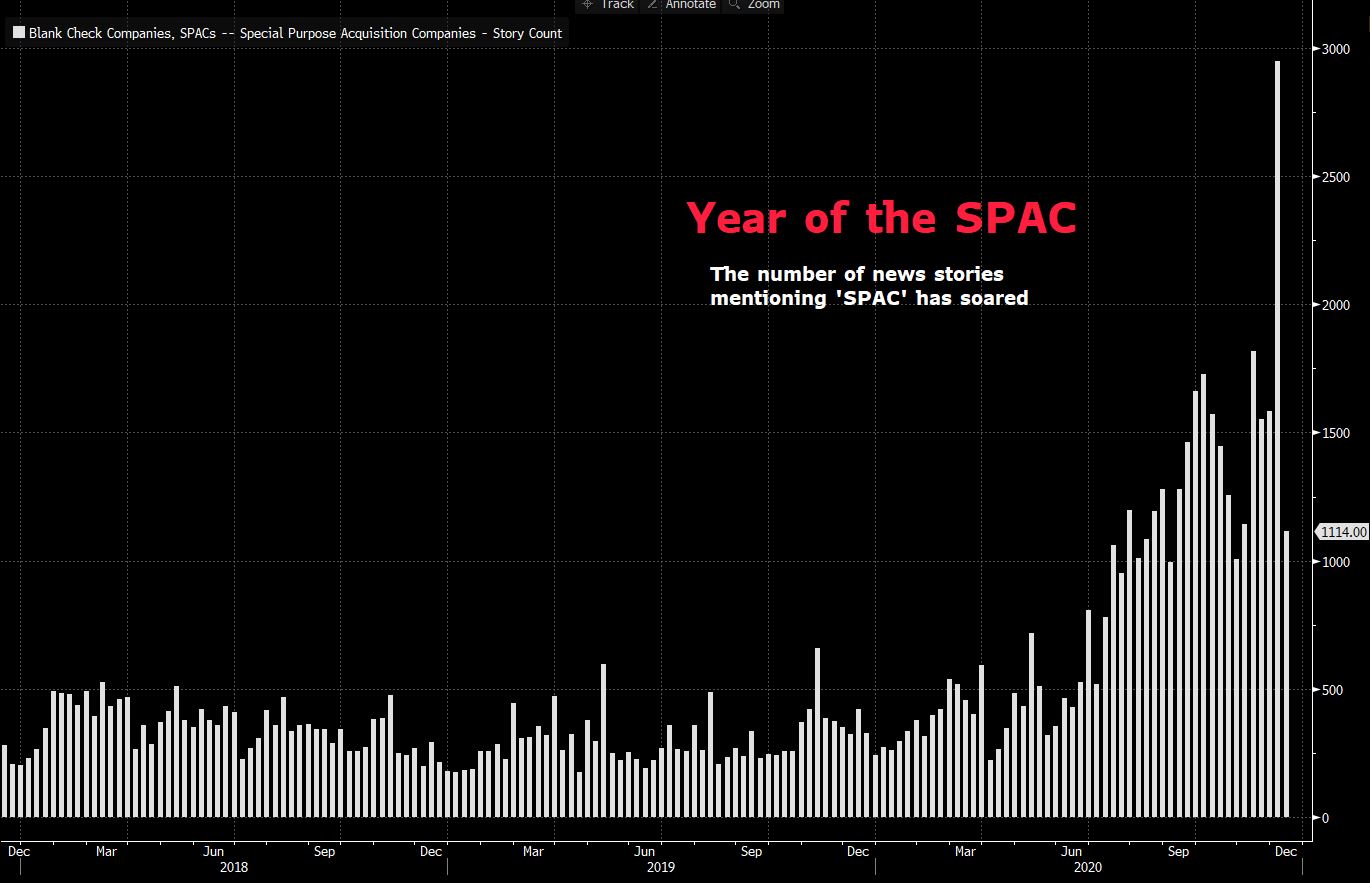

| Biden's victory is official. Beijing appears to formally ban Australian coal. China's central bank is set to inject more cash into the financial system. Joe Biden officially clinched the presidency after the Electoral College confirmed his victory Monday, capping a tumultuous period sparked by Donald Trump's refusal to acknowledge he lost with the help of Republicans willing to support his unsubstantiated claims. The 55 votes from California electors put Biden over the 270 needed to win. Monday's vote puts pressure on Senate Republicans and others who have refused to recognize Biden's overwhelming victory to finally acknowledge that Trump lost and Biden will be inaugurated as the 46th president on Jan. 20. The first Covid-19 vaccine shots were administered by U.S. hospitals Monday, the initial step in a historic drive to immunize millions of people as deaths passed 300,000. New York, the original epicenter of the U.S. pandemic, looks headed toward a second full shutdown. European governments are tightening restrictions, while Singapore approved Pfizer and BioNTech's vaccine and expects the first shipments by the end of the month, when it also plans to ease curbs. Japanese Prime Minister Yoshihide Suga said the government will suspend its "Go To" domestic travel incentive campaign. Markets MutedAsian stocks looked set for a muted open after a mixed session on Wall Street, as investors assessed the prospects for a federal spending package and the likelihood for further virus-related economic restrictions. The dollar retreated. Futures were little changed in Japan and Hong Kong, and dipped in Australia. The S&P 500 fell for a fourth session, capping its longest slide since September, while drugmakers led the Nasdaq 100 Index higher after Alexion Pharmaceuticals agreed to be bought by AstraZeneca. Energy producers tumbled after OPEC cut its demand forecast. Oil was lower most of the day before reversing. Treasuries were little changed. Australia's Trade Minister Simon Birmingham says he is "deeply troubled" by reports that China has formally banned imports of Australian coal, in the latest sign the dispute between the nations is worsening. More than 50 ships carrying Australian coal had been stranded off China after ports were verbally told in October not to offload such shipments, and now that ban appears to be official, with the National Development and Reform Commission on Saturday giving power plants approval to import coal without restrictions, except from Australia, the Global Times reported. China coal futures fell after the decision. China's central bank is likely to inject cash into the financial system Tuesday for a fifth straight month via the medium-term lending facility. With some 600 billion yuan ($92 billion) of one-year loans maturing in December, the People's Bank of China is expected to offer as much as 800 billion yuan in funding to banks, according to Huachuang Securities. The PBOC has sought to stabilize the amount of debt in the economy recently, as a policy of tapering stimulus measures has kept money-market rates elevated and triggered a string of high-profile corporate defaults. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in today"From a capital markets perspective, this year will undoubtedly be known as the year of the SPAC," declare Goldman Sachs analysts led by David Kostin. Blank-check companies have raised about $70 billion this year — a five-fold increase from 2019, according to Goldman's figures. And while many have tied the SPAC boom to investors' relentless search for yield, the Goldman strategists do so in a slightly different way. They argue that low interest rates have brought down the opportunity cost of sticking your money in a SPAC. When you're earning nothing on bank deposits or government bonds, it might make sense to put your money in a blank-check company that could in theory strike it rich with a savvy acquisition (and, if you don't like the acquisition, you can always redeem your SPAC shares).  Bloomberg Bloomberg In that sense, SPACs are a call option on future growth. The problem of course is that SPACs aren't necessarily competing with bank deposits and government bonds but are instead competing with other call options on future growth — which includes almost everything nowadays. Tech stocks with massive valuations are a call option on future growth. U.S. stocks trading near all-time highs are a call option on future growth. Anyone investing in a SPAC is effectively betting that management will be able to identify and produce growth at a higher rate than what's available in the universe of public stocks or traditional IPOs. With the S&P 500 up 13% year-to-date and some $61 billion in proceeds from over 200 SPACs still to be deployed, it might be tough for SPACs to compete. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment