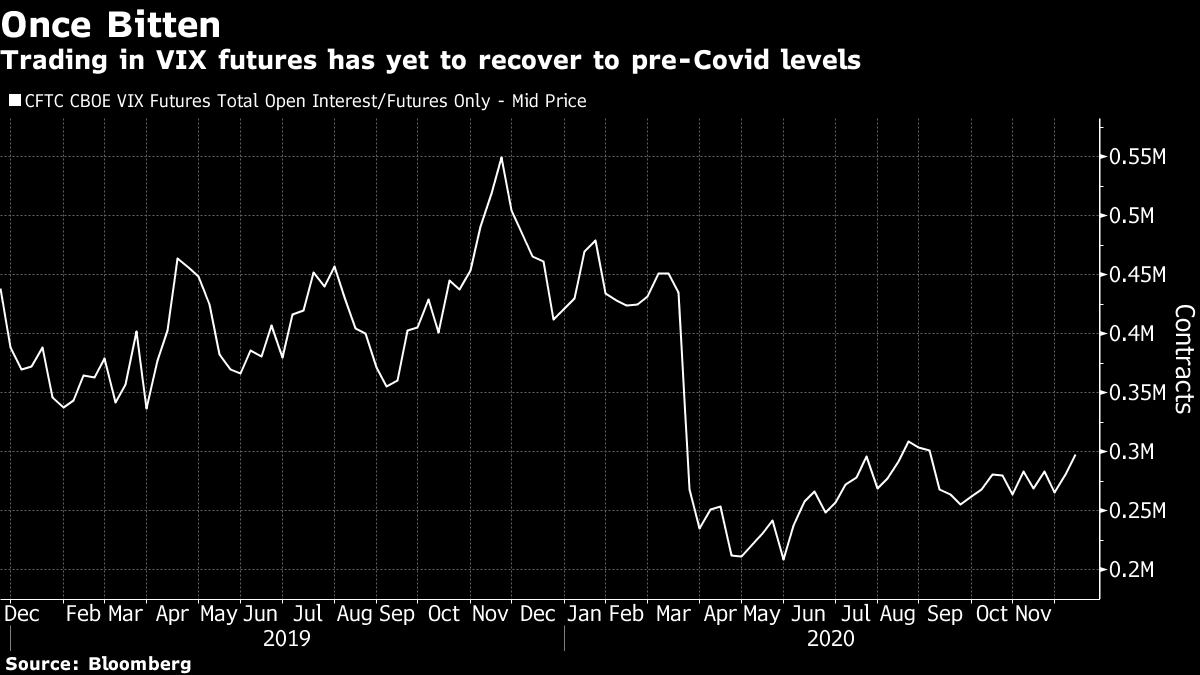

| Stimulus package of $900 billion nears, French president has Covid, and jobless claims due. Today?Stop me if you've heard this one before, but it looks like there may be a U.S. fiscal stimulus package unveiled today. Talks between congressional leaders have coalesced around a $900 billion deal that would include payments to individuals while omitting the state and local government aid as well as lawsuit-protection liability that have stalled the talks for months. With government funding running out tomorrow night, the timing has become very tight. Senate Majority Leader Mitch McConnell warned Republican senators in a private call that they should be prepared to work through the weekend. Covid French President Emmanuel Macron has become the latest world leader to test positive for Covid-19, with his office announcing this morning that he has mild symptoms. The news comes as the pandemic continues to rage across Europe, with Germany reporting 45,000 new cases this morning, its biggest ever jump. The U.S. saw a record 3,835 deaths from the virus yesterday, however, the growth in cases is slowing, particularly in the Midwest. The scale of the task in vaccine distribution is becoming clear, with some hiccups emerging in the effort to send shots across the U.S. Claims There is not expected to be much improvement from last week's surprise surge in initial jobless claims to 853,000 when the data is published at 8:30 a.m. Eastern Time. The median estimate from economists surveyed by Bloomberg is for a modest decline to 815,000 and continuing claims to drop only slightly. Also worth keeping an eye on before the open will be the Bank of England's last policy decision of the year following a meeting that would have been overshadowed by the ongoing uncertainty over trade negotiations with the EU. Markets riseStimulus talks, speed of vaccine distribution and continued dollar weakness in the wake of yesterday's Fed decision are the dominant themes in markets. Overnight, the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 0.4% higher. In Europe, the Stoxx 600 Index had gained 0.4% by 5:50 a.m. with miners among the strongest performers. S&P 500 futures pointed to more green at the open and the 10-year Treasury yield was at 0.925% while oil and gold both rose. Coming up... U.S. housing starts and building permits numbers and the Philadelphia Fed Business Outlook are at 8:30 a.m. Kansas City Fed manufacturing activity for December is at 11:00 a.m. The Bank of Mexico rate decision is at 2:00 p.m. FedEx Corp., Accenture Plc and BlackBerry Ltd. are among the companies reporting earnings today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Yakob's interested in this morningWhen the Cboe Volatility Index surged to a record high nine months ago, hedge funds like Malachite Capital Management that had made leveraged bets on market tranquillity imploded. Now things may be looking up for a strategy that surely ranks among the most high-profile wipeouts of the Covid crash. A new firm from Wall Street veteran Dennis Davitt is looking to raise more than $1 billion over the next 12 months to launch strategies that include shorting equity volatility. After taking a beating in March, short-vol strategies have largely remained on the sidelines. But Davitt, who previously worked at Malachite as well as Harvest Volatility Management, is betting the appetite will return. One sign that he's learned something from his Malachite days: Davitt says he'll cap the money in his funds and limit leverage to 1.5 times unless the client requests more.  Follow Bloomberg's Yakob Peterseil on Twitter at @YPeterseil. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment