The Anti-Contrarian ConsensusEveryone wants to be a contrarian. But that's logically impossible. Just watch the great scene in Monty Python's Life of Brian when Brian, mistaken for the Messiah, tries to convince his followers to think for themselves. "You're all completely different!" he cries. "Yes, we're all completely different!" the crowd shouts as one. Then one voice says: "I'm not." That scene aptly captures the problem for asset allocators as 2020 blessedly approaches its end. Generally, the way to make the most money in markets is by contrarian bets when you know the crowd is wrong about something. But when the consensus becomes overwhelming, contrarianism is impossible. And while it's generally good when animal spirits return, positivity can become dangerous when it degenerates into groupthink. At this point, anyone trying to argue against the overpowering belief that 2021 will be the year of reflation and recovery probably feels like Brian's hapless follower protesting that he isn't different. Increasingly, there is alarm at the strength of the consensus. But it is hard to counter the optimism. The latest quarterly survey of asset allocators by David Bowers of Absolute Strategy Research produced dramatic results that he summarized as follows: • record high for the Survey's "Composite Optimism Indicator"

• record probability of a stronger business cycle

• record (low) probability that US unemployment will be higher

• record probability that US IG Credit will beat Treasuries

• record probability that US HY Credit will beat IG Credit

• record probability that EM hard-currency bonds will beat HY

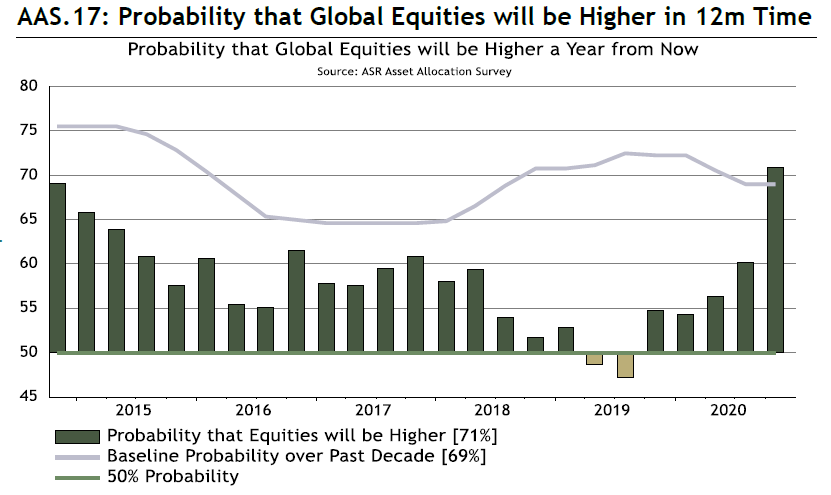

• record probability that Global Equities will be higher

• record probability that Global Earnings will be higher

• record (low) probability of a 20% drawdown in US equities

• record (low) probability that the USD will appreciate

• record probability that stocks will beat bonds

• record probability that Value will outperform Growth

• record probability that Cyclicals will outperform Defensives

• record probability the EM equities will beat DM equities

Does this seem to gibe with the world we're living in? The European Central Bank intensified its efforts to prop up the economy and asset markets last week; the Federal Reserve may well follow this week. How can this be necessary when the people in charge of directing money flows are almost unanimously convinced that things are getting much better? Leuthold Group's Jim Paulsen rattles off a list of short-term sentiment measures that look dangerously extreme: Lately, investor sentiment measures have become an increasing concern. Several metrics including the AAII Bulls less Bears, the put/call ratio, CNN's Fear & Greed Index, the smart money/dumb money indicator and the investment newsletters sentiment index all suggest investor optimism has become extreme. Historically, when sentiment reads have turned this bullish, the stock market often suffers a setback.

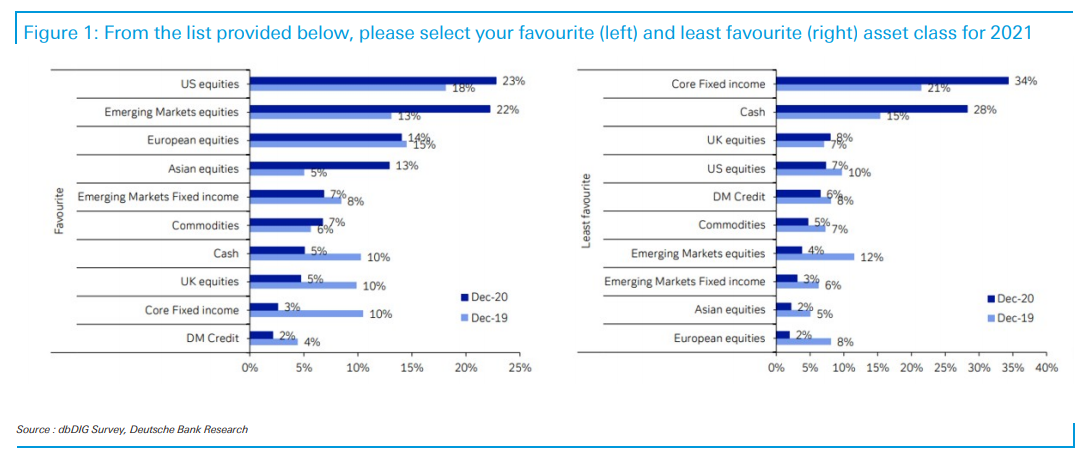

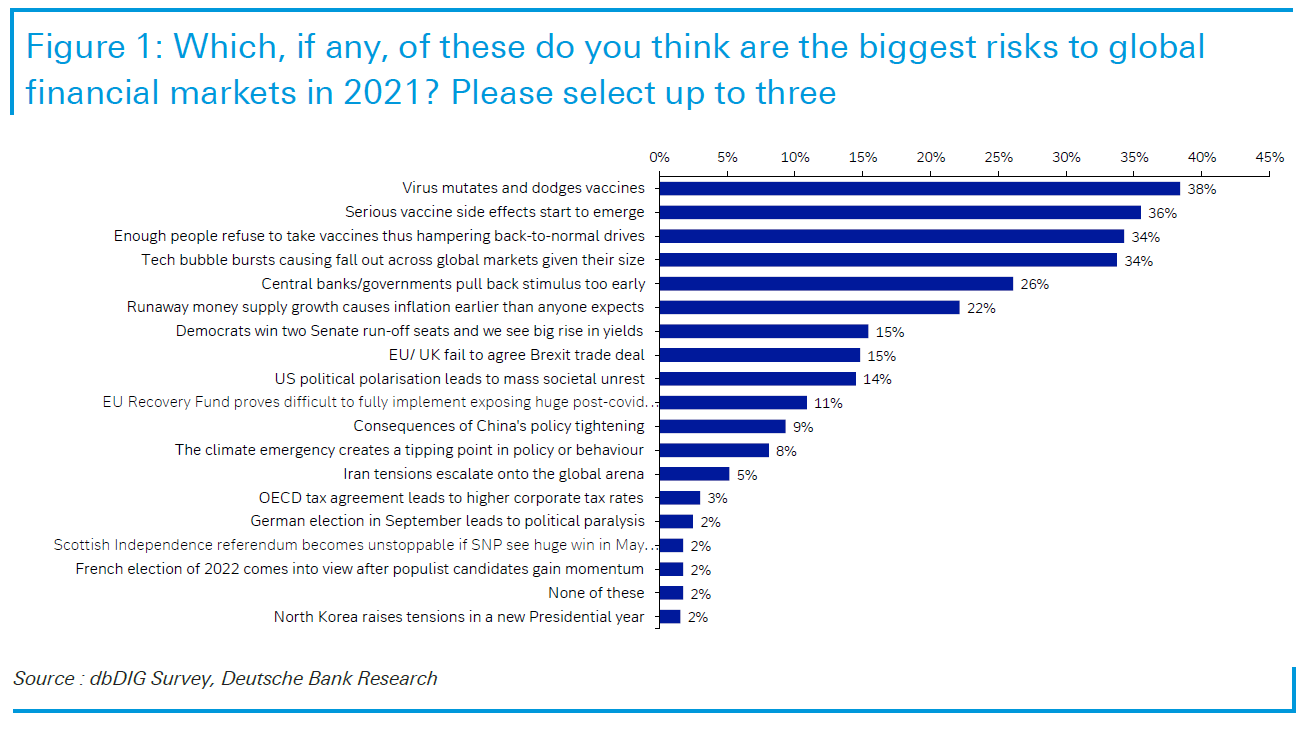

Meanwhile, the latest edition of the monthly BofA Securities Inc. fund manager survey, which came out in November, found global growth and profit optimism at a 20-year high, with 66% saying the macro economy was in an "early-cycle" phase, and not recession. BofA found an all-time high in the proportion of investors expecting a steeper yield curve (73%); allocation to equities at its highest (net overweight 46%) since January 2018; and allocation to cash (net 7%) at its lowest since April 2015. At the time, BofA warned that markets were close to "full bull" and it might be a good idea to "sell the vaccine." Instead, it looks as though the consensus has only strengthened. Channeling FDR, BofA Securities's chief technical equity strategist Stephen Suttmeier proclaimed: "The only thing we have to fear is the lack of fear itself." Jim Reid of Deutsche Bank AG, who headlines his survey of 984 investors "Biggest consensus in history?" came to much the same conclusion: As we do a long series of 2021 Zoom outlook calls the biggest push back is that the expected risk-on is extremely consensus for the next 12 months. It's fair to say that in the 25 years I've been doing this I can't remember a time when so few (if any) disputed the central narrative. Is this a warning sign or a reflection that the vaccine news has been uniformly positive and game-changing over the last 5 weeks?

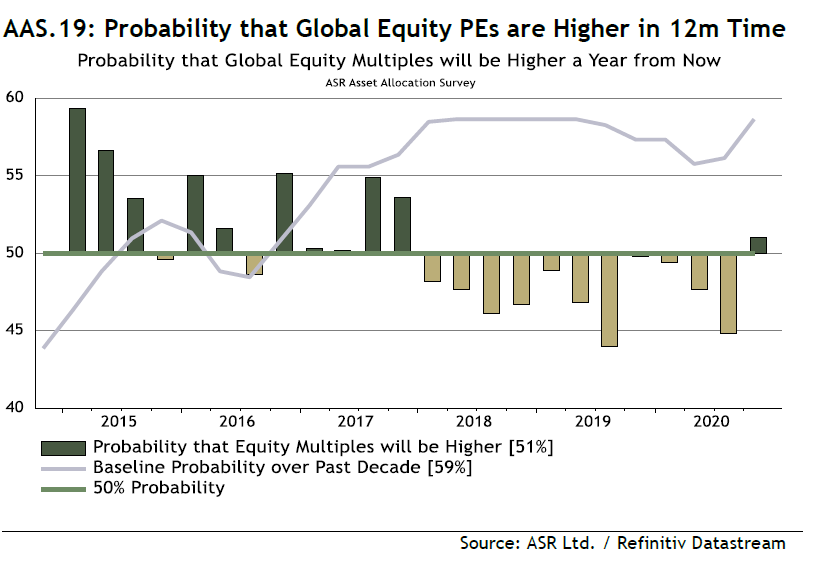

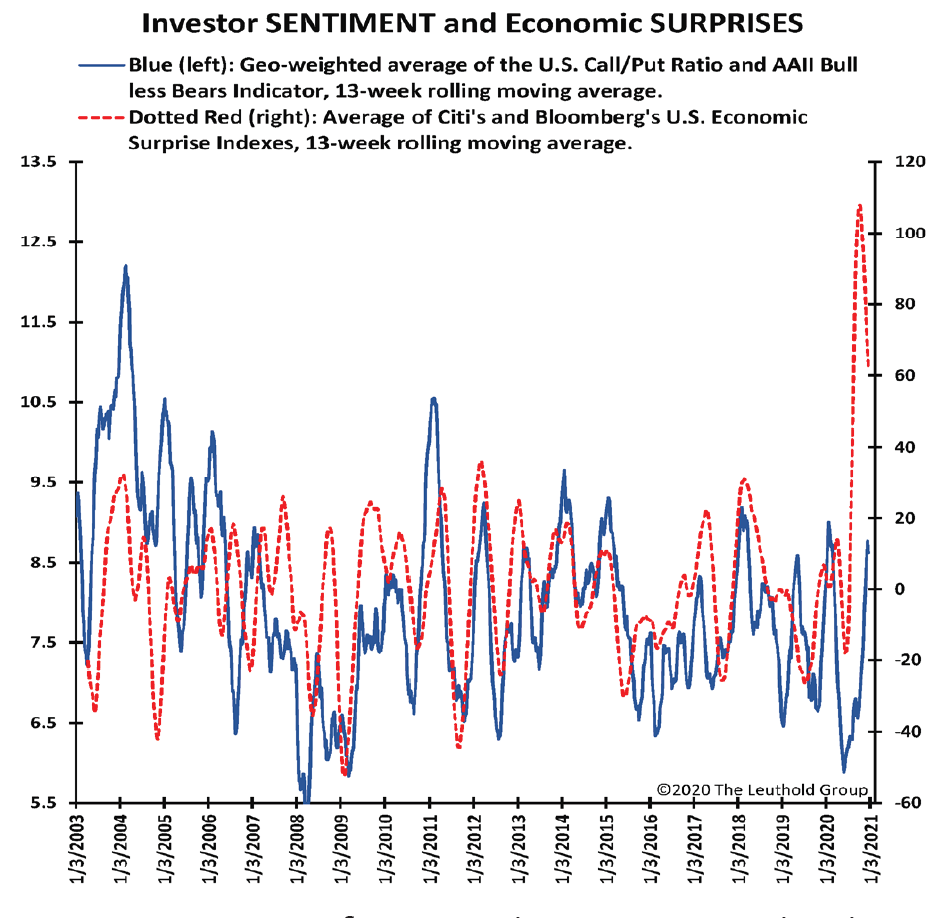

This is optimism for global equities over the next 12 months, from the Absolute Strategy survey:  Markets are already at record highs and widely perceived to have borrowed returns from the future. There is exceptional, if reasonable, optimism for improved earnings. This is combined, though, with a belief that investors will pay even higher multiples for those earnings:  Not to belabor the point, but multiples are currently at or near all-time highs, depending on how you measure them. An over-expensive stock can always become even more expensive. Still, it seems dangerous to make this a base case. Another concern is that investors are unwilling to follow their logic all the way. A major global reflation should more or less guarantee that the rest of the world, and particularly emerging markets, will outperform the U.S. Yet the surveys show a marked reluctance to make such a career-endangering move. This is Reid's measure of the most popular trades for next year, which is in line with other surveys:  Is there any way to reconcile what is going on? Reid offers this list of the main risks cited by his respondents. A virus mutation, or a major side-effect to the vaccine, could change things utterly. For the time being, optimism might reflect the fact that the greatest risks are medical, which asset allocators aren't qualified to assess:  Meanwhile, Paulsen suggests that what looks like bizarre and dangerous over-optimism may just be an artefact of a year of deep and sudden surprises that have befuddled our perception. Comparing sentiment measures with economic surprise indexes, he suggests that the rise in investor sentiment since March may only represent an improvement from extreme pessimism to simple pessimism. As his chart shows, the improvement in trader sentiment measures still lags a long way behind the surprising improvement in the economic outlook:  There is certainly something to this. The weirdly strong consensus probably does have something to do with emotional reactions to an extraordinary series of events. But the degree of implied groupthink is alarming. As Brian would say, we've got to think for ourselves. Because, as Benjamin Franklin put it, "if everyone is thinking alike then no one is thinking." Richard Breslow: from First Word to Last WordRichard K. Breslow, my colleague on the markets team at Bloomberg News, died Monday morning. A former trader at Goldman Sachs Group Inc. and WestLB AG, and a father of four, Richard was one of the wisest and most drily funny people I've met. I wish I'd had more than two years to learn from him. I have a later working day than most people at Bloomberg; Richard, after a lifetime as a trader, was happy to have a very early one. Although we had desks that faced each other, and did get to chat quite a lot, we rarely overlapped for more than a few hours. When he arrived at Bloomberg, Richard played a key part in establishing the First Word service for currencies. More recently, he was best known for his Trader's Notes column. This was one of those gems that you needed to subscribe to the terminal service to receive. But on this occasion, it's appropriate to share one with a broader audience. The last Trader's Notes to appear was on Oct. 16. I doubt he was consciously writing a last testimony for the world, or summing up his experiences. But what he wrote does read to me like something close to a last testament. The amount of wisdom Richard crammed into one brief column, both on investment and markets, and on the specifics of the pandemic situation, is quite extraordinary. I wish I'd written it, and reproducing it here is the best tribute I can make to him. Markets Don't Always Obey Your Whims or Follies: Trader's Notes Have you ever had one of those mornings? My alarm went off at 2 a.m. and I was giggling. I was watching, in my dream, a furious debate between two people about English as a second language. And was sure both combatants were correct in their interpretations concerning what everything meant. The world is full of grey areas. And I was furiously moving back and forth in my allegiance as I followed the event. There is little doubt it was an esoteric debate at best. Maybe it was silly. I don't know. I'm so sorry I no longer remember all of the details. It's the way dreams work. But it all seems more than a perfect metaphor regarding how we are looking at the world. No one has a clue, and we see everything through the prism of our personal experience and assume everybody else shares our views and experiences. We don't really have that right as commentators. Empathy is a responsibility, not merely a bone to be thrown out as it suits. - Markets have done nothing overnight. Which seems entirely appropriate. A little up and down, signifying nothing. It got me thinking about all of the debates about V-shaped recoveries, L-shaped ones, W's, etc. All to fit the narrative of the day. Fit the commentary to the latest price action and noise. The reality is that the K-shaped truth is what we are experiencing in a way that can't be denied. Good for many of us, to be sure. Unhealthy for many. A nightmare for policy makers with no solutions. And they will continue to dig the hole deeper. Keep priming the upper-K and giving lip-service to the other

- I know everyone hates the dollar. It's difficult to quite understand why. Being angry isn't a valid reason. Unless you believe in the Asian resurgence. Which is the most dynamic, and relevant, development to watch. The DXY stopped going down in July. Get over it. The euro isn't trading with any gusto. I've no problem with someone having a view. Happy days. Here's the button to push. But we need to stop saying the trend will continue

- Ten-year Treasuries haven't moved since the kerfuffle in March. I see lots of reasons to have them as a safety valve. Zero to assume yields will take off. And if they do? Happy days. The thirties at 1.50% may be an opportunity, but don't scream watch out

- As far as equities are concerned, they are the golden child. It's really the only market the authorities care about. It pains me to admit, but they must be your first priority. Ugh. The obvious ones keep flying. Making everyone look good. But the economy will only recover when the nuts and bolts ones from down below do better than get pulled along in the undertow

Rest in Peace, Richard. Survival TipsI've been sharing too many requiems in this space of late. Let me suggest Brahms's Ein Deutsches Requiem, one of the richest and most beautiful I know. This is my favorite movement, Denn alles Fleisch es ist wie Grass, as performed by the Berlin Philharmonic under Simon Rattle, with the great Thomas Quasthoff singing Baritone. I have one other somber recommendation, inspired by another brilliant colleague who left before his time. Peter Martin, former deputy editor of the Financial Times, died of cancer in his early 50s. One of his last columns was a sustained musing on Dover Beach by Matthew Arnold. This is the final verse of that extraordinary meditation on mortality and the human condition: Ah, love, let us be true To one another! for the world, which seems To lie before us like a land of dreams, So various, so beautiful, so new, Hath really neither joy, nor love, nor light, Nor certitude, nor peace, nor help for pain; And we are here as on a darkling plain Swept with confused alarms of struggle and flight, Where ignorant armies clash by night.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment