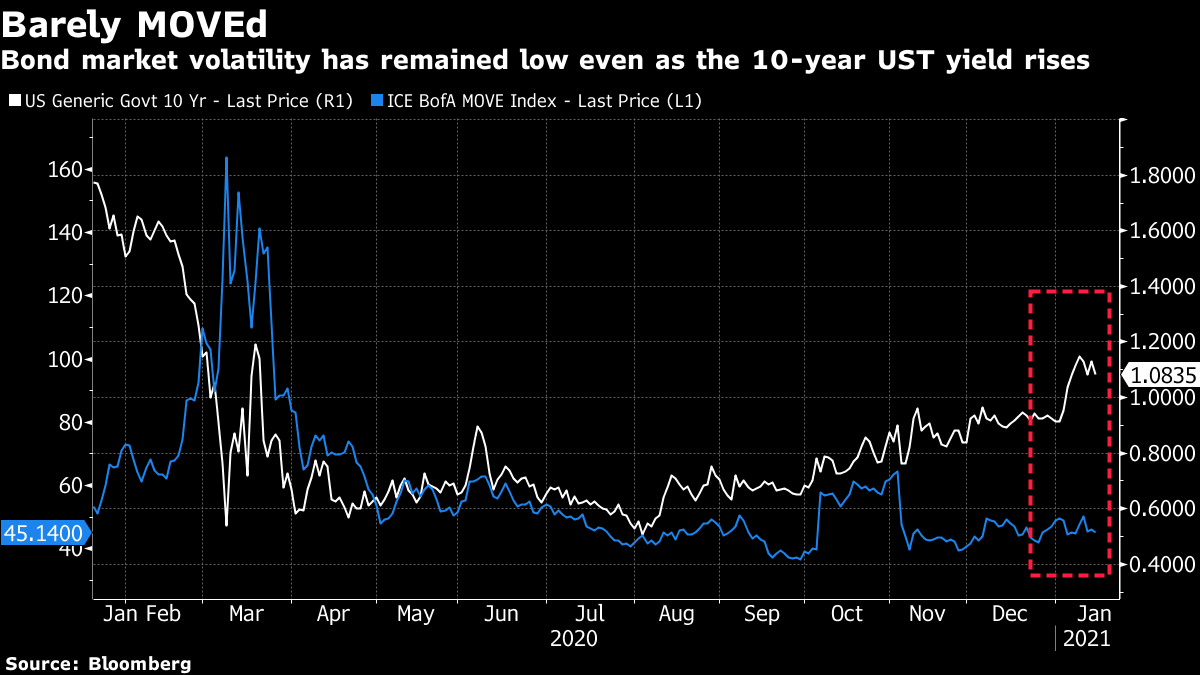

| Goldman lifts U.S. growth forecasts. Trump halts Huawei suppliers. Global asset managers can't crack China's $578 billion hedge fund industry. Goldman Sachs economists raised their growth forecasts for the U.S. this year and beyond after President-elect Joe Biden unveiled a sweeping revival plan calling for $1.9 trillion in spending. In a weekend report to clients, economists predicted the economy would expand 6.6% this year, faster than the 6.4% previously expected. The unemployment rate for the end of 2021 is now seen at 4.5%, down from the prior estimate of 4.8%. The U.S. economy is "spiraling downward", according to a top economic adviser to Biden, but the incoming administration's spending plan would generate "the kind of robust recovery we need," he said. Asian stocks looked set to greet the week with declines as investors look ahead to data on the progress in China's economic recovery. The dollar was steady in early trading. Currency markets saw muted moves, while equity futures indicated small losses when trading begins Monday. There is no trading of cash Treasuries due to the Martin Luther King Jr. holiday. On Friday, the S&P 500 declined and support for Treasuries pushed the yield on 10-year notes down to around 1.08%. Some Huawei suppliers, including Intel, have found their licenses revoked during the final days of Donald Trump's presidency, Reuters reported. In addition, the Commerce Department indicated its intent to deny "a significant number of license requests for exports to Huawei," according to an email Reuters said it obtained. Meanwhile, the Democratic chairman of the House Intelligence Committee said President Donald Trump should immediately be cut off from intelligence briefings, adding that he could not be trusted with classified information. And as we head into the new Biden era, will the U.S. be able to reboot its relationship with China after a tumultuous four years under Trump? Global asset managers are struggling to find a foothold in China's 3.74 trillion yuan ($578 billion) hedge fund industry, despite long-awaited policy changes designed to give foreigners more paths to invest. In November, China expanded access for more than 400 foreign institutions allowing them to invest through private securities funds, the local version of hedge funds. But reality has not lived up to expectations: local players continue to dominate and most existing hedge fund products remain off limits for qualified foreign institutional investors. China's policymakers need to balance growth with limiting risk, said Fuxin Wang, an analyst tracking hedge funds at Shanghai Securities. A stronger U.S. dollar is proving to be an early test for emerging-market currencies on the eve of Joe Biden's inauguration. The greenback gained over the last two weeks, buoyed by the president-elect's proposal for a $1.9 trillion stimulus package. Most developing-nation currencies have slumped in that span, and history suggests further pain may be in store. Although the MSCI's gauge of emerging-market currencies ended 2020 with its biggest quarterly advance in a decade, the backdrop of rising cases, renewed lockdowns and vaccine concerns threatens to reverse those flows. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne of the big stories in markets right now is the jump in rates, with the yield on the benchmark 10-year U.S. Treasury reaching as high as 1.14% last week. The worry is that a disorderly spike in yields could eventually hit stocks and bonds in a similar way to what we saw in the 2013 "Taper Tantrum." But of course, not all rate spikes are created equal and there are some indications that this creep higher in yields is good, rather than the start of a something bad. The easiest way of showing that is to look at the MOVE Index, which measures implied volatility on Treasury options in a similar way to how the VIX Index measures stock market volatility. Even as the 10-year yield jumped last week to its highest level since March last year, this measure of bond market volatility has remained pretty low, suggesting that investors' expectations of rates are still well-anchored.  Back in 2013, bond investors panicked after the Federal Reserve inadvertently suggested it was going to slow the pace of its asset purchase, which was widely seen as a prelude to raising interest rates. In 2020, yields are rising as the market prices in greater fiscal stimulus in the near-term and the eventual end of the coronavirus crisis as vaccines are rolled out (which is one reason why rates have been rising at the back end of the curve more than at the front). Fed Chair Jerome Powell has been consistent in the message that interest rates aren't going to rise anytime soon and we know that, after last year's wild events, the Fed is laser-focused on maintaining the smooth function of the Treasury market. Things could always change unexpectedly but for now there's not a lot to suggest that this recent rise in yields will lead to something disorderly. You can follow Tracy Alloway on Twitter at @tracyalloway. All Things Wall Street and Finance

Join the many Matt Levine subscribers and sign up for the Bloomberg Opinion columnist's daily newsletter here. Trust us, your inbox will thank you for it. |

Post a Comment