America's New Base CaseThere's still plenty of political uncertainty in the U.S., but for what follows I am going to make three assumptions. In descending order of confidence: - The Republicans maintain control of the Senate;

- Joe Biden prevails in the electoral college to win the presidency;

- Donald Trump fails to launch a challenge to results convincing enough to generate civil disorder or deeper uncertainty.

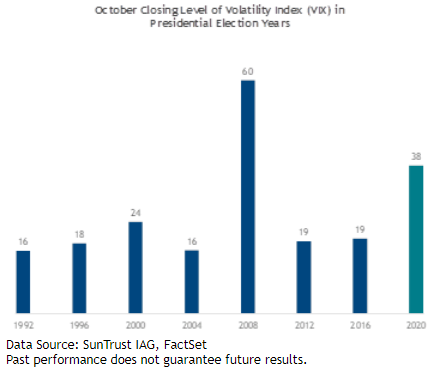

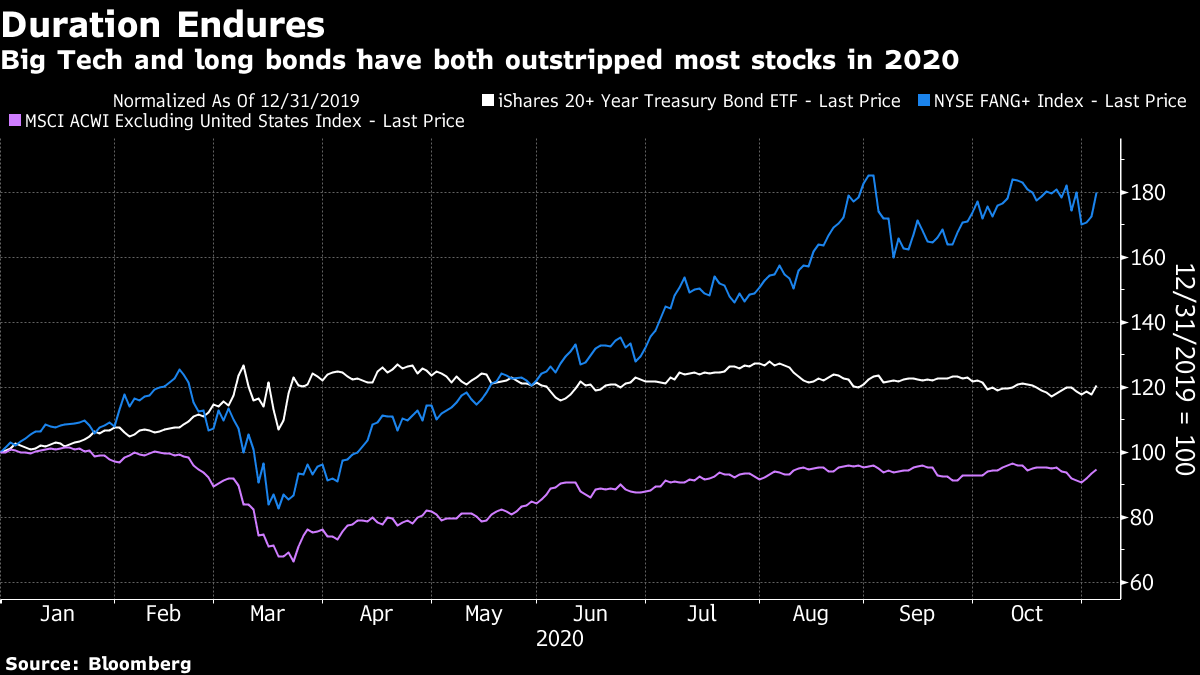

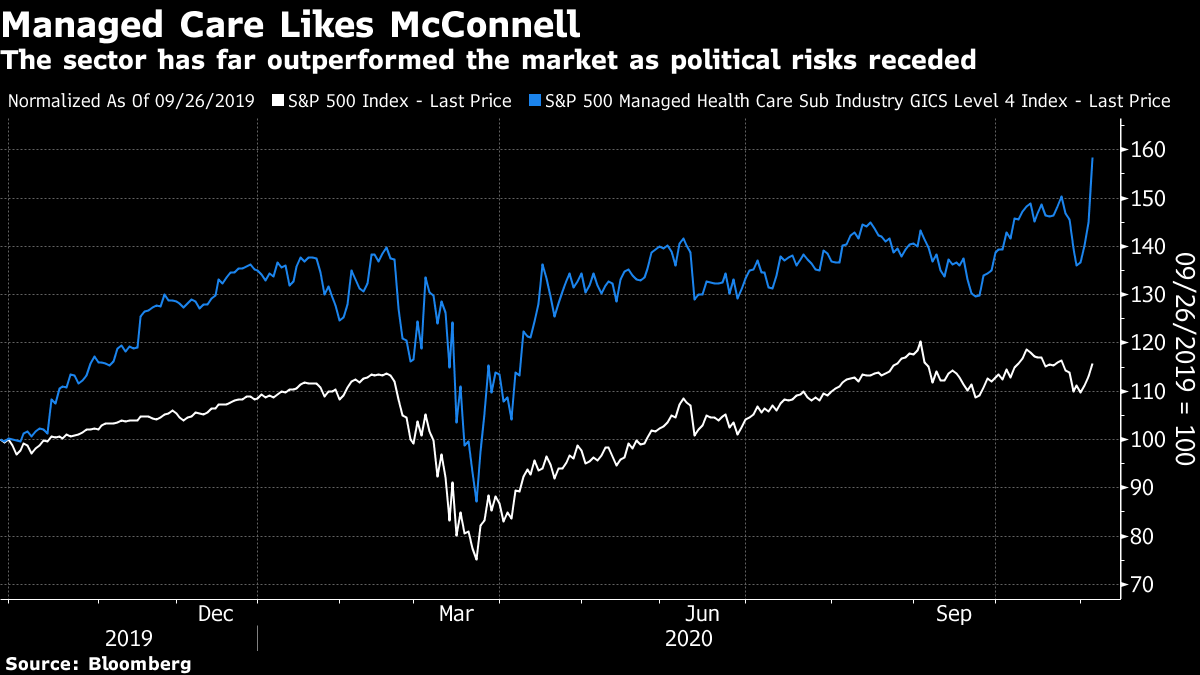

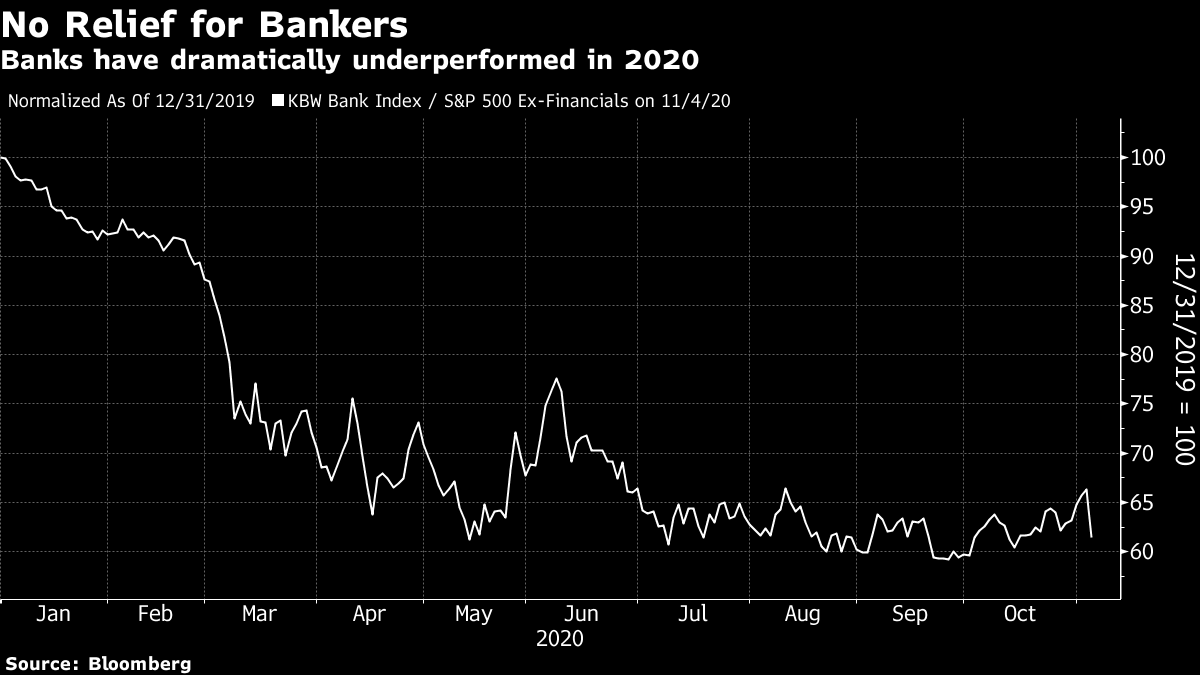

This isn't what was expected Monday evening, although markets apportioned a significant possibility to all these outcomes. Hence the day after the night before has seen much activity, but not a major dislocation or crisis. You can read elsewhere about the facts behind all these assumptions. The Democrats failed to win Maine in the Senate, a devastating blow given the antipathy many liberal activists have to the state's Republican senator Susan Collins, and at present appear to have a net pickup of only one seat. There are one and perhaps two run-offs to come in Georgia, and votes still to be counted in some states, but the odds that Republicans keep at least 51 seats are above 90%. For the presidency, Biden has his nose ahead in Arizona (which is tightening as more votes are counted) and Nevada at the time of writing. If he wins these states he wins the electoral college. Period. Pennsylvania is still opaque but it's quite likely he will win there as well. He might even, it now appears, win Georgia. Overall, betting and prediction markets at the time of writing put his chances of taking the presidency at 85%, and that's about right — it's possible that Biden has lost, but much more likely that he has won. The third assumption, that Trump fails to get traction in a dispute of the votes, is by far the most tenuous. If the eventual results are closer than they appear at present, and particularly if they are as close as they were in Florida 20 years ago, then there is the possibility of serious conflict. There is a concerted but rather desperate attempt afoot to cast doubt on the counting processes in the states where a winner hasn't yet been declared, and this risks triggering civil disorder. At the time of writing, this hasn't happened. Meanwhile, the president's chances of persuading the Supreme Court to help him look slim, as my colleague Noah Feldman explains. So, that's my story, and I'm sticking to it until events intervene to change it. Now for the markets' story: Changing the NarrativeMarkets run on narratives. So do human minds; it's easiest to think in terms of stories. What makes markets in general, and stock markets in particular, so special is (first) their ability to shift from one narrative to another in a nanosecond and (second) the ability to make sure that any prevailing narrative is good news for stocks. Four years ago, markets suddenly decided that President Trump would be good news; and although stocks have prospered under him, this piece I wrote in the aftermath of that shock shows most of the narrative was incorrect. The Blue Wave emerged as a narrative when Democratic senatorial candidates began to take the lead in a number of normally Republican states in the early fall. A decisive shift from monetary dominance to fiscal policy was seen as just the right thing to jolt the U.S. out of its increasingly Japanified low-rates state. Infrastructure spending was great. Higher taxes to pay for it would come later and could be dealt with in due course. (Incidentally, exactly the same arguments were made for Trump four years ago.) We now know that there will be no Blue Wave, and so there is a new narrative, that markets love gridlock (which has been a Wall Street staple for generations), and that the risk of higher taxes and more onerous regulations under a Biden administration has been averted. With Mitch McConnell's Republicans in the Senate acting as a check on profligacy, markets don't have to worry about higher taxes (they weren't), or deeper deficits (which they were actively hoping for a week ago). With cabinet secretaries facing confirmation by a Republican Senate, the Treasury secretary will be Lael Brainard of the Federal Reserve, and not Senator Elizabeth Warren. (It was always extremely unlikely that Biden would have given her the job, but again it's a reason to buy stocks.) Also, whispered rather more quietly, the new arrangement will be good because there will no longer be a need to worry about the capricious and unpredictable Trump. His bizarre interventions into negotiations over an extension of the CARES Act was just one example of the kind of behavior investors won't miss. Biden will also turn down the heat with China, which is fine by Wall Street. How well does the new narrative work? History suggests that stock markets actually prefer periods of harmony, when the White House and Congress are controlled by the same party. That is when things get done. It is only bond markets that like gridlock, because there is far less risk of excessive spending — and it is a while since excessive deficits deterred anyone from buying bonds. The Story So FarThis new narrative shouldn't, therefore, have been such great news for stocks. And of course, there was a lashing of uncertainty thrown in. So, of course, the S&P 500 had its best post-election Wednesday performance in history, with a gain of 2.2%. (My Bloomberg News colleague Ye Xie also reveals that the worst-received president in history was FDR in 1932, with a 4.4% fall in the S&P; William McKinley still holds the record for the most positive reception, with an increase in the Dow of 4.6%). Meanwhile, despite the very real continued risk of a contested election, volatility has shot down. This is what has happened to the VIX index — it rose as the risk of contested election appeared to grow, and then fell all the way back when election night left that scenario looking very possible:  This seems premature, but it is also fair to point out that the VIX had only once before been anything like as high entering election day — and that was in 2008, in the midst of the Global Financial Crisis. This chart is from SunTrust:  Meanwhile, bonds responded exactly as might be expected if gridlock is truly good for them. Yields dropped sharply, while the curve flattened. But this was less about relief from bond vigilantes worried about default risk, and more about a bet that the Fed will continue to be the only game in town. With no fiscal help coming from a Republican Senate, there will be no inflationary pressure. The Fed will have no choice but to keep propping up the bond market, and possibly even resort to yield curve control. That at least is the narrative But while the yield curve flattened dramatically, it only really undid the Blue Wave speculation of the last few days. It remains far steeper than it has been for most of the time since the corporate tax cut of early 2018, and its steepening trend remains intact for now:  Similar points can be made about the overall level of both nominal and real yields and about inflation breakevens — down sharply but not yet suggesting anything much more than canceling out a few days of unwise speculation. This might even make life easier for the Fed in the short term, as it removes a dilemma over whether to intervene to bring yields down. For the longer term, the Fed's job is getting harder as it may not be able to pass the baton to the Treasury. The Federal Open Market Committee meeting for November concludes Thursday afternoon — but Chairman Jay Powell is unlikely to say much specific when the presidential election will probably still be in the balance. The Next EpisodeAssuming we do have a Biden-McConnell duet in our future, what are the likely longer-term effects? In brief, it is probably best to brace for a repeat of the trends we have all grown to know and love in the last year or so. With rates held on the floor, and a deflationary, largely growth-less environment, duration becomes the be-all and end-all. The FANG stocks have run riot because they are seen as reliably profitable and immune to the economic cycle. Low discount rates make their future earnings streams ever more valuable. So far this year, the FANGs and long-dated bonds (represented by the TLT ETF) have done far better than the stock market as a whole:  They are also both among the clearest winners since election night. This is a trend that can be expected to continue. As for the dollar, the previous argument was that fiscal expansion under Biden would lead to a weaker currency; now the argument is that continued monetary dominance under Biden will lead to the same result. If the assumption holds, this should mean good things for countries that benefit from a weaker dollar — notably emerging markets. The JPMorgan EM FX index had its best day in two months Wednesday. All else equal, a weaker dollar also helps to prop up U.S. stocks. Is there anything else to consider? A Republican Senate means that there will be no "Bidencare" expansion of Obamacare. That is mighty good news for the managed care sector. The S&P 500 managed healthcare sub-index's performance since September last year, when Senator Warren was briefly the favorite for the Democratic nomination, is remarkable:  But this is now largely in the price. The Republican Senate means there is no way to adjust Obamacare to render it safe from being ruled unconstitutional by the Supreme Court. There is now a real possibility of the program being overturned with nothing to replace it. That could be a serious mess, particularly if it arrives before a Covid-19 vaccine. Then there is the issue of the banks. Four years ago, they were supposed to prosper under Trump's infrastructure boom. That didn't happen. Now, more years of monetary dominance presages bad things for the sector. Banks' continuing weakness is changing the nature of the financial system, and increasing the power of the bond market. Wednesday brought the underperformance of the big banks this year almost to its lows of 2020:  That leads to another point of concern, if two more years of gridlock and reliance on the Fed await. The problem of the age is growing inequality, and monetary dominance contributes to it. It is hard to imagine a Biden-McConnell duo coming up with measures to deal with that problem. Survival TipsOK, I am in a position to recommend the ideal playlist to listen to while operating in an over-caffeinated and sleep-deprived state, and being distracted by new bulletins every five minutes about incredible changes in a cliffhanging election. Profound these selections are not, but they've kept me going. My thanks to my kids for the list, which has a number of family favorites: Try Bad at Love by Halsey (which David Byrne of Talking Heads would have as one of his eight records on a desert island); Special Brew by Bad Manners; Baggy Trousers by Madness; Wake Up by the Boo Radleys; Sweet Dreams by Beyonce; She Wolf by Shakira; Naked Eye by Luscious Jackson; and I Wanna Be Sedated by The Ramones. All go well with cold coffee. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment