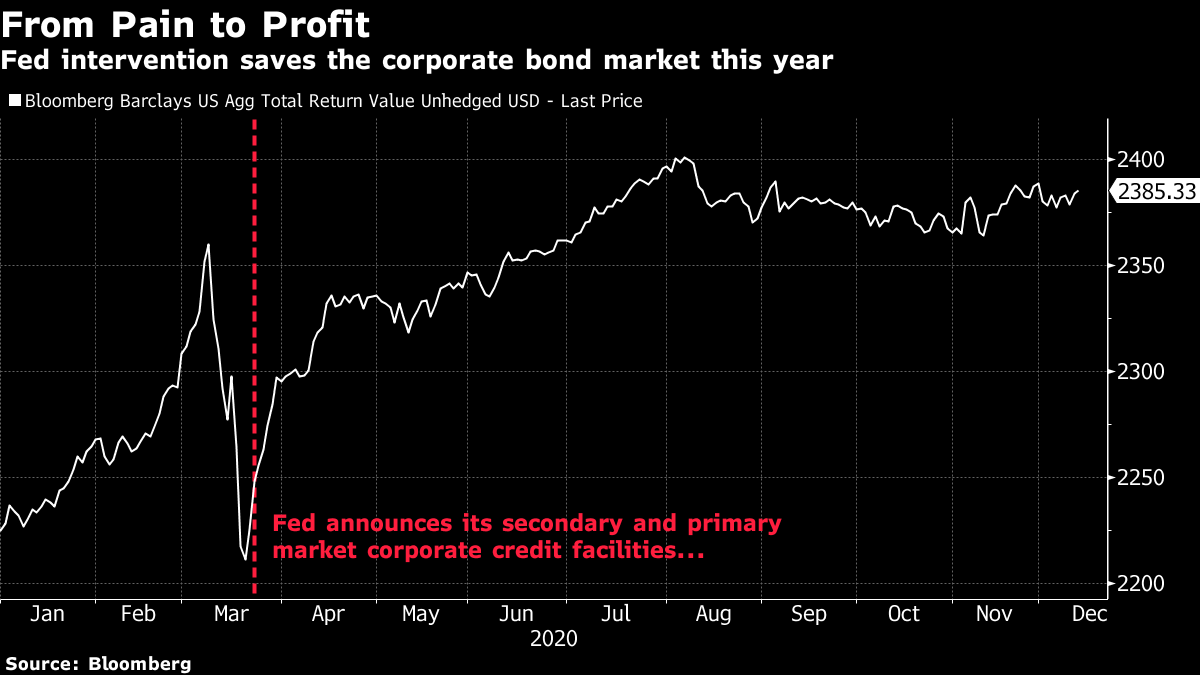

| Brexit talks extended. U.S. relief bill coming Monday. And the first vaccine doses will be delivered to Americans. More TalksThe pound rose after the U.K. and the European Union said they will continue talking about a trade agreement, keeping hopes for a late deal alive. U.K. Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed to go the "extra mile" and keep working on a post-Brexit accord. The duo had earlier said that negotiators had until Sunday to come up with a deal. Strong Yuan The unrelenting pace of inflows heading for China's bonds and stocks has one yuan bull predicting the currency could strengthen to a level not seen in nearly three decades. A "flood" of foreign cash will chase yuan-denominated assets in 2021 because they'll offer far better yield than the rest of the world, according to Liu Li-gang, chief China economist at Citigroup. He predicts the currency could rally 10% to 6 per dollar — or even more — by the end of next year. The yuan hasn't been that strong since late 1993, just before China's unification of official and market exchange rates triggered a plunge in the currency. Markets Open Stock traders will be watching the start of U.S. futures trading as the first American vaccines are deployed and investors weigh the latest development for a stimulus bill. The first deliveries of Pfizer-BioNTech vaccines are scheduled for Monday. A bipartisan group of lawmakers will unveil a $908 billion pandemic relief bill the same day, although there is "no guarantee" Congress will pass it, a key negotiator said. The currency markets saw a lively start to the week, with the pound surging more than 1% against the dollar. Pandemic Bill Senator Joe Manchin, a West Virginia Democrat, said on Fox News Sunday that lawmakers will "have a bill produced for the American people tomorrow, $908 billion." Democratic and Republican lawmakers engaged in the talks have said they completed detailed proposals on small business help, vaccine-distribution funding and other key areas. The sticking point is how to shield employers from virus-related lawsuits, a top demand of Senate Majority Leader Mitch McConnell. Iran Tensions Iran's Foreign Ministry summoned the ambassadors of Germany and France after they denounced the Islamic Republic's execution of a dissident journalist, the semi-official Iranian Students' News Agency reported on Sunday. Ruhollah Zam, who ran a Telegram channel that campaigned against Iran's leadership from his base in southern France, was hanged on Saturday morning after he was accused of inciting widespread unrest in late 2017 and convicted of "corruption on earth," a capital offense in Iran. What We've Been ReadingThis is what's caught our eye over the weekend And finally, here's what Tracy's interested in todayAs this unusual year draws to a close, it's natural to start thinking of what we've learned from the past 12 months. One of the biggest events of 2020 has been the Federal Reserve's moves to provide emergency assistance in such a way, one might argue, as to turn market pressure points into opportunities for profit. The lesson here: If those pressure points are big enough and if they affect the wider market and financial conditions, then the central bank will step in to fix them. Perhaps the best example of that has to do with corporate bonds. For years, there were worries over the corporate bond market's ability to handle a big sell-off. Credit was arguably inflated by more than a decade of ultra-low interest rates and yield-hungry investors, while massive changes on Wall Street had impacted liquidity, or ease of trading. At the same time, bond funds had grown super-sized.  In March, the credit market seized up spectacularly. The Fed stepped in with its corporate credit facilities (CCF) in a way that may have permanently altered the dynamics of the market. Citigroup credit strategists Daniel Sorid and James Keefe put it best in a recent note to clients. "The year that nearly broke the corporate bond market revealed a previously unknown fault line in the Federal Reserve's reaction function," they write. "Investors will not soon forget the central bank's brief but momentous foray to restore the flow of corporate credit at a time of frozen new-issue markets and alarmingly rapid redemptions from credit mutual funds. Even after the Corporate Credit Facilities are deactivated on Dec. 31, the tendency of corporate credit investors will be to assume a CCF 2.0 will be waiting in the wings if market failure ever looms. This should lower the liquidity risk premium for U.S. investment-grade credit for years to come." The Fed saved the corporate credit market in 2020. But it also turned a pressure point into an opportunity for profit. Anyone who recognized that dynamic early on would have made a spectacular return this year as corporate bonds rebounded sharply. And as the comment from Citi suggests, market participants are absorbing that lesson now. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment