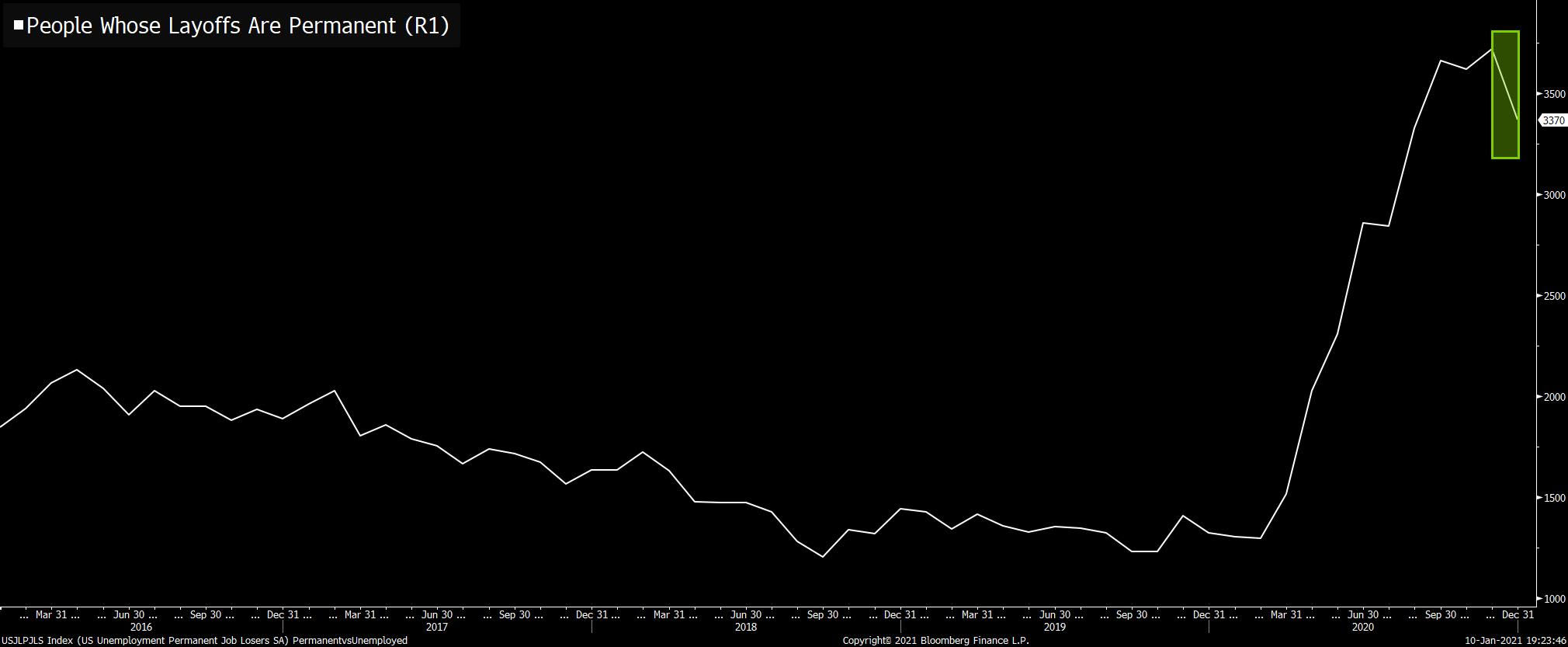

| Democrats eye fast Trump impeachment, Twitter shares plunge, and China sees more Covid cases. Second time House Speaker Nancy Pelosi said yesterday that the House would take up a resolution to impeach President Donald Trump for the second time in less than two years unless Vice President Mike Pence and the cabinet invoke the 25th Amendment this week. While a vote in the House could happen as soon as Wednesday, the Senate is not in session until Jan. 20, which would mean an impeachment trial would delay all business for the incoming Biden administration. Should Trump be impeached after he leaves office, it would bar him from running for president again. Plunge Shares in Twitter Inc. fell 7% in pre-market trading after the platform permanently banned President Trump's account on the site. The company said in a statement that the outgoing president's tweets breached its policies by risking incitement to violence. The move followed a similar suspension by Facebook Inc. Parler, a free-speech-centric social networking site, was banned from app stores and saw its web hosting services cut off by Amazon.com Inc. President Trump, who remains defiant in the face of the social media ban and potential impeachment, plans to travel to Texas this week to visit the border wall and is also preparing at least one more round of pardons. Pandemic China reported a new cluster of the virus as the country sees flare-ups in northeastern provinces. In Europe, Germany is calling on its citizens to further limit social contacts after the death toll climbed past 40,000. The push to vaccinate continues to gather momentum, with Los Angeles turning Dodgers stadium into a mass vaccination center. The number of shots administered has climbed to 25 million in 42 countries. Markets slip Stocks and Treasuries are retreating this morning as the dollar climbs against all its major peers. Overnight the MSCI Asia Pacific Index slipped 0.2%, with Japan's markets closed for a holiday. In Europe, the Stoxx 600 Index was 0.2% lower by 5:50 a.m. Eastern Time after hitting a 10-month high last week. S&P 500 futures pointed to a drop at the open, the 10-year Treasury yield was at 1.107%, oil traded below $52 a barrel and gold was higher. Coming up...There is no economic data of note today. Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan speak later. House Democrat lawmakers are expected to unveil an Article of Impeachment. CES, the annual trade show organized by the Consumer Technology Association, runs through Thursday. Carnival Corp. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningOn Friday we learned that the U.S. lost 140,000 jobs in December as the resurgent virus depressed service-based industry. But although this was the worst month for employment since the spring, the news wasn't all that bad. Even with the downturn, the level of permanent unemployment actually fell in December, as other cyclical industries like manufacturing actually added jobs.  Remember, back in the spring we talked a lot about job losses due to the virus specifically -- heavily concentrated in areas like restaurants and travel -- versus job losses due to the economic downturn more broadly. It's encouraging that we're actually seeing job gains in areas that are tied to the general economy. There's been this widespread narrative that after a few more months of pain, provided the vaccine rollout goes okay, that we see a robust rebound in the middle of this year. So it's very encouraging that so far, even in this painful period, there are underlying signs of economic momentum. With the added help of the recently passed stimulus (providing more checks to households, plus aid to the unemployed and more), the odds grow that things will hold together until a true reopening comes.

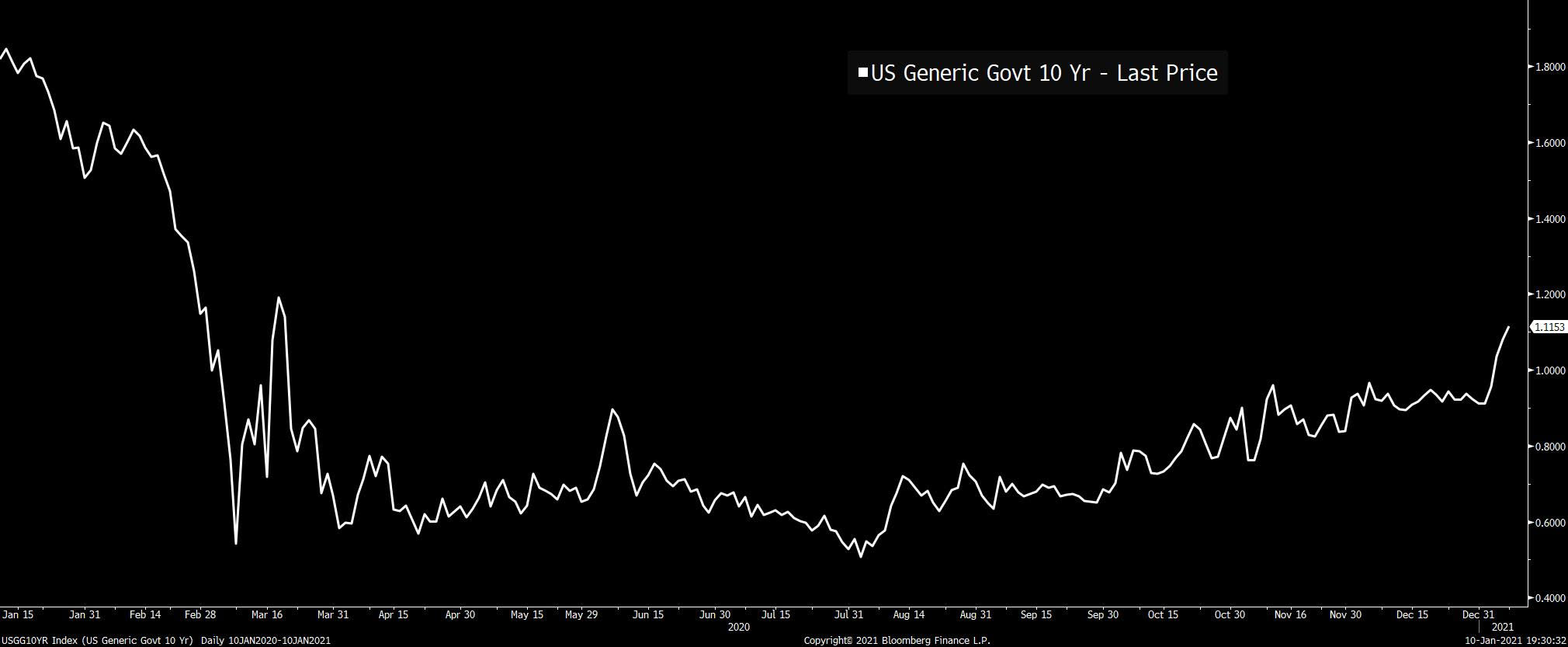

Meanwhile, another important dynamic is taking place in the Treasury market. After months and months of sideways action, the yield on 10-year government bonds has broken out a bit, with a particularly strong move in the wake of last Tuesday's election, where Democrats clinched control of the Senate.  Democratic control of the White House, the House and the Senate, of course, improves the odds of yet-another round of fiscal expansion, both in terms of short-term stimulus, and longer-term public investment. The rise in Treasury yields is saying, therefore, that at some point the Fed is expected to come back into the picture. Nobody expects a rate hike anytime soon, but fiscal stimulus that serves as more than just a "bridge to reopening" has the potential to lift nominal growth, build some heat in the economy, perhaps provide a reflationary impulse, and thus awaken the Fed from its self-imposed hibernation. Again, we're not talking about much, the market just does not see ZIRP forever here.

Put the two things above together: It's increasingly likely that the economy will be in a position to really take off once the virus truly fades. And when you combine that with more fiscal expansion, the market believes we may have enough juice to bring the Fed back in play, at least on some modest scale. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment