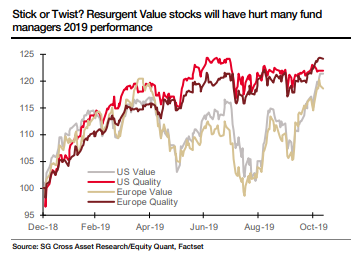

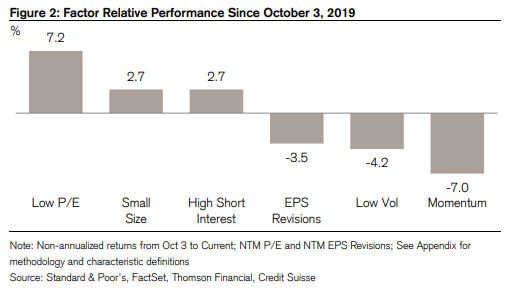

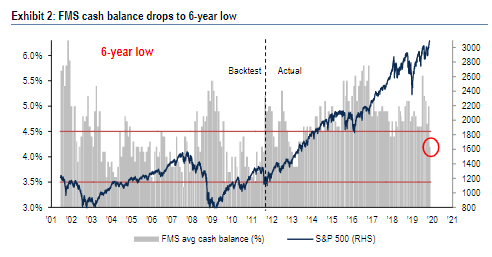

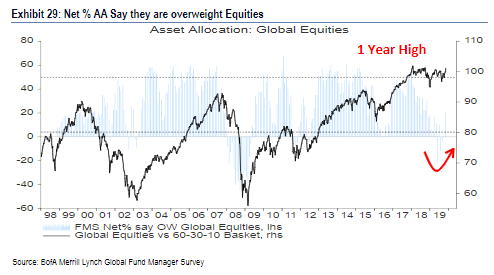

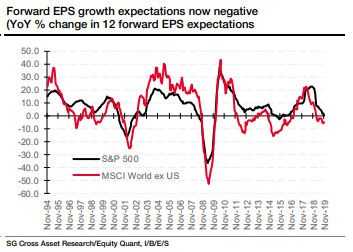

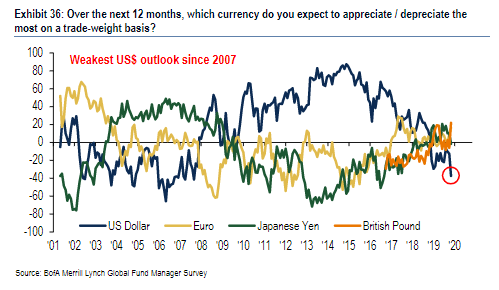

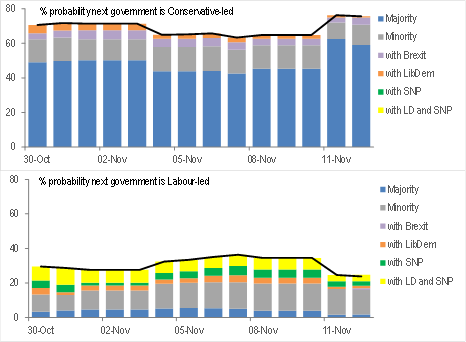

Feel the Rush Optimism is back, and the rush for risk is on. This isn't exactly hard to see. U.S. stock markets are, after all, at all-time highs, while bond yields have risen substantially from alarming lows. There are good reasons to question whether such optimism is justified, but there's no reason to question that it is back. There's also no reason to question the notion that if the optimism is justified (big if) then there is reason to fear missing out on a lot of good things. And for the short term at least, that resurgence of optimism will make life very hard for pessimists, as it will create its own market reality. Here, then, is a quick tour of the signs beneath the surface of the markets that show the hope is genuine, and that there is good reason to fear missing out: Hope… First, there has been a big shift toward value stocks, those that look cheap compared to their fundamentals. This is effectively a shift toward highly cyclical companies that will benefit most from an economic downturn. As this chart from SG Cross Asset Research shows, the effect is very pronounced in the last few months:  To view this in tighter perspective, Credit Suisse Group AG shows the returns of different factors since the rally got under way last month. Relatively risky strategies for the short term have succeeded, small companies have outperformed, and momentum has reversed:  Second, active managers are putting cash to work in a way that hasn't been seen for many years. The latest edition of Bank of America Merrill Lynch's global fund manager survey is out, and shows that cash levels are their lowest in six years. Professional managers are rushing to invest:  So even if you dig lower into markets, this seems to be a "real" resurgence. Fear (of missing out) This doesn't mean, however, that the hope is already in the price and the opportunity to profit has been lost. Judging by global fund managers' self-description, they are much more bullish than they were. The proportion saying they are overweight equities is the highest in a year. But the BofA Merrill Lynch survey also shows that they could be far more overweight:  Second, this is happening despite outright bearishness about earnings forecasts. As this SG Quantitative chart shows, the latest reporting season was sufficiently downbeat that expectations for the year ahead have gone slightly negative. That opens the opportunity for big upside surprises:  There is also a growing belief that we have a weaker dollar ahead. The last period of softness gave us arguably the best ever year for risk-adjusted stock market returns, in 2017. But fund managers are braced for a spectacularly weak dollar, which would flatter U.S. company profits, while relieving the pressure on emerging markets:  And this brings us to an important point, which is that this market is still very narrow. If (big if) the economy continues as well as investors now appear to expect, then there is ample room for different areas to catch up. For example, the rest of the world still badly lags the U.S. and hasn't regained the high made in January 2018:  Within the U.S., the recent domination of "mega-caps" at the expense of smaller companies is also marked. This compares the performance of the Russell Top 50 index with its 2000 index of smaller companies. Again, note that the small-caps are not even back to their 2018 high:  There is good reason to fear that these divergences will resolve themselves via falls for the U.S. mega-caps. But if the optimists are right, we can expect the process of narrowing the gap to involve making some nice profits. Fear of missing out on those profits has helped both non-U.S. and smaller companies of late, but they could easily go much further. Personally, I'm not at all convinced that the optimism is justified. But for the time being, it's a fact of life. And if we don't soon get some clear evidence to puncture the optimism, the powerful fear of missing out could drive quite a rally. Jeremy Has-byn With two days to go until nominations close in the U.K.'s general election, the pound is still rallying. It has rallied, in fact, ever since Prime Minister Boris Johnson took his "walk in the woods" with his Irish opposite number Leo Varadkar and emerged promising a deal that could break the Brexit deadlock. This week has brought a further shift upward against the euro:  Nigel Farage, leader of the Brexit Party, gave the cue for Monday's leap with his climb-down from a previous threat to run candidates against Johnson's Conservatives in every constituency. His party, which advocates leaving the EU without a negotiated deal, won't now field candidates in any Conservative-held constituency. This reduces the risk of splitting the pro-Brexit vote, while the anti-Brexit vote remains divided several ways. Adam Cole, foreign exchange strategist at RBC Capital Markets in London, produced the following chart derived from the odds available at bookmakers. While the market is small, it is very liquid, and has produced odds that make sense. Last week, the chances that the Conservatives would lose power nudged up a bit; now, Johnson's chances are their strongest yet.  Markets have until now been keen to see Brexit averted, so the strength of the rally might seem surprising. But it's worth looking at the lower panel in the RBC chart. The thinnest blue lines represent the chance of Jeremy Corbyn's Labour party taking power with an overall majority. That chance, as far as the betting market is concerned, is now negligible. That is plainly good news for capital markets, as Corbyn has a radical left-wing program that would dramatically increase the role of the state in the U.K.'s economy. So the pound is being supported by the removal of the tail risk of a socialist government. That said, there is a month to go until the election. A coalition including Labour that reversed Brexit but didn't go through with Corbyn's most statist ideas might still be more palatable to the market than a five-year term for a Conservative government led by Boris Johnson that starts by leaving the EU and then has to negotiate new trade deals. There is more to play for. Roula Britannia To finish, a word about a former colleague, and a former employer. The Financial Times, where I worked from 1989 until last year, announced Roula Khalaf will take over as editor from Lionel Barber, who has held the role since 2005.  Roula, currently the deputy editor, is a remarkable journalist who spent much of her career covering the Middle East. She was a great reporter and is a great editor, with extraordinary powers of persuasion. I can attest from personal experience that it is very difficult to say no to her. But what grabs the attention is that she is taking a job that has always previously been done by white British men. The FT, a great British institution, is now under Japanese ownership, and headed by a Lebanese woman. This is a great development, not just for the FT but also for the world's financial media. Good luck, Roula. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment