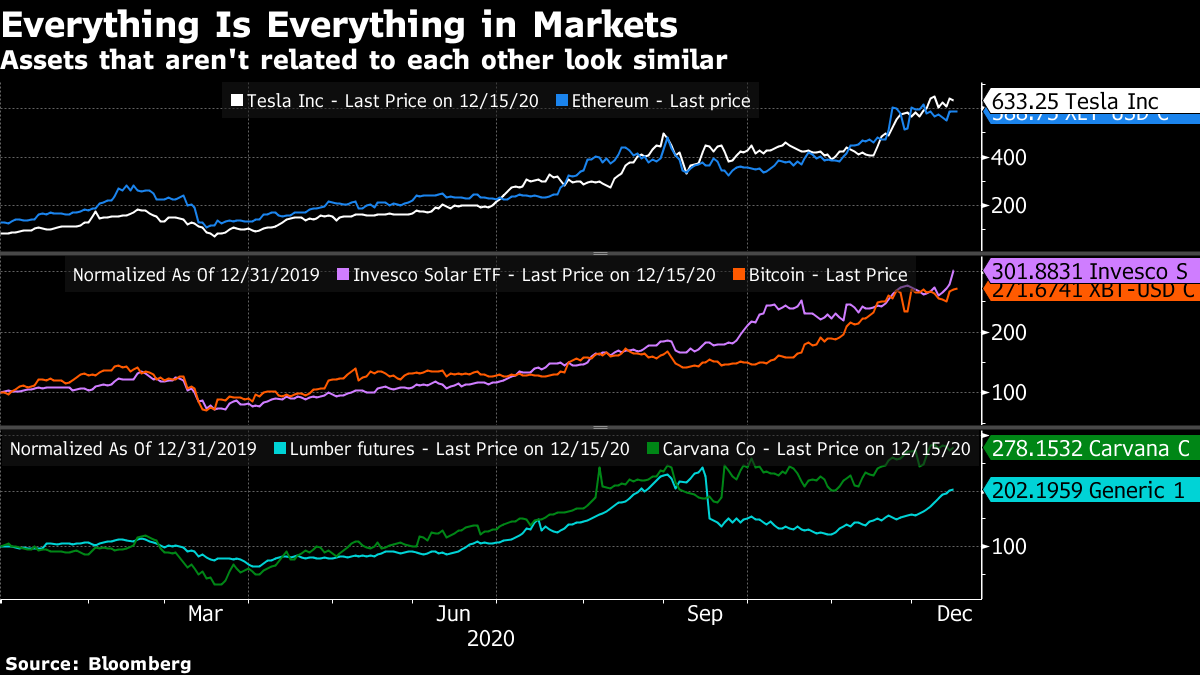

| Moderna's vaccine is on track for approval in the U.S. China prepares its economic priorities for 2021. And Vanguard's $1 trillion equity fund makes history. Moderna's vaccine is safe and effective for preventing Covid-19 in people ages 18 and older, U.S. regulators said Tuesday, clearing the way for a second shot to gain emergency authorization. The Food and Drug Administration also said that the experimental vaccine is 94.1% effective at preventing symptomatic Covid-19, confirming earlier results, but agency advisers still have to vote on whether to recommend authorization before a final FDA decision. Elsewhere in Europe, regulators will review Pfizer's vaccine earlier than planned, and Sweden's hospitals are facing a staff shortage. Asian stocks looked poised for gains after their U.S. peers halted a four-day losing streak, as Congress moved toward a spending package that would boost the economy. Futures pointed higher in Hong Kong, Japan and Australia after the S&P 500 rebounded from its longest slide since September. The 10-year Treasury yield moved above 0.90% as investors awaited the conclusion of the Fed's two-day meeting on Wednesday. The dollar weakened for a second day. Oil advanced with gold. China's leaders are likely to convene this week to lay out their economic priorities for 2021, with analysts expecting a renewed focus on slowing the pace of debt growth and insulating the economy from tensions with the U.S. The annual Central Economic Work Conference follows a year in which China loosened fiscal and monetary policy in response to the virus slowdown. Now that Beijing's satisfied with its handling of the pandemic and its economic expansion this year, the meeting will provide clues on how rapidly the leadership will tighten policy. Financial markets have already been spooked by the policy shift, and any signal of an early move could weigh on market sentiment further. A torrent of funds rushing into India's markets may tip the central bank's delicate balancing act in 2021. For most of this year, the Reserve Bank of India has capped currency gains as global investors poured around $50 billion into stocks in companies, boosting rupee liquidity in a banking system that's already flush with cash from the RBI's stimulus measures. There's growing consensus that the liquidity glut distorting money markets may spur the central bank to consider changes. Meanwhile, U.K. Prime Minister Boris Johnson will visit India in January for free trade agreement talks. A Vanguard Group equity fund has become the first of its kind to eclipse $1 trillion of assets, a testament to the rise of index-based investing over the past three decades. Vanguard Total Stock Market Index Fund, which includes both a mutual fund and an exchange-traded fund, had $1.04 trillion of assets as of Nov. 30, company data show. "Given that Vanguard birthed index investing, it seems only fitting that one of their flagship funds would be the first to reach this historic mark," said Nate Geraci, president of the ETF Store, an investment advisory firm. Here's more on the art of managing a fund that size. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in today"Everything is everything," sang Lauryn Hill some 22 years ago. It's an apt theme song for markets in 2020. Weird correlations are everywhere, and everything looks like everything else. My favorite example of this has to be Tesla and Ethereum, but you can find similar charts all over the place. Lumber futures and solar energy stocks are another odd pair, Carvana and Bitcoin yet another, and so on.  It's tempting to write these pairings off as coincidences but they might actually say something meaningful about markets. In an era of low economic growth and ample liquidity, investors can afford to buy "future growth" and wait. The growth narratives might look very different depending on the asset (Tesla will one day will dominate the market for self-driving cars, Bitcoin will see widespread adoption, solar energy will benefit under a Biden administration, and so on) but the fact they're moving in similar directions at the same time suggests they might have something in common. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment