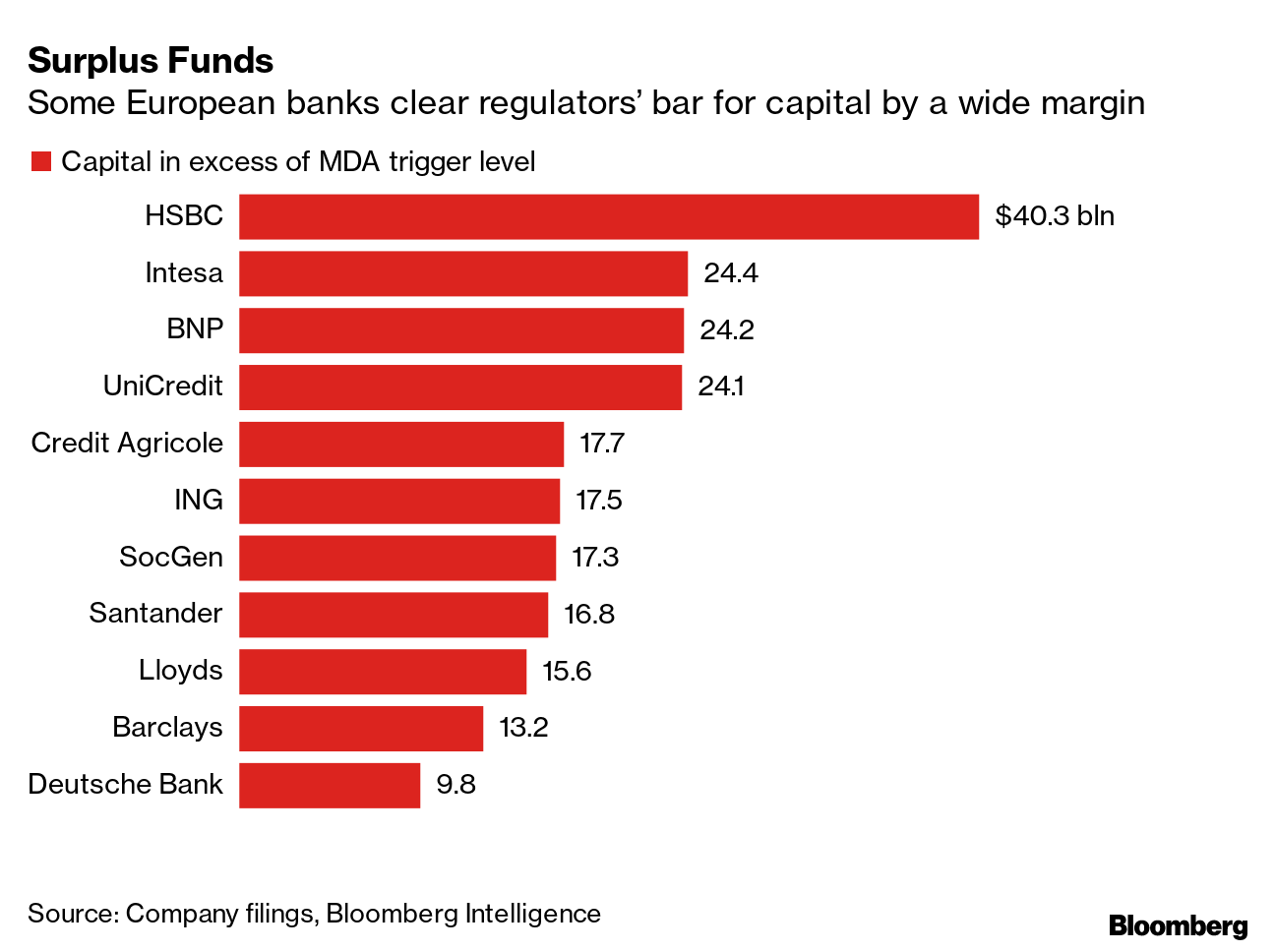

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. European leaders managed to salvage one historic deal, but are struggling to deliver another one. As the Brussels Edition goes to press, they are still continuing their negotiations over a stricter emissions-cut target for 2030. The all-nighter reflects the high stakes at play. A binding commitment to a more ambitious climate goal means a radical overhaul of the continent's economy and requires enormous investment, for which someone has to pay. For investors and struggling businesses, though, the key takeaway from this summit is that a substantial fiscal stimulus financed by jointly backed debt is going ahead. This will be topped up by even more monetary policy support extended from the European Central Bank yesterday. Sure, compromises were made along the way. And the potential delay in the climate goals deal highlights the EU's East-West rift. "But," as the poem goes, "is there anything human without some fault? And after all, you see, we do go forward." — Nikos Chrysoloras What's HappeningBrexit Drama | Where there seems to be no sign of a deal is a post-Brexit trade accord. Talks are set to continue until Sunday's declared deadline, but both sides of the channel seem all but resigned to the prospect of this falling apart. Still, miracles do happen, occasionally. Euro Summit | The summit continues today, with leaders set to discuss efforts to shore up the euro's architecture after their finance chiefs struck a long-anticipated deal on reforming the region's bailout fund. While that should give impetus to key outstanding reforms like common deposit insurance, the draft statement we've seen doesn't suggest efforts will intensify, calling instead on finance ministers to "prepare a stepwise and time bound work plans" on remaining banking issues. Nuclear Risks | As if 2020 wasn't bad enough already, a nuclear reactor in Finland halted power generation yesterday after an internal radiation leak. And failing cooling systems and steam absorber malfunctions in a nuclear plant in Belarus are serious enough to spook EU leaders. News that the 330-ton casing for the plant's atomic core slipped from a crane and plunged to the ground didn't help. Week-Ahead | Besides the Brexit finale, the biggest news we expect next week is the European Commission's digital regulation proposals on Wednesday. Social media and other tech platforms could face fines as high as 6% of global revenue if they don't comply with orders to remove terror propaganda or other illegal posts, according to a draft of the proposed new rules we've seen. In Case You Missed ItCyber Attack | The EU drugs regulator says it remains "fully functional" after a recent cyber attack. The Amsterdam-based European Medicines Agency also confirmed it will decide by Dec. 29 on authorizing Pfizer-BioNTech's coronavirus vaccine and do the same by Jan. 12 for one from Moderna. Virus Update | France eased some of its key lockdown measures, while extending other curbs and introducing a new curfew. London is on course to be placed in the toughest tier of virus restrictions next week. Here's the latest. Turkey Sanctions | EU leaders vowed to expand a list of Turks targeted with travel bans and asset freezes over Ankara's offshore drilling activities in the Eastern Mediterranean and threatened to consider broader punitive measures in the spring. It's doubtful whether any of this makes a difference in Turkey's clash with Greece and Cyprus over competing maritime claims in the region. Expensive Pollution | Carbon allowances in the EU rose to 31 euros, matching the record from 2006, as policy makers step up measures to cut greenhouse-gas emissions and meet increasingly ambitious climate targets. The price of carbon is a vote of confidence from the market that the EU is serious about reducing greenhouse gases significantly in the coming decades and a signal to industry about the costs of continuing to pollute. Chart of the Day European watchdogs are leaning toward extending the de facto ban on bank dividends well into next year, while allowing some lenders to make payouts if they can show sufficient financial strength. A potential compromise is building among central bankers and regulators that lenders should only be allowed to resume payouts when they have enough capital to absorb future losses stemming from the pandemic. Today's AgendaAll times CET. - 1 p.m. Emer Cooke, European Medicines Agency executive director, speaks about how safe and effective vaccines are developed and authorized in the EU

- 2 p.m. German Deputy Finance Minister Joerg Kukies speaks at CEPS think tank event

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment