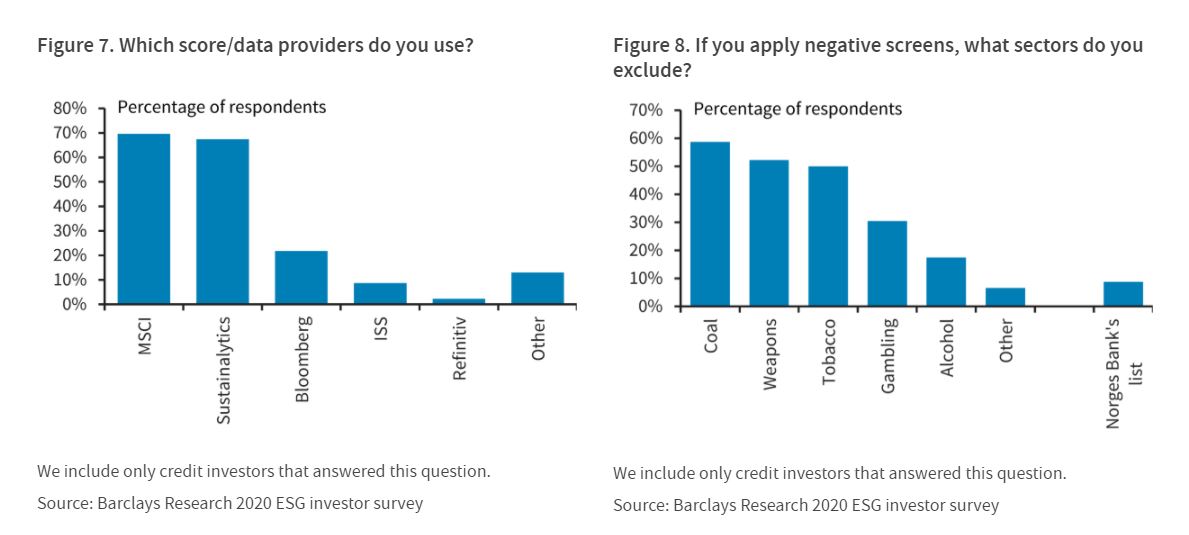

| Australia sounds trade warning. Giuliani tests positive for Covid-19. Markets aim higher. Australia issued a warning on trade, saying uncertainties from its souring ties with China and the lingering impact of an earlier drought will push down the value of its agriculture exports. The value of shipments is set to decline 7% in 2020-21 to the lowest level in five years, according to a report from the government forecaster Abares. While that's a slight improvement from its September estimate of a 10% slump, the downturn comes in a year of solid domestic production growth. President Donald Trump said his attorney Rudy Giuliani, 76, has tested positive for the Covid-19 virus. All Americans who want a Covid-19 vaccination should be able to get one by the second quarter of next year, Health and Human Services Secretary Alex Azar said. Records broke Sunday in California, New Jersey, Virginia and North Carolina. Even as vaccines roll out -- with the first shots possible Friday -- the U.S. outbreak is expected to worsen, potentially reaching 400,000 fatalities by the end of January, said Scott Gottlieb, former commissioner of the U.S. Food and Drug Administration and a Pfizer Inc. board member. In the U.K., shots will begin on Tuesday. Asian stocks will look to build on the recent momentum that pushed U.S. shares to fresh records on Friday as investors weighed the outlook for policy support and signs the deployment of a vaccine may be nearing. The pound fell as concern grew on a Brexit deal. The S&P 500 notched a fresh all-time high on Friday, when equity futures in Japan and Australia climbed. Treasuries ended last week with the benchmark yield just under 1%, the highest in nine months. The pound retreated as investors questioned how close Britain and the European Union are to sealing a final Brexit trade agreement. U.S. payrolls figures Friday showed a less-than-forecast increase, fueling hope in some corners for more federal relief. A satellite-controlled machine gun was used in last week's assassination of a top Iranian nuclear scientist, the semi-official Mehr news agency reported. Mohsen Fakhrizadeh, who was killed in a gun and car bomb attack on the outskirts of Tehran on Nov. 27, was driving on a highway east of the capital when the weapon "zoomed in" on him "using artificial intelligence," Mehr said on Sunday, quoting Commodore Ali Fadavi, deputy commander of Iran's Islamic Revolutionary Guard Corps. Various accounts of his death have emerged since the incident. Brexit negotiations resumed in Brussels amid signs that one of the biggest obstacles to a trade deal is on the way to being resolved. As the U.K. and European Union strive to finalize a deal before Monday evening, a compromise on the longstanding stumbling block of access to British fishing waters is starting to emerge, two people with knowledge of the discussion on both sides said. That would leave the issue of the level competitive playing field as the main remaining hurdle. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayWhat's ESG? According to Barclays, it's now "too trendy to ignore," with environmental, social, and governance (ESG) funds this year pulling in more new money as a percentage of their portfolios than non-green funds. But the interesting thing about ESG is just how much disagreement still surrounds the label. According to Barclays, the vast majority of bond investors are using proprietary methods to determine ESG-friendly investments and score them on sustainability, resulting in a wide variation in what constitutes an ESG investment or not. On the flipside, almost everyone can agree on what is not ESG. Coal companies, tobacco firms, gambling businesses and the like are most likely to be shunned by ESG investors and excluded from new mandates.  Barclays' ESG survey shows little agreement on what constitutes ESG but a lot on what isn't ESG. Bloomberg That discrepancy risks producing a terrible distorting effect as ESG investing becomes more entrenched in the bond market and a bigger influence on corporate funding costs. It means companies deemed suitable for ESG investors can be rewarded or punished for their ESG credentials, but companies that are excluded from the ESG bucket entirely will likely be judged on traditional measures of investability. Companies with poor ESG credentials might see their funding costs rise, but companies with no ESG credentials at all will be unaffected (at least until ESG mandates come to dominate the market). If the point of ESG is to encourage companies to alter their behavior by changing incentives, then it would be better to include the worst offenders in the pool of discerning ESG capital rather than remove them completely from it. And since everyone seems to be able to agree on which sectors are currently the furthest removed from ESG ideals, what should really be in every ESG bond portfolio is tobacco, coal and gambling debt. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment