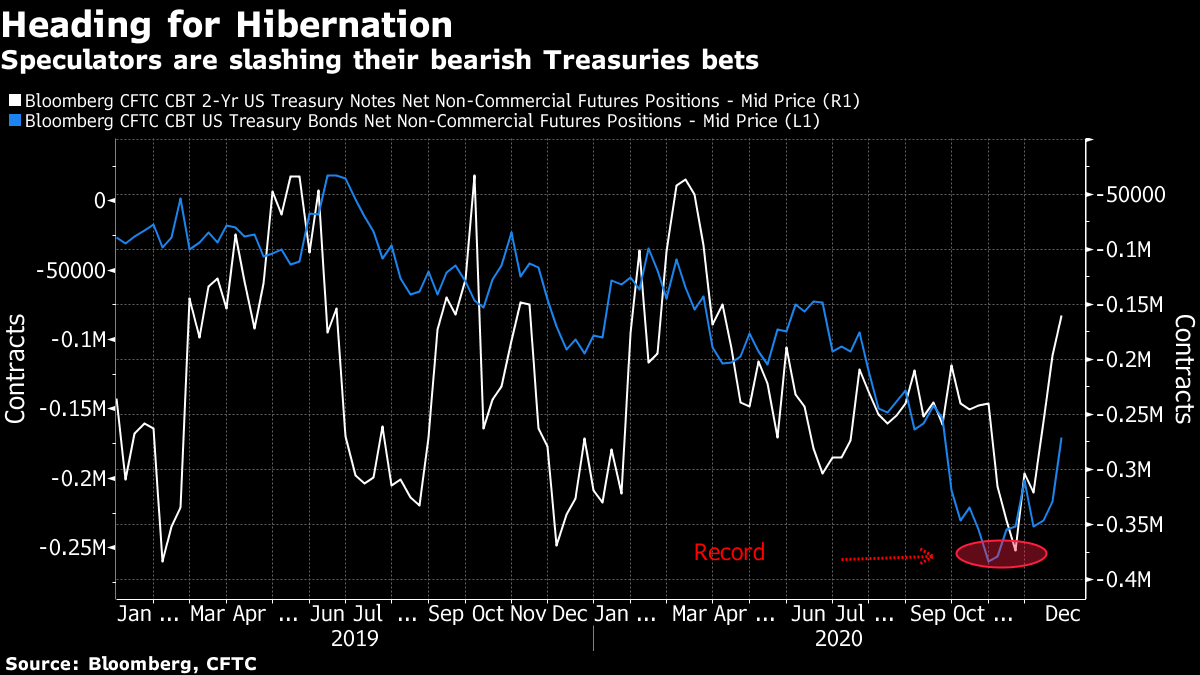

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. London hospitals overwhelmed, a last-ditch challenge to Joe Biden's certification as the next U.S. President, and a blistering Bitcoin rally. Here's what's moving markets. Europe's FightThe U.K. is getting ready to administer the first shots of AstraZeneca's vaccine today, after Prime Minister Boris Johnson warned that tighter lockdown measures in England, including school closures, will probably be necessary. The country logged its biggest daily increase in cases over the weekend, straining hospitals as a new variant of the deadly virus continues to spread. The NHS is set to cancel urgent surgery in London to accommodate surging Covid-19 cases, postponing crucial treatment of cancer patients and others, the Guardian reported on Saturday. Elsewhere, German media reported that the country's lockdown is likely to be extended beyond Jan. 10. In more encouraging news, U.S. officials are exploring making the vaccine available to more people by offering half-doses of Moderna's shot to people ages 18 to 55. Delaying BidenOn Wednesday, U.S. Congress is scheduled to meet and certify the results of the Electoral College, which affirmed Democrat Biden as president-elect, a gathering that is typically a formality. However, a group of senators led by Republican Ted Cruz called for a delay and a 10-day investigation into accusations of wrongdoing related to the election. Those claims have been stoked by President Donald Trump but repeatedly dismissed in court, including by Trump-appointed judges. Meanwhile, an audio recording obtained by Bloomberg showed Trump urging Georgia election officials to "find" thousands of votes and recalculate the election result to flip the state to him -- an extraordinary effort to strong-arm fellow Republicans. Just ShyTesla Inc. came within a hair of meeting its 500,000-vehicle goal for 2020, setting the stage for a new year in which it's expanding in China and poised to open new factories in Texas and Germany. The electric-car maker said Jan. 2 it delivered 180,570 vehicles in the year's final three months, the most for any quarter ever but falling just 450 vehicles shy of the half-million mark Chief Executive Officer Elon Musk had set for the entire year. Tesla has been ramping up output of its mass market models to meet rising global demand for battery-powered cars, with 2020's total jumping 36% from the prior year. UnchainedBitcoin soared to $34,000 just a day after smashing through the $30,000 level this weekend, extending an eye-popping rally as other cryptocurrencies also gather momentum, with Ethereum rising above $1,000 this morning. Proponents of Bitcoin argue that it's muscling in on gold as a hedge against U.S. dollar weakness and inflation risk, citing evidence of growing interest among institutional investors. Skeptics view the digital asset's more than 300% surge over the past year as a risky bubble fueled by investors chasing the momentum in cryptocurrency prices. Coming Up…Energy ministers in the OPEC+ alliance will meet virtually to decide whether to add as much as 500,000 barrels a day to production. It's their first meeting since the bloc agreed to meet on a monthly basis, rather than bi-annually, to better manage the volatile crude oil market. Investors in Fiat Chrysler and Peugeot owner PSA will be asked to approve a merger that will form Stellantis, the world's fourth-largest automaker. A London court is expected to rule on the extradition of Julian Assange to the U.S., which accuses the WikiLeaks founder of conspiracy to commit computer hacking. Last week, lawyers told Bloomberg that the odds of Assange being granted a Trump pardon are greater than those of the London judge halting extradition. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningArguably the two most consensus calls for 2021 are for a weaker dollar and higher bond yields. And recent positioning data suggests traders are happy to finish 2020 betting heavily against the greenback. Net short non-commercial positions in futures linked to the ICE U.S. Dollar Index have surged to the most since March 2011, according to recent Commodity Futures Trading Commission data. But the speculators have been pulling back from their bearish bets on short- and long-dated Treasuries. Speculative net short positions in two-year Treasuries have been slashed to less than half their mid-November record, and equivalent bets on long bonds are down by almost a third over the same period. The move could be just down to a tidying up of positions into year-end. But the still-raging coronavirus outbreak could also be casting doubt on the ability of the U.S. economy to return to normal anytime soon, and traders may feel uneasy betting heavily against a Federal Reserve committed to keeping interest rates low for a prolonged period.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment