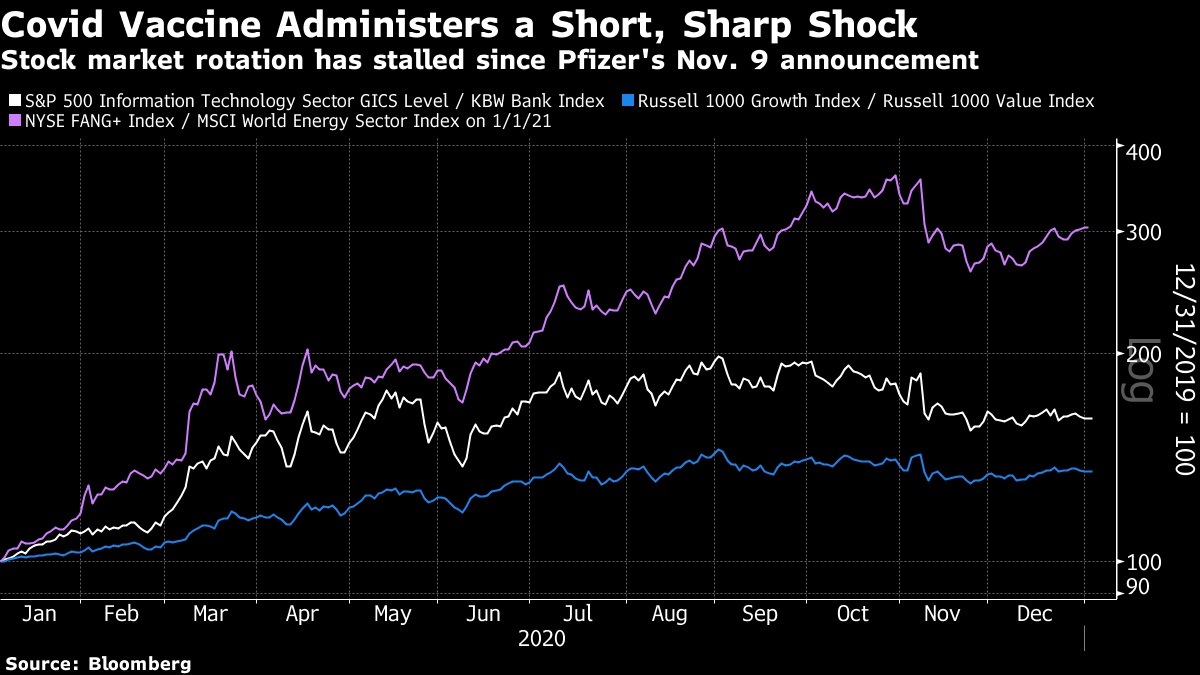

New Year, Old IssuesWelcome to a new year. Rarely if ever can so many have wished so fervently for the old one to end. The start of 2021 brings a sense of renewal and possibility. The problem is that a turn in the calendar doesn't itself change anything else. The view from my window is the same as it was last year. And certain "2020" issues remain virulent. Here, as I reacquaint myself with a lot of charts and numbers on the terminal, is my best attempt to sum up where we stand before the 2021 markets get started. The Reflation Narrative DominatesAs I recorded several times toward the end of last year, the consensus in favor of reflation in the next few years is overwhelming. Ten-year inflation expectations for the U.S. are their closest to exceeding 2% since late 2018 (when the Federal Reserve was still expected to cut back its balance sheet on "auto-pilot"). Intriguingly, 5-year 5-year expectations, covering expected inflation between 2025 and 2030, are slightly lower, suggesting a belief in relatively imminent inflation that subsequently comes under control.  BubblesThere is a growing argument over whether we are living through a repeat of the dot-com bubble of 1999 and 2000. Purely subjectively, I don't think we're there yet. That bubble happened before 9/11, before Putin came to power in Russia, and before China was admitted to the World Trade Organization. There was a level of confidence and happiness in the West that hasn't existed since; and that's before we even mention this once-in-a-century pandemic. That said, if you want signs of 2000-caliber excess, they're out there. This is the bitcoin price:  Then there is the rise of the initial public offering (which veterans of the dot-com bubble will remember well). Companies no longer go to market without profits or revenue in prospect. Instead, special purpose acquisition companies, or SPACs, raise money, promising to buy companies that have profits or revenue. The following chart, indexed to the day in July when the IPOx SPAC index was initiated, shows how IPOs were already outperforming the S&P by midsummer, and SPACs have poured on the performance since. An awful lot is being taken on trust:  Then of course there is the issue of valuation. The S&P 500 is trading at a higher multiple of sales than it did at the top of the dot-com bubble, while its prospective earnings multiple is almost at a record. Valuation doesn't help with timing; it does help us gauge whether a market is good value, and U.S. stocks are not:  The U.S. is markedly more expensive than stocks in the rest of the planet, in part because of tech. But relative to their own history, valuations in "EAFE" — Europe, Australasia and the Far East, or the developed world outside the U.S. — look almost as over-extended:  Yes, rates are very low, and there is overwhelming consensus that central banks will keep them that way. Stocks are priced on that assumption. It wouldn't be good if rates were to rise. Signs of DiscontentDespite all of the above, volatility hasn't gone away. The CBOE VIX index, which measures equity volatility via the options market, dipped sharply once the election was over and Pfizer Inc. had announced positive test results for its Covid-19 vaccine. But there has been no follow-through. The VIX appears to be settling into a "new normal" at about 20, having spent most of the four years ahead of the Covid shock at about 10.  In one sense this is positive. It shows that markets haven't fallen victim to 2000-style complacency. But the combination of record valuations with elevated nervousness isn't healthy. Food for ConcernOne trade nearly made it into the Hindsight Capital round-up for 2020, and it was very simple. Betting on the Bloomberg Commodities agriculture sub-index while shorting the energy sub-index would have made you 110%:  We know about the problems for energy. Food prices have risen sharply in the last few weeks ahead of signs of a poor harvest for soybeans in South America (which would increase the price of animal feed). Liquidity-driven demand in emerging markets can also lead to higher food prices. In China, India and other emerging markets, rising food inflation can be very dangerous. There was a major spike ahead of the global financial crisis, which overlapped with a surge in energy prices as emerging markets boomed. That led to social unrest. A second spike in late 2010 helped to spark the "Arab Spring" uprisings.  Weak demand, shown by low oil prices, combined with food inflation could yet upset emerging markets, from which much is expected this year. A Ray of Light Against this, developments in solar power are radical, and seem to have passed many by. As Hindsight Capital showed, buying solar energy stocks last year worked out very well. Despite concern over climate change, they had been in the doldrums almost without a break since 2007:  What makes the current rally more remarkable is that it has co-existed with a fall in oil prices. Generally, solar stocks need higher oil, as this sharpens the incentives to find an alternative. A rally while oil prices are low suggests genuine optimism about the industry. Covid-19While 2020 will probably always be known as the Year of the Coronavirus, that doesn't mean that it has ended. The latest virus wave is by almost any measure the worst yet. I will stick with death rates, which are lagging indicators though ultimately the most important. This is how the daily death toll has moved in the U.S., with a weekly moving average to make the trend clearer:  And here is the same exercise for the European Union:  The patterns are strikingly similar, with death rates rising again. The longer this continues — and the appearance of a more contagious variant is an alarming development — the worse the long-term impact. These trends might help to explain the way the stock market has moved in the last two months. Pfizer's vaccine announcement on Nov. 9 created one of the most dramatic reversals in history. Stocks harmed by Covid gained, while the few names to benefit from it fell. But that didn't last long. As the chart shows, after a brief interruption for "Vaccine Day," growth stocks have been beating value again, tech stocks have lost no further ground to banks, and the FANG internet platform stocks continue to outpace energy groups. There is at least some reassessment going on about the vaccine.  This is partly because of the pandemic's latest wave. It is also because the difficulties of distributing the vaccine grow ever clearer. This isn't just about logistics, although that is a problem. There is also the issue of exactly who should be getting it. As I tried to lay out last week, science and ethics jointly suggest that the vaccine should go first to the elderly, and those most at risk of dying should they be infected, and not to emergency responders and those most likely to spread it. It's an incredibly difficult moral issue, but one key point has been overlooked, in my view. We don't know if getting a shot will stop you from spreading the virus to someone else, even if it will almost certainly spare you from getting sick yourself. This line appears in the U.S. Food and Drug Administration's frequently asked questions about the Pfizer vaccine: Most vaccines that protect from viral illnesses also reduce transmission of the virus that causes the disease by those who are vaccinated. While it is hoped this will be the case, the scientific community does not yet know if the Pfizer-BioNTech COVID-19 Vaccine will reduce such transmission.

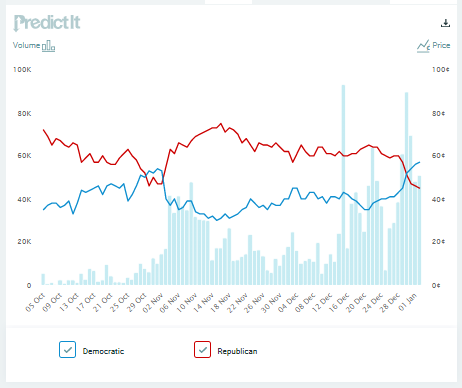

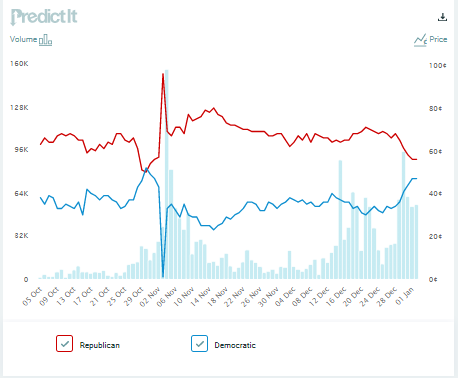

This isn't a vaccine that can be given to delivery drivers, shop workers and so on to stop the spread. For months, many have worked on the assumption that this wonderful vaccine will save us all instantly. It won't. Georgia on My MindThe great excitement of American politics in 2020 still awaits resolution. Wednesday will likely see vintage political theater as Republicans in the House and Senate object to the results of the electoral college. The chance that this changes the winner of the presidential election is barely higher than zero. This explains the relative calm in markets. Tuesday night is more consequential. Georgia goes to the polls in special run-off elections for its U.S. Senate seats. If Democrats win both, then the Senate will be split 50-50, and they will control it thanks to the vice president's casting vote. There have been few polls over the last two months, and with so much depending on getting people out to vote in the middle of winter during a pandemic, much must be left to conjecture. But the prices on the Predictit prediction market show it is close. This is the race between the Democrats' Raphael Warnock and Republican Kelly Loeffler:  The same trend is at work in the contest between the Democrats' Jon Ossoff and Republican David Perdue, who is still hanging on to a lead:  For Democrats, control of the Senate agenda would be a huge deal. Obstructionist tactics would become almost impossible for the Republicans. The chances of more fiscal spending to alleviate the coronavirus, or a bigger push on infrastructure, would look much stronger. This would boost the reflation trade. But more active fiscal policy would also mean higher interest rates, all else equal, while reducing the pressure on the Federal Reserve to keep them low. This is an outcome for which investors aren't positioned, so it could cause a market mess. BrexitBritain and the European Union finally did it. The U.K. is now an "independent" country, with a new "skinny" trade deal with the EU. With services barely covered, the issue of the island nation's relationship with Europe will continue. Still, it has done what many thought impossible and left EU jurisdiction while retaining some access to its internal market. The chances that Britain could leave the world's largest trading bloc and not suffer some negative economic effects were always zero. The possibility remains that those effects won't be too severe to counter the advantages that many Britons perceive in regaining full sovereignty. I voted to remain, and I find it hard to forgive Prime Minister Boris Johnson for touring the country in 2016 in a bus emblazoned with the untrue slogan that leaving would mean an extra 350 million pounds ($478 million) per week for the National Health Service. But it was obvious that a majority of my compatriots were never comfortable with the EU. That is why the relationship remained such a hot-button topic in British politics. Negative attitudes had much to do with the unending propaganda from opponents of the U.K.'s membership; but it is also true that Britain's elite did a terrible job of explaining the worth of the EU. Maybe, just maybe, it is worth a hit to GDP to get rid of this horrible, divisive issue. As for markets, the pound's behavior bears out this view. It tanked on the referendum result, but hasn't fallen further. As far as the foreign-exchange market was concerned, Brexit was a one-off self-inflicted wound, whose damage could be assessed in 2016. The weaker pound will help the U.K.'s competitiveness; now to get on with it. Brexit per se should no longer be a significant issue, and British assets appear to have been adequately repriced.  Survival Tips2020, we all know, was marked by more bereavement and suffering than most years. I am no expert on these subjects, having made it into middle age without suffering the loss of a parent, sibling, spouse or child. I know I am very lucky in this, and have no idea how I will cope when the moment comes. For the many who might need help or companionship dealing with bereavement, I commend the recent LinkedIn posts by Ray Dalio, founder of Bridgewater Associates, whose son Devon was killed in a car accident shortly before Christmas. Many of us are used to looking to Dalio's commentaries on investment. Part of being such a successful investor involves emotional intelligence, or the ability to control the emotions while thinking. That seems to me to show in Dalio's prose about his excruciating loss; he is capable of viewing his pain with dispassion. My best wishes to Mr. Dalio; and to everyone, have a good week and a happy new year. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment