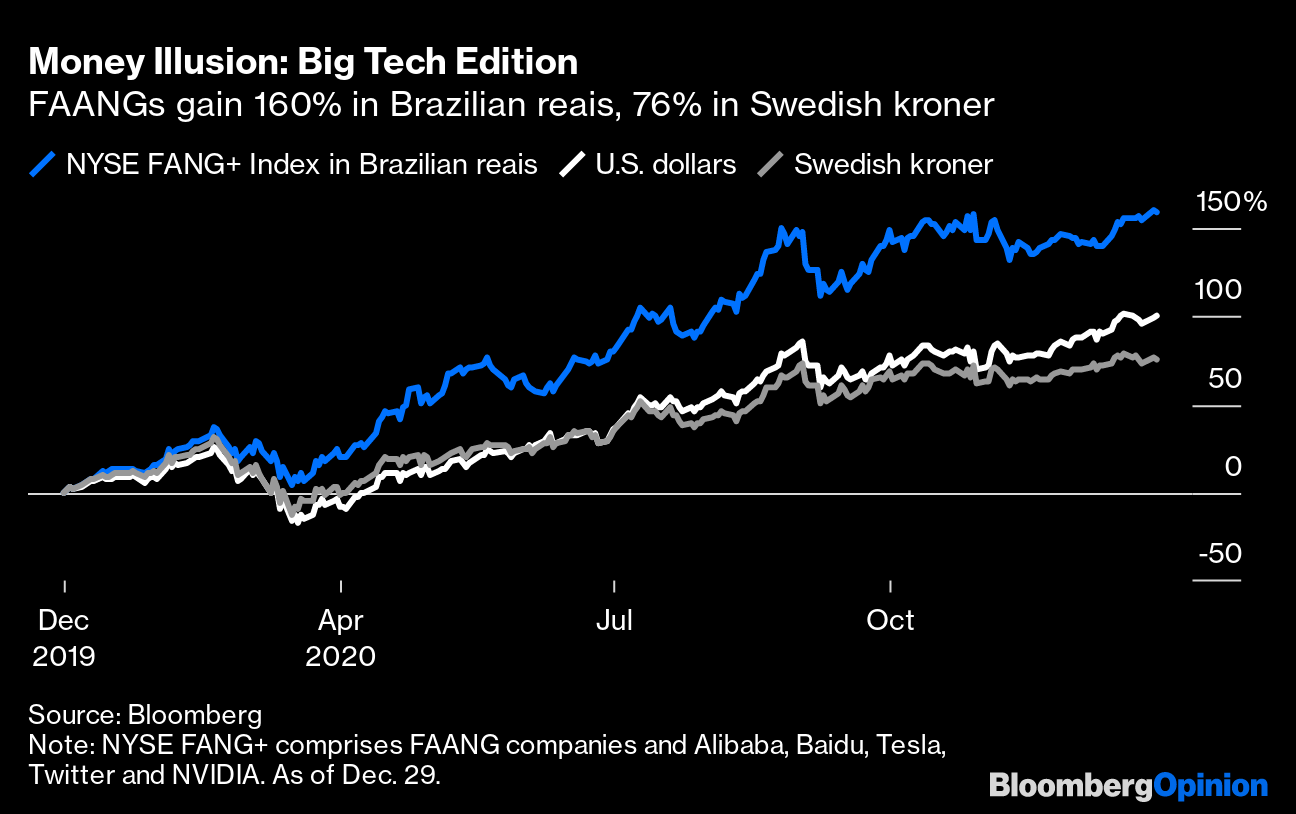

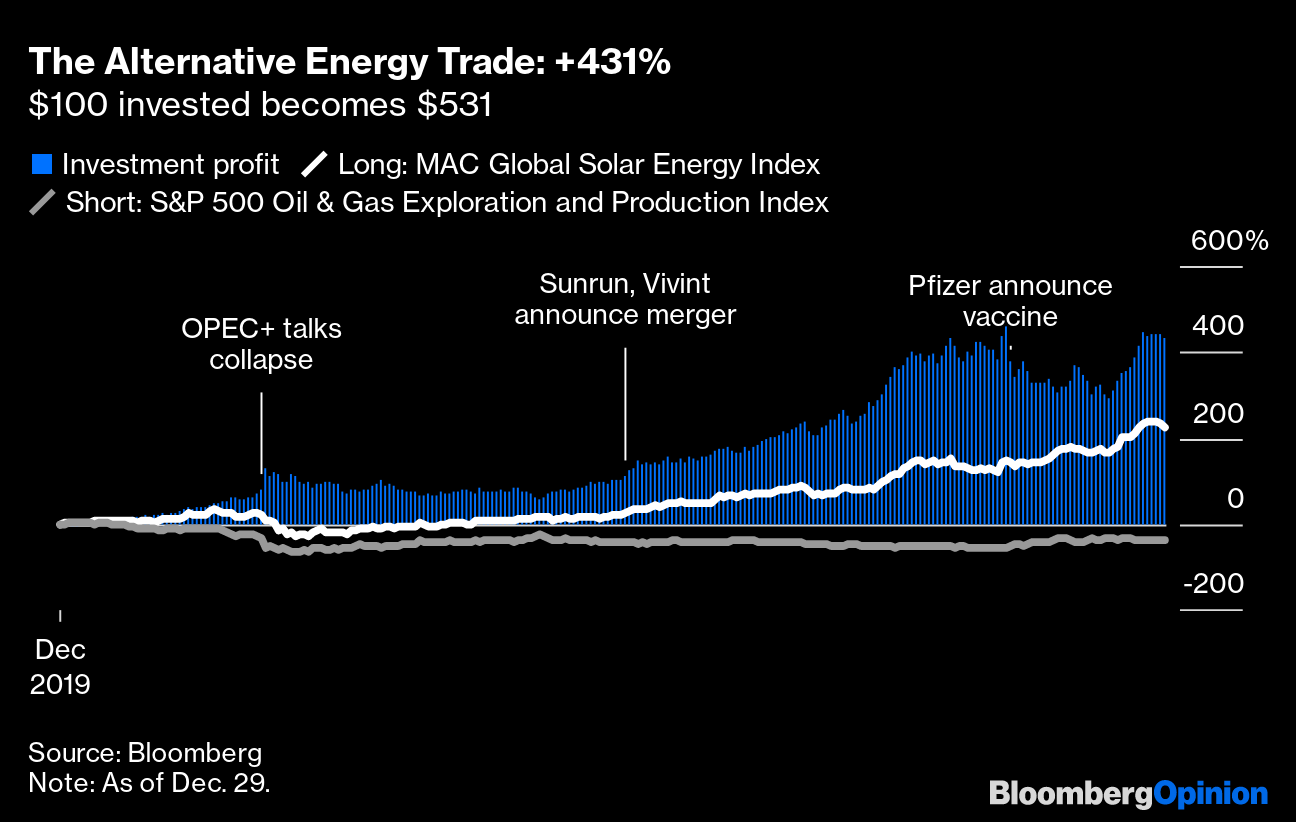

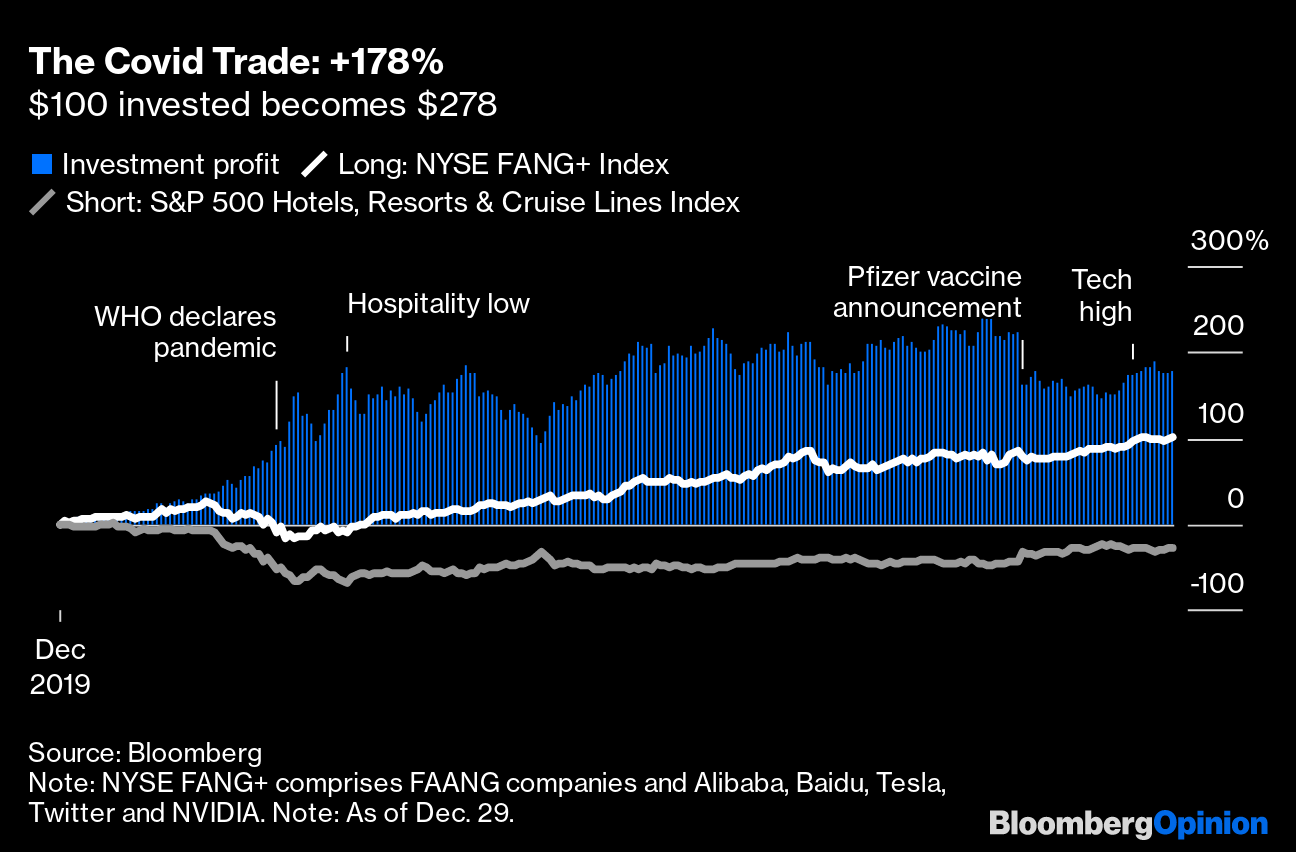

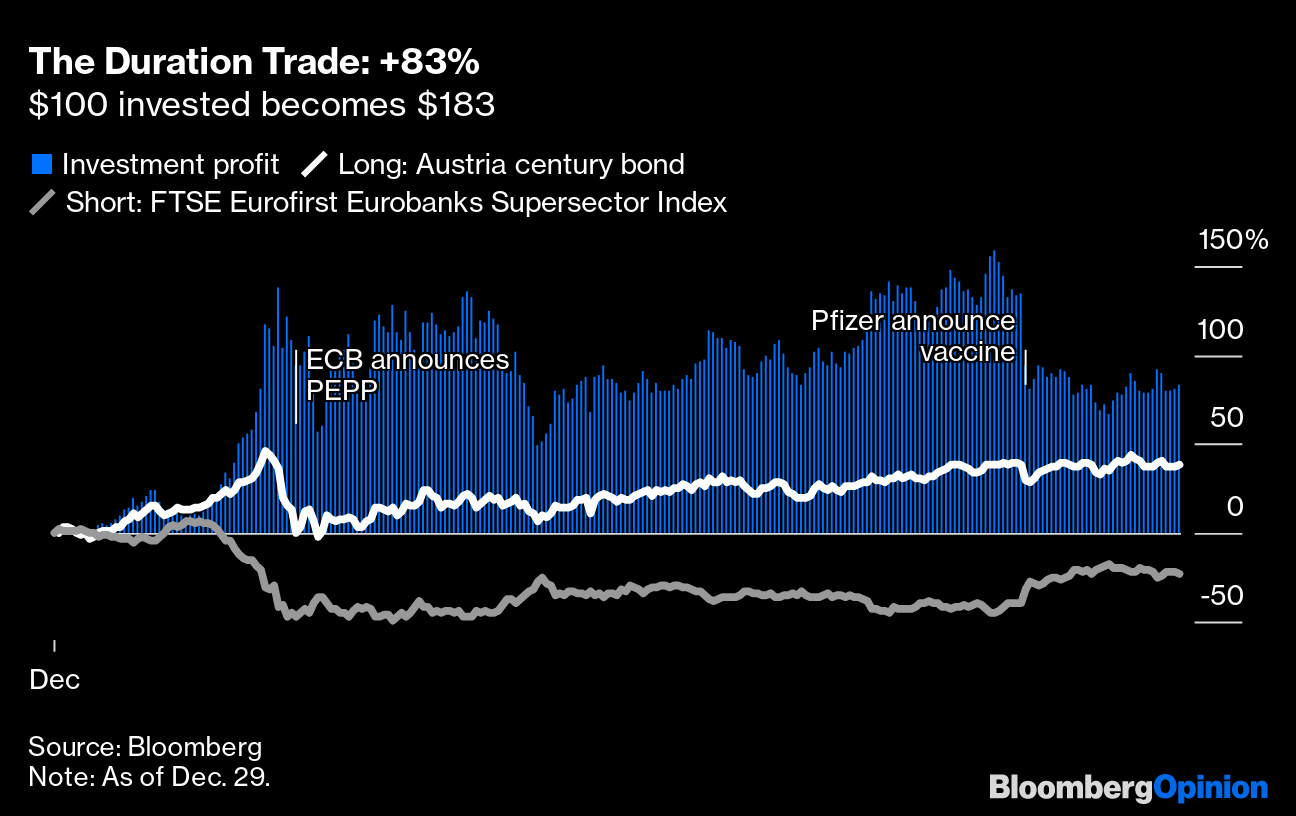

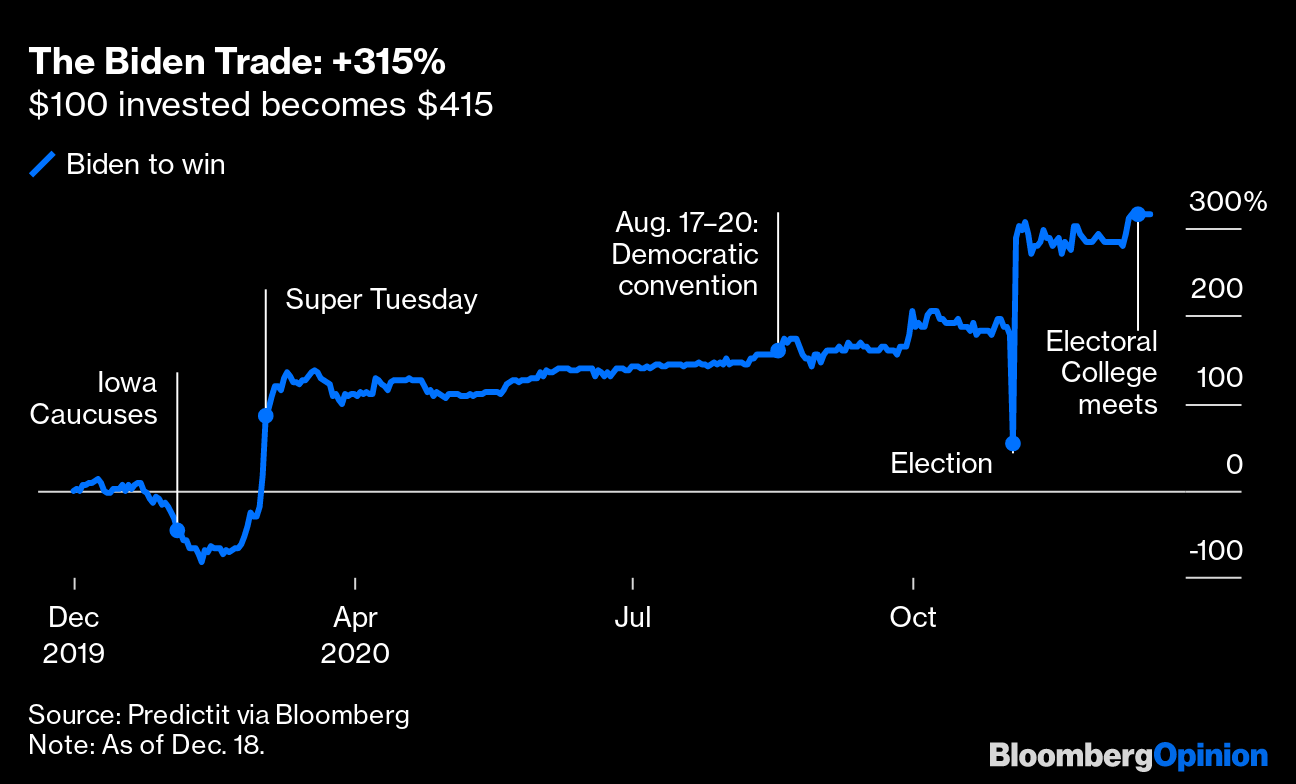

2020 HindsightAs the miserable year of 2020 has almost reached its end, it is time to return to the offices of Hindsight Capital LLC. For those unfamiliar with the work of this great, albeit imaginary, hedge fund — which I visit every year at about this time — Hindsight Capital invests with the benefit of a style guaranteed to beat all others year after year: hindsight. All of its trades are placed at the beginning of the year, in full knowledge of what will happen. As such perfect vision would allow for infinite returns, certain limits are imposed on Hindsight Capital's managers: It is not allowed to trade during the year; it cannot use leverage; and it is not allowed to invest in individual stocks, instead having to make broader or sectoral bets. Hindsight can, however, make "long-short" trades, buying one security while betting against another by "shorting" it (borrowing and then selling, so as to profit if it falls in price before needing to be paid back). Hindsight also must be able to explain how someone might have made such a trade based on only what they knew at the time. Foreknowledge of earthquakes and hurricanes, for instance, is not allowed. As for the pandemic, at the beginning of this year, Hindsight Capital's managers were aware of the novel coronavirus in Wuhan and had little difficulty in predicting how the world would react and what its effects would be. That was crucial, as will be seen. Here, then, are Hindsight Capital's trades for 2020: Go to RioHindsight Capital always bases itself in the country with the year's weakest currency. In 2020, that was Brazil, giving its managers a great excuse to live out the pandemic from an office overlooking Ipanema Beach. Whenever the world hits a rough patch, it's a safe bet that Latin American assets will be grievously affected. Brazil made its position worse with President Jair Bolsonaro's lamentable handling of Covid-19. Even before the pandemic, the central bank had slashed interest rates below the rate of inflation — once an almost unimaginable development — to combat a slumping economy. Whatever the investment, a weak currency transforms it (a phenomenon known as money illusion): hot "FAANG" stocks (a group of dominant internet platform companies based around Facebook Inc., Amazon.com Inc., Apple Inc., Netflix Inc. and Google's parent Alphabet) gained 160% in Brazilian reais and only 76% in Swedish kroner, the year's strongest currency; 20-year Treasury bonds gained only 2% in kroner, but 50% in reais.   Catching RaysThe coming pandemic would mean lower demand for oil. Meanwhile, OPEC+ was fracturing, with tensions between Iran, Saudi Arabia and Russia growing unmanageable. All of them had an interest, though, in squelching the fracking boom in the U.S. When the oil price falls, as it did catastrophically, those most hurt are oil-exploration companies — demand for their services collapses. Normally, lower oil prices also hurt alternative energy; in 2020, however, with the winds of deglobalization blowing strong, and with breakthroughs in solar power technology as solar companies consolidated, this was the time to put money into solar. It was a spectacular success. Putting the trades together made 431%.  Lockdown LifestylesIt was clear to Hindsight that the pandemic would freeze travel and any activity that involved people meeting together in large groups. Therefore, it logically bet against hotels, resorts and cruise lines. As for beneficiaries: Companies that make it easier for us to work together or entertain ourselves without physical contact were bound to do well, and these include many names in technology. The "FAANG" stocks in particular also have the advantage of being entrenched monopolies with reliable profits — exactly the companies that will thrive when the economy is in trouble. Put the trades together, and the FAANGs gained 100% while the hotels index fell 28%, having been down 68% at the worst in April. Hindsight made 178% on the trade (which topped at 243% before Pfizer Inc.'s announcement of successful vaccine trials on Nov. 9).  Bricks to ClicksWith people stuck indoors, the moment for a final coup de grace to the traditional retailing model had arrived. Many struggling store chains were on life support anyway, but Hindsight decided to bet against real estate investment trusts investing in regional malls, which had a thoroughly predictable nightmare year. Meanwhile, Amazon may have already been a well-discovered story, but Hindsight foresaw the excitement to invest in any company with guaranteed profits and loved the prospects for the internet retailers as ever more of their brick-and-mortar competitors vanished forever. The trade made 198% (and would have made 293% if profits had been taken the day before the Pfizer vaccine announcement). Going LongOnce the pandemic hit, it was a perfectly safe bet that countries of the West would respond by slashing rates and printing money. It's how they have always attempted to deal with crises in recent history. This year's response was extreme, driving real interest rates to historic lows. In such an environment, banks will suffer; they need higher rates to make wider profit margins. And the euro zone saw the lowest rates. Meanwhile, the bonds with the greatest duration, or sensitivity to changes in interest rates, will do best. Austria's century bond, issued in 2017 and not repayable until 2117, was the perfect vehicle. Panic measures by central banks effectively penalized banks and poured money into anyone prepared to lend to governments for the very, very long term. Shorting the banks and using the money to lend to Austria made 83% in local currency, having peaked at 158% before the vaccine announcement.  Home Sweet HomeCheap rates make it easier to buy a home. The pandemic spurred many people to try to leave big cities — something that is relatively easy to do in the U.S., where there are few restrictions to building new housing. So, Hindsight played a likely surge in homebuilding by buying futures in lumber, where the boom would show up first. Meanwhile, central bank intervention and the ultralow rates it sustained would make life prohibitively difficult for mortgage REITs, which aim to make money by financing mortgages. Put them together, and the trade made 213% for the year. (It had peaked at 303%).  Crypto ManiaThe pandemic meant that there would be cash aplenty seeking a home; it also meant that confidence in governments, already seemingly rock bottom, would crash yet further. What could be more obvious, then, than to put money into cryptocurrency, an exciting investment that coheres with libertarian distrust of governmental overreach? Bitcoin is the best known cryptocurrency, but Ethereum, which embeds contracts in the blockchain, was an even more exciting prospect. Buying Ethereum made 464% in dollars (and 631% for Hindsight, which made the trade in Brazilian reais, against 394% in Swedish kroner; Bitcoin, even in reais, made only a paltry 388%).  China Rising ...With China rocked early in the year by the pandemic, it was a safe bet that the country would press the accelerator again. Rather than hope to stimulate the Chinese consumer, this meant big infrastructure spending — and that meant a big rise for the industrial metals that China needs, led by iron ore. China would gain strength from cheap oil, which was guaranteed by weak demand elsewhere and the dissension within OPEC+. So Hindsight shrewdly bet against crude and went long iron ore. The trade briefly tripled Hindsight's money in late March; by year's end it had made a profit of 136%.  … Neighbors, TooChina's recovery helped keep the global economy together, but the best way to play this was through the stock markets of the countries most closely linked to it: Taiwan and particularly South Korea. Both expertly limited the damage of the pandemic, while their corporate sectors, more mature and more popular with Western investors than China's, profited even more than companies on the Chinese mainland. Brazil should eventually benefit from resurgent Chinese demand. In 2020, the story was about the victory of Asia — and its successful management of the pandemic — and the defeat of Latin America, which was already deeply troubled before it succumbed to Covid-19. Putting the trades together made 70%.  A Bet on BidenAt the start of 2020, it seemed unlikely that a 78-year-old white man who's been in Washington forever and has a penchant for misspeaking would have a shot at winning the White House in the charged atmosphere of the moment. And yet, Hindsight Capital saw that the Democrats were desperate to beat Donald Trump above all else and that the way to do that was to reclaim the three Rust Belt states they lost by tiny margins in 2016. Biden — a moderate born in Pennsylvania — was plainly the best candidate to do that, and the party went with him. He did what he had been hired to do, narrowly winning those states to retake the presidency. There was a huge turnout and much anger, but Trump's 2016 victory had always relied on a combination of circumstances unlikely to be repeated; Biden made sure they weren't. Betting on him at the beginning of the year in the Predictit futures market yielded a massive 315% return. Hindsight's managers, however, were still annoyed that the rules prevented them from buying Biden futures at his political nadir in February, after crushing losses in Iowa and New Hampshire; that would have netted them 2,153%.  Summing UpIs Hindsight Capital a fair benchmark for others? No. Everyone in the real world has to hedge against the possibility that they are wrong. Foreseeing the pandemic from the evidence available last December would have been difficult. But only a few assumptions were needed to make Hindsight's trades: the pandemic would affect the economy, the West would deal with it far worse than Asia, and the main response would be cheap money. Throw in the implosion of OPEC+, which again could be seen coming, and it turns out most of these trades could have been put on without much hindsight at all. As for next year, it is noticeable that a number of these trades have turned down since Pfizer announced its vaccine test results. This has since led to government approvals in the U.S., U.K. and European Union and the start of a massive inoculation campaign — aided also by Moderna Inc.'s shot and others to come — that promises to put the pandemic's end in sight. Will this continue into 2021? Alas, Hindsight Capital wouldn't tell me, nor would it disclose its trades for next year. —Elaine He contributed graphics. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

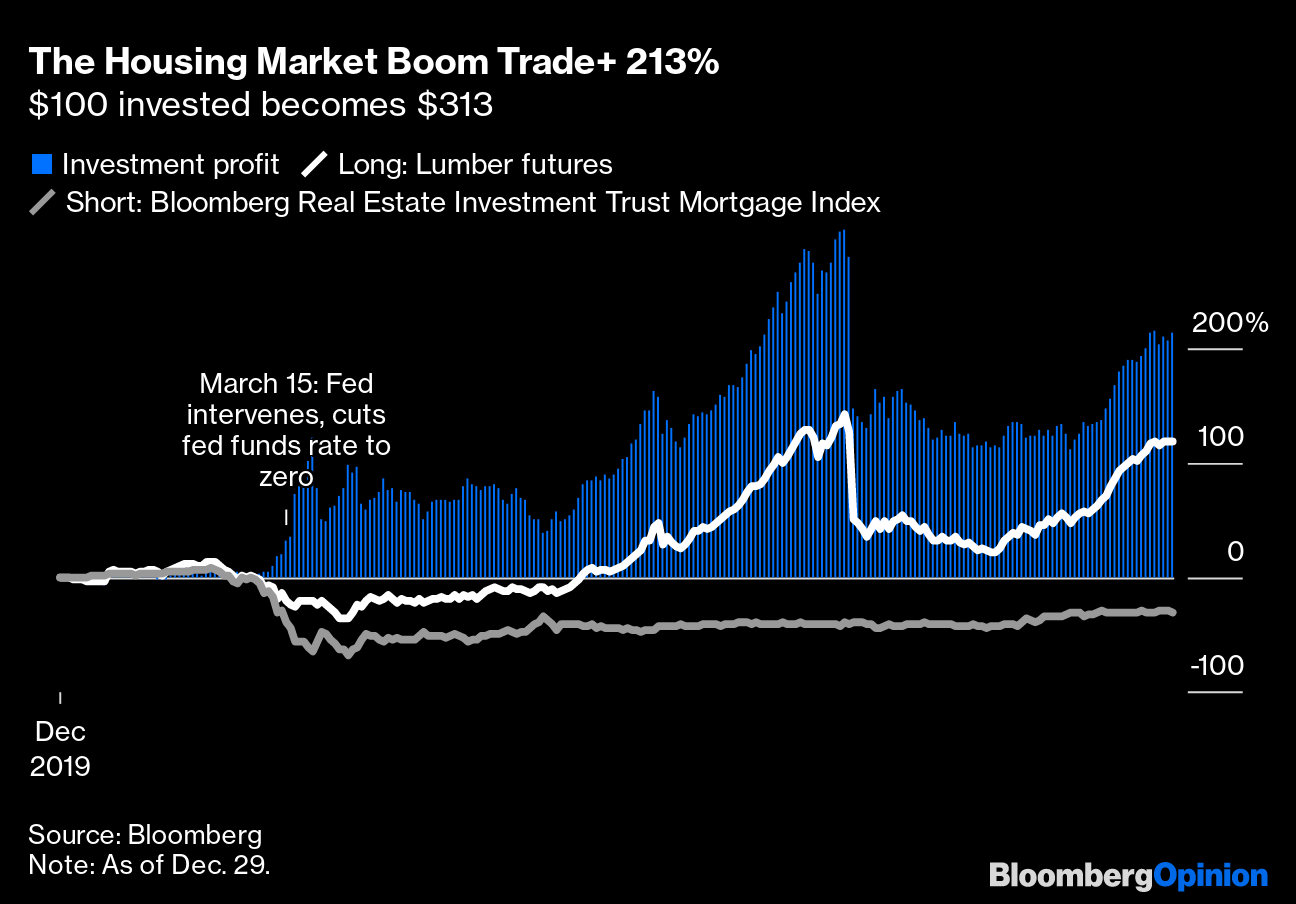

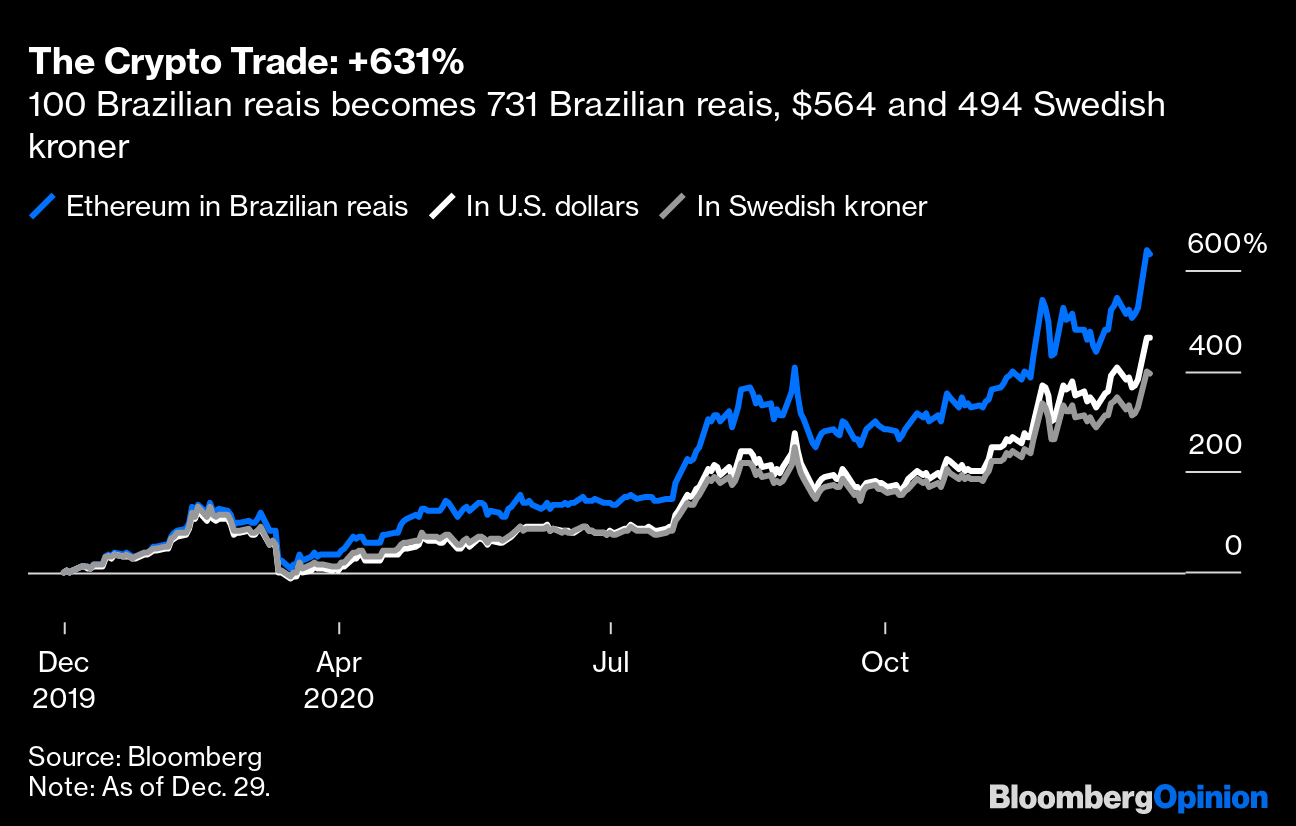

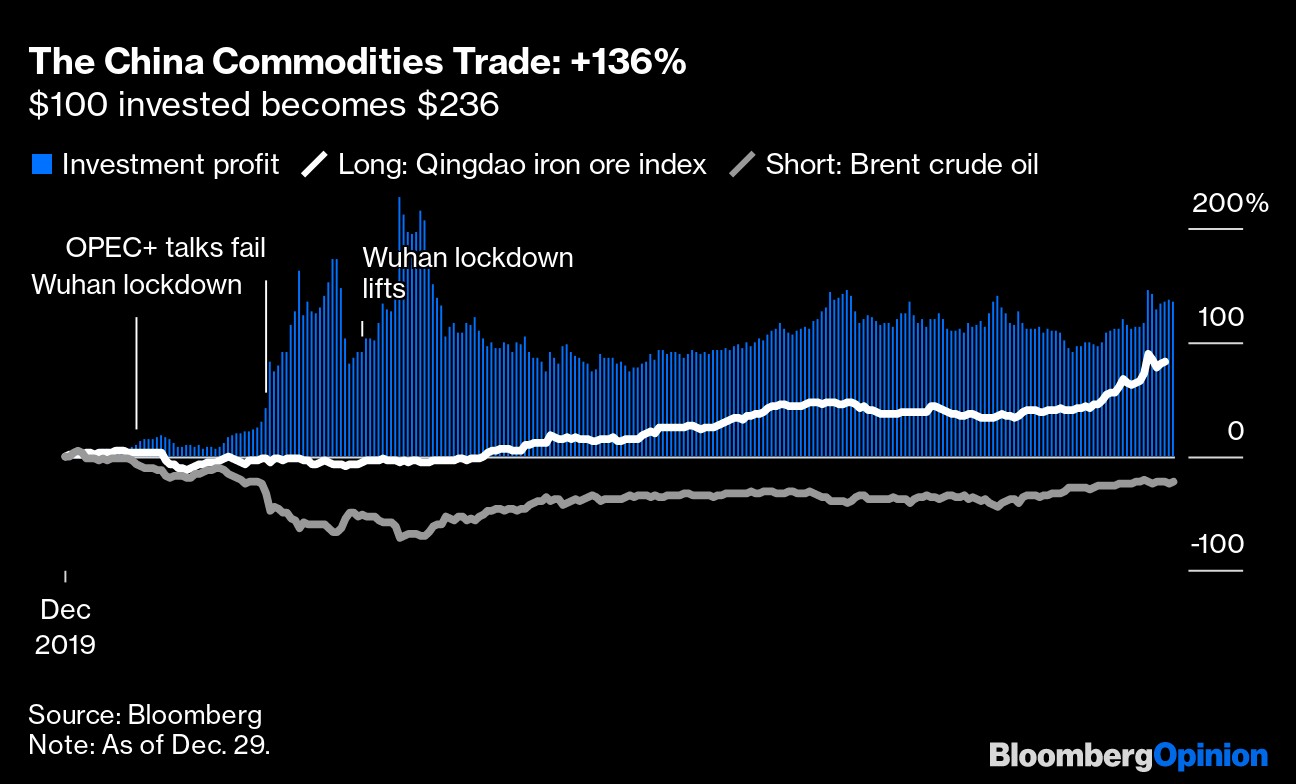

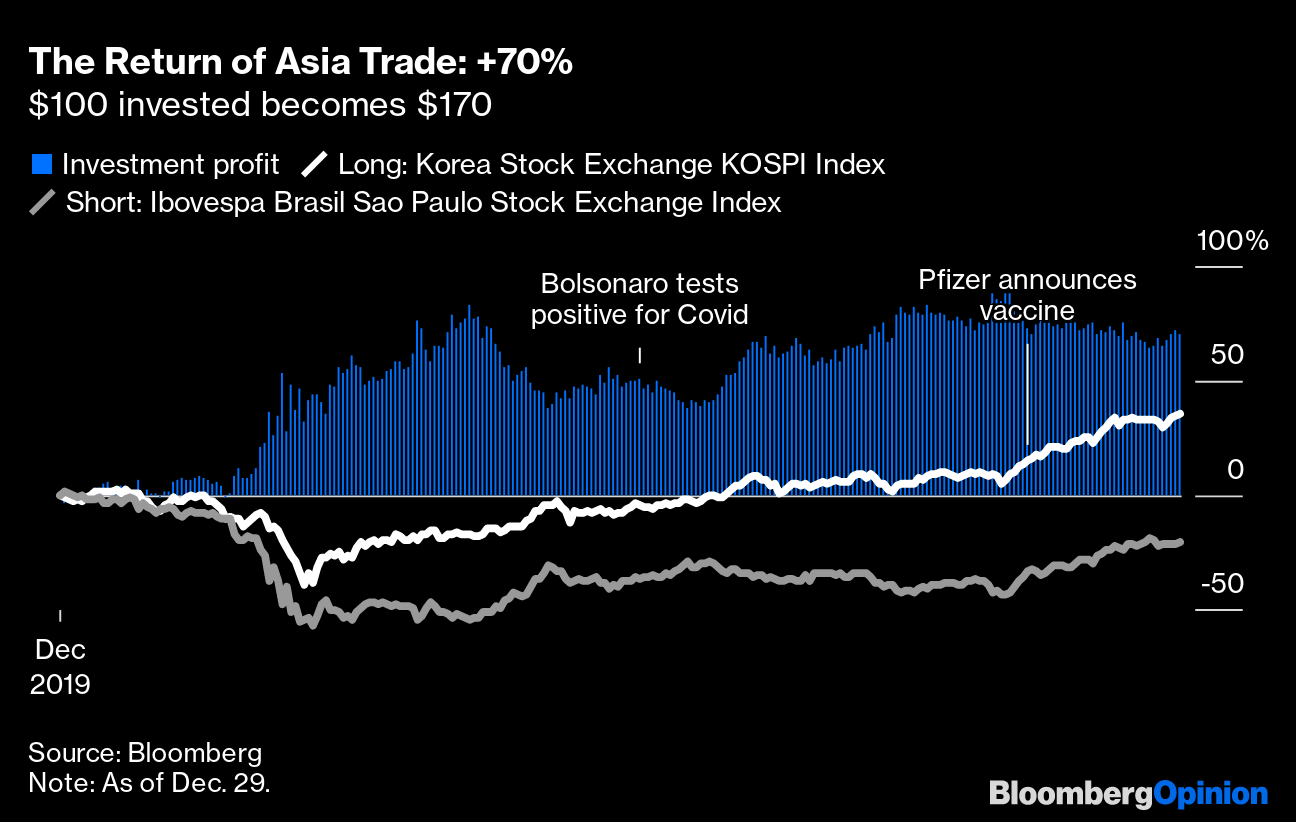

Post a Comment