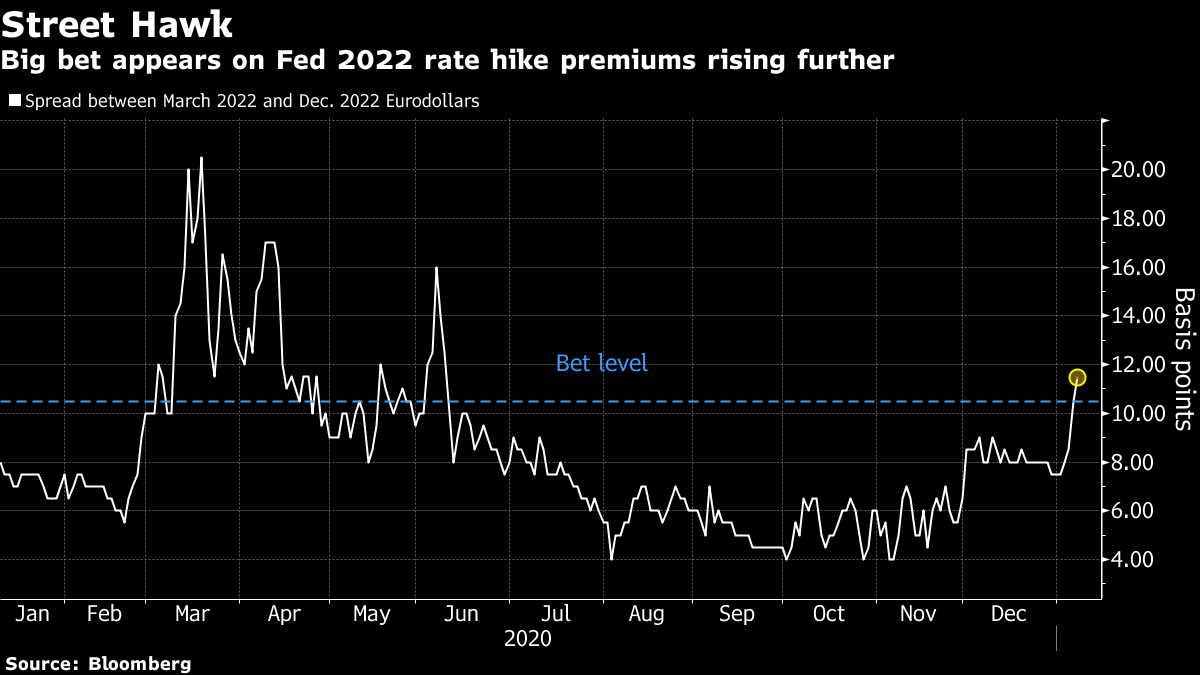

| Good morning. Donald Trump may face another impeachment vote, social media companies face a reckoning and Europe struggle to contain Covid-19. Here's what's moving markets. ImpeachmentHouse Speaker Nancy Pelosi said lawmakers will take up a resolution to impeach President Donald Trump for the second time in less than two years unless his cabinet invokes the 25th Amendment to remove him from office. Trump, banned from social media platforms and with a dwindling circle of advisers around him, is said to be planning a defiant final few weeks in the White House, which is likely to include trips to highlight what he considers his key accomplishments in office and potentially another round of pardons. Vice-President Mike Pence, however, says he will attend the inauguration of Joe Biden. Social ReckoningThe riots at the Capitol are also fueling questions for social media platforms on their accountability for what happens on their services. Trump has been banned from Twitter permanently and Facebook indefinitely, though the former has faced criticism from Democratic lawmakers, who will take control of U.S. Congress and the presidency in less than two weeks time, for doing too little, too late. Facebook is also being pushed to preserve digital evidence from the riots which may be required for future legal action. Parler, the social network popular with extremist groups and which was used to organize the violence, is also being removed from various services as a public safety threat. Follow the RulesGerman Chancellor Angela Merkel has urged citizens to adhere closely to tougher lockdown measures as Covid-19 deaths rise ahead of what she says are likely to be the toughest weeks of the pandemic yet amid severe pressure on the health service. The U.K. is facing similar strain as the new strain of the virus hits hard, with cases having now surpassed the 3 million mark and the country ramping up its vaccine rollout. France, meanwhile, faces the problem of a lack of confidence in its government's ability to handle the pandemic. Also discouragingly, a new variant similar to the U.K. strain has been discovered in Japan. Playing 2021One surprisingly busy week out the way provides a good opportunity to parse through any emerging investing themes, albeit it remains very early in the year. Those hoping for a revival for value stocks got their wish, with banks particularly in vogue. Unloved U.K. equities are winning some fans with a Brexit deal done and reflation optimism providing the positivity. Treasuries traders too are piling into favored reflation wagers in the hope that a Democrat-controlled Senate will follow through on the upsized stimulus plans President-elect Biden has outlined. And keep watching Bitcoin, which just had one of its best weeks on record followed by a hefty tumble over the weekend. Coming Up…European stock-futures and U.S. futures are trending lower heading into Monday, after a mixed session in Asia and with the U.S. dollar trading higher. Monday's agenda is relatively quiet, though earnings season will start to heat up in the next fortnight before kicking into gear after that. For the rest of the week, European Central Bank President Christine Lagarde will make her first public appearances of the year, Fed Chair Jay Powell will speak and there will be GDP data from Germany and the U.K. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith the Democrats securing control of the Senate, traders are bringing forward their expectations for the first rate hike from the Federal Reserve -- as part of the reignition of the so-called reflation trade. As my colleague Stephen Spratt pointed out Friday, signs of a large new bet on a hike in 2022 rippled through futures markets last week. The clues came in two bursts of trading in different Eurodollar futures Thursday -- which are priced off expectations for where interest rates will be -- in a strategy wagering December 2022 rates would rise relative to those in March the same year. The spread between the two widened last week to about 12 basis points Friday as rate-hike premiums crept higher in the wake of the Georgia Senate vote. The bet began with a buyer of the March 2022 contract, with almost 80,000 futures trading in a one-minute window -- over 25% of the day's volume. Later, a seller of December 2022 contracts emerged, in almost identical size. If the two are linked, this so-called steepener trade -- executed at just below 11 basis points -- stands to make or lose the investor about $2 million for every basis point the spread shifts higher or lower. Whoever put the bet on is wagering consensus expectations for the first hike will come forward. Overnight index swap markets still show just a 50% chance of a rate hike by the first half of 2023, with the first "full" 25 basis point move not priced in until the start of 2024.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment