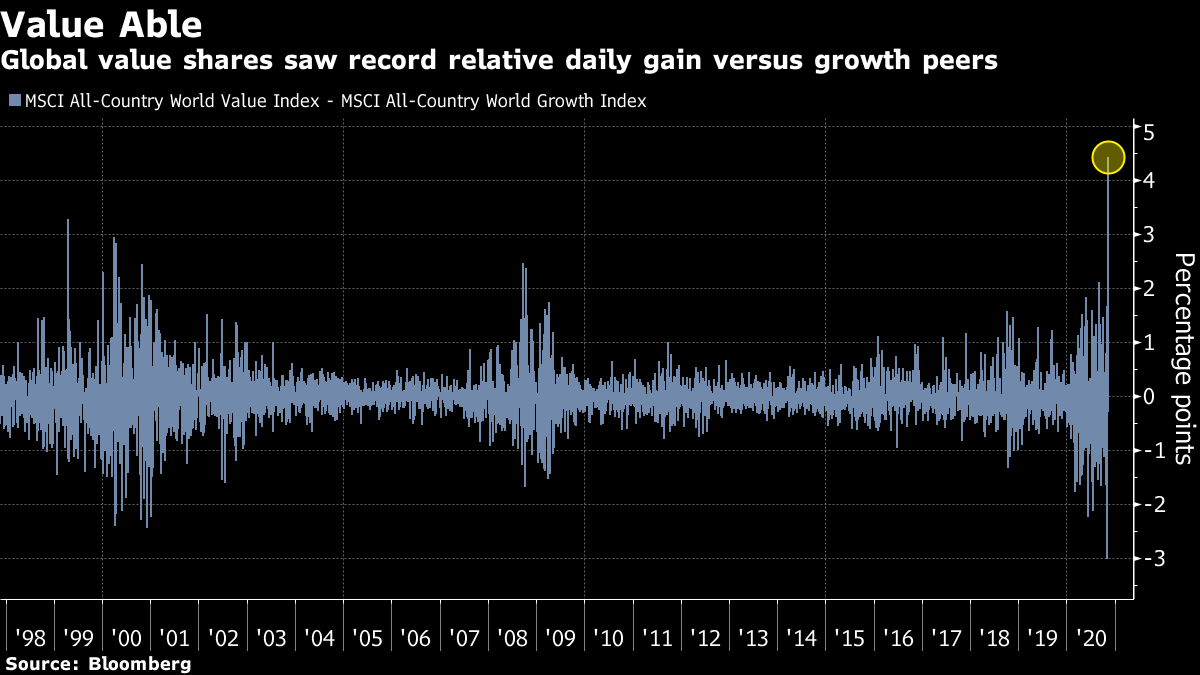

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. A vaccine rally peters out, Johnson faces a setback in parliament, and peacekeepers are moving into Nagorno-Karabakh. Here's what's moving markets. StalledA global rally sparked by Pfizer and BioNTech's announcement of a successful Covid vaccine trial lost steam late on Monday, with U.S. stocks ending the session 1.2% higher despite earlier gains of as much as 3.9%, the biggest intraday jump since April. Experts cautioned that questions about production, distribution and, most importantly, the performance and capability of the shot itself still need to be answered. Since U.S. markets closed, Eli Lilly's antibody therapy was granted an emergency-use authorization by U.S. drug regulators for treating Covid-19. Have a look at Bloomberg's tracker for ongoing vaccine and treatment developments. CheckedThe U.K.'s House of Lords rejected government plans to break international law over Brexit, putting the onus back on Prime Minister Boris Johnson, who immediately vowed to push ahead with the legislation. The Upper House voted late Monday to remove the most controversial parts of the Internal Market Bill, which gives ministers the power to unilaterally rewrite parts of the Withdrawal Agreement that Johnson signed with the European Union. Elsewhere in London, EU and British negotiators are in their final week of talks before a de-facto Nov. 15 deadline, after which Britain risks a disorderly exit from the single market at year-end. Back to BusinessThe European Union will impose tariffs on $4 billion of U.S. goods starting today, in a tit-for-tat escalation of a trans-Atlantic fight over illegal aid to aircraft manufacturers Boeing and Airbus. The tariffs are set to target various Boeing models, which will face a 15% duty, as well as goods ranging from spirits to tractors and video games. EU trade chief Valdis Dombrovskis on Monday said the bloc would drop its duties if the U.S. removes levies it imposed in 2019 on $7.5 billion of EU products. Both sets of import taxes are part of a dispute that began 16 years ago. Peace DealArmenia signed an agreement to end the war over Nagorno-Karabakh, just days after Azerbaijani forces captured a key strategic city in the contested region and closed in on its capital Stepanakert. The deal was signed with the leaders of Russia and Azerbaijan and takes effect immediately. Russian President Vladimir Putin said the agreement would be the basis for long-term stability in the war-torn region and called for the deployment of peacekeepers, adding that Azerbaijani and Armenian troops will halt at their current positions. Turkish forces will also be deployed in Nagorno-Karabakh as peacekeepers, Azerbaijani President Ilham Aliyev said in an address to the nation. Protests erupted in the Armenia, with angry crowds entering the country's parliament. Coming Up…Euro Stoxx 50 futures are lower, suggesting yesterday's rally will be pared at the open. Earnings highlights this morning include adidas, DHL parent Deutsche Post and Persil maker Henkel. Renewables firm Siemens Energy is due to release its first earnings since its IPO. Telecom Italia and accessory maker Salvatore Ferragamo are also due, but usually report after markets close. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe best suggestion I've read about Pfizer/BioNTech's vaccine study is to see it as the beginning of the end of the coronavirus struggle, but with a heavy emphasis on beginning. The results should be enough to provide a modest boost to risk assets, but some of the moves seen on Monday looked excessive. There is nothing that has shifted the consensus view that a vaccine won't be widely available until deep into 2021, and while the headline 90% effective rate is hugely promising, it was based on a small sample size. There was little in the press release that should have sent the world's value stocks surging the most on record relative to their more defensive growth peers. That move smacks of positioning, with traders caught in the middle of an unwind of pre-election Blue Wave bets just as stop-losses were triggered across a slew of asset classes. Tellingly the Cboe Volatility Index edged higher despite gains in the S&P 500 Index and U.S. retail brokerages faced technical difficulties as day traders jumped on board the positive trend. Investors on Tuesday morning are now faced with global stocks at record highs and widespread distribution of an as-yet unapproved vaccine still unlikely till the second half of next year. That leaves a lot of time for infections to rise, economies to falter and businesses to go bust. Pfizer has strengthened the hope that the end of the coronavirus is in sight, and that's a positive. But it's not yet a green light for an indiscriminate risk rally and there is still a long and difficult road ahead.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment