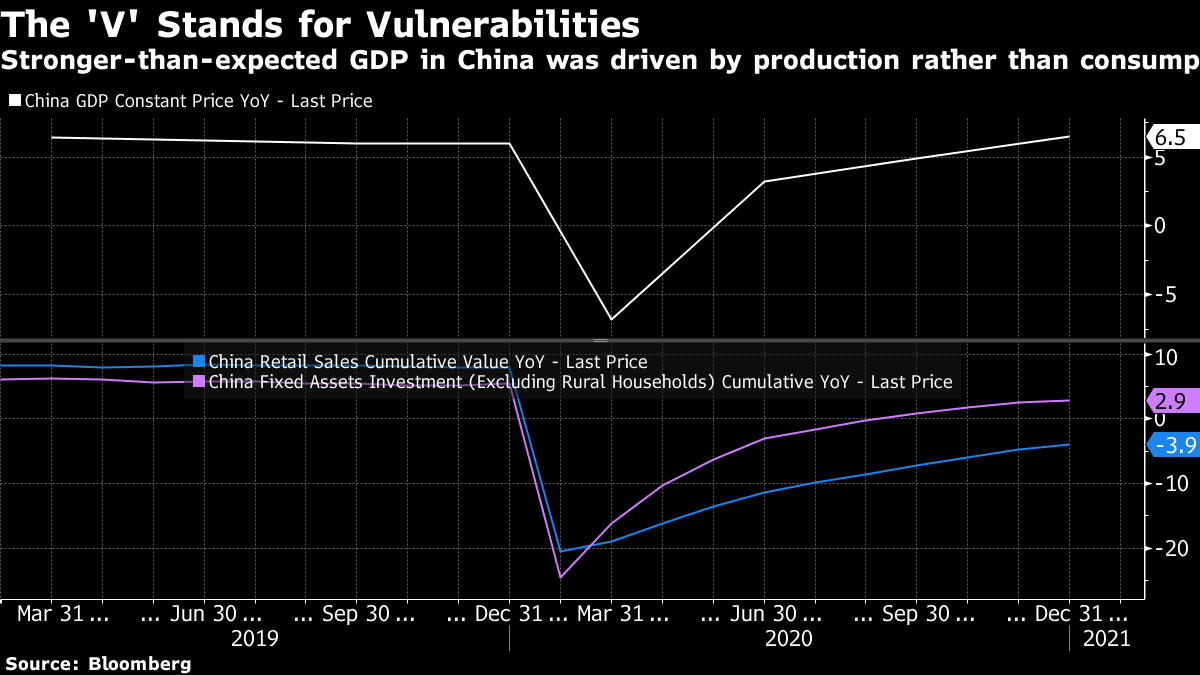

| China's sovereign wealth fund is restructuring international investment decisions. HSBC accelerates its push into Asia. Pressure mounts on Singapore's richest family. China's $1 trillion sovereign wealth fund is restructuring how its decides on international investments as it tries to boost efficiency and make better progress on a goal of increasing the share of private assets in its global portfolio. China Investment Corp. formed two committees earlier this month to approve investments in public and non-public assets, replacing bodies at units CIC International and CIC Capital that previously had overlapping responsibility, according to people familiar with the matter. Separately, CIC Capital's management department is also being dismantled and the various teams will be folded into other departments, they people said. Here's more on why CIC continues to suffer from talent loss Asian equities looked set for modest gains Tuesday as investors awaited President Donald Trump's last full day in office and mulled stimulus plans from President-elect Joe Biden. The dollar pared an earlier advance. Futures pointed higher in Japan, Hong Kong and Australia. S&P 500 contracts fluctuated with U.S. markets closed for the Martin Luther King holiday Monday. Treasury futures were little changed. Investors will watch out for comments from Treasury Secretary nominee Janet Yellen, who has a Senate confirmation hearing Tuesday. Elsewhere, oil edged lower, gold climbed and Bitcoin fluctuated around the $36,000 level. Pressure is mounting on Sherman Kwek, the 45-year-old chief executive officer of City Developments and heir to Singapore's biggest family fortune. He's trying to salvage the troubled property investment at the center of an ambitious expansion into China, but in the past month he's seen two more board member resignations, taking the total to three since October. His firm set up a special team to decide on the sale of assets at its joint venture with Sincere Property Group, the Chinese developer that's driven a rift in the family, and to look at restructuring its liabilities. His father came out to defend the investment, but it's the biggest challenge yet for Kwek, after Covid put most of Sincere's projects on hold. HSBC plans to accelerate its expansion across Asia in its imminent strategy refresh, according to Chairman Mark Tucker. Tucker said "the world had changed" in the 11 months since Europe's biggest bank announced a long-awaited overhaul, forcing the lender to make its plans more radical. "We see real opportunities to grow our wealth business and expand across South Asia," he said. The London-based lender has seen its share price drop by a third in the last year amid the Covid-19 pandemic. Read more on HSBC's evolving strategy. Krafton, the maker of global video game smash PlayerUnknown's Battlegrounds , is planning an initial public offering in mid-to-late 2021 that could be South Korea's biggest in years. The share sale could raise billions of dollars, chief executive officer Kim Chang-han said in an interview in Seoul. The IPO could value the startup at as much as 30 trillion won ($27.2 billion), according to a recent report by Eugene Investment & Securities, which added that Korea is set to raise as much as $10.9 billion, a record, through more than 120 IPOs this year. The surge comes after South Korea's benchmark stock index gained 34% in the past 12 months, one of the best performances in the world. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayFor years China has been trying to rebalance its economy towards something more consumption-driven. The idea is that by shifting focus to domestic consumers and away from investment and a massive trade surplus, China could achieve more sustainable economic growth and avoid the middle income trap that has plagued other emerging markets. Economic growth that was less dependent on investment, it was thought, could lead to a more efficient use of resources, thereby avoiding a major and potentially troublesome build-up of debt, while also helping develop the country's technological expertise by allowing companies to compete for a growing body of domestic spenders. Meanwhile, reorienting growth away from exports would theoretically help China insulate itself from a backlash of Western protectionism. While GDP numbers released Monday showed China's economy expanding by a better-than-expected 2.3% last year — making it the best-performer among major economies, and probably the only one to escape contraction in 2020 — they also reveal a major rollback of decades of economic ambitions, in the form of a big divergence between consumption and production. Spending per capita fell 4% in 2020, while exports surged and investment in fixed assets such as real estate and infrastructure grew 2.9%. Long-time China watcher Michael Pettis suggests this means that the share of consumption in China's GDP will probably have dropped "almost back to its nadir in 2010-11."  When push came to shove it looks like China's leadership fell back on tried-and-true methods of boosting the economy: ramping up infrastructure spending and real estate at the expense of long-term debt reduction and steadier growth. And because external demand, rather than domestic demand, contributed so much to China's economy in 2020, there's a chance that the country will find itself in a worse position when spending in places like the U.S. and Europe eventually normalizes and switches from goods to services. In short, Monday's GDP figures reveal China's economic vulnerabilities as much as its strengths. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment