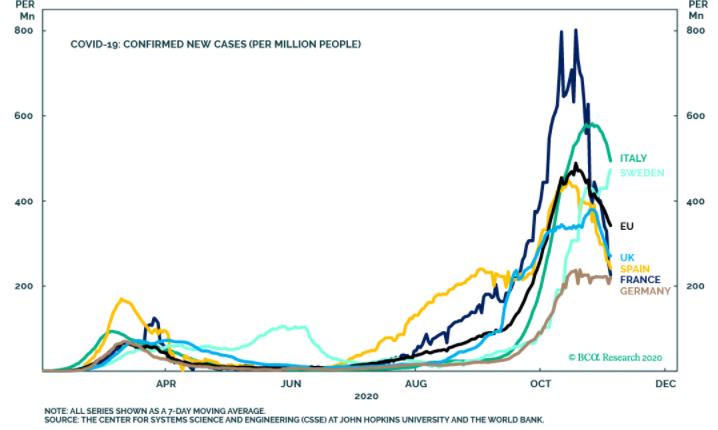

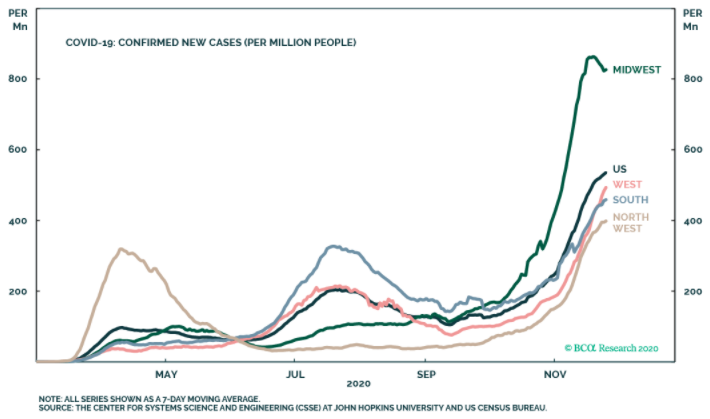

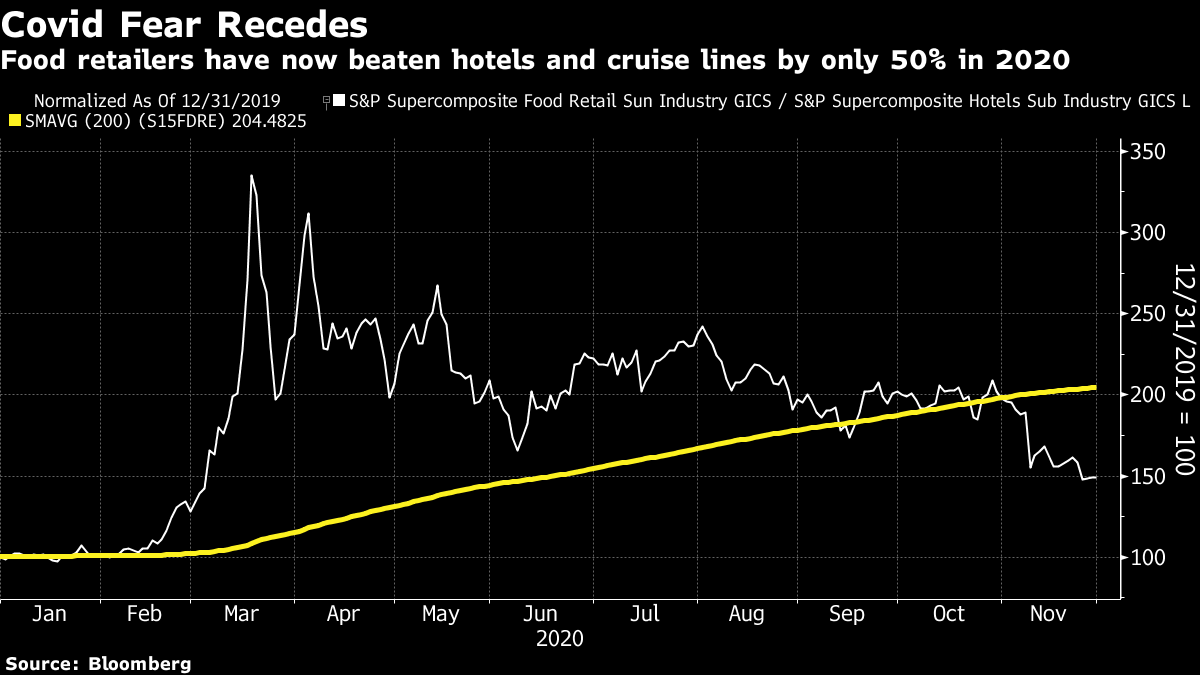

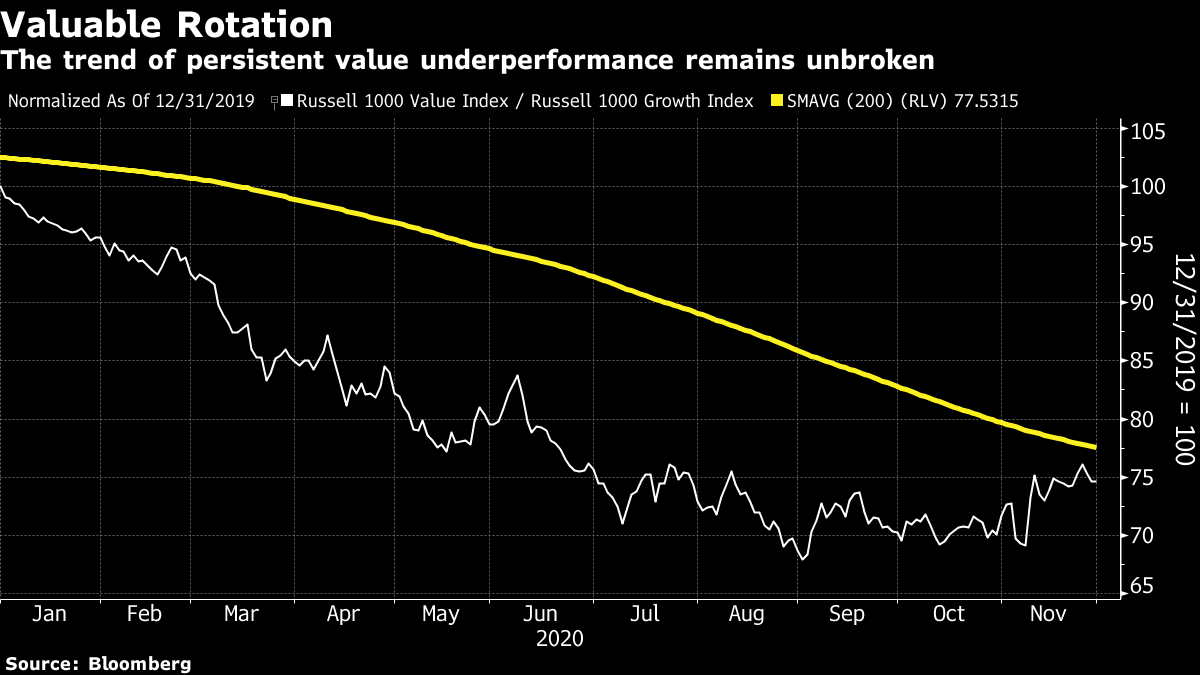

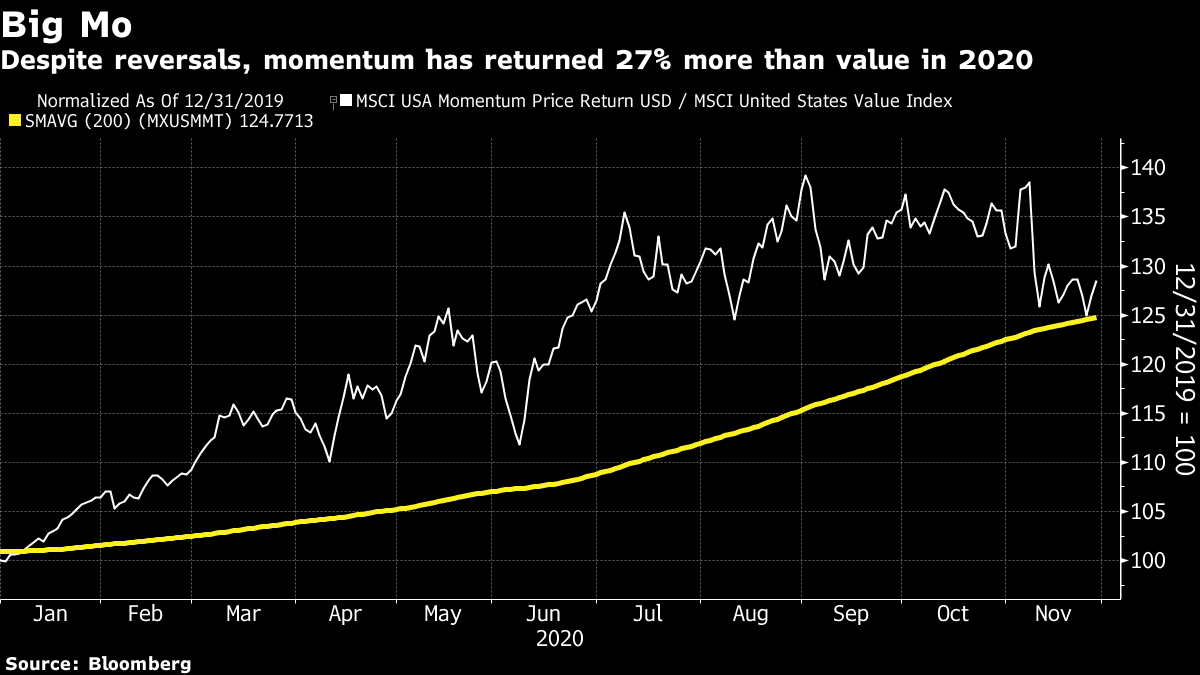

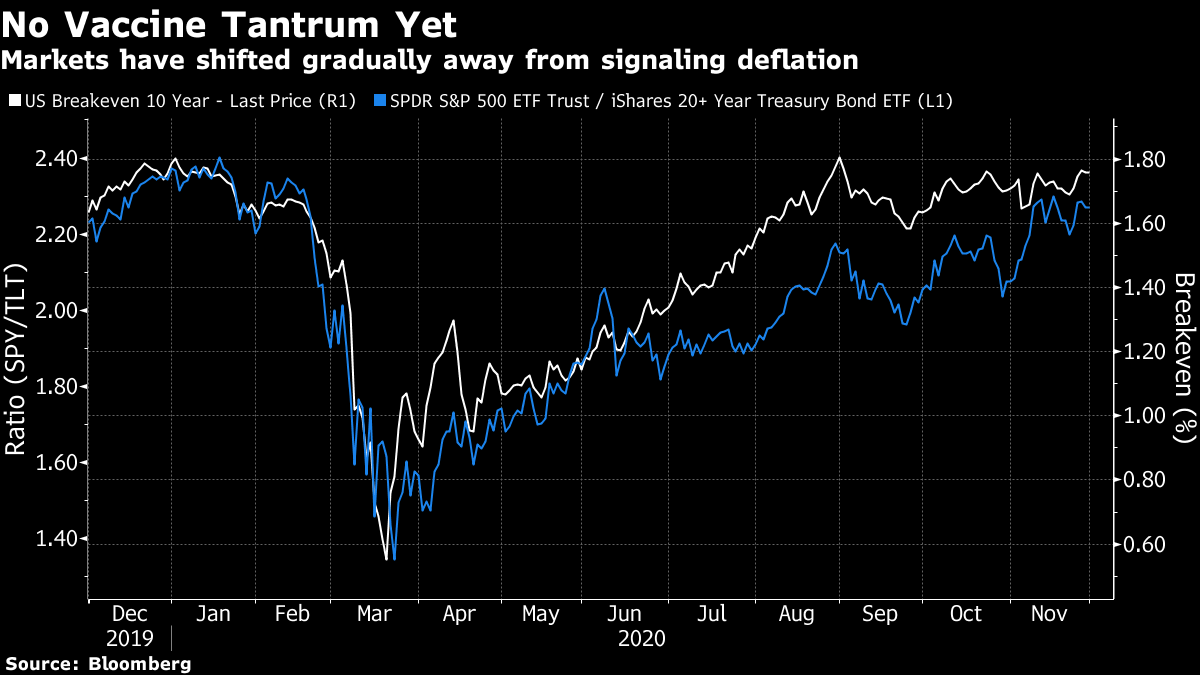

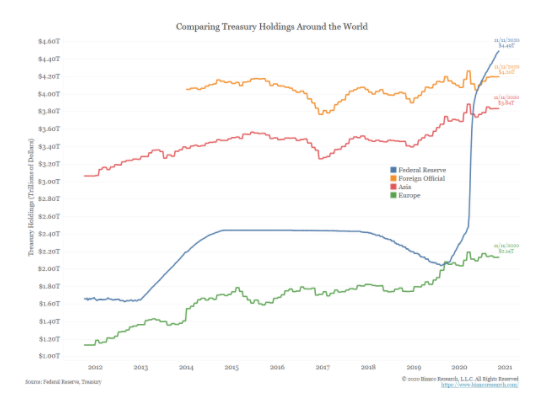

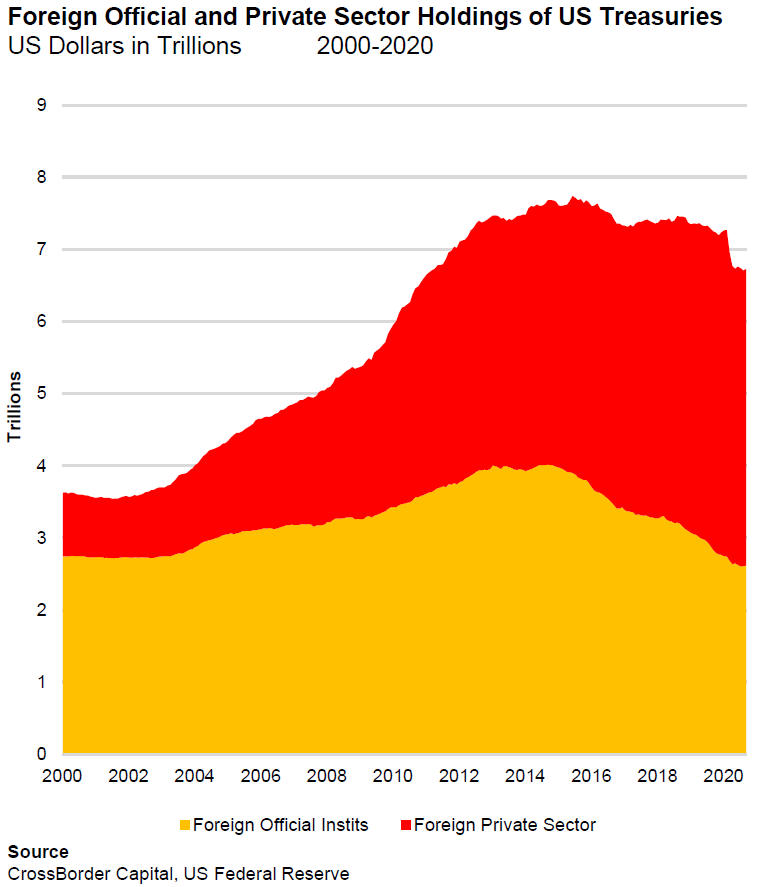

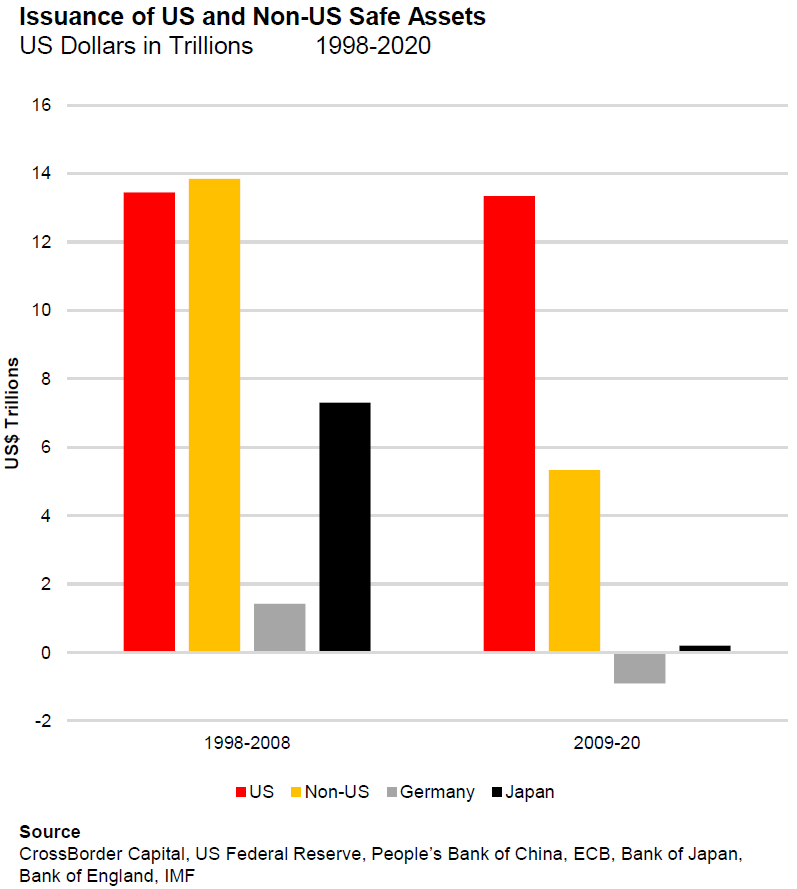

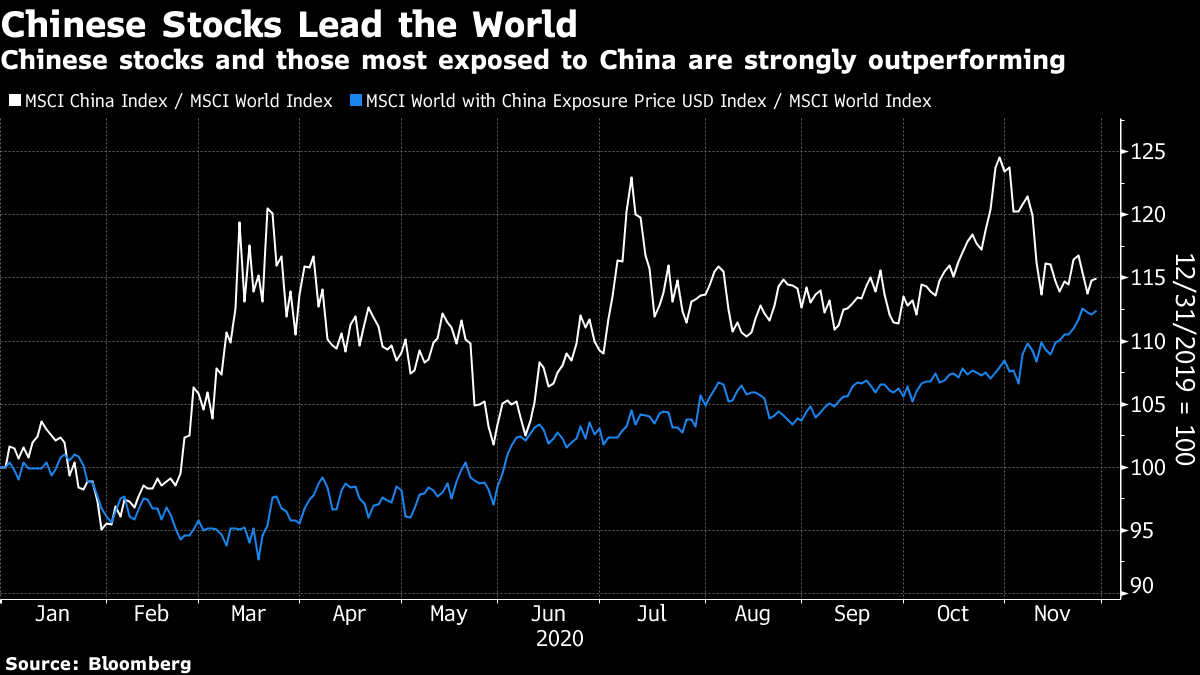

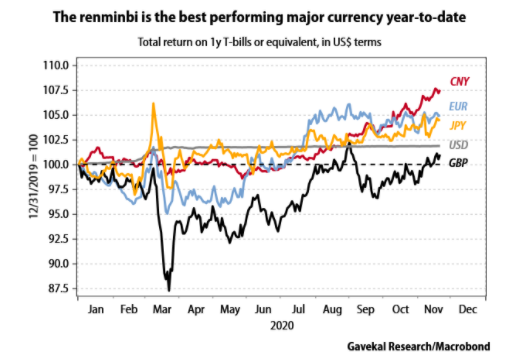

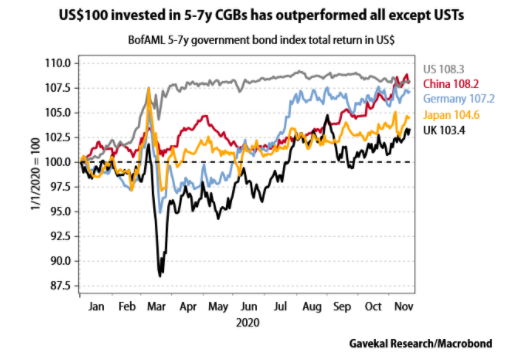

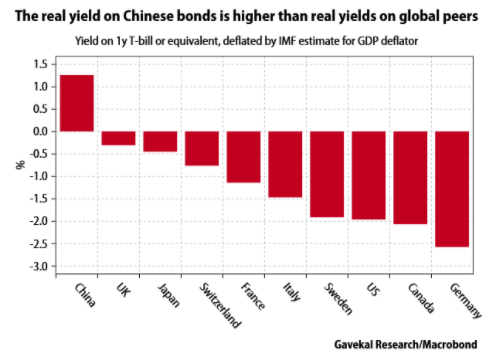

Blessings, CountedThanksgiving is over, and Americans have counted their blessings. Despite everything, there have been a few things for which investors can be thankful. Here are some: Covid-19It looks as though the pandemic's latest wave may be coming under control. The following chart, produced by BCA Research, shows new cases per million for a range of European countries, and what looks in most like a clear recovery from a peak earlier in November. (Intriguingly Sweden, hailed in many quarters for allowing the epidemic to let rip earlier in the year in an approach that was supposed to save it from misery later, is an exception with cases still rising):  Meanwhile, in the U.S. the "third" wave has at least shown signs of cresting in the Midwest, which was the worst affected area of late. Increased travel for Thanksgiving may yet change this and create a "surge on top of a surge," but there have been at least some signs that the pandemic is peaking:  The focus on the world's most prosperous economies shouldn't obscure the fact that on a global scale the pandemic has done nothing but grow at a steady rate. At this point, some 600,000 new cases are confirmed each day:  This brings us to the development for which we should be most thankful. Public health officials may have failed to stop the spread, but medics are doing better and better at stopping the disease from killing. The global death rate peaked in April at about 7% — an alarming number that was probably exaggerated by underreporting of cases. It has declined ever since and is now approaching 2%:  Finally, of course, there is good news on the search for a vaccine. A number of different ones appear to work, and it doesn't appear too difficult to mass-produce or distribute them. The point at which enough of us have had a shot to halt the spread should be within a few months; this was by no means clear at the beginning of November. MarketsAs for markets, we can be grateful that the vaccine news is being greeted with relative calm. The clearest indicator of specific fear of Covid — the performance of food retailers relative to hotels, resorts and cruise lines — shows that the food companies have now outperformed by "only" about 50% for the year so far. A shift back toward the sectors most damaged by the pandemic is plainly on, and has much further to go:  A rotation toward value from growth stocks is under way. Again, this has much further to go. There have been some violent trading days, but it is reasonable to expect this trend to carry on:  Similarly, the news from factorland is that momentum stocks are still beating value by 25% for the year, even after being pegged back by the vaccine news. The momentum/value ratio remains just above its 200-day moving average. So again, if you want to place money in assets to benefit from a gradual reflation as the vaccine works its wonders next year, you have time and opportunity:  Within broader markets, the shift away from extreme fear of deflation has been more gradual, and has roughly been completed. Both breakeven levels of inflation, and the level of stocks relative to bonds, are now back almost exactly where they were before the pandemic took hold. The vaccine news hasn't (as yet) driven a sharp rise in bond yields or inflation expectations:  Global ImbalancesIn the years leading up to the 2008 crisis, one phrase recurred again and again as a source of concern: global imbalances. It was shorthand for the way the U.S. was borrowing huge sums of money, particularly from Japan and China, which needed somewhere to stash the cash they had made from highly successful exports. One of the most popular explanations for the global crisis at the time was that a "savings glut" had kept U.S. interest rates unnecessarily low and allowed credit to balloon. Such worries appear to have come to an end. The U.S. problem is no longer an unhealthy addiction to credit from the central banks of Asia; rather, post-Covid, its problem is now an addiction to credit from its own central bank. As shown by this chart from Bloomberg Opinion colleague Jim Bianco, the Fed's holdings of Treasury bonds now exceed those of foreign official accounts (central banks and governments) combined:  While the total amount of foreign lending to the U.S. remains higher than before the crisis, it reached a peak early in the last decade and is now declining, largely thanks to a drop in official holdings. As this chart from London's CrossBorder Capital shows, the interest of the foreign private sector in Treasury bonds remains far higher than it was a decade ago:  But if we have seen an end to an imbalance in demand for U.S. Treasuries, deemed the world's most unimpeachable "risk-free" asset, there is now a massive imbalance in the global supply of such safe investments. In the decade before the crisis, issuance outside the U.S. exceeded the supply from America. In the decade since, there has been far less choice, largely owing to a cratering in sales by Japan and Germany. Peripheral European debt, or debt issued by U.S. mortgage agencies, no longer seems so "risk-free." In the last year, there has been far more issuance of risk-free assets in the U.S.:  The implication is that as other countries resume selling such debt, the flows that have been supporting the U.S. this year will diminish. In other words, this should be dollar-bearish. The general decline of risk-aversion has already seen the U.S. currency drop sharply from its March highs. The conventional wisdom is for dollar weakness to continue (which would make life easier for many people around the world):  ChinaMore for which to be thankful: China continues to be a sheet anchor for the global economy. Many remain furious about the way China's growth was achieved at the expense of others, about the way the country cheats on intellectual property, and about its bad record on human rights. But China can be forgiven a lot in the current circumstances, as it showed how to beat the virus, and then kept on buying stuff from everyone else. Chinese stocks (pegged back a little since the vaccine news started breaking) and global equities most exposed to the country have strongly outperformed developed world counterparts throughout this year:  This isn't just about stocks. As the following charts from Gavekal Research show, China is unmistakably leading fixed income and currency markets as well. It has the strongest currency for the year to date, measured in terms of returns on short-term bills:  It also very nearly has the best return on longer-term bonds, where it is close to overtaking the phenomenal performance of Treasuries:  Then there's the fact that China remains refreshingly normal compared to the stronger economies of western Europe and North America, in that it actually pays a real yield on its bonds:  This gives Chinese assets the kind of appeal that U.S. securities have enjoyed for much of the last decade. China seems to be impervious even to some of the apparently dreadful news of the last few weeks, led by the inept last-minute cancellation of the Ant Group Co. IPO, and including an internet antitrust clampdown and the default of Yongcheng Coal & Electricity Holding Group Co. As Louis Gave of Gavekal put it, the country may have been forgiven because: "China remains the only major economy that still offers positive real interest rates, solid economic growth, and limited risks of riots and social breakdowns. In other words, any sell-off triggered by these sudden policy moves will offer investors a buying opportunity."

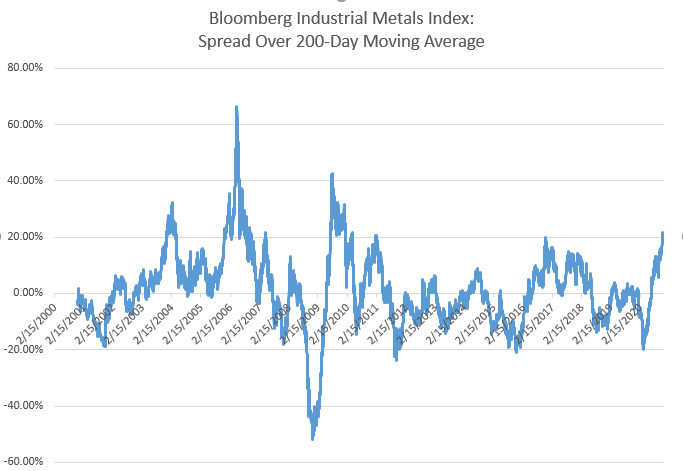

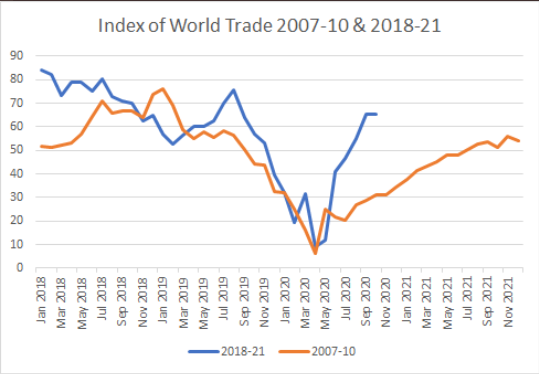

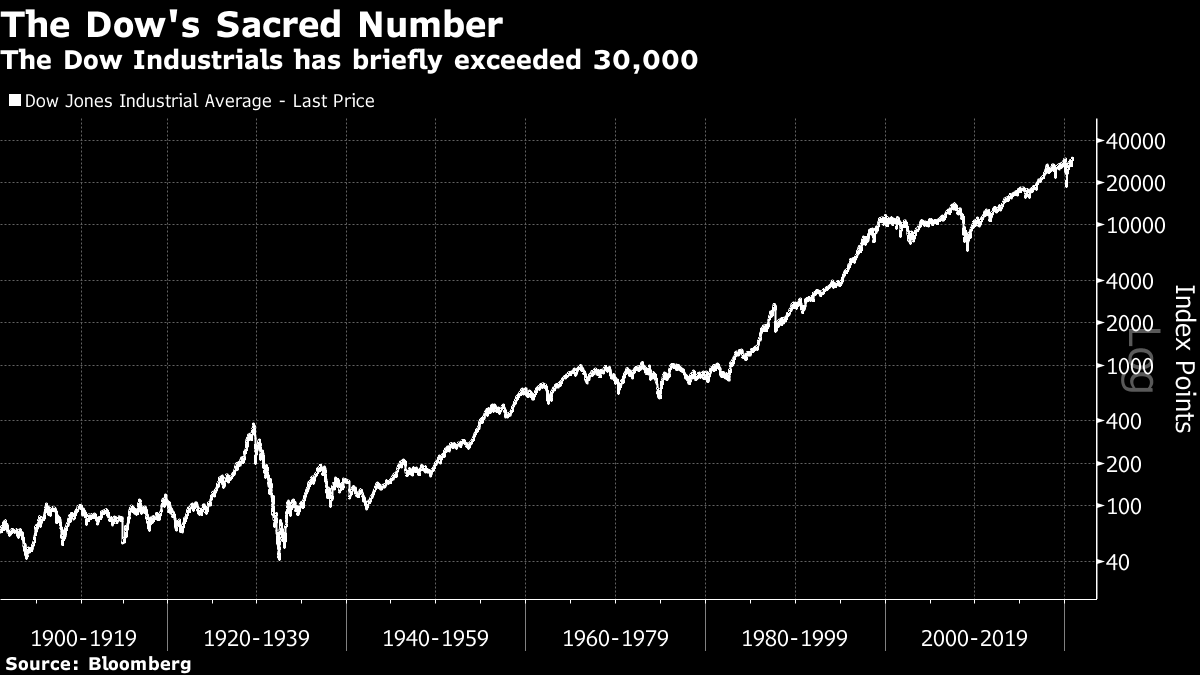

It is possible that these incidents show China is finally about to hit the skids. It is more likely that they show officialdom is genuinely worried about the possibility of asset bubbles and Minsky Moments, and is prepared to work with an iron fist to deal with the problem. For the time being, the market for industrial metals continues to show unambiguous confidence in China, which has been the marginal buyer of copper and iron ore for many years now. The Bloomberg industrial metals index is further above its 200-day moving average than at any time in a decade:  TradeScarcely a year ago, international trade was the topic that blotted out all others. Now it has almost vanished. The Biden presidential victory has much to do with that, of course, but optimism is also driven by the fact that trade has already bounced back far more impressively than it did after 2008. This chart, from CrossBorder Capital, averages the Cass Corporate Freight Index, the Baltic Panamax Freight index and the RWI/ISL Container Throughput index for a reasonably up-to-date measure of trade activity, and it suggests a very strong recovery:  Animal SpiritsMaybe this isn't a cause to be thankful, but there are still some rude animal spirits at work. As I commented earlier this month, Bitcoin and other cybercurrencies increasingly behave like growth stocks. And indeed over the month so far, Bitcoin and Tesla Inc. have behaved a lot like each other. There is a whiff of speculative excess around both:  Meanwhile, as President Trump has commented, the Dow Jones Industrial Average passed 30,000 for the first time, just before Thanksgiving. It topped 20,000 shortly after his inauguration, so his four-year term has been book-ended by landmarks for this antiquated index. As the chart shows, the Dow's performance over the last four years isn't as exceptional as the president likes to think; the current bull market still isn't as extended as those of the postwar period or the 1980s and 1990s. But equities have done well on his watch:  Will it continue? Given what happens when major stock market bubbles form and then burst, it might be better if it didn't. So perhaps one more piece of news for which to be thankful is that all the good news I have mentioned above is already in the price. Survival TipsMaybe one more thing for which to be thankful: the life of Diego Maradona. The Argentine footballing genius died last week, shortly after his 60th birthday. For a great book on the man, try Hand of God by my former colleague Jimmy Burns — he found presenting his book to a skeptical Argentine public even more hazardous than his earlier assignment reporting from Buenos Aires for a British newspaper during the Falklands war. Streaming services are awash with tributes. For those who don't know what the fuss is about, here are the condensed highlights of Argentina's World Cup quarter-final against England in 1986, the first time the countries had met since the Falklands. Argentina, the eventual champions, went through on the strength of two Maradona goals, one an intentional handball for which he would have been sent off had modern replay technology been available, and the other arguably the greatest goal ever scored. Yes, it still feels like yesterday, and yes it still hurts a bit. British newspapers were plastered with photos of the handball after his death, not his masterpiece goal a few minutes later. But there's nothing like sport to transcend the boredom of lockdown. And I can think of no athlete who transcended their sport to the extent that Maradona did. Gracias Diego, and have a great week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment