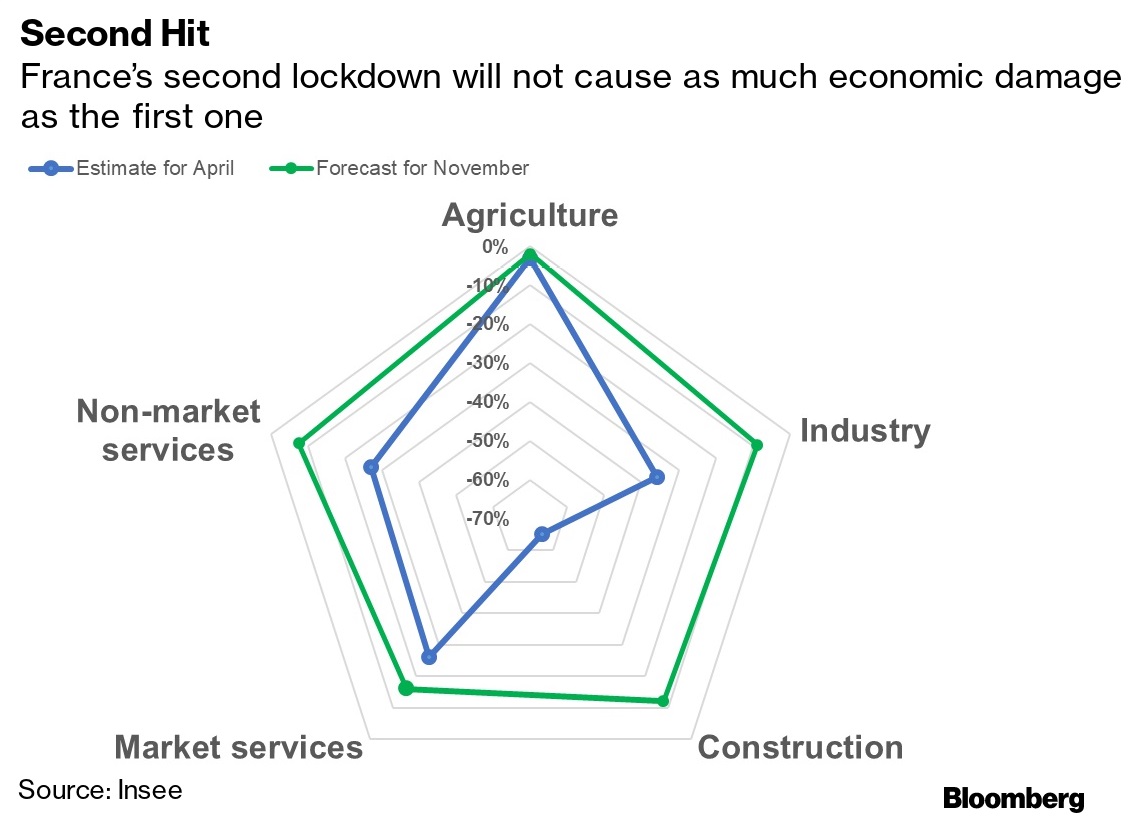

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The EU Commission kicks off an exercise today to ensure all countries are on the same page when it comes to spending their way out of the coronavirus crisis. In normal times, the discussion would be focused on budget discipline, but this year the message is very different. The shackles of EU spending limits have been temporarily cast aside due to the outbreak, so the main goal is for countries to invest wisely and sow the seeds of future growth. Of course, part of the funding is supposed to come from the bloc's 750 billion-euro recovery fund, but that money is still uncertain amid opposition from Hungary and Poland, which object to linking the payouts to the rule of law. — Alexander Weber What's HappeningEdging Closer | The U.K. and EU could strike a deal on their future trading and security relationship early next week as the two sides edge closer to agreement on the biggest sticking points. Officials are planning for the possibility of a Brexit breakthrough to be announced as soon as Monday, although no precise day has been settled on. Testing Times | The Commission will recommend ways for EU countries to recognize each other's rapid antigen tests for detecting Covid-19, the latest effort to prevent national health measures from undermining the free movement of people across the bloc. Still in the works is a commission recommendation on coronavirus-related quarantines in member nations. Managing Expectations | European Central Bank officials are trying to persuade investors not to focus too much on the size of their next dose of monetary stimulus, hoping they will instead look at its design. President Christine Lagarde and colleagues have used a run of public comments to stress that December's much-anticipated policy decision will aim to cement cheap money for the duration of the crisis. Final Hurdle | Making vaccines that are safe and effective is certainly the hard part of the race to pull humanity from the pandemic brink. Yet the final phase will require navigating the maze of regulators who will decide when, which, and where shots of the most promising candidates will be approved, produced and distributed. Virus Update | German Chancellor Angela Merkel expressed optimism that an economic recovery will gather pace once the pandemic is brought under control. French bars and restaurants will remain closed until mid-January, and Austria's restrictions are having an impact. Here's the latest. In Case You Missed ItAuto Aid | Germany's auto industry secured 5 billion euros to help weather the coronavirus crisis and invest in the transition to electric cars. Merkel's government will extend cash bonuses for purchasing electric-powered vehicles until 2025, making an additional 1 billion euros available. Troop Withdrawal | Donald Trump ordered the Pentagon to accelerate a drawdown of U.S. troops in Afghanistan and Iraq to 2,500 in each nation. Prior to the announcement, NATO Secretary General Jens Stoltenberg warned that withdrawing troops from Afghanistan prematurely risks a resurgence of international terrorism. Merging Banks | Spain's banks are at the forefront of a merger wave reshaping Europe's financial landscape, with industry leaders counting on consolidation to cut costs and confront a grim economic outlook. Gaining a bigger domestic presence may also allow them to be acquirers, or better defend themselves, should bigger cross-border deals start to take off. Balkan Blockade | Bulgaria objected to the official start of EU accession talks with North Macedonia, hindering the nation's efforts to open the long-delayed negotiations by year-end. The veto at a virtual meeting of EU affairs ministers yesterday came on the grounds that its neighbor is violating a 2017 bilateral treaty to resolve historical disputes. Chart of the Day Bloomberg Bloomberg The French economy will shrink again this quarter even though restrictions to contain the coronavirus aren't as severe as earlier in the year, according to the country's statistics agency. In a best-case scenario of restrictions ending Dec. 1 and a quick return to the level of activity before the second lockdown, output would still drop 2.5%. If activity remains at November's levels through December, the contraction could be as deep as 6%. Today's AgendaAll times CET. - 9:15 a.m. ECB Supervisory Board Chair Andrea Enria speaks at banking union conference

- EU Commission issues economic policy recommendations for the euro area, including on the use of recovery funds

- EU Commission issues recommendations on the use of rapid antigen tests for the diagnosis of SARS-CoV-2 infection

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment