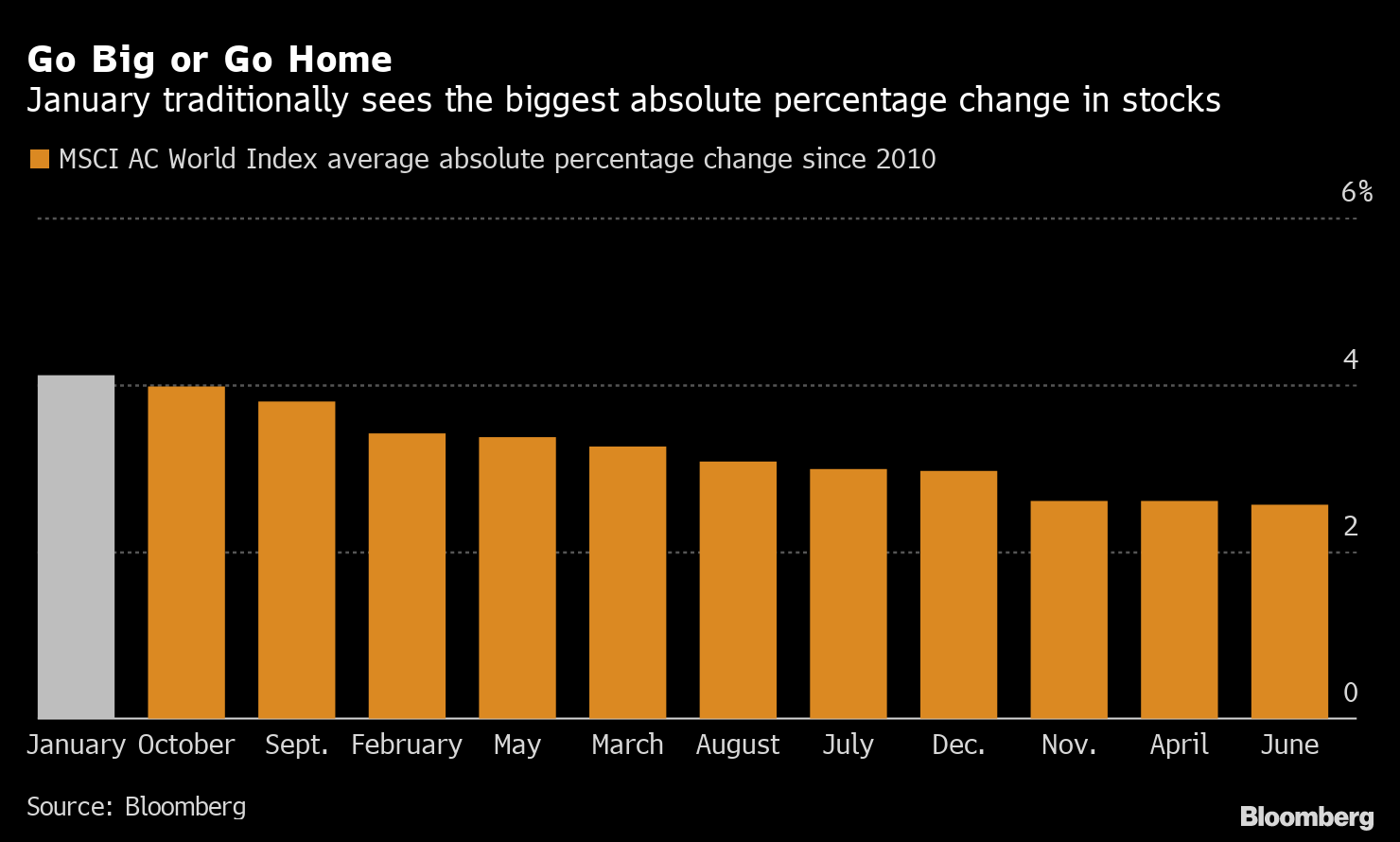

| Good morning. Tension in Brexit talks increases, governments push for vaccines and a major cybersecurity breach. Here's what's moving markets. BlockedEuropean Commission President Ursula von der Leyen said "big differences" remain in the Brexit trade talks with the U.K., with fisheries still the main sticking point between the two sides. The U.K., meanwhile, warned progress in the talks had been "blocked" and that time is running out for a deal to be done. Officials have expressed confidence that a deal may be struck before next week, however, with talks making progress behind the scenes despite the negative rhetoric publicly. And U.K. businesses are hoping for a grace period to adjust to post-Brexit rules. VaccineThe European Union is pushing for vaccinations to start just after Christmas, with an update from a key advisory committee due on Monday. The need was likely given extra impetus after French President Emmanuel Macron tested positive for Covid-19, after which a number of European leaders had to isolate having come into contact with him. In the U.S., Pfizer is pushing back on claims it is experiencing issues in producing its Covid vaccine and is continuing talks on a pact with the U.S. government. Meanwhile, case numbers worsened in Los Angeles and New York. Huge HackThe U.S. nuclear weapons agency, at least three states and Microsoft have all had their systems exposed to what increasingly appears to be one of the biggest cybersecurity breaches in recent memories. Hackers tied to the Russian government are suspected of being behind the attack, which took advantage of weakness in the electronics supply chain to penetrate several U.S. federal agencies, with the list of victims continuing to widen. President-elect Joe Biden said he plans to make cybersecurity a "top priority" when his administration takes over, while President Donald Trump has yet to address the issue. Bitcoin's RiseThe rapid rise in Bitcoin's price this week has sparked more warning of a bubble as the cryptocurrency soars past records. The rally has systematic traders dabbling in playing the trend, and there are plenty of considerations for investors to take into account before they indulge their FOMO and jump aboard. Some see it, alongside copper, as a risk-on growth proxy investment. Coinciding with the rise -- which moderated on Friday -- cryptocurrency exchange Coinbase Global filed for an initial public offering, entering into another part of the market which has been prone to huge price pops recently. Coming Up…European and U.S. stock-futures are pointing lower heading into Friday's session, after a mixed day in Asia on low volumes. Oil prices are poised for a seventh weekly gain as lawmakers in the U.S. work toward a stimulus package that could help to boost demand. The earnings and economic calendars in Europe are pretty bare, though watch for any reaction to Germany's Siemens reviving plans to sell its logistics arm. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith positive catalysts in the rear-view mirror, the risk-asset rally could struggle to maintain its course in the new year, as it navigates a worsening virus situation and tougher economic environment. Since 2010, January has tended to see the biggest shifts in the MSCI All-Country World Index; six times posting gains, five times declines, for an average absolute move of 4.1%. The gauge is trading at an all-time high after a near 70% rise since the March low. Chances are the new year will begin with a stimulus deal in Washington, a Brexit agreement and a vaccination campaign under way. Where is the next imminent positive catalyst? Republicans seem determined to tie the hands of the incoming Biden administration, suggesting Democrats will have their work cut out approving further stimulus. More immediately, January could be a particularly cruel month on the coronavirus front. The world is heading into a holiday season -- where the social need to come together may prove too strong to resist -- with daily cases and deaths back at record levels in many places. The latest jobs figures suggest the U.S. labor market's recovery is faltering, while retail sales have disappointed for two straight months. European car sales are slumping again. Of course, there are positives to latch on to, not least the welcome roll-out of vaccines around the world. And stock markets are forward-looking. But after such a fantastic run, and with a lot of good news already in global equity prices, the odds point toward declines in January. History suggests that such a pullback could be meaningful.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment