| Democrats push to remove Trump from office. Musk becomes the world's richest person. China faces a new virus outbreak.

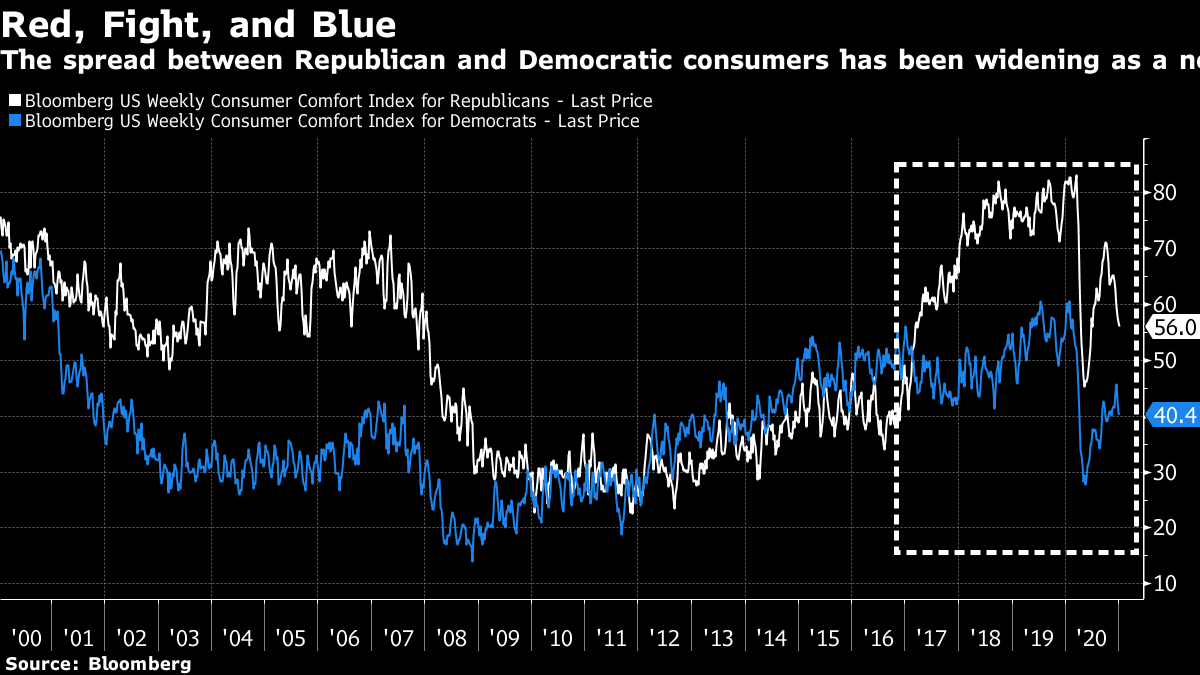

House Speaker Nancy Pelosi and Senate Democratic leader Chuck Schumer demanded that President Donald Trump's cabinet immediately remove him from office and threatened a new drive to impeach him if they don't act. They accused Trump — who has prepared a sweeping list of individuals he's hoping to pardon in the final days of his administration — of inciting the mob that stormed the Capitol and called him a continuing threat to democracy in his waning days in the White House. Trump is "a very dangerous person who should not continue in office," Pelosi said. Meanwhile a growing list of Trump administration officials have stepped down, Biden brands the Capitol mob "domestic terrorists", and the two Republicans beaten in Georgia's Senate runoff refuse to concede. Asian stocks looked set to follow their U.S. peers higher Friday as investors focused on the prospect for more stimulus and the likelihood that calm will prevail as Joe Biden takes the presidency. The dollar strengthened. Futures pointed to modest gains in Japan and Australia, though were little changed in Hong Kong. All major U.S. equity benchmarks notched all-time highs, with about 70% of the companies in the S&P 500 in the green and the Nasdaq 100 jumping 2.5%. Benchmark Treasury yields climbed toward 1.10%. Elsewhere, Bitcoin pared gains after topping $40,000. Oil edged higher and gold dipped. The yen retreated with the euro. Elon Musk, the outspoken entrepreneur behind Tesla and SpaceX, is now the richest person on the planet. A 4.8% rally in the electric carmaker's share price Thursday boosted Musk past Amazon founder Jeff Bezos on the Bloomberg Billionaires Index, a ranking of the world's 500 wealthiest people. The South Africa-born engineer's net worth was $188.5 billion at 10:15 a.m. in New York, $1.5 billion more than Bezos, who has held the top spot since October 2017. Meanwhile, Long-term bear RBC Capital Markets upgraded its recommendation on Tesla, admitting it had misjudged the electric-vehicle maker. Japanese Prime Minister Yoshihide Suga's bet that a less-stringent state of emergency will limit the economic damage of virus containment runs the risk of compounding the pain if it proves insufficient. More analysts now see the economy shrinking again for the first time since the summer, as they recalculate projections in light of Suga's emergency declaration. It's a similar problem now facing Thailand after the country skipped hard lockdowns despite the threat of spiraling cases. The new outbreak is likely to crimp consumer spending and delay a tourism revival, prompting warnings the economy may undershoot expectations for a rebound this year and next. A city of 11 million people near China's capital has been locked down after the emergence of some 200 virus cases, the worst outbreak in about two months in the country. Authorities in Shijiazhuang banned people and vehicles from leaving the city, located in the province of Hebei that surrounds Beijing. Testing will be rolled out city-wide, and five hospitals have been emptied to treat Covid patients. Meanwhile, China's Sinovac vaccine was shown to be 78% effective against Covid-19 in late-stage trials in Brazil. Overseas, the new U.K. strain of the virus has shown up in multiple U.S. states as infection records continue to be broken. British medics will be able to give Covid-19 shots to hundreds of thousands of people every day by January 15, U.K. Prime Minister Boris Johnson said. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayBifurcation is the name of the game following the extraordinary events this week in Washington. Markets largely shrugged off the storming of the U.S. Capitol by Trump supporters. My Bloomberg colleague Sarah Ponczek even points out that more than 29 million bullish call options traded as the chaos unfolded — the fourth highest number in history. Investors didn't just ignore what happened, they doubled down on U.S. stocks as the epicenter of American democracy was attacked. Elsewhere in the discord, Bespoke Investment Group points out that U.S. consumer sentiment is performing its usual divergence as a new president takes office. For Republicans, Bloomberg's Consumer Comfort Index has been dipping ever since the election, while Democrats have been gaining in confidence the closer we come to Joe Biden taking office. As Bespoke notes: "The recent drop in Republican sentiment relative to Democrats is basically consistent with the change of power to a Democratic President; it's likely to continue in coming months and is an important fact to remember when assessing the economic and market sentiment of the country as a whole."  Keeping these bifurcations in mind is important as markets reach new highs. The biggest investors tend to be exposed to a limited slice of the American base: Democratic, urban, able to work from home, and wealthy enough to withstand the worst of the economic impact of Covid-19 restrictions. However, a big chunk of the U.S. doesn't fall into these categories, and shouldn't necessarily be shrugged off. You can follow Tracy Alloway on Twitter at @tracyalloway. All Things Wall Street and Finance

Join the many Matt Levine subscribers and sign up for the Bloomberg Opinion columnist's daily newsletter here. Trust us, your inbox will thank you for it. |

Post a Comment