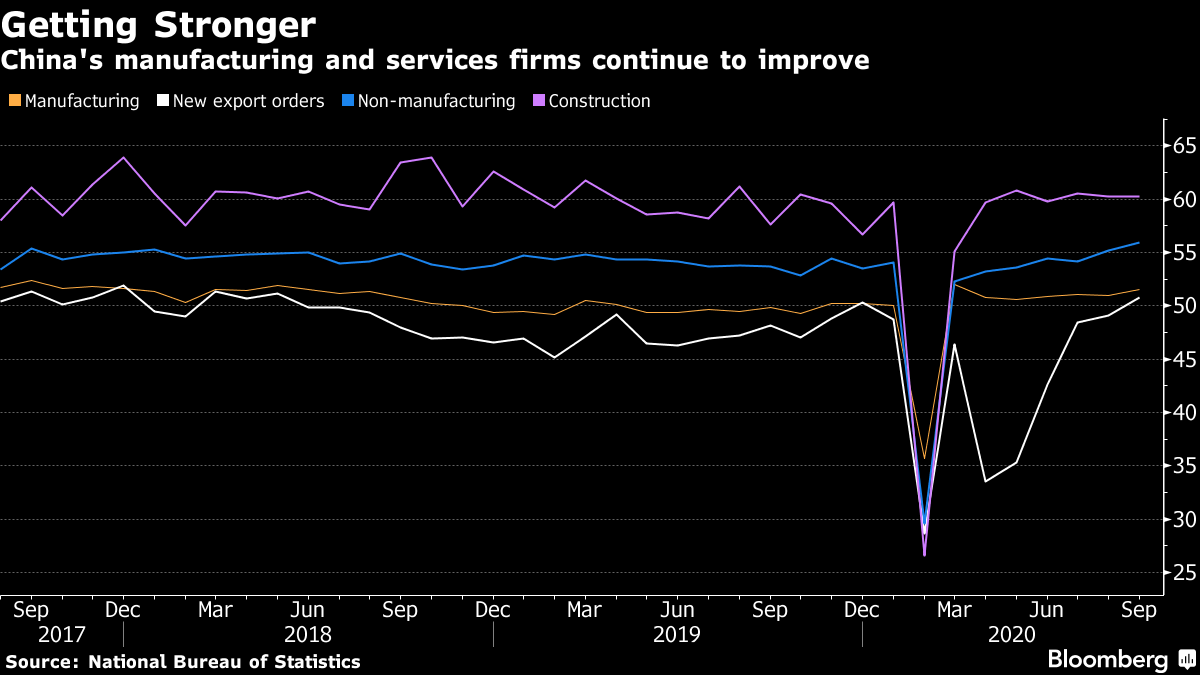

Goldman Sachs resumes job cuts. The Fed extends limits on dividends and share buybacks for the big banks. And the global economic recovery is turning into a real slog. Here are some of the things people in markets are talking about today. Goldman Sachs is resuming job cuts as the pandemic outlasts the financial industry's resolve to offer jittery employees stability. The firm plans to eliminate about 1% of its workforce, or roughly 400 positions, according to people with knowledge of the matter. The move comes even as the firm's core trading and dealmaking businesses are booming. Persistent coronavirus outbreaks in the U.S. are forcing the nation's biggest banks to re-examine plans to wait out the turmoil, with Wells Fargo and Citigroup among the first to restart cuts after their stock prices slumped and they face looming souring loans. The Goldman layoffs are among tens of thousands of job cuts announced by blue-chip companies in a 24-hour period — a warning sign for the world's economic recovery. The best is already over for the global economic recovery. That's the warning from Wall Street economists heading into the final months of a traumatic year. Some $20 trillion of stimulus from governments and central banks has pulled the world's economies almost back to pre-pandemic levels. But the last stretch is set to be the hardest. Policy makers could dial back the fiscal support that's been key to recovery — as they've already done in the U.S. — and temporary job cuts may harden into permanent ones. And the virus itself is spreading, forcing governments to reimpose lockdowns. The risks have made investors less bullish than they've been since the early weeks of the coronavirus crisis. The S&P 500 Index declined in September after five straight monthly advances, and Europe's Stoxx 600 also pared gains. Asian stocks were set for modest gains at the start of the year's final quarter though volumes may be subdued Thursday with many markets closed for holidays. U.S. shares earlier finished higher after a volatile session. Futures in Japan and Australia climbed. The S&P 500 Index earlier climbed 0.8%, paring gains of as much as 1.7% after Treasury Secretary Steven Mnuchin said there had been no agreement on pandemic relief, though talks would continue. Speculation a deal was in the works kept the benchmark at a two-week high. The dollar declined and Treasury yields ticked higher. Markets in China, Hong Kong, Taiwan and South Korea are shut for holidays. The Fed has extended unprecedented constraints on dividend payments and share buybacks for the biggest U.S. banks through the rest of the year. Why? Because of ongoing "economic uncertainty from the coronavirus response" and the need for the banking industry to preserve capital, it said in a statement Wednesday. The news is likely to disappoint lenders such as JPMorgan, which had already indicated interest in resuming buybacks. The caps announced in June have restricted banks from increasing dividends above second-quarter levels, and buybacks were banned. Those restrictions were less than the total elimination of dividends demanded by some Democratic lawmakers. After slowing the coronavirus pandemic to just a trickle of new cases a day, Australia's Prime Minister Scott Morrison faces his next challenge: shoring up an economy now into its first recession in almost 30 years. His conservative government on Tuesday will deliver its federal budget, expected to include accelerated tax cuts and infrastructure spending to restore growth and tackle rising unemployment, forecast to hit 10% this year. It's a dramatic rewriting of Morrison's economic narrative that, less than 12 months ago, was focused on returning the budget to surplus for the first time in more than a decade. Instead, the deficit is expected to blow out to A$198.5 billion ($141.8 billion) in the 12 months to June 30, 2021, according to Deloitte Access Economics. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningChina's economy is recovering well from the pandemic shock earlier in the year. Data on Wednesday confirmed this trend is very much intact, as the chart below shows. An official gauge of activity in the country's manufacturing industry climbed in September and activity in the services sector also strengthened.  The next big test comes as the national Golden Week holiday begins. The spending patterns and data on consumption during this period will be key to gauging how the fourth quarter will play out in China. One analyst at brokerage CICC expects an increase in sales of Baijiu liquor, thanks to more family banquets and weddings. Whether or not this can feed into broader indications of an increasingly buoyant consumer will go a long way to determining the recovery path for Asia's biggest economy through the end of this year. Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. |

Post a Comment